Whirlpool: An Impressive Upside, Giving Us A ‘Buy’

Jonathan Knowles/DigitalVision via Getty Images

One of my favorite considerations is that you don’t have to get “fancy” or look for complex investment schemes to make a good amount of money. This company that we’re going to look at in this article is a good example of this.

Whirlpool (NYSE:WHR) has been an investment I’ve been successful with for years – buying cheap and divesting expensively. I last sold a large chunk of my position at over 10X normalized P/E back in mid-2021. I’ve been looking for a good opportunity to really get back into the mix with Whirlpool.

I believe that time has now come, and I believe everyone should take a look at Whirlpool here.

Whirlpool – recent developments

Since my last article, the company has declined significantly in valuation. The company’s current share price is now under the $175 level, which is interesting considering I sold much of my position at over $250/share. At the current valuation, the company yields over 4%, is still investment-graded, and based on a 2021-2022E P/E is trading at between 6-7X P/E multiple, which is well below its standard range.

What reason is there for this, exactly? 2021, after all, was an amazing year for Whirlpool.

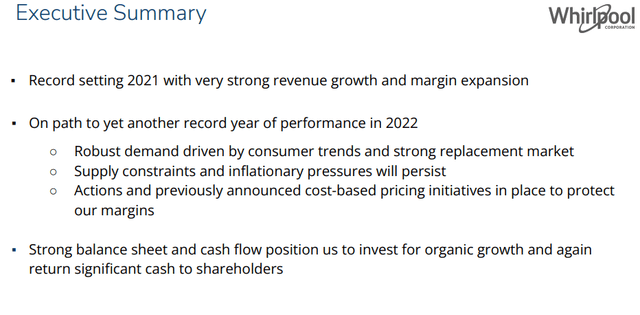

Whirlpool 2021 Report (Whirlpool IR)

And what’s more, the company guided for yet another impressive year in 2022 based on good demands and company actions. The company even bumped the dividend by 25% and announced a solid buyback.

So what exactly happened?

Well, things got more and more choppy as chaos in Ukraine and Russia started to persist. What’s more, Whirlpool actually has significant Russian production/facilities. In Russia, Whirlpool operates two separate production plants that employ more than 2,500 employees. The company also has Ukraine operations. In line with other companies, Whirlpool is winding down operations and providing only “essential” services.

So while 2021 results were excellent, with a 13% YoY net sales growth, large margin expansion, and increase in cash conversion and with numbers excellent out of NA, EMEA, LATAM, the company is seeing fear and impact from what’s currently going on in the east of Europe. Aside from Russia and Ukraine, Whirlpool also has a significant production capacity in Poland. While Poland isn’t at war and unlikely to be, the proximity here might be playing into things as well.

Continued COVID-19 uncertainty may of course also be playing a role. The war has done little to assuage fears of inflation and pricing increases – and with parts of its production capacity effectively eliminated, we’ll have to wait until 1Q22 in mid-April or so to see exactly what’s going to be happening here in terms of impact.

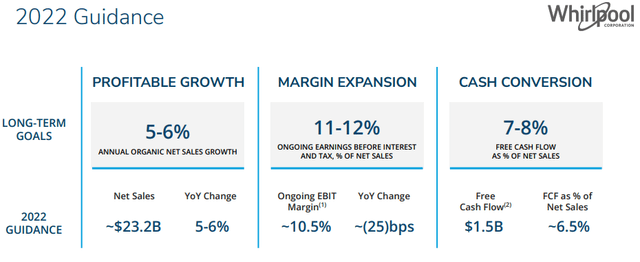

The company did give us 2022 guidance at the end of 2021 – and that guidance was good.

Whirlpool 2022 Guidance (Whirlpool IR)

However, we now need to include the impact on Russia – and the impact of this, as of right now, is unclear. I don’t think we’ll see the company completely unable to deliver growth because of this, but I do believe the growth will be more muted than it could have been. The company intended to deliver improved margins on the back of improved price/mix – and while this is likely still in the bag, it may be harder to realize under the current geopolitical macro.

Still, the fundamentals are solid. The company is within its debt target range and is just coming out on a fourth consecutive year of record results, with $1.4B of cash returned to shareholders.

There are two crucial components to Whirlpool’s potential outperformance in 2022.

First, the company’s upside isn’t as dependent on Russia or Ukraine as we might think – so even if the market is currently punishing the company heavily and we’re seeing a valuation we’ve not seen in over a year for the company, it might not be completely justified when looking at the long term. Or, in layman’s terms, the market is currently being driven by fear.

Secondly, and more importantly, the company may be trading at an absolutely excellent sort of valuation to ensure a long-term outperformance at a very high likelihood.

I believe both of these factors are currently at play here, and they guide my current thesis for Whirlpool.

