Pilgrim’s Pride: Attractive Valuation In The Face Of A Tough 2023, Shares Nearing Support

Serhii Shleihel/iStock via Getty Images

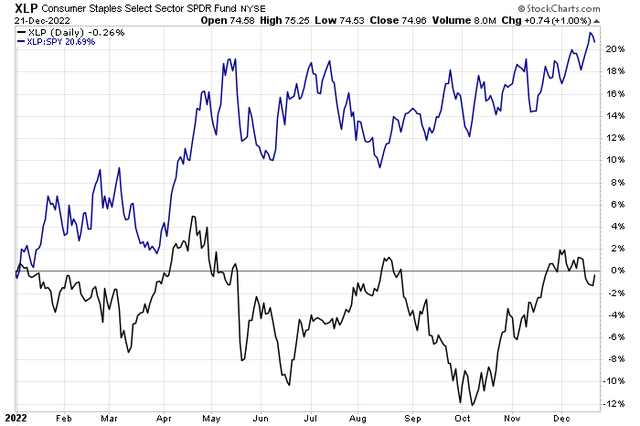

Consumer Staples stocks, despite being richly valued on a P/E basis, continue to be a spot of safety for investors in this volatile month and year. So far in 2022, the Consumer Staples Select Sector SPDR ETF (XLP) is about unchanged when dividends are included, outperforming the broad market by more than 20 percentage points.

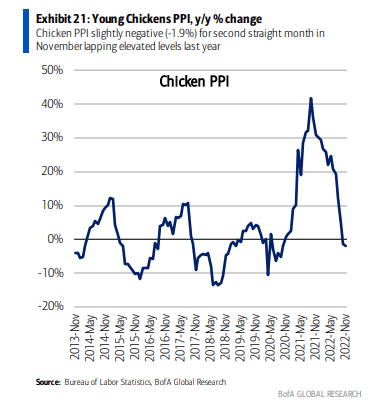

Some food-producer stocks have benefitted from much higher prices, but one name has struggled as wholesale prices for chicken have retreated lately.

Staples Scoring Big Relative Gains

Stockcharts.com

Chicken Inflation Coming Home to Roost

BofA Global Research

According to Bank of America Global Research, Pilgrim’s Pride Corporation (NASDAQ:PPC) is the second largest, vertically integrated broiler (chicken) producer in the U.S. with an estimated 17% share of processing capacity according to Watt Poultry. The company also maintains chicken operations in Mexico and the UK. In the US PPC maintains a diversified portfolio of big bird (30%), small bird (30%), tray pack/retail (30%), and prepared foods (10%) operations within chicken.

The Colorado-based $5.5 billion market cap Food Products industry company within the Consumer Staples sector trades at a low 6.0 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Amid the worst avian flu outbreak in history, there’s been volatility in PPC shares. Still, the stock was able to top analysts’ earnings expectations back in late October. There could be trouble ahead though as consumers struggle to keep pace with inflation and their excess savings dwindles.

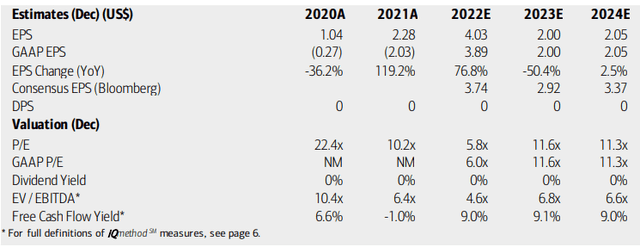

On valuation, analysts at BofA see earnings having risen sharply in 2022 amid high chicken prices and a strong consumer that was able to absorb higher food costs. Looking into next year, however, earnings are seen as falling sharply before just a modest per-share profit increase in 2024. The Bloomberg consensus forecast is more upbeat in the coming years. Even using next year’s reduced EPS figure, the stock trades at a below-market multiple and the EV/EBITDA ratio is nearly half that of the S&P 500. Meanwhile, free cash flow is very high on PPC this year through 2024.

Overall, I like the valuation and free cash flow situations despite an uncertain and volatile 2023.

