The markets can have a mind of their own at times … The recent pull back is reminescent of 2009 when many financial stocks were discounted.

Corp Account Guidelines

A reminder on the account guidelines:

- Preserve capital by not taking unnecessary risks while not expecting growth per say.

- Earn income from the investment with a yield above 5% from dividends or distributions.

- Keeping up with inflation is not necessary as it’s not a retirement account.

- No re-investment of income. It will either be used to pay taxes, or withdrawn from the corporation as dividends to myself.

- Focus on Canadian currency.

Screening Method

The method I used to screen GWO during my first trade is still valid.

I did, however, double check for better options. Income trusts or ETFs were currently excluded in my filtering as I wanted to focus on a dividend stock due to the market drop.

The short list is the following with a yield close to 6%

I had a look at the banks and only Scotia Bank had a yield near 5% and still not in the attractive territory unlike many of the life insurance stocks.

I opted to stick with Great West Life instead of its parent company or Manulife.

Interestingly, Great West Life was also highlighted as a top pick on BNN last week.

Tax Efficiency

At this point, I have 60% of my initial contribution in dividend stocks while 40% in an ETF which is more tax efficient for a similar yield.

The difference is that Great West Life will increase the dividend over time while the ETF will stay relatively fixed.

It’s a balance and not just a play on tax efficiency.

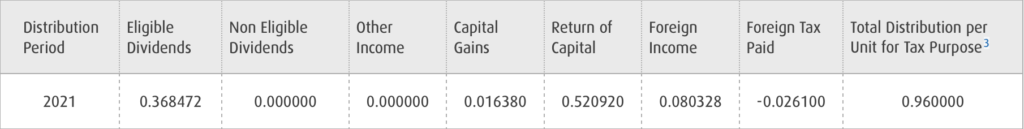

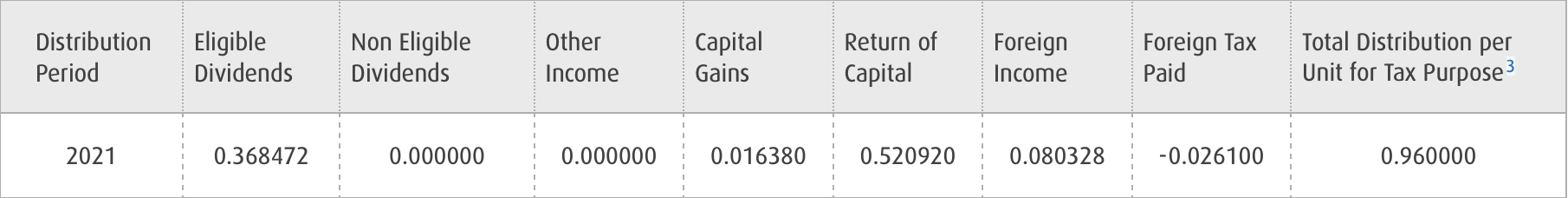

In a corporate account, capital gains are very efficient and many covered call ETFs pay a return of capital. You get money back without any taxes until you sell and trigger a capital gains.

See the ratios below to understand the actual tax rate of the ETF distribution.

Note that I am still learning about corporate tax for investing … While I have a good handle of personal taxes, it’s my first year doing corporate taxes with an accounting firm. Hopefully, I am not making too many inneficient decisions.

Next Steps

The markets can always make me adjust my plans but my next contribution of $5,000 will be earmarket for an income trust or ETF.

Published at Tue, 17 May 2022 22:55:26 -0700