Wall St dips as Treasury yields rise; Disney hits 5-month high

© Reuters. FILE PHOTO: Traders work on the trading floor at the New York Stock Exchange (NYSE) in New York City, U.S., January 27, 2023. REUTERS/Andrew Kelly/File Photo

By Carolina Mandl

(Reuters) – U.S. stock indexes turned lower on Thursday afternoon as Treasury yields rose after an auction, overshadowing gains in Disney after strong earnings.

“The stock market started today’s session with a distinct bullish bias, but then Treasury yields moved up and that took some of the steam out of the positive market today,” said Jason Ware, chief investment officer at Albion Financial Group in Salt Lake City, Utah. He said investors were also still digesting recent comments from Fed officials.

The U.S. 30-year Treasury yield rose after an auction in the early afternoon, while the yield curve between two-year and 10-year notes widened earlier.

Wall Street’s three main indexes opened higher after data showed initial claims for state unemployment benefits rose 13,000 to a seasonally adjusted 196,000 last week, above a forecast of 190,000 claims.

The data tentatively eased concerns about the Federal Reserve’s rate-hike path after a strong January employment report rattled markets last week.

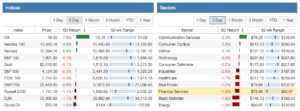

Weighing on the and Nasdaq indexes, Alphabet (NASDAQ:) Inc extended losses from the previous session to fall 5.2179%. The S&P 500 communication services sector sank 2.86%.

The Google parent’s new chatbot shared inaccurate information on Wednesday, feeding worries that it is losing ground to rival Microsoft Corp (NASDAQ:).

Meanwhile, Disney Co was up 0.36% after posting the highest gains since late August. It beat earnings estimates and announced job cuts, encouraging activist investor Nelson Peltz to terminate his quest for a board seat.

Salesforce (NYSE:) Inc added 2.31% on reports that hedge fund Third Point LLC owns a stake in the company.

At 2:36 p.m. ET, the fell 175.71 points, or 0.52%, to 33,773.3, the S&P 500 lost 23.16 points, or 0.56%, to 4,094.7 and the dropped 77.55 points, or 0.65%, to 11,832.97.

Stocks have enjoyed an upbeat start to the year on hopes that the Fed will abandon its hawkish rhetoric and pilot the economy to a soft landing.

Traders are betting that the Fed will raise its benchmark rate to a peak of 5.1% in July, largely in line with the forecasts of Fed officials.

PepsiCo (NASDAQ:) Inc rose 0.67% as the snack and beverage maker reported better-than-expected results, while drugmaker AbbVie Inc (NYSE:) gained 3.08% after beating fourth-quarter profit expectations.

Ralph Lauren Corp (NYSE:) gained 1.01% after beating quarterly sales expectations, while peer Tapestry (NYSE:) Inc soared 4.48% on a strong annual profit forecast.

More than half of the S&P 500 companies have reported quarterly earnings so far, and 69% of them have beaten estimates, according to Refinitiv data.

Cardiovascular Systems (NASDAQ:) Inc soared 48.38% after Abbott Laboratories (NYSE:) said it would buy the medical device maker for $837.6 million. Abbott fell 1.80%.

Declining issues outnumbered advancing ones on the NYSE by a 1.85-to-1 ratio; on the Nasdaq, a 2.02-to-1 ratio favored decliners.

The S&P 500 posted 15 new 52-week highs and one new low; the Nasdaq Composite recorded 69 new highs and 41 new lows.

Published at Thu, 09 Feb 2023 20:11:08 -0800