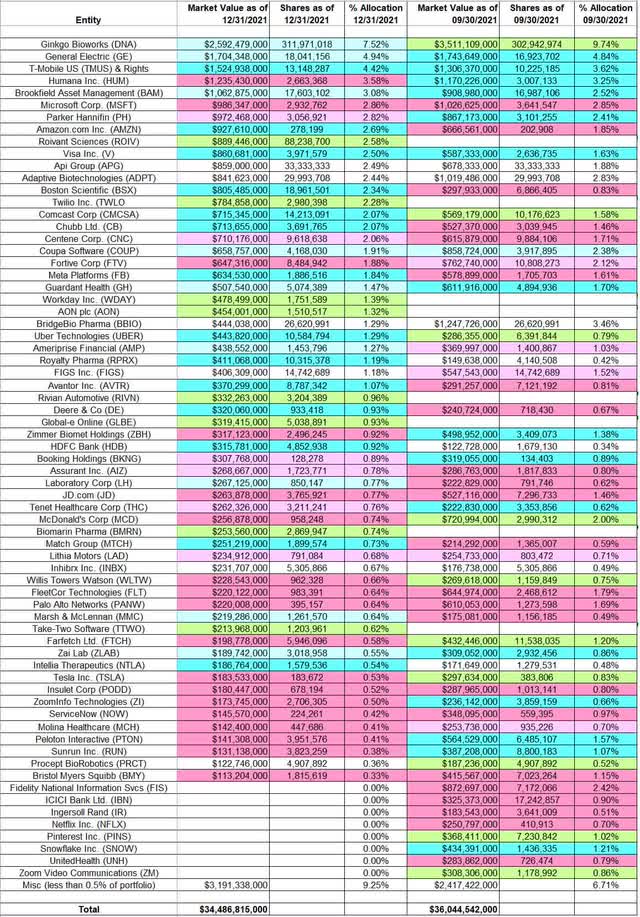

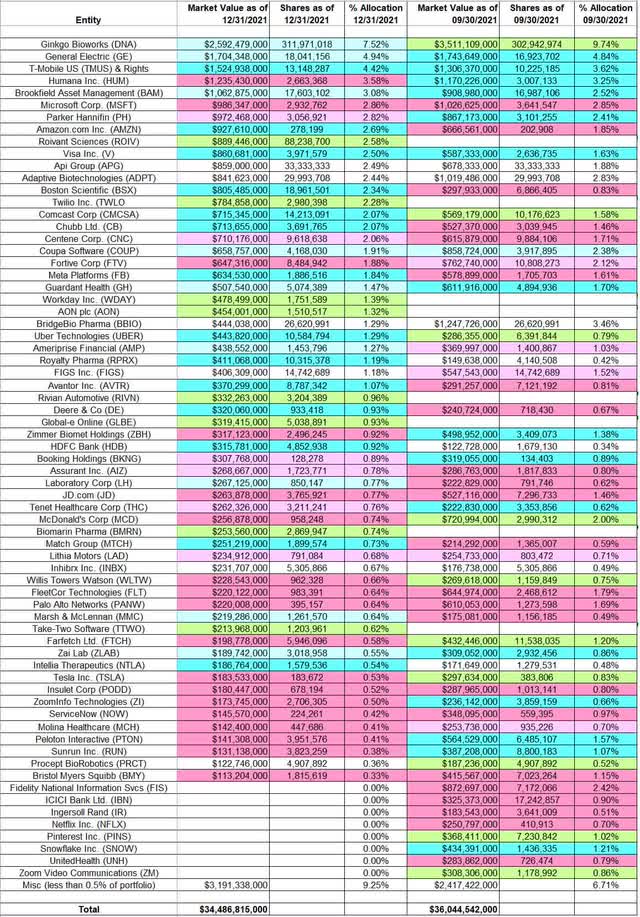

Tracking Ole Andreas Halvorsen’s Viking Global Portfolio – Q4 2021 Update

Antagain/iStock via Getty Images

This article is part of a series that provides an ongoing analysis of the changes made to Ole Andreas Halvorsen’s 13F stock portfolio on a quarterly basis. It is based on Viking Global’s regulatory 13F Form filed on 2/14/2022. Please visit our Tracking Ole Andreas Halvorsen’s Viking Global Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q3 2021.

