Dear Quentin,

I recently opened a robo-adviser account because purchasing and picking stocks seems complicated, and I would have no idea what I am doing. I figured a robo-adviser would take out a lot of guesswork and confusion. All I have to do is deposit money and let the account do the hard work, which works for me.

I opened my account in September 2021 with a $300 deposit, and I have deposited a total of $9,298 into my account. However, I have $8,522 invested as I have taken in some losses. I keep depositing money into the account with not many gains; I feel like I should maybe have $10,000 by now.

A friend of mine suggested I can just keep putting money in a high-yield savings account and when the stock markets are getting better, I can just deposit a lump sum into my robo-adviser account. But I keep reading that I should just keep investing, as the stock market will eventually pick up.

I am freaking out! Should I keep investing given that few people have luck with timing the market? Rumors of the stock market crashing are not helping. I know investing comes with risk, but I am a bit scared to lose all my hard-earned money. I have no idea if what I am doing is good or bad.

Are my numbers so far any good?

Anxious Investor

Dear Anxious,

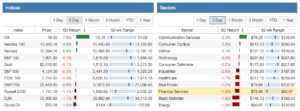

You may have lost money over the last 10 months, but it could have been a lot worse. Your investment is down around 8%. The Dow Jones Industrial Average

DJIA,

meanwhile, is down almost 10% over the same period, the Nasdaq Composite

COMP,

is 27% lower, and the S&P 500

SPX,

is down nearly 15%. So your robo-adviser should take a bow.

Of course, there’s no guarantee that your portfolio won’t plunge lower, or even go higher. With persistent worries about inflation and the U.S. Federal Reserve’s delicate balancing act — trying to control inflation without pushing the economy into a recession, which some say is already here — anything can happen with stocks. So buckle up, sunshine.

A stock market crash is, by definition, a sudden and protracted fall in stocks that is also typically unexpected. By those standards, the stock market has already experienced a dramatic decline and, at the very least, many stocks have seen their value plummet. Some say this could be a “lost decade” for stocks. Others say a bull market is just months away. Maybe.

“There are many robo-advisers and they all take a different approach. However, just like live human advisers, you need to tell them what your goals and risk tolerance are so they can invest your portfolio accordingly,” says Larry Pon, a financial planner based in Redwood City, Calif. “You need to answer their questions as honestly as possible. If you give them inappropriate information, then your portfolio may be invested inappropriately.”

Ideally, robo-advisers help take the emotion out of investing, Pon says. He put $10,000 into a robo-adviser account with a “moderate” allocation of 50/50 stocks and bonds for long-term investing without too much risk.

“The current value is $8,804,” he says. “This means the account is down 12% from when I opened it. I am not freaked out by this. As a matter of fact, I’ve been adding more to the account because the share prices are down so I am buying on sale.”

“‘As the 2008 financial crisis showed, the stock market will eventually recover. You just need to make sure you have time.’”

You could put your money into a high-interest savings account, or continue to invest at the current levels. You will rarely, if ever, be able to time the peak of the market before a downturn, but the good news for those who wish to invest is that we’re a long way from that now. As the 2008 financial crisis showed, the stock market will eventually recover. You just need to make sure you have time.

Robert Seltzer, the founder of Seltzer Business Management in Los Angeles, Calif., says you are experiencing one of the shortcomings of robo-advisers. They encourage you to invest consistently, but they don’t replace humans. “Unlike with an account with a responsible financial adviser, there was no conversation about risks and what to expect or how the stock market works,” he said.

Seltzer said he can’t really tell from your letter whether investing in the stock market was appropriate for you. For example, if you were saving for a down payment on a home in a year or two, he says the stock market would not be appropriate for you right now. However, if this was for retirement and you are in your 30s, then Seltzer says it would be appropriate.

“There is volatility in the stock market and, if you are a long-term investor, it is fine,” he adds. “However, the stock market is not the place to put emergency funds or short-term money.” Your friend’s suggestion, as you indicate in your letter, is not exactly a wise one. “Trying to pick a time to get back in the market is next to impossible,” Seltzer says.

Michael J. Mussio, the president of FBB Capital Partners, believes you should keep going. “You are currently employing some of the most successful strategies of long-term investors,” he says. “You’re investing early and often, and you’re doing so by dollar cost averaging over time rather than putting a bunch of money in the market at once trying to time a bottom (or a top).”

“It can be frustrating to see negative returns as you move closer to the one-year mark since you first began with your plan; however, you’re likely better off having spread your investment out over time,” Mussio adds. “By spreading your investment out over time, you have been buying more shares of your current strategy at lower prices for most of this calendar year.”

The only way for you not to lose all of your hard-earned money is to not invest all of your hard-earned money. If you have no idea what you are doing, find a robo-account that has a human being who gives you advice. And if you are freaking out and it’s making you miserable, you are answering your own question: Only invest what you are comfortable losing.

But remember any losses you see now are paper losses — and over your investing lifetime, as the advisers I quoted here point out, there’s a good chance you will look back on this period of the stock market and see that you (probably) invested at a good time. There are no guarantees. But the market’s previous performance over time is a good indicator of its future performance.

“It is nearly impossible to time the market and I would ignore the misinformation that you see on the internet,” Pon says. “You are fine if this money is meant to be a long-term investment. The overall trend of the market has been positive. Market downturns are part of the normal cycle. A way to protect yourself from these downturns is to be invested in a diversified manner.”

With all that advice in mind, take a deep breath — and, assuming you are a couple of decades away from retirement, freak out about something else instead.

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Readers write in to me with all sorts of dilemmas. Post your questions, tell me what you want to know more about, or weigh in on the latest Moneyist columns.

The Moneyist regrets he cannot reply to questions individually.

By emailing your questions, you agree to having them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Also read:

Published at Fri, 15 Jul 2022 16:12:00 -0700