Photronics: Mismatched Valuation And Growth Profile Suggest Upside

pederk

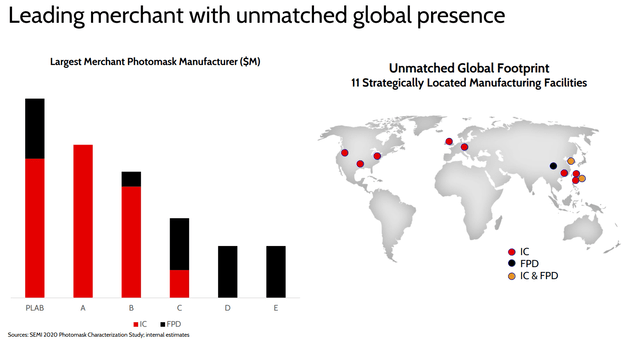

Investment overview: Photronics, Inc. (NASDAQ:PLAB) is a leading photomask technology supplier to the semiconductor industry, focusing on integrated circuit and flat panel display technology. Shares are priced today as they were to start 2022, despite a sizable reduction in debt, increasing cash flows, improved valuation, and impressive growth. This rare combination of value and growth suggests shares were, and remain, mispriced. We arrive at a $25 price target based on valuation targets, and note that this stock is cheaper than all of its peers despite superb growth.

Photronics, Inc. stock is rallying today on the back of pretty strong Q4 earnings. Readers, this is a stock that we highlighted as taking a pretty bad beat, and we told you, publicly, to buy this ridiculous dip in late summer. Well, it turned out to be a prescient call, as this super-high-margin photomask technology business stock has now returned those who took the advice upwards of 20% now. Pretty solid returns for a quarter long hold. Not bad at all.

But the thing is, there is likely more upside to go, despite a rough time for semiconductors and where we are in the cycle. Folks, if the company is performing this well in a slower part of the semiconductor cycle, we think you should be buyers of the next substantial dip. The stock is back in the $20’s here, and we see further upside, but are recommending new money scale in on dips into the teens if and when this occurs. Perfectly fine to open here, at say, the high $19 range, but we would plan to scale in on weakness. This is a key teaching of our trading. We suspect that you will get a chance to add, but if we are wrong and the market just bids this higher, well, it is a high quality problem as you will still have made money by buying some now. We would rather be wrong and have it fly on a single purchase, than to see you buy all at once and the market take this down 20%. We teach trading, and this is a simple and effective way to limit downside.

Today, the stock is getting a nice boost following fiscal Q4 results that seemingly impressed the Street. We believe this an appropriate reaction to the top and bottom line beat, as well as the outlook. Let us discuss.

Forward view

Although our niche is rapid-return trading, we are also investors. This is a great stock to invest in, particularly when we are in a trough for the semiconductor sector’s demand. Folks, this company is well-positioned for future growth and is continuing to benefit from a very strong pricing environment. While pricing has moderated a touch, and month-to-month chip demand will fluctuate, chips are simply in everything. If chip shortages continue to be an issue, the sky is the limit. Right now, there is a bit of a supply glut, but demand is everywhere. And Photronics is the world’s leading manufacturer of photomasks for semiconductor companies, and it is a sector that is still so beaten down. We remain contrarian here and think you want to be buyers, especially if we get a big Q1 2023 dip, as many are predicting, including our firm.

Despite the pain the sector has experiences, Photronics is still in growth mode, despite chip demand and sales somewhat suffering this year. The sector is in a downturn as part of the cycle, but demand is only going to rise, as soon as a mid-2023 when we start to emerge from any sort of recession. We like buying this dip.

As we look longer-term, as opposed to our rapid-return trading focus, future growth will continue to depend on international trends, so that is one major risk factor to be aware of. The fact is that international trade and political issues can impact investments in the short-run, but in the long run, we are seeing the demand globally skyrocketing as major companies continue to see increased demands for photomask and integrated circuit tech, exactly what Photronics provides. It is a global leader.

