The first transaction for the company income account is done. The intention with this account is to share the process used to find the holdings.

Corp Account Guidelines

A reminder on the account guidelines:

- Preserve capital by not taking unnecessary risks while not expecting growth per say.

- Earn income from the investment with a yield above 5% from dividends or distributions.

- Keeping up with inflation is not necessary as it’s not a retirement account.

- No re-investment of income. It will either be used to pay taxes, or withdrawn from the corporation as dividends to myself.

- Focus on Canadian currency.

Screening Method

Since the goal is to have a yield higher than 5%, I started with filtering the Canadian Stocks with a yield great than 5% from the Dividend Snapshot Screeners. I was left with 28 stocks. Note that the screener has not split-share corporations for now.

Next, I eliminated all stocks with an “Expensive” 5Y Yield Strength. If they are expensive, it means the yield is lower than the 5Y average. Not the right time to buy it. I was left with 19 stocks.

Since I am looking for a stable income and a stable capital, I decided to focus on “Large Cap” stocks only based on a standard Market Capitalization grouping. Canada doesn’t have “Mega Cap” stocks anyways. I was left with 5 stocks.

The short list is the following with a yield between 5.01% and 5.90%:

Nothing wrong with any of the five companies. I just need to pick one. While I could simply pick the highest yield, I also want to be mindful of the potential capital growth and dividend growth.

IGM Financial has no consecutive years of dividend growth while the others are at 7 or 10. IGM Financial is out.

I am good with 7 or 10 years of dividend increases. I noticed that both BCE and Enbridge are trading at the top of the 52-week range while Power Corporation and Great West Life are trading below mid-range which is represented in the “Opportunity Score” if you have the screeners. I decided to choose between Power Corporation and Great West Life.

With the last two stocks to chose from, I decided to go with Great West Life as it’s an insurance company that should profit from higher interest rates even though Power Corporation is the parent company. Sometimes parent companies don’t do as well.

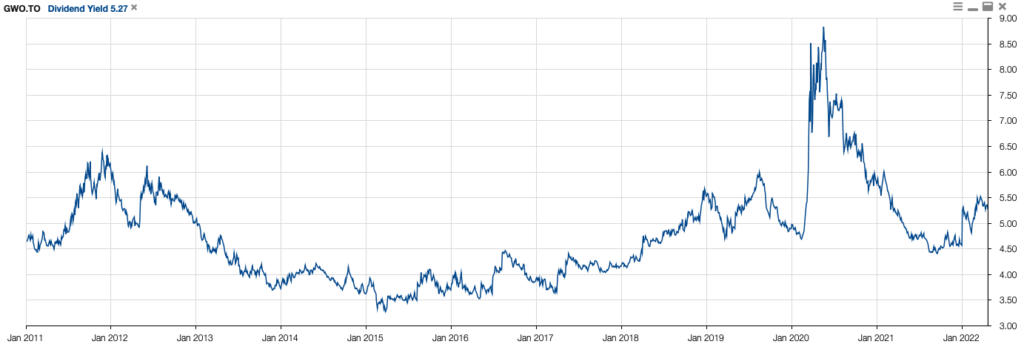

One final check I do is looking at the yield chart as shown below. The yield is even better than what the 5Y average was telling since 2020 scewed everything. Under normal times, the yield is generally under 5.0% which means we should see the price go up and I should see some dividend increases. In short, the 5.0% yield should be safe along with the capital.

Published at Thu, 21 Apr 2022 20:10:21 -0700