TFSA – 2022 Contribution Limit

The TFSA account is relatively new and often referred to as a younger sibling to the RRSP.

The choice of investing in your TFSA or RRSP first is still a debated question but what isn’t up for debate is your contribution amount per year and how much you accumulate in contribution room.

The TFSA contribution limits starts accumulating once you turn 18 unlike RRSP where you need to have income declared to accumulate contribution room. It’s the perfect vehicle to create a passive income machine with dividend investing.

How much you can contribute is based on your accumulated limit and how much you have contributed. Your TFSA contribution room is pretty easy to calculate – check out the amazing calculator below with mind-blowing math.

The TFSA account is the best way to start investing.

2022 TFSA Contribution Limit

The TFSA contribution limit for 2022 is $6,000 for a total contribution of $81,500 since inception.

Here are the limits for each year since inception. The total since the beginning and up to 2022 is $81,500. All of the profits made within a TFSA is completely tax free. The latest increase was for 2019 and the inflation adjustment is not pushing the limit to the next nearest $500 just yet.

Future contribution limits are indexed to inflation rounded to the nearest $500. You can always review the detail over at the Canada Revenue Agency (CRA) but to see how profitable a TFSA can be, continue reading.

| wdt_ID | Year | Yearly Limit | Cumulative | Comment |

|---|---|---|---|---|

| 1 | 2009 | 5,000 | 5,000 | |

| 2 | 2010 | 5,000 | 10,000 | |

| 3 | 2011 | 5,000 | 15,000 | |

| 4 | 2012 | 5,000 | 20,000 | |

| 5 | 2013 | 5,500 | 25,500 | |

| 6 | 2014 | 5,500 | 31,000 | |

| 7 | 2015 | 10,000 | 41,000 | |

| 8 | 2016 | 5,500 | 46,500 | |

| 9 | 2017 | 5,500 | 52,000 | |

| 10 | 2018 | 5,500 | 57,500 |

TFSA Contribution Calculator

It’s pretty simple to calculate your contribution with the table above. The formula is the total for the current year minus your contribution to date minus the total for the year before you turn 18.

For example, if you turned 18 after 2011, the formula would have the following parameters:

- Total for 2022 is $81,500

- Contribution to date, say $10,000

- Total before turning 18 is $10,000

We are left with the following math: $81,500 – $10,000 – $10,000 = $61,500

Now that you can easily calculate your potential and actual contribution room, my suggestion is that you try to keep up with filling up your contribution room if you can. A strong dividend growth approach will easily beat inflation and provide solid returns..

Accessing Your Contribution Details

As soon as you file a tax return, you should have an account with the Canada Revenue Agency and you can always check the status of your contribution room under your account. Financial institutions are required to report the contributions.

You simply need to create an account. It’s pretty useful to have the account and you can manage your direct deposit for your tax return.

TFSA Withdrawal Rules

You can withdraw tax-free at any time but you cannot contribute that money until the new year. If you were to contribute the maximum over the first few months of the year and then withdraw it in August, you can only add it back come January 1st of the following year.

TFSA Over-Contribution Penalty

If you happen to over contribute, the extra contribution will be subject to a 1% penalty per month. I recently handled an RRSP over-contribution and it’s more paperwork than you want.

If you realize you have over-contributed, quickly withdraw the amount and start filling the forms. Get ahead of it to avoid surprises.

TFSA Growth Opportunity

Having the account is step one in building wealth, the next step is putting your money at work. When you do and you start early, time can do wonders when partnered with compound growth.

Below is a graph and table showing the potential growth. Choosing between investing in your RRSP or TFSA first is a good problem to have and the perfect solution is based on your situation. Investing in a RRSP requires diligence in how you handle the tax refund to truly reap the benefits.

The better you do in your TFSA the less it will impact your OAS clawbacks and the more you can retain from your CPP payments in retirement.

How you decide to grow this tax free account can have a major impact later in life and that’s why it’s an investing account and not an emergency account. Investing is important if not critical.

