Kimberly-Clark: An Overvalued Dividend Growth Stock

Rob Kim/Getty Images Entertainment

Kimberly-Clark (NYSE:KMB) is a good dividend stock for investors looking for income. But, the stock is richly valued along with the rest of the consumer staples sector. The company does not offer much revenue growth, so the dividend and the great brands are the two good things about this stock. It is important to remain patient and wait for a pullback before investing in this stock.

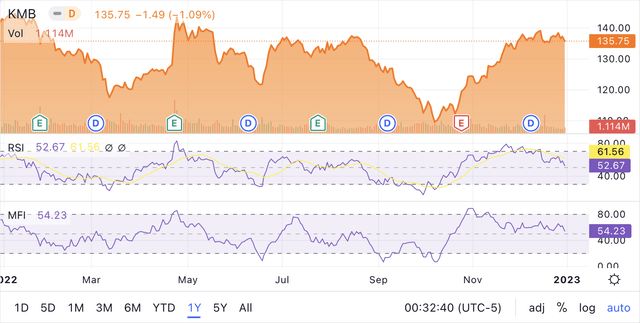

Inventory and receivables at manageable levels

Having covered many consumer staples and industrial companies in the past year, I have seen many companies struggle with rising costs and uncertain demand. This uncertainty and inflation have led companies to carry more inventory, thus raising their days’ sales in inventory. Carrying more inventory reduces operating cash flows. Kimberly-Clark has shrewdly managed its overall inventory levels.

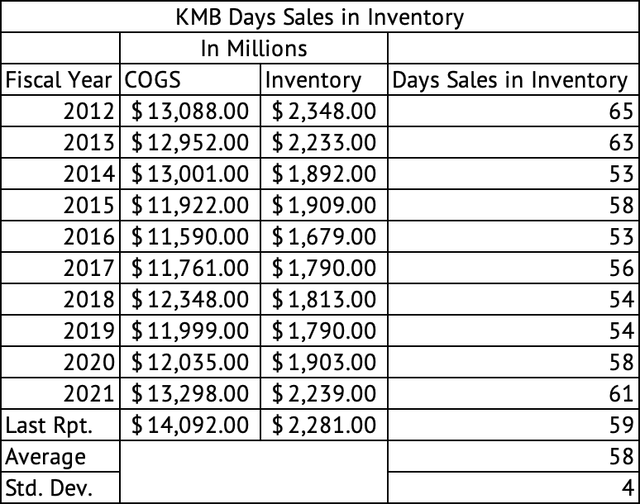

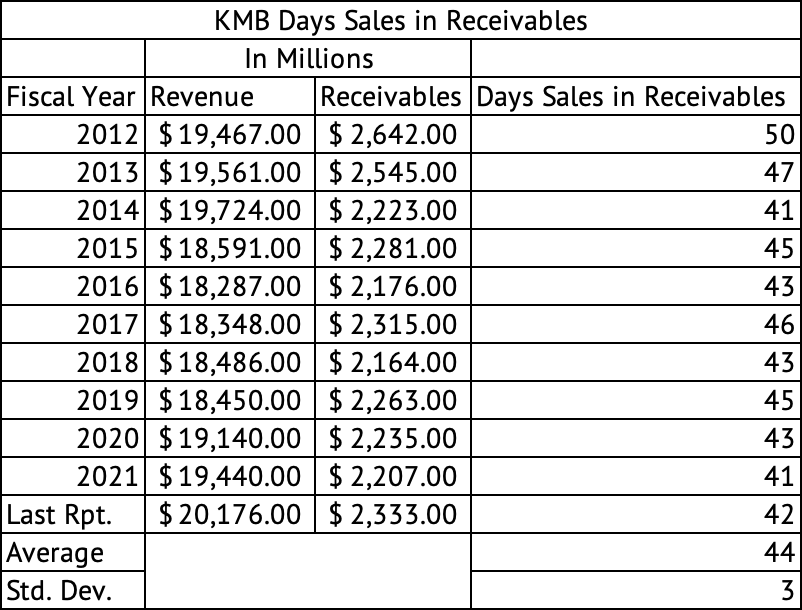

As of the last report (Exhibit 1), the company held 59 days’ worth of sales in inventory and 42 days’ worth of receivables outstanding (Exhibit 2). Both these numbers are below their average over the past decade. Although not directly comparable due to differences in the products and end markets, Conagra (CAG) carried 82 days’ worth, and J. M. Smucker (SJM) carried 89 days’ worth of sales in inventory. Procter & Gamble (PG), and Clorox (CLX) have much more in stock than their average over the past decade (Exhibit 3).