Whirlpool’s Valuation

The company’s valuation-related thesis is not that complex even at this time, and even after this drop.

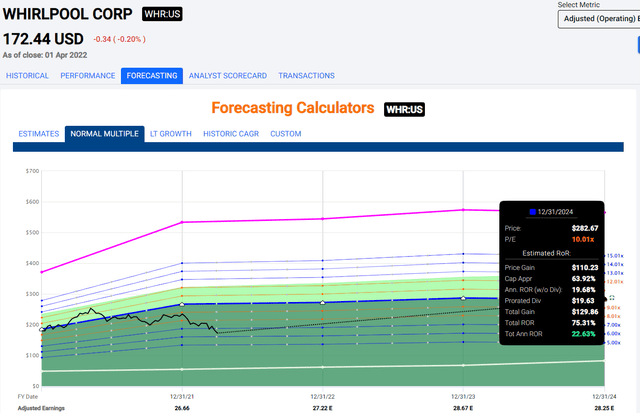

Trading at less than 6.5X P/E, the company has a long-term upside to a normalized P/E ratio of 10X which at this point is more than 22% annually, until 2024. This also includes a recently-raised, well-covered 4% yield with a less than 35% payout ratio on the back of EPS.

While I do believe that EPS for the coming 2-3 years will be muted – in the sense that it likely won’t be growing all that much, the level at which it will be “flat”, will allow for some further growth of the dividend within the company’s range of payout, and it will also allow for the company’s valuation to revert to a more normal level.

Whirlpool Upside (F.A.S.T graphs)

So, on the assumption of a simple 10X P/E normalization, you could basically make 75% in 2-3 years – that’s some excellent data and upside as I see it and a very safe one at that. That’s why I recently bumped my stake in Whirlpool back to a full position in my portfolio.

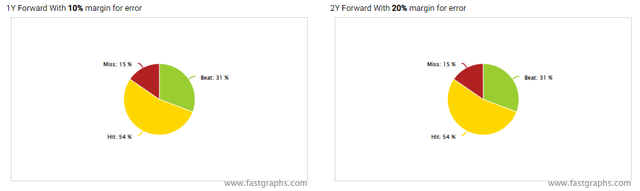

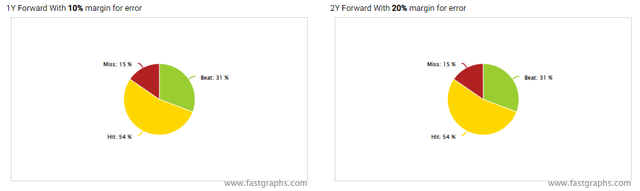

I’m also very open at this valuation, to buying more shares in the company if it were to drop even lower. The upside is only going to get better and better if this does happen. While there’s some analyst miss chance here, it’s relatively small, going by the historical accuracy here.

F.A.S.T graphs Whirlpool Accuracy (F.A.S.T Graphs)

Other sources give the company a similar level of upside here. Whirlpool has a target range of $137-$300 from 7 analysts from S&P Global, with an average PT of $228. Most of these analysts are currently in a “HOLD” position despite this average PT, reflecting a current uncertainty for the 2022 impact that’s also causing this drop in share price, as I see it.

For me, this is a clear opportunity – as clear as it gets. If you recall, I’ve bought Whirlpool in recurring sets when the company troughed to below 7X P/E valuation. It’s actually a pretty solid strategy with Whirlpool over time – buy the company below 7X, sell above 10X. Doing so has resulted in some impressive profits over the past 20 years.

While I do see some impact from Russia and the conflict, I don’t see trouble to a degree where I would be worried about the company seeing some serious level of fundamental deterioration. At worst, we might see growth-ceasing impacts similar to the ones that are currently being forecasted by FactSet (essentially 1-2% EPS growth over 3 years).

And even in that case, at current levels, this company is a “BUY” to me.

Thesis

Despite its character as a traditionally cyclical company and the volatility inherent to Whirlpool, I see this one as a fairly “simple” thesis. Whenever a quality business like this drops to below-logical levels of valuation, it’s time to start buying.

I started buying below $180 – and I’ve kept buying until today, and I intend to keep buying in small chunks until things revert back, or until the position in my portfolio is full.

The company’s valuation history gives us a pretty good idea of how far things can drop for Whirlpool – and while we’re far away from a COVID-19 type drop, this also isn’t a COVID-19 type event, so I don’t think we’re going back to 4.5X P/E for the company.

Whirlpool, at this time, for me is a “BUY” with a price target of no less than $235 for the very long term, accounting for the Russia/Ukraine risk.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Whirlpool is a “BUY” here.

Thank you for reading.

Published at Mon, 04 Apr 2022 21:18:33 -0700