This quarter, Halvorsen’s 13F stock portfolio value decreased from $36.04B to $34.49B. The number of holdings increased from 96 to 107. Largest five individual stock positions are Ginkgo Bioworks, General Electric, T-Mobile US, Humana, and Brookfield Asset Management. They add up to ~24% of the portfolio.

Ole Andreas Halvorsen is one of the most successful “tiger cubs” (protégés of Julian Robertson & his legendary Tiger Fund). To know more about “tiger cubs”, check out the book Julian Robertson: A Tiger in the Land of Bulls and Bears.

New Stakes:

Roivant Sciences (ROIV): ROIV came to market last September through a SPAC merger with Montes Archimedes. The stock currently goes for $5.22. Viking Global’s 2.58% of the portfolio stake goes back to a private investment made in July 2016.

Note: Viking Global controls ~13% of Roivant Sciences.

Twilio Inc. (TWLO), Workday (WDAY), and AON plc (AON): These are medium-sized new positions established this quarter. TWLO is a 2.28% of the portfolio position purchased at prices between ~$248 and ~$369 and the stock currently trades at ~$150. The 1.39% of the portfolio position in WDAY was established at prices between ~$250 and ~$301 and it is now at ~$235. AON is a 1.32% stake purchased at prices between ~$285 and ~$321 and it now goes for ~$316.

Note: AON is back in the portfolio after a quarter’s gap. A 2.10% AON stake was built in H1 2020 at prices between $146 and $237. The two quarters through Q1 2021 had seen a ~30% selling at prices between ~$180 and ~$234 while next quarter there was a similar increase at prices between ~$230 and ~$259. The disposal last quarter was at prices between ~$227 and ~$299.

Rivian Automotive (RIVN), Global-e Online (GLBE), BioMarin Pharma (BMRN), and Take-Two Software (TTWO): These are small (less than ~1% of the portfolio each) positions established this quarter. Rivian had an IPO last November. Shares started trading at ~$100 and currently goes for $42.13.

Stake Disposals:

Fidelity National Information Services (FIS): FIS was a 2.42% position built in 2020 at prices between ~$102 and ~$157 and it now goes for $95.20. There was a ~20% selling in Q1 2021 at prices between ~$123 and ~$146. That was followed with a ~22% reduction this quarter at prices between ~$121 and ~$151. The disposal this quarter was at prices between ~$102 and ~$125.

Snowflake (SNOW): SNOW is a 1.21% of the portfolio position that saw a ~160% stake increase last quarter at prices between ~$237 and ~$324. The position was sold this quarter at prices between ~$295 and ~$402. The stock is now at ~$209.

ICICI Bank (IBN), Ingersoll Rand (IR), Netflix, Inc. (NFLX), Pinterest, Inc. (PINS), UnitedHealth Group (UNH), and Zoom Video Communications (ZM): These small (less than ~1% of the portfolio each) stakes were sold during the quarter.

Stake Increases:

Ginkgo Bioworks (DNA): Shares of Ginkgo Bioworks started trading last September after the close of their De-SPAC transaction with Soaring Eagle Acquisition. Viking Global started investing in Gingko Bioworks in 2015 when the business raised ~$45M in a Series B funding round. The valuation at the time was ~$200M. They have 22.8% ownership stake in the business. The stock now trades at ~$3. There was a marginal increase this quarter.

General Electric (GE): The large (top three) 4.94% of the portfolio GE stake was purchased over the last five quarters at prices between ~$44 and ~$115 and the stock currently trades at $95.53.

T-Mobile US (TMUS): The large (top three) 4.41% TMUS stake was purchased over the six quarters through Q1 2021 at prices between ~$74 and ~$135. Next quarter saw a ~25% reduction at prices between ~$125 and ~$147 while last quarter there was a ~35% stake increase at around the same price range. That was followed with a ~30% stake increase this quarter at prices between ~$107 and ~$128. The stock is now at ~$129.