Before you think the 10% growth in the table below is not possible, my TFSA market value is outlined below in the table and keeping up with the 10% and doing better. Check out my stock portfolio to see what I hold. Dividend investing is true passive income.

It’s true what they say: “The first million is the hardest!”.

| wdt_ID | Year | Yearly Limit | Cumulative | 5% Growth | 10% Growth | Dividend Earner | Spousal |

|---|---|---|---|---|---|---|---|

| 1 | 2009 | 5,000 | 5,000 | 5,250 | 5,500 | Not Tracked | Not Started |

| 2 | 2010 | 5,000 | 10,000 | 10,762 | 11,550 | Not Tracked | Not Started |

| 3 | 2011 | 5,000 | 15,000 | 16,550 | 18,205 | Not Tracked | Not Started |

| 4 | 2012 | 5,000 | 20,000 | 22,628 | 25,525 | Not Tracked | Not Started |

| 5 | 2013 | 5,500 | 25,500 | 29,534 | 34,128 | $41,742 | Not Started |

| 6 | 2014 | 5,500 | 31,000 | 36,786 | 43,590 | $52,820 | Not Started |

| 7 | 2015 | 10,000 | 41,000 | 49,125 | 58,949 | $56,307 | Not Started |

| 8 | 2016 | 5,500 | 46,500 | 57,356 | 70,984 | $70,200 | Not Started |

| 9 | 2017 | 5,500 | 52,000 | 65,999 | 84,034 | $78,900 | $13,308 |

| 10 | 2018 | 5,500 | 57,500 | 75,074 | 98,487 | $96,937 | $58,818 |

| 11 | 2019 | 6,000 | 63,500 | 85,128 | 114,986 | $129,467 | $82,596 |

| 12 | 2020 | 6,000 | 69,500 | 95,684 | 133,030 | $153,993 | $95,906 |

| 13 | 2021 | 6,000 | 75,500 | 106,769 | 152,933 | $187,601 YTD | $113,194 YTD |

| 14 | 2022 | 6,000 | 81,500 | 118,407 | 174,827 | ||

| 15 | 2023 | 6,500 | 88,000 | 131,152 | 199,459 | ||

| 16 | 2024 | 6,500 | 94,500 | 144,536 | 226,555 | ||

| 17 | 2025 | 6,500 | 101,000 | 158,587 | 256,361 | ||

| 18 | 2026 | 6,500 | 107,500 | 173,342 | 289,147 | ||

| 19 | 2027 | 7,000 | 114,500 | 189,359 | 325,762 | ||

| 20 | 2028 | 7,000 | 121,500 | 206,177 | 366,038 | ||

| 21 | 2029 | 7,000 | 128,500 | 223,836 | 410,342 | ||

| 22 | 2030 | 7,500 | 136,000 | 242,902 | 459,626 | ||

| 23 | 2031 | 7,500 | 143,500 | 262,923 | 513,838 | ||

| 24 | 2032 | 7,500 | 151,000 | 283,944 | 573,472 | ||

| 25 | 2033 | 7,500 | 158,500 | 306,016 | 639,069 | ||

| 26 | 2034 | 7,500 | 166,000 | 329,192 | 711,226 | ||

| 27 | 2035 | 7,500 | 173,500 | 353,526 | 790,599 | ||

| 28 | 2036 | 7,500 | 181,000 | 379,078 | 877,909 | ||

| 29 | 2037 | 7,500 | 188,500 | 405,906 | 973,950 | ||

| 30 | 2038 | 7,500 | 196,000 | 434,077 | 1,079,595 |

TFSA Investing Strategy

Before you delay investing by learning about all various strategies, start with the simplest one and buy the S&P500 index which covers the top 500 companies in the US which are all international conglomerates.