Pilgrim’s Pride: Earnings, Valuation, Free Cash Flow Forecasts

Stockcharts,com

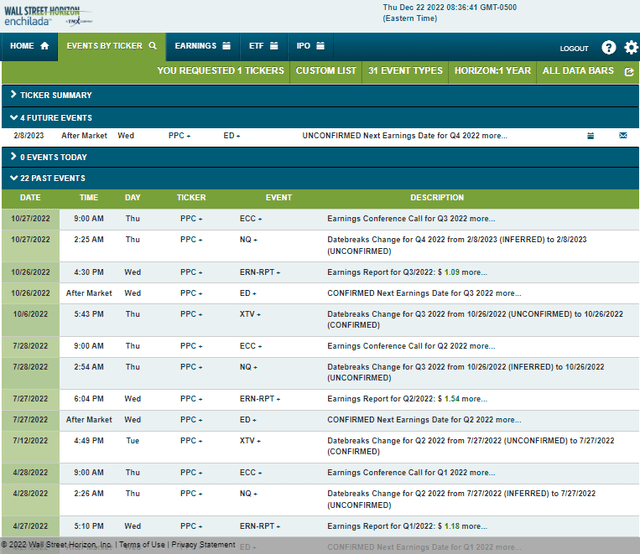

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Wednesday, February 8 AMC. The calendar is light on volatility catalysts aside from that earnings event.

Corporate Event Calendar

Wall Street Horizon

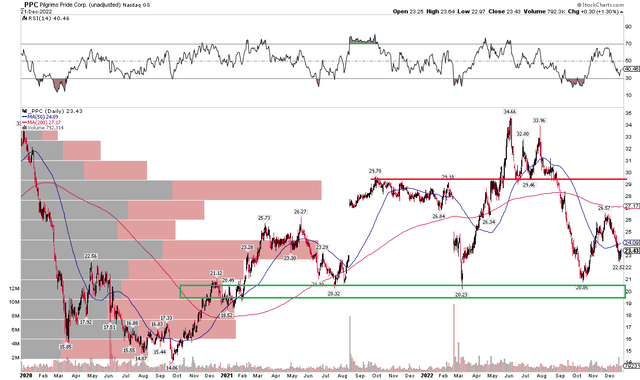

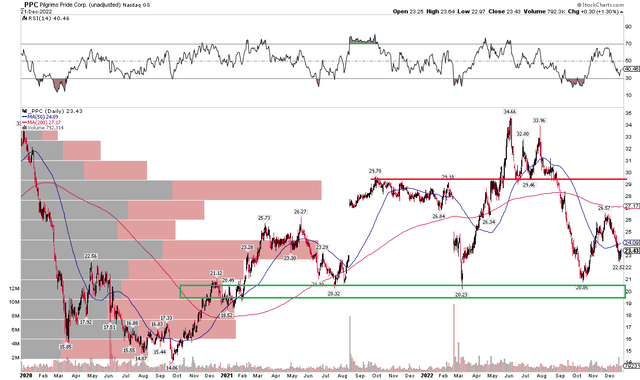

The Technical Take

PPC dropped big after falling through critical support at the $30 mark back in the third quarter. I now see support in the $20 to $21 range. Notice in the chart below that shares have bounced modestly from a near-term trough of $22.52, so there could be a little room left to the downside. While the valuation looks good, a tactical buy-the-dip strategy could work here. I would have a sell stop below the July 2021 low of $20.32, so perhaps just under $20.

On the way up, though, PPC could see some selling pressure at the scene of the crime around $30 – there is also a high amount of shares traded in the $28 to $29 area as evidenced by the volume by price indicator on the left.

PPC: Shares Break $30 Support, Drifting Toward $20

Stockcharts.com

The Bottom Line

I continue to like the valuation on PPC. After breaking noted support around $30 earlier this year, shares could find their footing in the low $20s – which represents an attractive price versus fair value. While chicken prices have retreated, shares appear to have discounted that trend.

Published at Thu, 22 Dec 2022 09:58:50 -0800