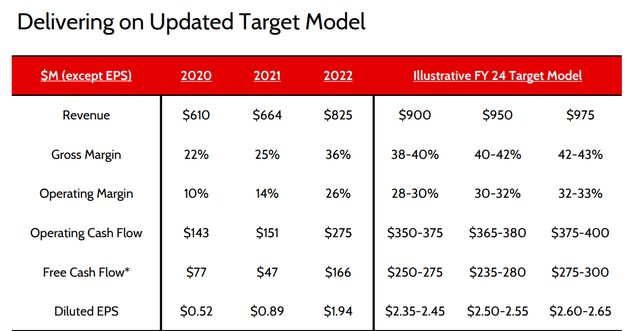

PLAB May 2022 Presentation

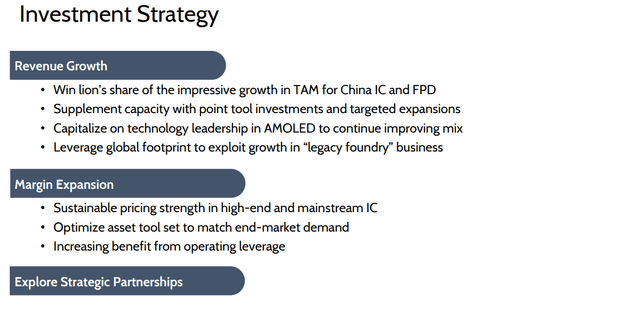

We would like to remind you that the global growth strategy has revolved around expansion into new markets and leveraging China’s Made in China 2025 initiative. This has paid off as the growth has been stellar. The 2025 Made in China is driving a larger addressable market while they are in the fastest-growing subsector demand. While there are many risks in being exposed to China, and we are cognizant of this fact, China is a key target market and one of the tenets of the investment strategy for Photronics.

PLAB Q4 Presentation

So the company is looking to take a big share of the growing total addressable market (“TAM”) in China, but also leveraging growth globally in the legacy foundry business. When we look at Q4 performance, it was quite impressive.

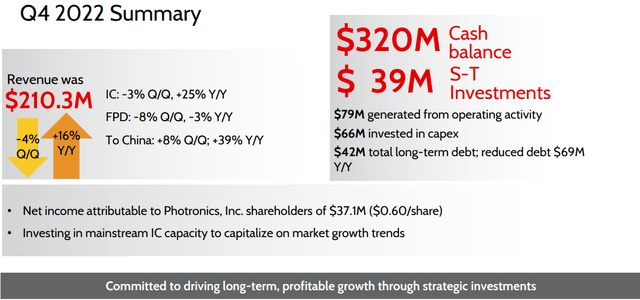

Revenue was $210.3 million, down 4% sequentially but 16% year-over-year. This was also a beat against consensus estimates.

PLAB Q4 Presentation

Net income was $37.1 million, or $0.60 per share, up 81.8% over last year. This is just so strong. For the year, net income grew from $0.89 per share to $1.94 per share. Folks, net income more than doubled. So, we ask, what slowdown is there? Photronics does have challenges from its customers seeing some weaker demand, but you would not know it from these incredible numbers. Earnings also beat consensus by $0.12 in the quarter.

We want to add, too, that the business lines were strong. Integrated circuit (or IC for short) revenue in Q4 was $156.2 million, down 3% sequentially but up 25% from last year. The flat panel display (or FPD) revenue has seen more challenges and this is related to the Photronic’s customers seeing a slowdown in demand from their customers. Revenue was $54.1 million, down 8% from last quarter and up 11% over the same period last year.

Buying back shares and repaying debt

The company is also very shareholder-friendly, buying back shares. The organic growth is also being funded by cash flows. This year the company bought back $2.5 million in shares, though not nearly as much as in 2021, where they bought back $48 million. We suspect a reduction in share repurchases was due to a focus on repaying debt, which they repaid $65 million this year. Debt has been reduced from $112 million to $42 million. The company still has $316 million in cash. We love the ratios here. And this comes at a time where debt is more expensive. The company is protecting itself by reducing the debt, though it still has $32 million left on its share repurchase authorization. Bottom line is the balance sheet is more than sufficient to fund investments, and more share repurchases, and possible strategic M&A opportunities.

Dirt cheap even on the low end of the target model

As we look ahead, the company is modelling some seriously strong numbers. You have to love this growth, and it is why we love this name.

PLAB Q4 presentation

This is some solid growth for FY 2024 models. Let us just look at the low end of the target model. For EPS to move to $0.52 in 2020, to $0.89 in 2021, to as low as $2.35 in 2024, that is just impressive growth and means the stock is cheap because of this growth. At the lowest forecast, the stock is at 8.5X FWD EPS. For reference, at the high end, the stock is 7.5X FWD EPS, but growth in EPS is over 20%. This is a tremendous opportunity in our opinion. Further, there is a price to sales ratio here of 1.4x, and an impressive price to cash flow of 5X over the last 12 months. Cash flow over the next 12 should remain strong, particularly as we look to the modelling. Margins are improving, cash flow is improving (and price to cash flow could be as low as 3X depending on the final target hit). With a forward EV/EBITDA around 3.5X, there is just a lot to like here on a valuation front when the company is looking to put up these kinds of growth numbers.

