EXD: 7.41% Distribution Yield, Monthly Pay

RomoloTavani/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on March 28th, 2022.

In an otherwise stellar line-up, Eaton Vance Tax-Managed Buy-Write Strategy Fund (NYSE:EXD) was one of the least popular Eaton Vance funds. For years it languished, but in 2019 they changed its strategy and changed the fund’s name. At that time, they made it much more like its sister fund, Eaton Vance Tax-managed Buy-Write Opportunities Fund (ETV).

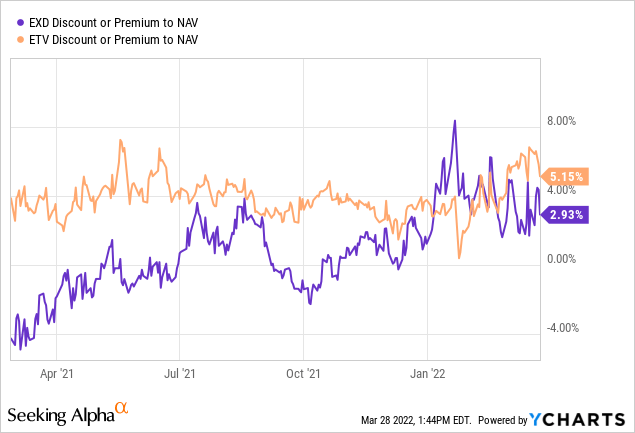

For quite a while after that, investors still weren’t paying attention to the fund. It traded at a discount, while ETV traded at a premium. However, that has since changed, and we touched on that in a previous article. Since starting to reach a premium in 2021, it has only briefly touched back into the discount territory. Throughout most of the last year, it has traded at a premium. It still remains slightly cheaper than ETV, making it a consideration for those who want tax-friendly distributions.

The Basics

- 1-Year Z-score: 0.82

- Premium: 2.93%

- Distribution Yield: 7.41%

- Expense Ratio: 1.21%

- Leverage: N/A

- Managed Assets: $109.6 million

- Structure: Perpetual

EXD’s strategy is to “invest in a diversified portfolio of common stocks and write call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. The Fund’s portfolio managers use the adviser’s and sub-advisers internal research and proprietary modeling techniques in making investment decisions. The Fund evaluates returns on an after-tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund.”

EXD is on the smaller side, with the market declining this year, which hasn’t helped either. This can be a risk to larger investors that need a lot of liquidity. It is just over $109.6 million in total managed assets. Since its investment change, it has grown. That was a nice change of pace from the continual declines it seemed plagued with previously. However, it would take some massive moves before making it more accessible for most investors.

The fund’s expense ratio is rather reasonable at 1.21%. They don’t employ any leverage at the fund level, but they do hold quite a bit of tech exposure, making it a bit volatile. Their primary strategy to generate enhanced returns is by writing calls on indexes. They overwrite almost 100% of their portfolio (97% at the end of Q4 2021 was overwritten.)

Performance – Outperforming ETV

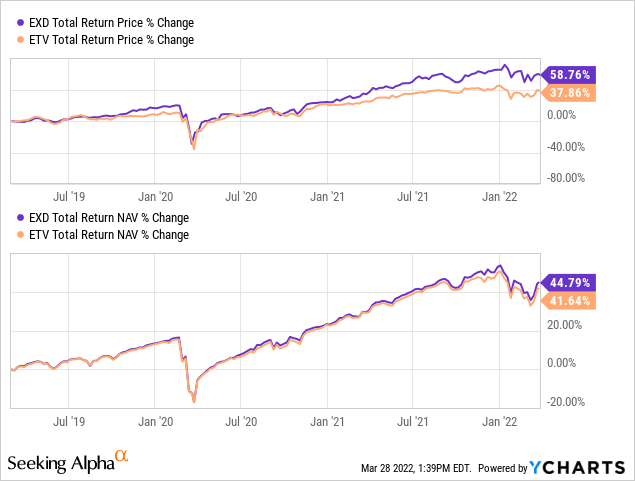

Since the end of February 2019, EXD has been a better performer when compared to ETV. In the grand scheme of things, it hasn’t been anything too massively different. It helps show just how similar the two funds are at this point now.

That, of course, was a significant change from what shareholders saw previously. EXD, at one point, had an overwrite strategy similar to what it has now, but the underlying portfolio was muni bonds.

Ycharts

As we can see, the discount would have shrunk for EXD as it has outperformed its total NAV return price. That is the opposite of what we had seen from ETV; in that case, the total share price return lagged the total NAV return. ETV still trades at a higher premium than EXD. However, we could see a similar divergence occur again with current valuations. I don’t suspect it will be as drastic as what we’ve seen in the last few years now. It is also interesting to see the comparison below between the two funds, as EXD had briefly traded richer than ETV.

