GNOM: Get Exposure To The Latest Genomics And Biotechnology Companies

Editor’s note: Seeking Alpha is proud to welcome Sakshi Patni as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Evgenii Kovalev

Strategy

The Global X Genomics & Biotechnology ETF (NASDAQ:GNOM) tracks the Solactive Genomics Index. This index invests in stocks of developed countries’ companies that are involved in further advances in the field of genomic science and biotechnology. A genome is a complete set of DNA of an organism, and genomics refers to the editing of those genomes to predict and diagnose disease more accurately than before. The fund provides exposure to a variety of stocks in the genomics industry, allowing investors to get in on the ground floor as the field takes off. GNOM uses an indexing approach and is not actively managed.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: New Growth

-

Sub-Segment: Healthcare

-

Risk (vs. S&P 500): Low

Proprietary Technical Ratings*

-

Short term (next three months): B

-

Long term (next 12 months): B

*Our assessment of reward potential vs. risk taken (rating scale: A = Excellent, B = Good, C = Fair D = Weak, F = Poor).

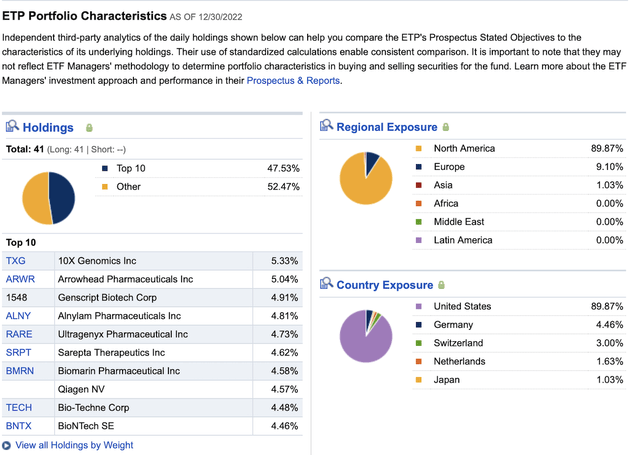

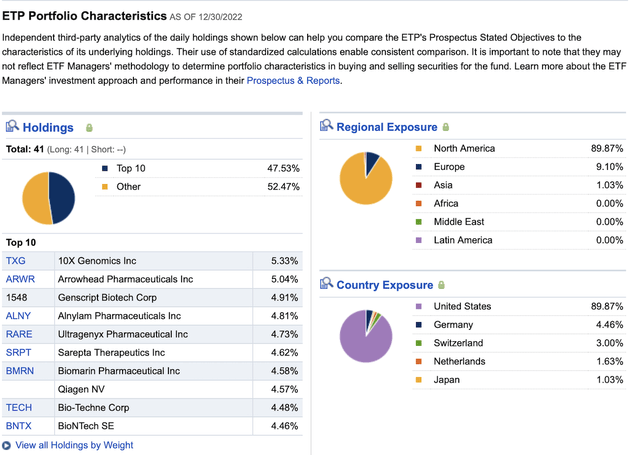

Holding Analysis

The fund is highly concentrated in one industry; all the holdings are in genomics and biotechnology companies. Genomics, which is the study of an organism’s DNA and genetics, is a rapidly advancing field with many potential applications in areas such as medicine, agriculture, and biotechnology. The fund’s geographical exposure is highly focused in North America (90%), followed by Europe (9%) and significantly less exposure in Asia (1%).

screener.com

Strengths

GNOM offers global exposure to emerging areas within the healthcare sector. This ETF sits precisely at the intersection of science and technology. Investing in a genomics ETF can be a great way to diversify your portfolio and take advantage of potential gains from the rapidly growing field of genomics. Genomic sequencing is the process of studying the structure of DNA, which can be useful in studying how diseases – such as cancer – form. The possibility of transforming patients’ lives using genomic sequencing creates growing demand for drug development, precision medicine, and much more. There has been a significant reduction in the cost of genomic sequencing, from nearly $100 million per genome in 2002 to less than $1,000 in 2020.

Weaknesses

Investors must realize that this is a highly targeted, niche ETF – not a broad-based index. The fund’s performance will be greatly impacted by general economic conditions and cyclical market patterns in this industry. Both of those things are negatively affected by changes in demand and supply, competition for resources, adverse labor relations, and political/world events. In addition, this subsector of the healthcare business is prone to the obsolescence of technologies, as well as increased competition or new product introductions that might affect the profitability or viability of companies.

Opportunities

The fund can increase its geographic exposure, particularly in Asia, as the Asia-Pacific is emerging as a leader in genome-based medicines. With the news of established star scientists from North America and Europe relocating to the Asia-Pacific region, this area is actively investing in a younger generation of skilled professionals. This can be backed up by the fact that the Asia-Pacific region constitutes 60% of the world’s youth.

Threats

Though the future of genomics looks promising, genomics companies typically face intense competition and can experience rapid product obsolescence. These businesses also rely heavily on intellectual property rights and could be adversely affected by the loss or impairment of those rights. There is no assurance that these companies will be successful in protecting their intellectual property against the diversion of their technology, or that competitors will not develop technology that is substantially similar or superior to that of these companies. Genomics companies typically spend a lot of money on research and development, and there is no guarantee that the products and services they manufacture will be successful.

Conclusions

ETF Quality Opinion

This ETF is ideal for investors looking to gain exposure to an advanced field of the healthcare sector such as genomics and biotechnology. The fund has a fine balance of small, midsize, and large genomics and biotechnology firms.

ETF Investment Opinion

The fund hasn’t generated returns since its inception, but the future of genomics looks promising given the advancement of technology. Our bottom line rating on GNOM, for now, is that it’s a hold.

Published at Wed, 18 Jan 2023 14:16:00 -0800