The markets can have a mind of their own at times … The continued pull back in October is reminescent of 2009 when many financial stocks were discounted.

Corp Account Guidelines

A reminder on the account guidelines:

- Preserve capital by not taking unnecessary risks while not expecting growth per say.

- Earn income from the investment with a yield above 5% from dividends or distributions.

- Keeping up with inflation is not necessary as it’s not a retirement account.

- No re-investment of income. It will either be used to pay taxes, or withdrawn from the corporation as dividends to myself.

- Focus on Canadian currency.

The money invested is simply a way to put the cash to work. Banks don’t pay interest, and a high-savings account doesn’t pay either.

New Investment With HCAL

The markets just got to a point where I needed to take a position. The banks are heavily discounted and I wanted to capitalize on it with a good income.

As you know, when it’s only for income (i.e. not growth), I am comfortable with ETFs and covered call ETFs.

In this case, HCAL is a little bit special as it follows the big six banks using the Solactive Canadian Bank Mean Reversion Index with a cash leverage position.

If you are not comfotable with the cash leverage, you can simply invest in HCA.

Here is the weighting as of today. I did not expect TD to be out of favor, but according to the index, it’s out of favor.

The two ETFS, HCAL and HCA, follow the Solactive Canadian Bank Mean Reversion Index. The index is rebalanced quarterly as per Solactive. Here is how it’s all mathematically selected as for the index guidelines.

- Calculate the percentage difference between the INDEX COMPONENT’S CLOSING PRICE and its 200- trading-day average CLOSING PRICE on a SELECTION DAY.

- The three INDEX COMPONENTs with the lowest percentage difference between their CLOSING PRICE on a SELECTION DAY and their 200-trading-day average CLOSING PRICE will be weighted at 80% divided by 3 each.

- The three INDEX COMPONENTs with the highest percentage difference between the CLOSING PRICE on a SELECTION DAY and their 200-trading-day average CLOSING PRICE will be weighted at 20% divided by 3 each.

Basically, if you are out of favor in the markets, you get bought more.

When it comes to the banks, I am sure many of you have thought of doing something like this based on how the bank trades in Canada. Here you go, there is an index just for that!

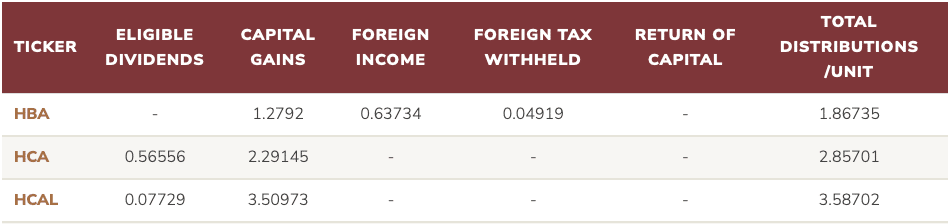

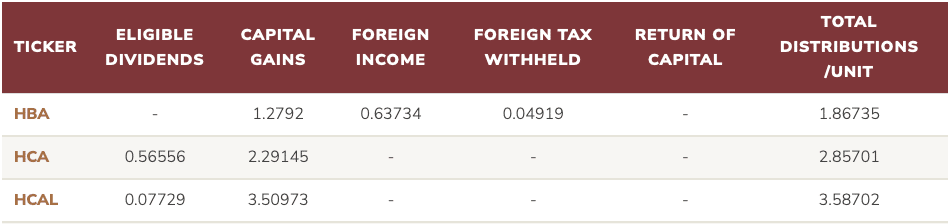

Tax Efficiency

It’s quite effective on the tax front which is providing capital gains and eligible dividends. The data is as of 2021. The 2022 ratios will be available in 2023 for the tax time.

Next Steps

So far, I may be done investing for the year in the corporate account but if the markets continue to drop, I may invest more. Otherwise, January will be the next trade time.

Published at Sat, 22 Oct 2022 11:00:58 -0700