Brookfield Asset Management (BAM): BAM is a ~3% of the portfolio position purchased over the last two quarters at prices between ~$44 and ~$57 and it is now at $55.47. There was a minor ~3% stake increase this quarter.

Amazon.com Inc. (AMZN): AMZN is now at 2.69% of the portfolio. It was established in Q2 2015 at prices between $370 and $446 and increased by roughly one-third the following quarter at prices between $429 and $548. The position has wavered. Recent activity follows: The four quarters through Q1 2021 had seen a ~80% selling at prices between $1908 and $3531. The stake was rebuilt next quarter at prices between ~$3094 and ~$3505 but was again sold down last quarter at prices between ~$3188 and ~$3731. The pattern continued this quarter: 37% stake increase at prices between ~$3190 and ~$3696. The stock currently trades at ~$3145.

Visa Inc. (V): The 2.50% Visa position was primarily built in Q4 2020 at prices between ~$181 and ~$219. There was a ~45% reduction over the next two quarters at prices between ~$193 and ~$237. Last two quarters saw a stake doubling at prices between ~$190 and ~$251. The stock currently trades at ~$214.

Comcast Corp. (CMCSA): CMCSA is a 1.58% of the portfolio stake built over the last two quarters at prices between ~$48 and ~$62 and it is now at $46.48.

Boston Scientific (BSX) and Chubb Ltd. (CB): These two positions were increased substantially this quarter. The 2.34% BSX stake saw a ~175% stake increase at prices between ~$38 and ~$45. The stock currently trades at $44.21. CB is a ~2% position that saw a ~20% stake increase at prices between ~$174 and ~$196. It is now at ~$211.

Coupa Software (COUP): COUP is a 1.91% of the portfolio position built in H1 2021 at prices between ~$217 and ~$370 and it currently trades at $81.91. Last two quarters have seen minor increases.

Note: Viking Global controls 5.6% of the business.

Guardant Health (GH): The 1.47% GH stake saw a two-thirds stake increase over the last two quarters at prices between ~$99 and ~$166. The stock is now at $55.82. There was a minor ~4% stake increase this quarter.

Note: Viking Global controls ~5% of the business.

Meta Platforms (FB), previously Facebook: FB is a 1.80% of the portfolio position established over the two quarters through Q1 2021 at prices between ~$246 and ~$295 and it is now at ~$208. Last two quarters had seen a ~27% selling at prices between ~$295 and ~$382 while this quarter saw a ~10% increase.

Ameriprise Financial (AMP), Avantor, Inc. (AVTR), Deere & Co (DE), HDFC Bank (HDB), Intellia Therapeutics (NTLA), Laboratory Corp. (LH), Marsh & McLennan (MMC), Match Group (MTCH), Royalty Pharma (RPRX), Uber Technologies (UBER), and Zai Lab (ZLAB): These small (less than ~1.5% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Humana Inc. (HUM), and Parker-Hannifin (PH): The 3.58% HUM stake was built over the last two quarters at prices between ~$407 and ~$471. The stock currently trades at ~$441. There was a ~11% trimming this quarter. The 2.82% PH stake saw a huge stake build-up last quarter at prices between ~$279 and ~$313. The stock currently trades at ~$289. There was marginal trimming this quarter.

Microsoft Corporation (MSFT): MSFT is now at 2.86% of the portfolio. It was established in Q2 2016 at prices between $48.50 and $56.50 and increased by ~140% in the following quarter at prices between $51 and $58.50. Recent activity follows. 2019 had seen a ~90% reduction at prices between $102 and $159. Q1 2020 saw the stake rebuilt at prices between $135 and $189. There was a ~25% reduction next quarter at prices between $152 and $202. H2 2020 saw a ~180% stake increase at prices between ~$200 and ~$232. Last four quarters saw the position sold down by ~75% at prices between ~$212 and ~$343. The stock is now at ~$295.