Exhibit 1:

Kimberly-Clark Days Sales in Inventory (Seeking Alpha, Author Calculations)

Exhibit 2:

Kimberly-Clark Days Sales in Receivables (Seeking Alpha, Author Calculations)

Exhibit 3:

Days Sales in Inventory Latest, Average Over Past Decade (Seeking Alpha, Author Calculations)

A downturn in earnings

In the last three months, 11 analysts have revised their EPS guidance downwards, while two have revised it upwards. The majority of the analysts have also revised the revenue guidance downwards. In December 2022, Deutsche Bank slapped a sell rating on Kimberly-Clark. The company is expected to earn $5.63 per share. Based on these estimates, the company trades at a trailing GAAP PE of 25.8x and a forward GAAP PE of 23.6x. Procter & Gamble trades at a trailing GAAP PE of 26.2x and a forward GAAP PE of 25.9x.

Although Kimberly-Clark trades in-line companies like Procter & Gamble, the consumer staples sector is overvalued now. The Vanguard Consumer Staples ETF (VDC) companies trade at a PE of 24.6x and a price-to-book ratio of 4.9x. Kimberly-Clark has shown very little revenue growth, yet it trades like a growth stock. With its enormous cash flows, margins, and growth prospects, technology giant Microsoft (MSFT) trades at a 25x forward PE, while search giant Alphabet (GOOG) (GOOGL) trades like a value stock with 18.4x forward GAAP PE.

Investors are taking refuge in the consumer staples sector during these volatile times. But, professional traders, large trading firms, and hedge funds have enormous resources to get in and out of industries in seconds. Most individual investors do not have the time or resources to trade at lightning speeds.

Individual investors may be better off with a buy-and-hold strategy, but buying Kimberly-Clark at these valuations may be a mistake. When the consumer staples sector goes out of fashion, the individual investor is left holding the bag with enormous capital losses. Very few people can time the market perfectly and buy stocks at their absolute bottom, but investors should buy when the valuation seems reasonable. Kimberly-Clark is not trading at a fair valuation. Kimberly-Clark is a good, long-term dividend income stock at a fair valuation.

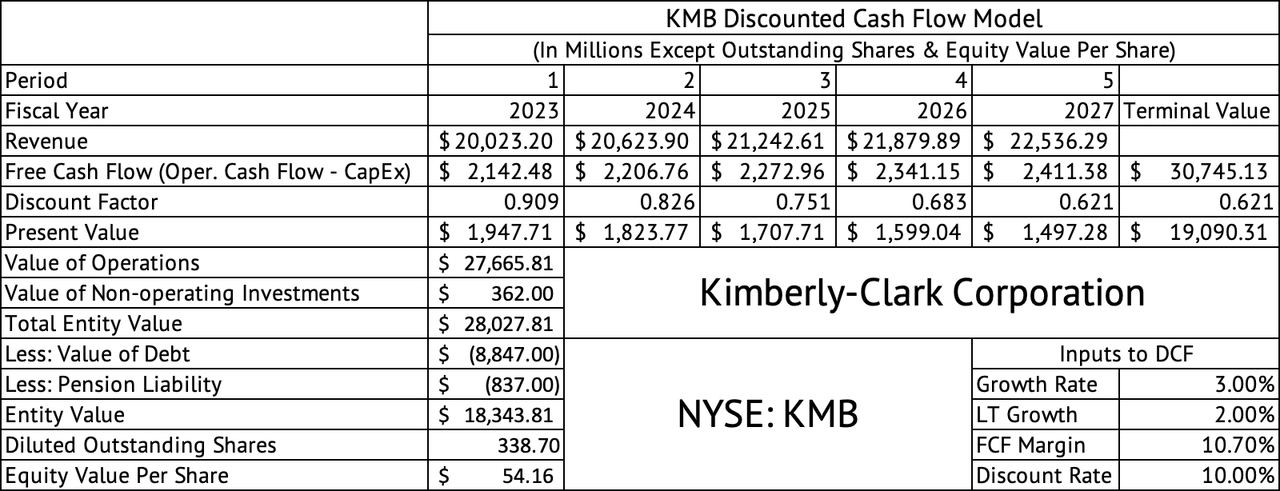

Discounted cash flow model show overvaluation

Even under optimistic growth rate assumptions, the company does not generate enough cash flow to justify its current valuation, in my view. The discounted cash flow model uses a free cash flow margin (operating cash flow – CapEx) to estimate the cash flows (Exhibit 4). The free cash flow margin is based on the company’s average over the past decade. This model assumes a revenue growth rate of 3% between 2023 and 2027, a very optimistic assumption. The long-term growth rate is set at 2% to calculate the terminal value. A 2% long-term growth rate seems optimistic for Kimberly-Clark, given that the company grew revenues by an average of 0.01% over the past decade. A discount rate of 10% is applied to the cash flows. This DCF model yields a value per share of about $50. The stock is trading at $135.