Ycharts

Distribution – Attractive 7.41%

Since the fund is at a premium, we don’t benefit from obtaining better yields on the share price relative to the NAV. In this case, though, it also doesn’t work against us too much. The current distribution rate is 7.41%. It works out to 7.53% on a NAV basis.

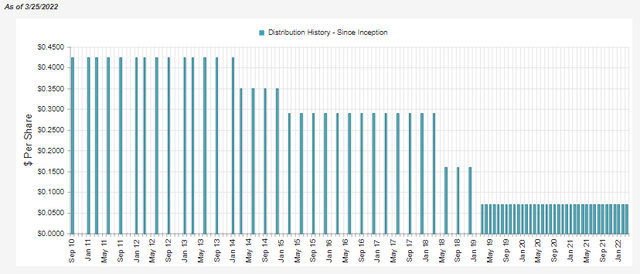

One of the other changes that was implemented with the fund’s change in strategy was going to a monthly distribution. For income investors, that is a bonus, and for some, it is even a requirement before they’ll invest.

EXD Distribution History (CEFConnect)

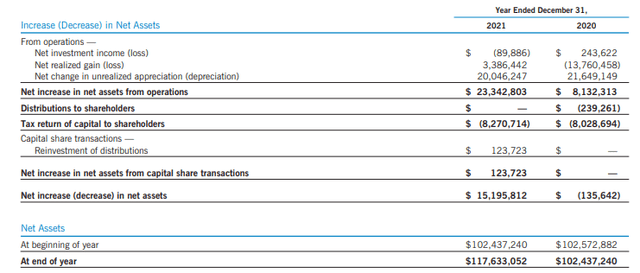

One of the changes in the last fiscal year for EXD is that the fund’s total investment income wasn’t enough to cover its expenses of the fund. So, in this case, 2021 shows a net investment income loss. It isn’t a substantial loss, nor was the fund’s NII necessarily anything material previously either.

EXD Annual Report (Eaton Vance)

The distribution mainly required capital gains previously; now, to cover the distribution, it will rely on them entirely. At least based on these earnings, next year could see positive NII once again.

One thing we drilled into previously was how EXD is tax-managed in the first place. What we can see above is that neither 2021 nor 2020 – despite having some NII – “covered” the distribution in terms of realized gains or income. Instead, they were covered indirectly via unrealized gains.

This can be the case when the fund’s NAV still rises for a period of time, such as over the course of a year. This was the case in 2021, and 2020 was very close. If we wanted to get technical, around $110k of the distribution wasn’t covered, even by unrealized gains.

All this results in distributions that are mostly return of capital for shareholders. In this way, it acts as a way to defer taxes for shareholders. Sometimes this could be indefinitely under current tax law if you never sell and if the distributions never push your cost basis below zero.

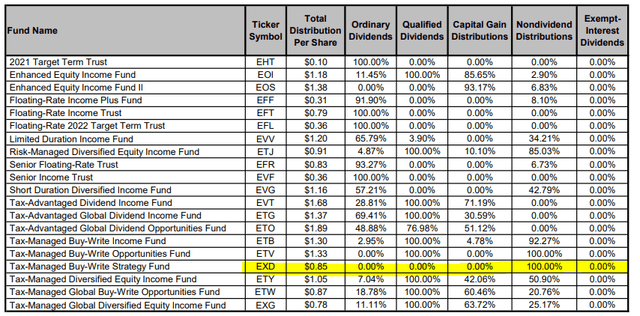

For 2021, even though we see some realized gains for EXD – 100% of the distribution qualified as ROC.

EV Tax Breakdown (Eaton Vance)

Since the fund’s NAV increased – quite strongly, might I add – we would consider this distribution covered or “good” ROC.

EXD’s Portfolio

EXD overwrites its portfolio via writing calls against the NASDAQ 100 and S&P 500 Indexes. The overall turnover of the portfolio since the fund’s strategy change has been rather low. Last fiscal year, the turnover rate was reported at just 3%. This is pretty standard in how Eaton Vance operates these funds. They don’t want to generate too many realized gains, instead just harvesting losses from the portfolio or options strategy. In that way, they act a bit more similar to a passive ETF in that they don’t frequently trade with the underlying portfolio.

It is also important to note that while the fund benchmarks against these indexes, it doesn’t hold even close to what these indexes do. At the end of Q4, 2021, the fund held a total of 136 positions. That’s less than the 180 positions ETV had at the same comparable time. That alone tells us why the outcomes in terms of performance between the two funds were different.

