Three Dividend Growth Stocks Increasing Shareholder Dividends

I review the list of dividend increases as part of my monitoring process. This helps me review the story behind companies I already own. It also helps me review companies for potential inclusion into my watchlist.

A long track record of annual dividend increases is an indication of a quality company with a strong business model. Its strength could be due to a favorable environment, competitive position, unique product, patent or trademark, a strong brand, a loyal group of customers or a combination of the above.

I find it helpful to identify these businesses and place them on my list for further research.

During the past week, there were three companies with long histories of annual dividend increases, which also hiked distributions to shareholders.

The companies include:

Bank OZK (OZK) provides various retail and commercial banking services. It accepts various deposit products, including non-interest-bearing checking, interest bearing transaction, business sweep, savings, money market, individual retirement, and other accounts, as well as time deposits.

The bank raised its quarterly dividend by 3.10% to $0.33/share. This is a 13.79% increase over the dividend paid during the same time last year. Bank OZK has increased its quarterly cash dividend on its common stock in each of the last forty-nine quarters.

Over the past decade, the company managed to increase dividends at an annualized rate of 18.16%. The five year average is at 12.07%, which is still very impressive. This dividend achiever has managed to increase annual dividends in each year since 1997.

The stock sells for 9.21 times forward earnings and yields 3.1%

RPM International Inc. (RPM) manufactures, markets, and sells specialty chemicals for the industrial, specialty, and consumer markets worldwide.

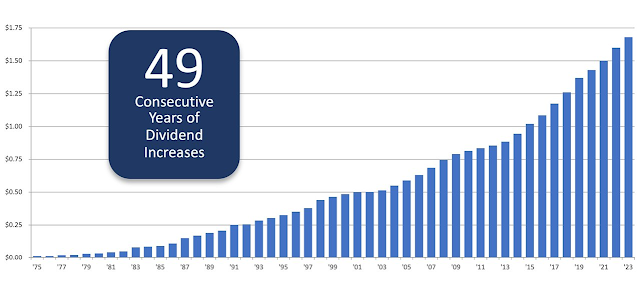

The company increased its quarterly dividends to shareholders by 5% to $0.42/share. This action marks RPM’s 49th consecutive year of increased cash dividends paid to its stockholders. RPM International is a dividend champion.

“The incredible efforts of RPM associates and their ability to collaboratively address the challenges we’ve faced have enabled RPM to continue to drive growth, at the same time we are achieving greater operational efficiency across all our businesses,” stated Frank C. Sullivan, RPM chairman and CEO. “We remain committed to delivering sustainable, long-term value for our stockholders, and our 49th consecutive year of increasing our dividend exemplifies this commitment.”

Over the past five years, it has managed to grow dividends at an annualized rate of 13.40%.The stock sells for 19.60 times forward earnings and yields 1.69%.

Trinity Bank, N.A. (TYBT) provides personal and business banking products and services in Texas.

The bank raised semi-annual dividends by 4% to $0.78/share. This is a 6.85% hike over the dividend paid during the same time last year. Trinity Bank has now increased its semiannual dividend each six months since dividends were initiated in 2012. Over the past five years, it has managed to grow dividends at an annualized rate of 9.27%.

CEO Opitz stated, “I am proud of Trinity Bank’s history of performance and earnings which has made it possible to share a significant piece of that success with our shareholders through these cash dividends. Our excellent employees, who are committed to building long-term banking relationships and delivering exceptional customer experiences, are the ones to thank for this success.”

The stock sells for 15.50 times earnings and yields 1.79%.

Relevant Articles:

– Six Dividend Aristocrats Expected to Boost Dividends in October 2022

Published at Mon, 10 Oct 2022 01:00:00 -0700