Exhibit 4:

Kimberly-Clark Discounted Cash Flow Model (Seeking Alpha, Author Assumptions and Calculations)

Gross margin erosion

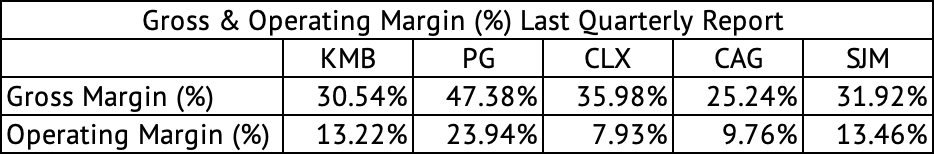

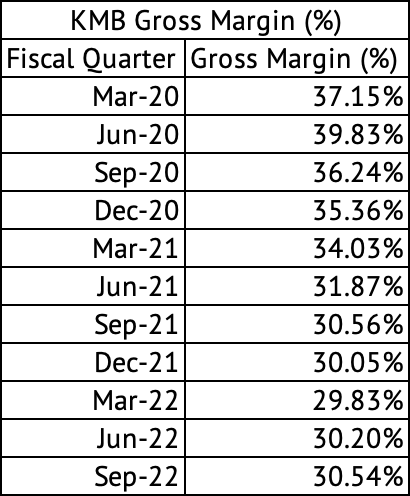

Kimberly-Clark’s operating margins compare favorably with the competition. It has done better than Clorox but cannot compete against the global consumer staples giant – Procter & Gamble (Exhibit 5). Kimberly-Clark has seen a downshift in its gross margins beginning in June 2021 (Exhibit 6).

Exhibit 5:

Gross and Operating Margins for Kimberly-Clark, Procter & Gamble, Clorox, Conagra, and J. M. Smucker (Seeking Alpha, Author Compilation)

Exhibit 6:

Kimberly-Clark Quarterly Gross Margins (Seeking Alpha, Author Compilation)

High inflation may be to blame for this margin erosion. The company mentioned a commodity price impact of $470 million in Q1, $405 million in Q2, and $360 million in Q3 2022. The trend indicates that price inflation is receding, but prices may settle at higher levels than before this cycle began in 2021. A surprising thing happened for most consumer staples companies during these inflationary times; volume declines have been muted in the face of double-digit price increases. For example, Conagra saw single-digit volume declines in the face of double-digit price increases. Despite price increases, Kimberly-Clark saw sales volume hold up better for most of its product lines.

Good dividend stock

The company’s dividend has grown for 50 years, offering a good 3.4% yield. The dividend has grown by an average of 3.6% over the past five years. The payout ratio is high at 85%, but over the past five years, the payout ratio has averaged 76%.

