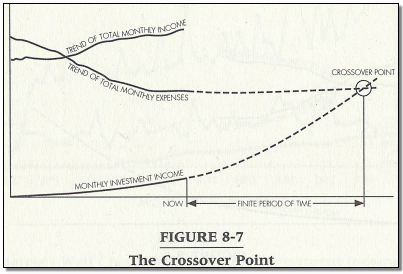

The goal of every dividend investor is to one day accumulate a portfolio of income producing stocks, which would throw off a large amount of dividends every month. The magic point is where the dividend income exceeds the expenses of the dividend investor. At the dividend crossover point your dividend income meets or exceeds your expenses. For many dividend investors, this is the point synonymous with financial independence. After all, after years of sacrifice, wise investment and sticking to a plan, investors would finally be able to do be free from a nine to five job. The goal of reaching the dividend crossover point is achievable, but it takes capital, time, skill or luck in order to get to the magic point.

In order to reach that magical point, a lot of work needs to be done. Investors need to design a retirement strategy, and then stick to it through thick and thin, while also improving along the way. Some of the biggest dangers to successful dividend investing are not market volatility, dividend cuts or recessions, but investor psychology.

The process of accumulating a viable dividend stream will take anywhere from several years for those who are starting out with a large amount in their 401 (k) or IRA’s to a few decades for these young investors who are just starting out in their professional careers. Along the way, many investors will lose track of the goal due to sheer boredom or due to lack of patience. Successful dividend investing is sometimes as exciting as watching paint dry. Unfortunately, investors who enter dividend investing for the sheer excitement do not stick to it. On the other hand, investors who attempt to find shortcuts to speed up the process of capital accumulation by using options and futures, risky growth stocks or massive leverage will likely be disappointed along the way.

The key ingredients to accumulating a sufficient dividend income stream include time, dividend reinvestment and regular contributions to your portfolio. The power of regular contributions is important, because this ensures that investors consciously keep working towards their goal of dividend independence by investing in dividend stocks every month. While markets fluctuate greatly, I have always found at least 15 – 20 attractively valued income stocks at all times. Dividend reinvestment in dividend growth stocks is essential for turbo-charging your passive income. And last but not least, investors need the time to let their income compound to their desired amount.

Dividend investing takes time, before the amount of distributions reaches decent levels. Imagine that someone managed to save $1000/month for one year. Each month, they put $1000 total in two companies ($500 dollars per company per month). At the end of the first year, they would have about 24 companies, and the portfolio cost will be $12,000. If the average yield were 4%, this portfolio will generate $480 in annual dividends, which accounts for roughly $40/month. On the positive side, the dividends from this portfolio will generate enough to purchase one additional stock position per year. In addition, $40/month could pay for utilities, phone or internet bills for the investor pretty much for life. On the negative side, assuming that the investor needs $1000/month to cover their basic expenses, he or she would calculate that they would need to sacrifice almost for one decade, before their income reaches a decent amount. Once they are there however, and their portfolios consist of wide-moat dividend champions with sustainable distributions, investors will be able to live off dividends.

You can see that building that dividend machine can be a long term process. The levers within the control of the investor include their savings rate, ability to develop a strategy and stick to it, in order to allow the power of long-term investment compounding to do its magic.

In my investing, I have found very important to follow a few simple rules in order to create a sustainable dividend producing machine, which would produce dependable income for decades.

First, investors should focus on companies which have a long history of paying and raising dividends. I typically look for companies which have increased dividends for at least ten years in a row.

Second, investors should make sure that these companies are trading at attractive valuations. I have found that paying a P/E of over 20 could lead to poor results.

Third, investors should make sure that the company’s dividend is sustainable out of earnings or cash flows. I typically look for a dividend payout ratio of less than 60% for ordinary stocks. For REITs or Master Limited Partnership I look for FFO Payout and DCF Payout Ratios.

Fourth, investors should perform a qualitative analysis of the dividend paying company they consider for purchasing. This analysis should include understanding how the business makes money, growth prospects, competitive landscape, whether the business has any moat, whether the company has any strong brands, which consumers are loyal to and result in pricing power.

Fifth, investors should try to build a diversified dividend portfolio consisting of at least 50 -60 individual stocks coming from at least ten sectors. Having exposure to internationally based companies is a plus, despite the fact that most dividend growth stocks derive a major part of their profits from outside the US.

Conclusion

Today we discussed the concept of the dividend crossover point, which is the point where dividend income exceeds expenses. We also discussed the tools within the investor’s control to get there.

Finally, I shared a brief overview of the types of simple investing rules I follow to evaluate dividend paying stocks. All of the principles listed in this article are the cornerstones of the Dividend Growth Portfolio Newsletter that I launched a few years ago. I believe that by showing how I am building a real world portfolio from scratch, I can educate investors on the inner works of dividend investing.

At the same time, dividend income makes it easy to see how we are doing against our ultimate goal of $1,000 in monthly dividend income. Right now, the dividend growth portfolio is earning $110 in expected average monthly dividend income after three years of saving and investing.

Relevant Articles:

– Use these tools within your control to get rich

– Getting Started – The Hardest Part About Dividend Investing

– What are your investment goals?

– Financial Independence Is Easier to Model with Dividends

Published at Thu, 12 May 2022 11:30:21 -0700