The $700-A-Month Portfolio Building Strategy For Retirement – Sept. 2022 Update

It’s been a rough month.

Ronald Martinez

Finviz.com

Since August 25th, when we decided to make $1M in a new portfolio, the S&P 500 has dropped from 4,000 to 3,635 (9.1%) and the market mood has certainly gotten sour. This is EXACTLY what the Fed wants and needs as it ends the TINA (There Is No Alternative) for Stocks at the same time as it chases people out of housing and that leaves – BONDS! – which the Fed holds a lot of and the Government needs to sell a lot of.

The alternative to the Fed raising rates to get in-line with inflation is that they don’t do that and the bond market (via note auctions) does it for them. Since the Fed’s entire power is adjusting rates – taking that out of their hands will cause a massive lack of confidence in the whole system and then we would be truly screwed – Greece-style.

Rates were going to go up whether the Fed raised them or not. By making themselves the bad guy – they get to look like they are controlling things but what idiots would by $100Bn worth of 10-year notes at auction if they were still paying 2%? What idiot would lend you $400,000 to buy a $500,000 home at 4% when inflation is 10%? Rates out of line with inflation expectations grind liquidity (lending) to a halt and that is DOOM!!! for any economy.

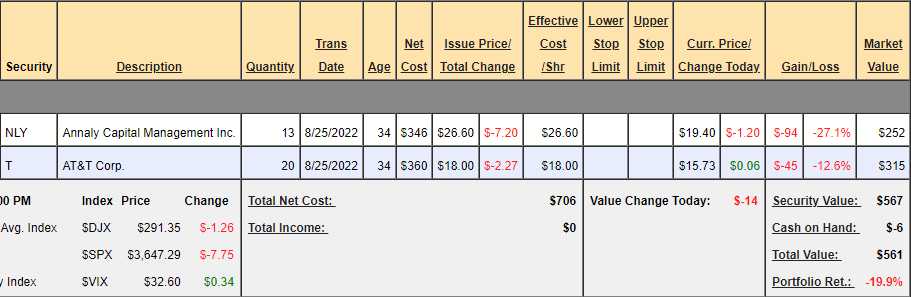

So let people panic about a perfectly normal economic cycle as this too shall pass and, meanwhile, we shall keep buying. Last month, we initiated our new $700 Per Month Portfolio with 2 purchases and now we look like this:

$700/Month Portfolio (Philstockworld.com)

Down 20% in our first month is not a good start. NLY did a 1:4 reverse split yesterday and the stock has been dropping like a rock since they effectively cut the dividend by 75%. I would love to take advantage of this and sell a put, like the 2025 $20 puts that are trading for $8, which would be a net $12 entry but we only have another $700 to spend and no margin so all we can do this month is stick to our plan:

- Buy 18 shares of NLY at $19.40 ($349.20)

- Buy 22 shares of T at $15.73 ($346.06)

NLY Daily Chart (Finviz.com)

T Daily Chart (Finviz.com)

Nothing has changed in our premise – the market has simply gone down, so we’re buying our second set of shares cheaper than the first. Even though they are down, NLY will average $23/share for 31 shares and we’ll collect 0.22 dividend tomorrow so $22.78 per share will be our net cost. Once we get to 100 shares, the Jan 2025 $18 calls can be sold for $4 and that will drop our net to $18.78, less the next dividend is another 0.22 (if they keep it here) would be $18.56 and that’s only our first 100 – so I’m not worried.

The same goes with T as we now have 56 shares at an average of $16.865 and we’ll get 0.28 from them next month and that will be net $16.58 average and, when we get to 100 shares, we can sell the 2025 $13 calls at $3.60 to drop our net to $12.98 – not to mention more dividends!

So despite the drops right after our initial entries, we’re still on track to establish our first two dividend-paying positions in month 2 (of 360). Yes, it’s a very slow, tedious process but it also works – even in horrific market conditions – and that’s the point of this exercise – to teach you to be patient and take a step by tedious step process to your long-term investing goals!

NLY has a cousin stock, Chimera Investment Corp (CIM), with the same management team and I like them as well. They are currently at $5.99/share and pay an 0.92 dividend (15.3%) but I imagine the same logic that drove them to reverse-split NLY will move them to do the same with CIM but, if they are still at this level next month – I would consider selling 1 CIM 2025 $7 put for $2.90 – as that would net us in for $4.10 on 100 shares and would only use $410 of our buying power (the assignment risk) and we’d either keep the $290 we collect (more than two years dividend) if the stock is over $7 or we’d have a net $4.10 entry on our first 100 shares if it’s under $7 – a 31.5% discount to the current price.

CIM Daily Chart (Finviz.com)

With a $410 commitment to owning 100 shares, the next step (using our $700 monthly limit) could be buying 100 shares for $600 and selling a 2025 $5 call for $1.50 ($150). That would be net $450 and then we’d own 100 shares for $450 less the $410 we collected for promising to buy 100 more at $7 so net $40 out of pocket for the 100 shares and our worst case would be having another 100 assigned at $7 but that would total $740 for 200 shares or $3.70 per share – not much of a worst case, is it?

To the upside, if we get called away at $5, we net $460 in profits (plus dividends collected) and, if we are over $7 – that’s going to be it and over $5 and under $7 means we’d get 100 shares assigned to us for $700 – less the $460 we made would be $240 or $2.40 per share.

When your worst case sounds great – it’s a good trade!

Published at Thu, 29 Sep 2022 09:00:03 -0700