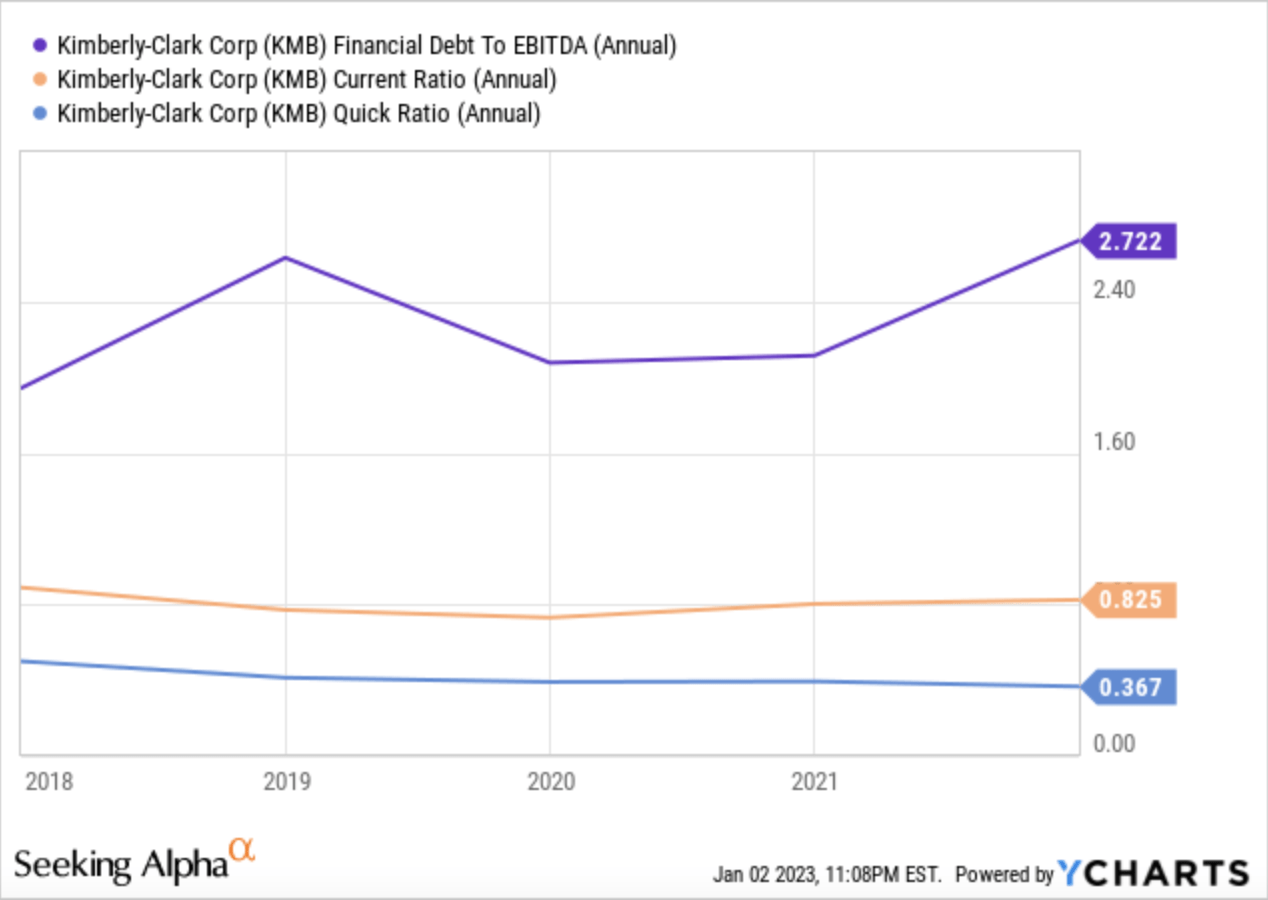

Kimberly-Clark had $2.8 billion in operating cash flow to pay a dividend of $1.5 billion in 2021. The company’s debt to EBITDA ratio is a tad high at 2.7 for today’s interest rate environment, and its current and quick ratios are below 1 (Exhibit 7). The company has $8.1 billion in outstanding debt, with weighted average interest rates between 0.4% and 3.2%. At the end of Q3 2022, the company had $959 million in debt payable within one year. The company will be paying a much higher interest rate in today’s interest rate environment.

Exhibit 7:

Kimberly-Clark Debt-to-EBITDA Ratio, Quick, and Current Ratios (Seeking Alpha)

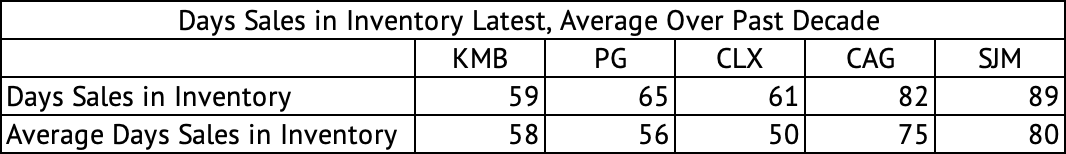

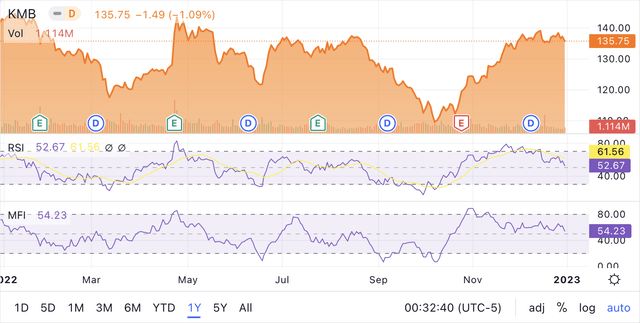

The stock has had good price momentum over the past three months, having returned 20.6%. The stock has dropped 4% over the past year, while the Vanguard S&P 500 Index ETF (VOO) has dropped 19.7%. The stock’s momentum may fade, with RSI and MFI technical indicators dropping since November 2022 (Exhibit 8). The high valuation and low growth may put a ceiling on this stock.

Exhibit 8:

Kimberly-Clark RSI and MFI Technical Indicators (Seeking Alpha)

The consistent, growing dividend is the primary reason to own Kimberly-Clark. Investors may have to brace for a loss in principal if they buy this stock at a high valuation. Consumer staples stocks, such as Kimberly-Clark, will likely stay at elevated valuations as long as the Federal Reserve continues raising rates and the path forward for the economy is not clear. Investors may have to be patient to buy this dividend stock at a reasonable valuation.

Published at Tue, 03 Jan 2023 13:07:32 -0800