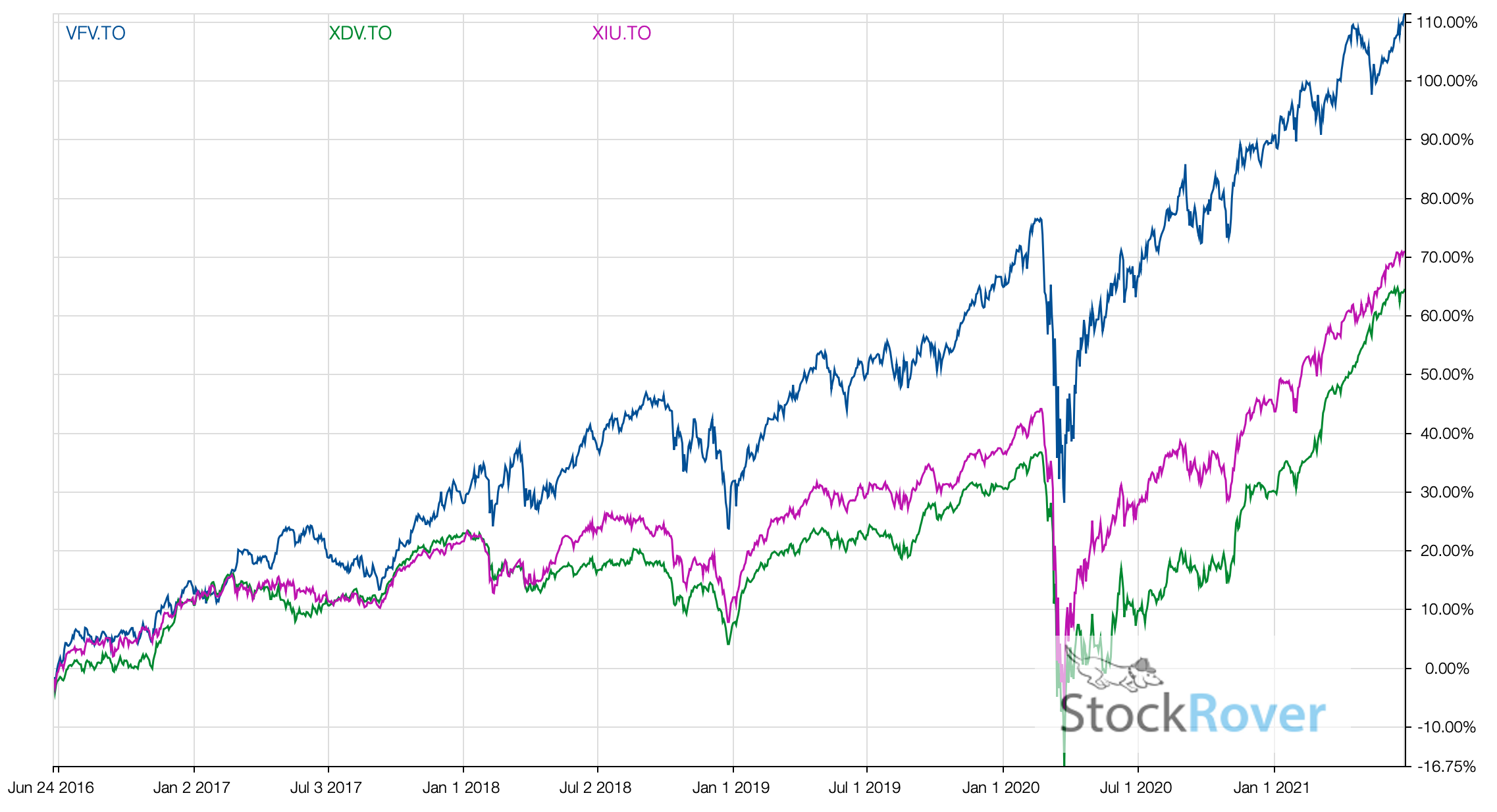

VFV is an ETF purchased in Canadian dollars tracking the S&P500 index. It’s my go to benchmark.

When trying to build wealth or outperform an index, you need the right tools to find your winning investment. As a DIY investor, my winning tool is Stock Rover. It allows me to build the most powerful dividend stock screeners. Stock Rover is powerful! It’s like having a supercar in your hands, take the time to learn the tool.

Published at Wed, 17 Nov 2021 21:20:00 -0800