Predicting Consistently High Dividend Growth

One of my favorite investing activities is testing various ideas and then crunching numbers. I spend quite a lot of time thinking about investing from various angles.

I recently tested whether high rates of historical annual dividend growth had any predictive value.

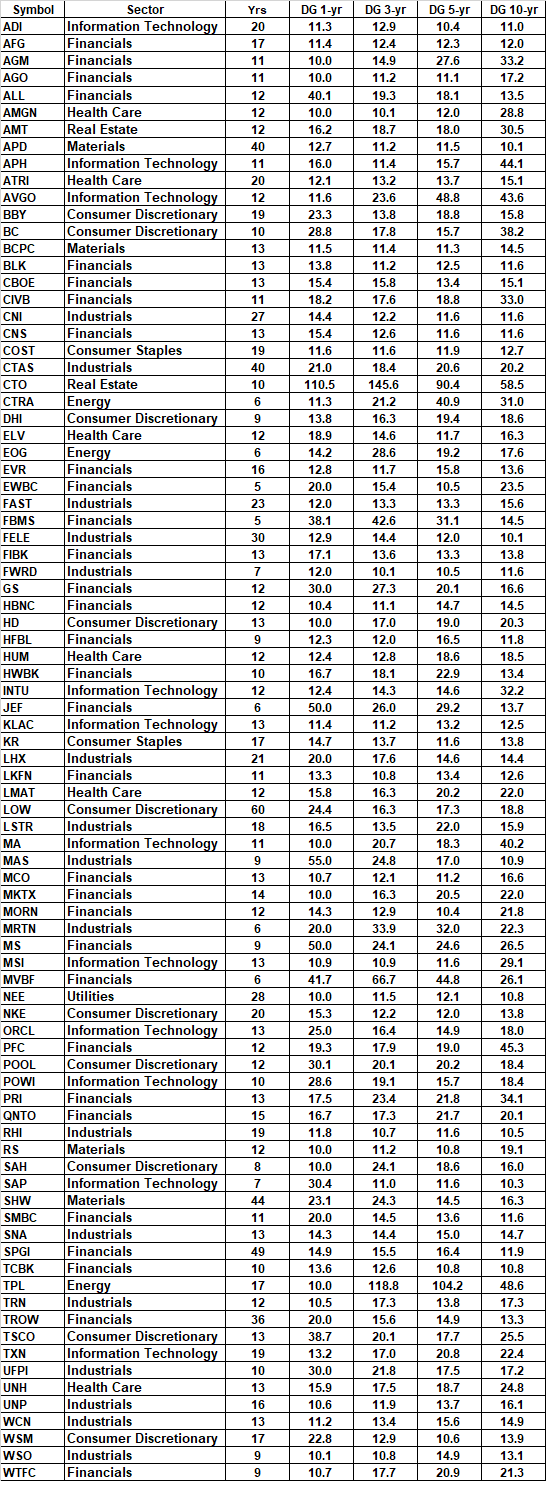

I did that by obtaining a list of Dividend Growth Stocks with a historically high rate of annualized dividend growth as of December 2012.