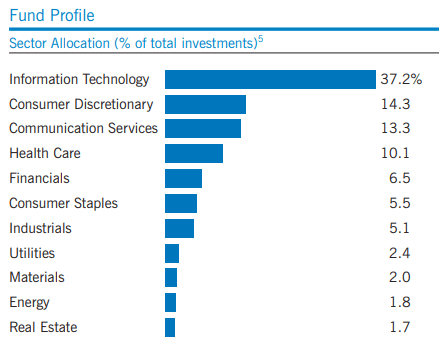

Due to the tilt towards the NASDAQ 100 and writing calls on that index, EXD’s portfolio tilts heavily in technology stocks. The reason for this is that they can’t own an index directly. So they will mirror what these indexes blended exposure might reflect. Therefore, if there is a strong rally, the loss will be mitigated from the options side by having underlying positions in the EXD rally. The sector exposure shown below is provided from the Annual Report for the period ending December 31st, 2021.

EXD Sector Exposure (Eaton Vance)

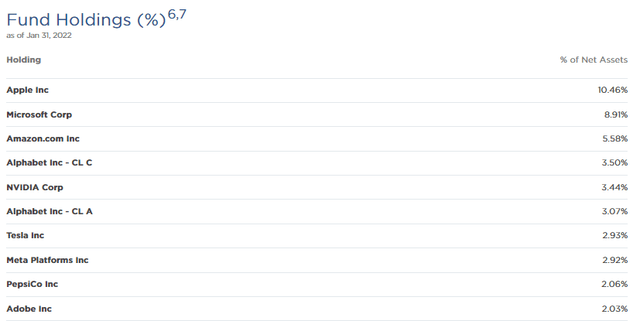

For the most part, EXD’s top positions aren’t surprising at all. We have the MAMAA stocks (Microsoft (MSFT), Apple (AAPL), Meta (FB), Alphabet (GOOG) and Amazon (AMZN).) It is a bit unoriginal, but this is really how the portfolio should be tilted with its strategy. The top ten of the portfolio represents 44.9% of the fund. This is somewhat similar to the 45.39% reported previously at the end of August 2021. That means the other 126 positions of the total 136 actually don’t come up to be all that meaningful on their own.

EXD Top Ten (Eaton Vance)

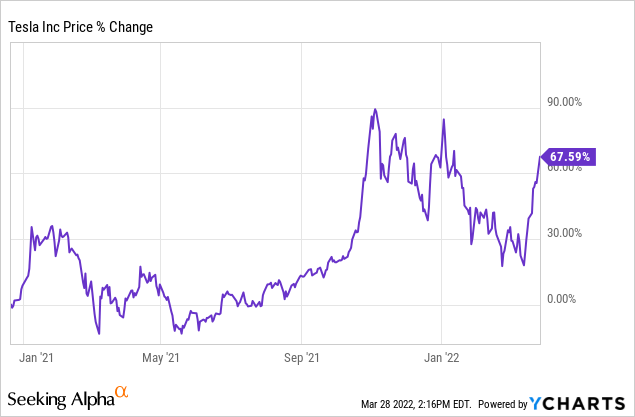

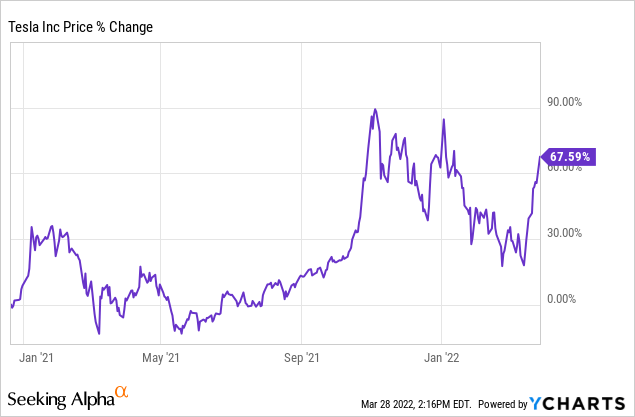

One of the newer positions we’ve seen pop up is Tesla (TSLA). It was only a matter of time before this name made its way into a sizeable position for EXD. This is because it was added to the S&P 500 Index at the end of 2020. More specifically, it was before the opening on December 21st.

It was certainly controversial given that some believe it is simply a bubble stock and others truly believe in its longer-term growth; it has provided positive returns since then. However, it languished a bit throughout 2021 before rallying strongly into year-end.

Ycharts

In fact, as I’m writing this, TSLA’s stock is up nearly 8% because they will ask to increase the number of authorized shares of the company. Often, that would be met with a crash in price due to dilution. However, in this case, it is to be able to deliver a stock dividend to investors. In that way, it’ll be a stock split which they had don’t a 5 for 1 split in 2020.

This is all good news for investors in EXD that have also been participating in TSLA’s strong results.

Conclusion

EXD isn’t as cheap as it once was, but it isn’t necessarily at a sky-high premium either. Given the attractive distribution rate and the tax-friendly nature of the distribution, I suspect investors will keep it elevated, similar to ETV. With that being said, these two funds are a great swap pair where you can exchange one for the other when valuations dictate the opportunity.

Published at Tue, 29 Mar 2022 21:25:49 -0700