Centene Corp. (CNC): Most of the ~2% of the portfolio stake in CNC was purchased in H1 2019 at prices between $47and $66. H2 2019 saw a ~22% selling while next quarter there was a ~50% stake increase at prices between $45.50 and $68. The two quarters through Q1 2021 had seen a one-third selling at prices between ~$58 and ~$71. The stock is now at ~$88. This quarter saw a ~3% trimming.

Fortive Corp. (FTV): FTV is a 1.88% of the portfolio position established in Q3 2019 at prices between $67 and $83. Q4 2019 saw a ~50% stake increase at prices between $64 and $77 and that was followed with a one-third further increase next quarter at prices between ~$42 and ~$79. Q3 2020 saw a ~22% selling at prices between ~$56 and ~$65 while next quarter there was a ~17% stake increase. There was another ~40% stake increase in Q1 2021 at prices between ~$66 and ~$73. This quarter saw a ~20% selling at prices between ~$70 and ~$79. It currently goes for ~$61.

McDonald’s Corp. (MCD), and Farfetch Ltd. (FTCH): These two small stakes established last quarter were sold down this quarter. The 0.74% of the portfolio position in MCD was purchased at prices between ~$229 and ~$248 and the stock currently trades at ~$238. There was a two-thirds selling this quarter at prices between ~$236 and ~$269. The 0.58% FTCH position was purchased at prices between ~$37 and ~$51 and the stock currently trades way below that range at $13.65. There was a ~50% reduction this quarter at prices between ~$30 and ~$47.

Assurant, Inc. (AIZ), Booking Holdings (BKNG), Bristol Myers Squibb (BMY), FleetCor Technologies (FLT), Insulet Corp. (PODD), JD.com (JD), Lithia Motors (LAD), Molina Healthcare (MOH), Palo Alto Networks (PANW), Peloton Interactive (PTON), ServiceNow (NOW), Sunrun Inc. (RUN), Tenet Healthcare (THC), Tesla Inc. (TSLA), Willis Towers Watson (WTW), Zimmer Biomet Holdings (ZBH), and ZoomInfo Technologies (ZI): These small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

APi Group (APG): Viking Global was an early investor in J2 Acquisition, a SPAC which acquired APi Group in October 2019. APi Group started trading at $10.40 and now goes for $21.07.

Note: Viking Global has a ~17% ownership stake in the business.

Adaptive Biotechnologies (ADPT): ADPT position is now at 2.44% of the portfolio. It came about as a result of Adaptive’s IPO in June 2019. Viking Global was a majority investor in Adaptive. Shares started trading at ~$48 and currently goes for $12.42. Q1 2020 saw a ~13% trimming at ~$25 per share. There was another ~10% trimming in Q4 2020 at ~$50 average price.

Note: Viking Global still controls ~21% of Adaptive Biotechnologies.

BridgeBio Pharma (BBIO): BBIO is a 1.29% stake. It had an IPO in Q1 2019. The stake goes back to earlier funding rounds prior to the IPO. The stock started trading at ~$27 per share and currently goes for $10.76.

Note: Viking Global controls ~21% of BridgeBio Pharma.

FIGS Inc. (FIGS): FIGS had an IPO last May. Shares started trading at ~$30 and currently goes for $18.90. Viking Global’s 1.18% of the portfolio stake goes back to funding rounds prior to the IPO.

Inhibrx (INBX) and Procept BioRobotics (PRCT): These two very small (less than ~1% of the portfolio each) positions were kept steady this quarter.

Note: They have a 11.3% ownership stake in Procept BioRobotics and a 14% ownership stake in Inhibrx.

Note: Viking Global has significant ownership stakes in the following businesses: 4D Molecular (FDMT), Amylyx (AMLX), Edgewise Therapeutics (EWTX), Pharvaris NV (PHVS), PMV Pharma (PMVP), Rallybio Corp. (RLYB), Talaris Therapeutics (TALS), and Zentalis Pharma (ZNTL).

The spreadsheet below highlights changes to Halvorsen’s 13F stock holdings in Q4 2021:

Ole Andreas Halvorsen – Viking Global Investor’s Q4 2021 13F Report Q/Q Comparison (John Vincent (author))

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Published at Thu, 17 Mar 2022 20:26:40 -0700