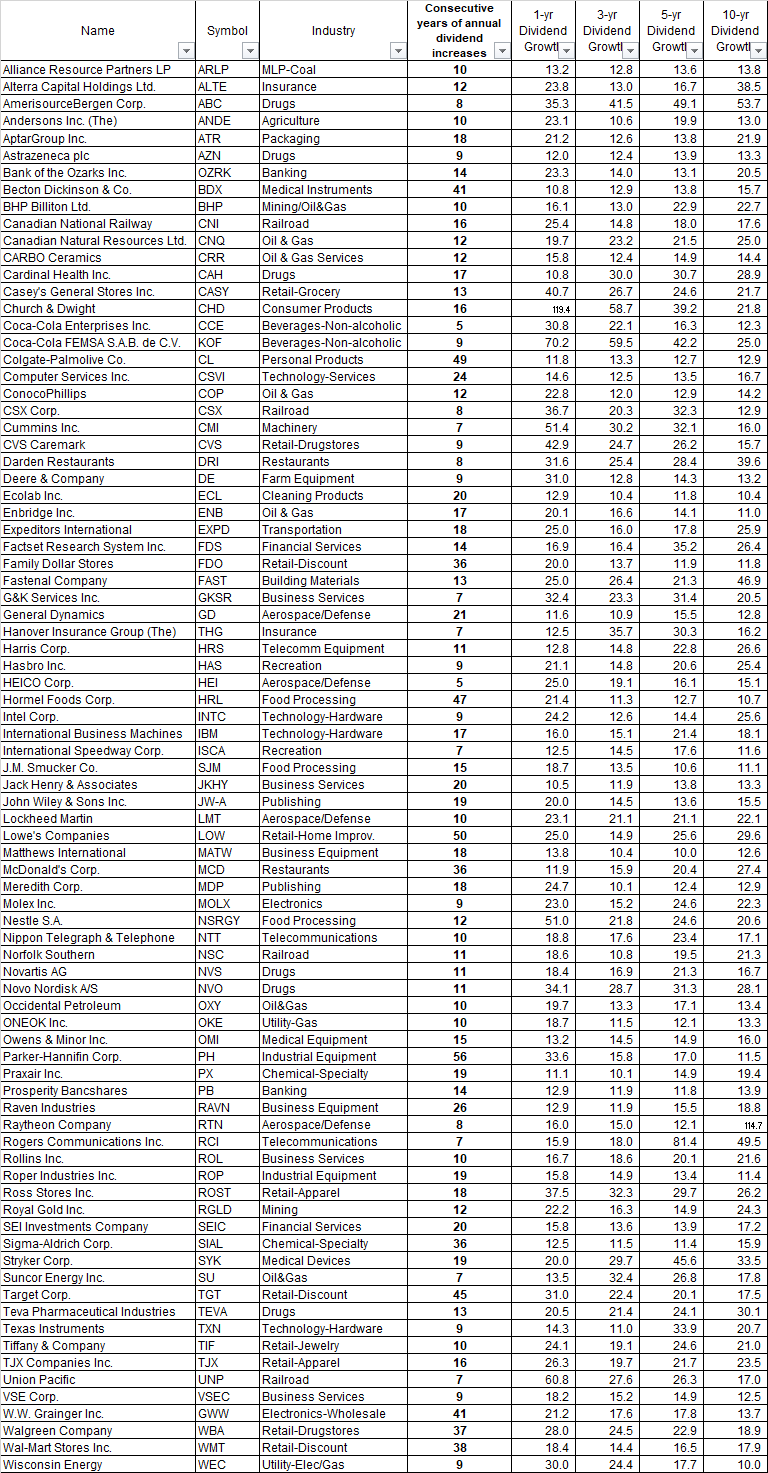

The list below includes:

1) Companies that had raised annual dividends for at least 5 years in a row as of December 2012

2) Companies that had managed to grow annualized dividends by at least 10%/year, over the previous 1, 3 ,5 and 10 years

This resulted in a list of the following 83 companies below:

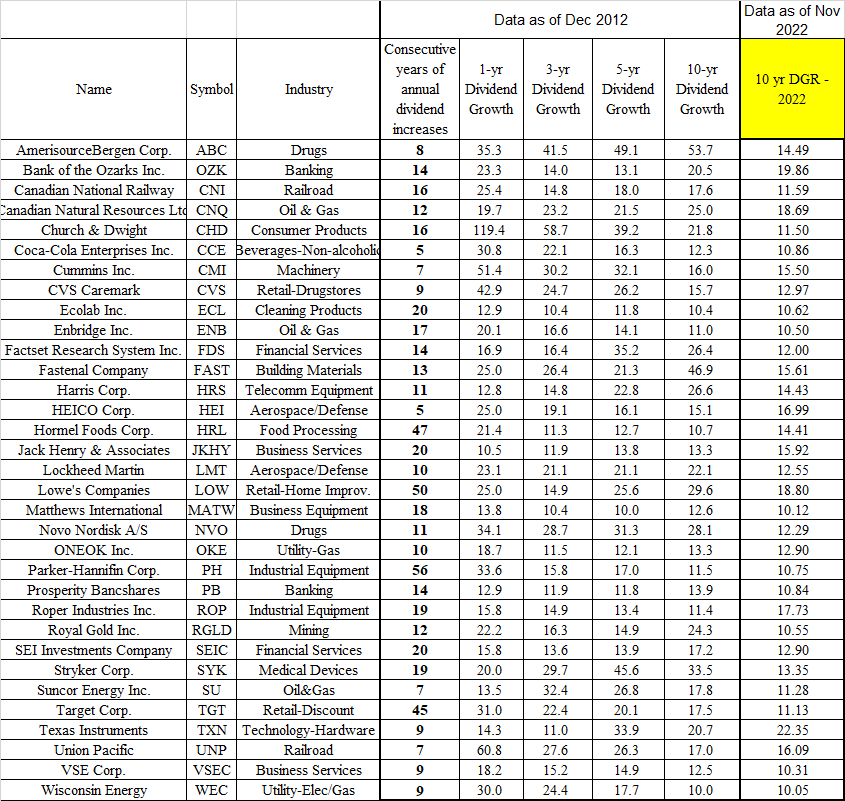

After that, I went ahead and checked to see how these companies did over the next decade (through November 2022).

