Half-Price Metalla Royalty & Streaming Limited Worth Another Look

A_Carina/E+ via Getty Images

Introduction

Metalla Royalty & Streaming Limited (MTA) is a royalty company currently focused on the precious metals sector of gold and silver and is a business model that we like. This tiny sector of the market has been kind to us in the past so we retain an interest as well as some investments in this sort of company.

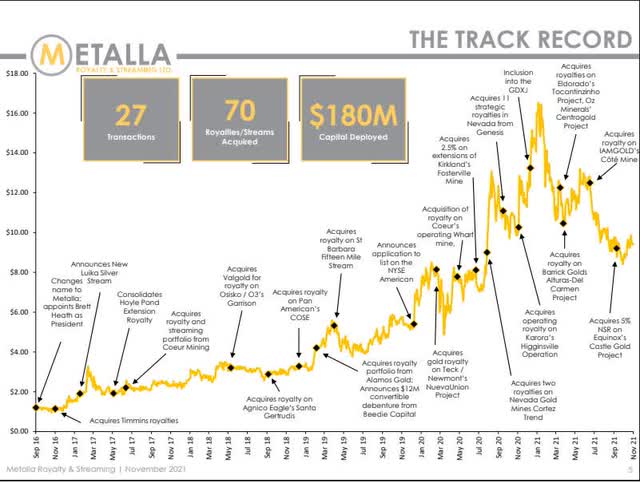

Metalla came to our attention some time ago when it entered the market and made moonshot-like progress through its acquisitions which were reflected in its stock price. Their track record shown below highlights their achievements and gives us a pictorial snapshot of their business.

Metalla Royalty & Streaming Ltd Track Record

Metalla Royalty & Streaming Ltd

However, the clamor for the stock was such that we decided to keep it on the Watch List in the hope that some of the frothiness would evaporate and a more favorable entry level may present itself.

Management

Touching on the management team we thought that E.B. Tucker who is a non-executive Director and a founding shareholder of Metalla was worth a mention. He does appear to be the face of the company and delivers very compelling arguments as to why the royalty model is the best vehicle for investors in this sector and especially why we should invest in Metalla.

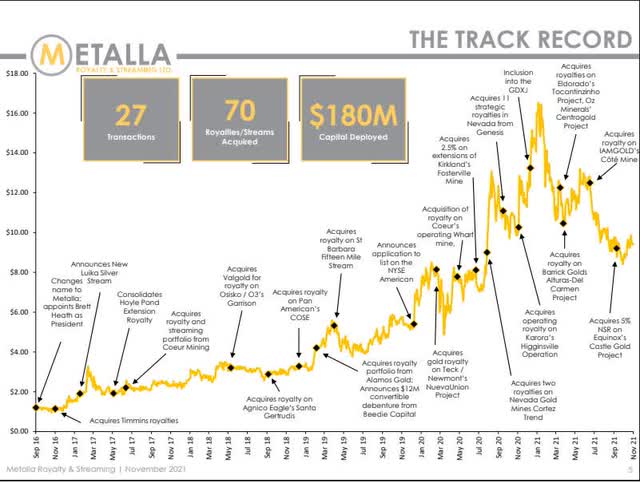

Metalla 18-Month Chart

In 12 months, MTA has trended lower from a peak of $13.50 to today’s price of around $6.84. The RSI, MACD and the STO are currently neutral. The support level at $6.00 needs to hold for MTA to consolidate and form a base from which it can rally to higher ground.

Metalla Progress Chart

stockcharts.com

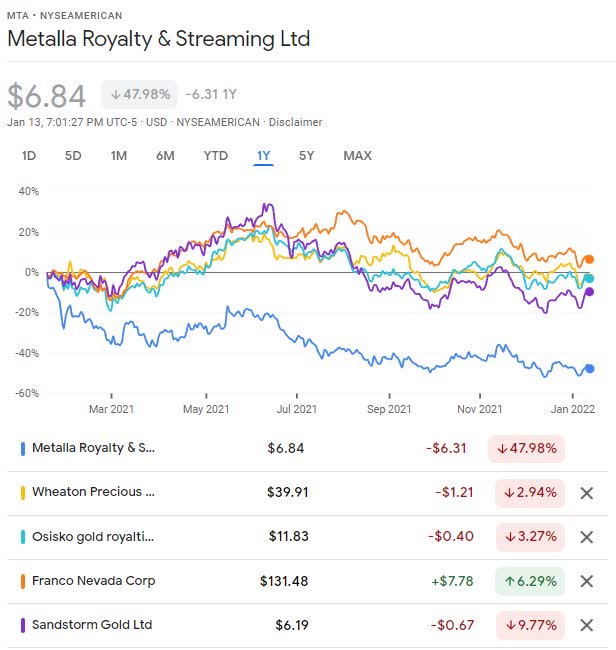

Metalla Compared To Other Royalty Companies

When we compare Metalla to other royalty companies over the last twelve months we can see that they are not all in the same boat. The giant in this sector is Franco-Nevada (NYSE:FNV) with a market cap of around CDN$31 billion which has more than held its own, other companies have lost a little but nothing too dramatic.

Metalla Compared To other Royalty Companies

Google Finance

Metalla has a market capitalization of $294.012M which is a lot smaller than the billion-dollar companies that I have compared it with on the above chart. In terms of market capitalization two companies of a similar size are EMX Royalty Corporation (EMX) with a market cap of $233.285M and Nomad Royalty Company Ltd. (NSR) with a market cap of $407.175M. Interesting to note that these two similar sized companies haven’t performed too well either but still a tad better than Metalla.

It may be the case that this market sector is maturing in general and the larger operators have the financial muscle to make the deals that the smaller companies just cannot compete with. As the old adage goes all boats rise on a rising tide including the small ones, however recent performance suggests that growth, turnover and profitability could be a tough challenge for the small caps such as Metalla in this market sector.

Metalla compared with Similar Size Streamers

Google Finance

We are aware that Metalla has a large exploration portfolio with some of the industries highly respected operators, however developing a mine takes time and the process is subject to a myriad of influences including geopolitical change, environmental impact requirements, taxation, fluctuating energy prices to name just a few. These are all threats to the construction and operation of a profitable mine and they apply to all of the operators in this sector. It could therefore be some time before a profit on this trade could be realized and so I will sit on my hands for a little longer

Conclusion

Metalla could be a bargain at these price levels for those investors with the patience to see it through. In this sector, a lot depends on the strength of the underlying commodities of gold and silver, should they rally as we expect them to then this whole sector could rise with some gusto.

It is worrisome that Metalla’s correction has been so severe when compared to other royalty companies. We will keep Metalla on the Watch List but are not prepared to acquire it just yet as we doubt that it is best in class and prefer other royalty companies.

Your comments would be very much appreciated, and I will do my best to address each and every one of them.

For the record, I have been long physical gold and silver for a number of years and also own a portfolio of stocks in the precious metals sector, including Wheaton Precious Metals Corp. (WPM), SSR Mining Inc. (SSRM), Sandstorm Gold Ltd. (SAND) and Kirkland Lake Gold Ltd. (KL).

As always, go gently as these are treacherous waters

Published at Wed, 19 Jan 2022 16:57:05 -0800