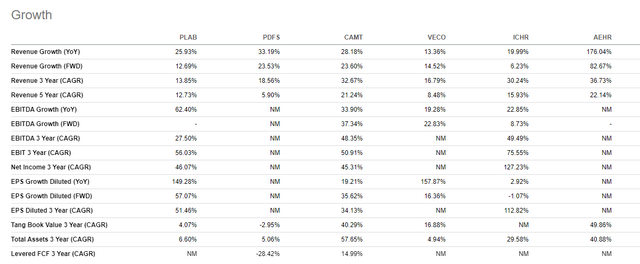

What kind of growth numbers? As you can see the growth metrics have been impressive and are expected to be just as impressive going forward. Revenue growth of 10% is modelled on the low end, but as high as 18% next year, is still strong. A 20% jump in EPS is quite impressive and in our opinion with the aforementioned and other valuation metrics, we think there remains upside of about 30% here, putting a price target of $25 on the stock from the current share price of $19.40 at the time of this calculation.

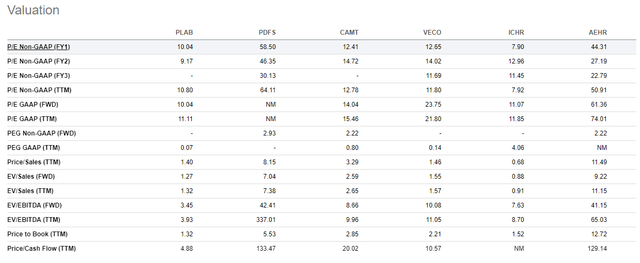

In our opinion, this a rare combination of value and growth. We love stocks like this. We also find the investment compelling given the fact that the stock is largely cheaper than its competitors, while offering comparable, if not superior growth metric.

Seeking Alpha PLAB Peer Valuation Comparison

Seeking Alpha PLAB Peer Growth Comparison

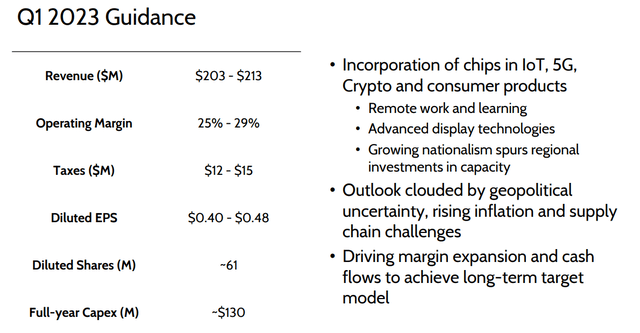

This is impressive. The valuation seems to be a mispricing in our opinion. In the very near term, growth remains strong, and the Q1 guidance also is impressive.

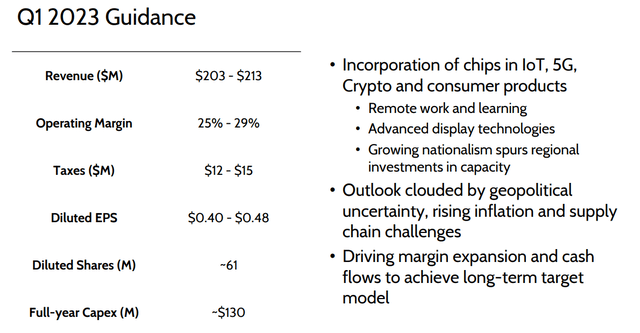

Photronics Q1 2023 Guidance

The CAPEX is continuing to be funding organic growth, and the margins are strong. There remains inflation and uncertainty (as is impacting nearly all companies), but growth is pretty strongly evident here.

Despite the recent rally the last few weeks, the stock is pretty much flat on the year. That seems strange to us when the company is churning out at least a good 20% plus growth in EPS next year.

Take home

We know the semiconductor industry is cyclical, though arguments can be made that it is much more secular than it once was given that chips are in so many different products in our lives. The rapid growth of the last upcycle has slowed, but we are looking at a solid combination of value and growth. We do recommended letting the stock pull back, we do not like for our readers to chase here. We think you can buy a little now, and add on pull backs, perhaps each $1 decline from here. The overall stock market is expensive after this recent rally, so pick your spots.

We have a price target of $25 on Photronics, Inc. shares here based on our analysis and the expectations for growth relative to valuation, and because the stock is seemingly undervalued relative to its peers.

Published at Tue, 13 Dec 2022 09:43:51 -0800