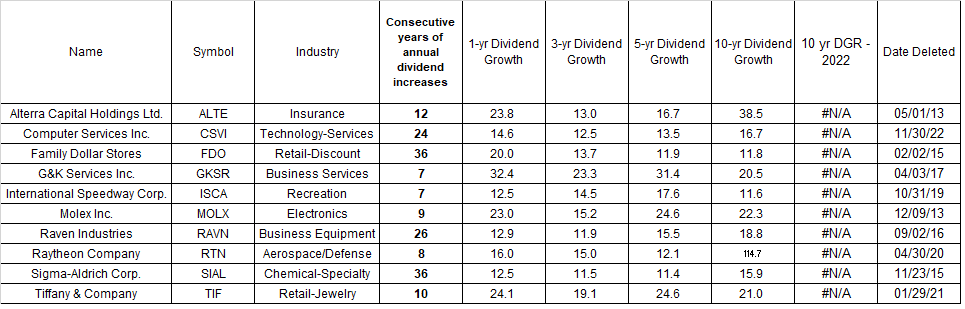

I went ahead, and looked at companies, which had managed to grow dividends at 10%/year over the preceding decade. I included companies that continued to at least pay a dividend over the next decade, even if they didn’t continue raising it every year. But it doesn’t include dividend cuts

There were 33 companies that managed to grow dividends at an annualized rate of 10%/year over the preceding decade.

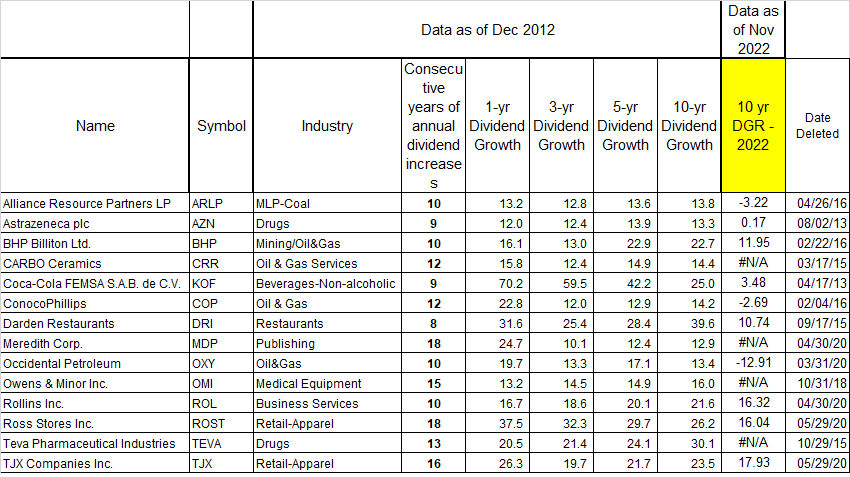

Not all companies from the original 86 remained continued raising dividends each year.

For example, CVS didn’t raise dividends each year, but it still managed to grow them at an annualized rate exceeding 10%/year.

For companies that were non US based, like Canadian National Railway, I compared subsequent dividend growth rates in US dollars.

There were a few ticker changes (Bank of the Ozarks went from OZRK to OZK), and a few acquisitions/mergers. For example, Harris merged with L3 to form L3 Harris. The dividend record for LHX is a continuation of the dividend record for old Harris.

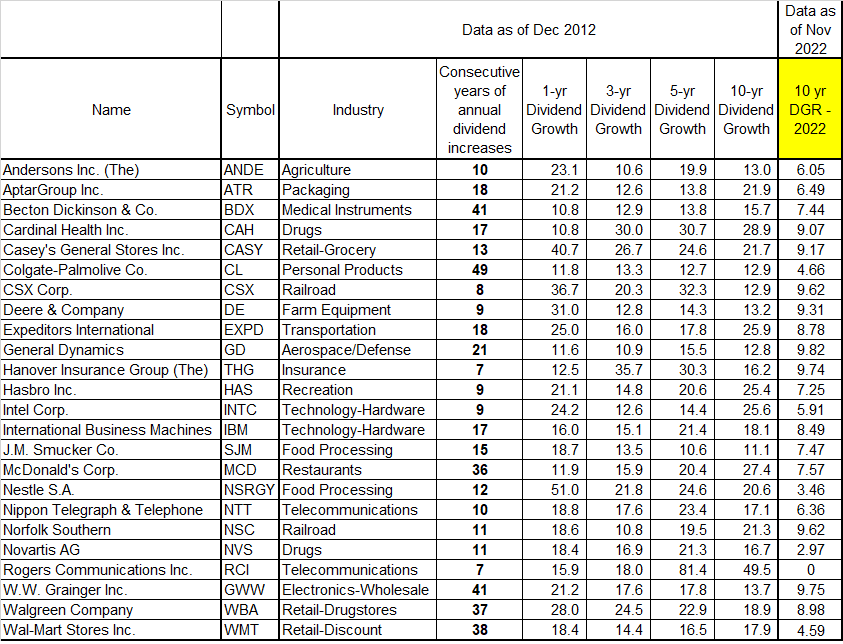

Another group of 24 companies managed to grow dividends, albeit at dividend growth rates below 10%/year over the ten year period ending in November 2022. The average annualized dividend growth is 7.19% over the past decade, which is pretty good in my opinion. Note there were some foreign companies at the end of 2012, and their dividend growth is in US Dollars.

Addendum:

You can check this list in Google Drive:

Published at Wed, 14 Dec 2022 01:00:00 -0800