Energy Transfer: The Hikes Continue

Mongkol Onnuan

Article Thesis

Energy Transfer (NYSE:ET) is a leading American energy infrastructure company that has one of the largest asset footprints on the continent. It generates large amounts of cash, but its valuation is very inexpensive, as some, including some former investors, still consider it uninvestable due to the dividend cut during the pandemic. But Energy Transfer has made it very clear that reinstating their dividend at pre-pandemic levels was their main goal, and with the most recent dividend increase in the books, ET is very well on its way to doing that. Investors get a nice dividend yield, further dividend growth is likely, and ET also has upside potential due to a pretty low valuation.

Great But Unloved Assets

The world is experiencing an energy crisis today. Oil, natural gas, even coal and electricity are highly expensive in many markets around the world. At the same time, companies that are active in producing these commodities have been cutting back on investments in recent years, due to multiple reasons, including ESG mandates and the pandemic. Demand hasn’t fallen, however. Instead, it continues to grow, which is why markets for many of these commodities have become tight in 2022. Add OPEC’s decision to reduce oil production in order to keep supply even more suppressed, and global energy markets are reeling to find any supply they can. In that environment, American energy, or more precisely oil and natural gas, is highly important for both the US itself as well as for foreign markets, such as Europe and East Asia.

Exports of US-produced oil, oil products, and natural gas (in the form of LNG) will be highly important for the world going forward, and that bodes well for the companies that supply the necessary infrastructure. Energy Transfer’s pipelines, storage facilities, terminals, and so on are quite essential for the world, as they help supply much-needed energy products to the markets where they are needed — both domestically and on a global scale, e.g. by moving natural gas to LNG export terminals.

And yet, despite the importance of this industry, these assets are unloved by investors. That holds true for most energy infrastructure names, as they all tend to trade at undemanding valuations. But this low valuation is especially pronounced when it comes to Energy Transfer, which trades at a very low valuation even relative to its peers. There are several reasons for that. First, the investor community is worried about ET’s debt levels. They are higher than those of Enterprise Products Partners (EPD), for example, but Energy Transfer doesn’t look threatened by its debt. In fact, the company has been reducing its leverage by paying down debt, and growth in EBITDA should lead to further leverage ratio improvements. With massive free cash generation even despite the interest payments ET has to make, there is little reason to worry about its debt, I believe.

Energy Transfer is also disliked by some for its decision to cut its dividend during the pandemic. That wasn’t great for investors, as companies ideally maintain their dividends even during a crisis. But ET has not eliminated its dividend (it was cut in half), and the company has made a lot of progress in restoring the dividend at the old pre-crisis level. I do not think that the track record is so bad that ET should forever trade at a very low valuation. This means that investors who can look beyond the dividend cut in 2020 can load up on shares of a very inexpensive high-yielder that is operating in an environment where its assets are arguably becoming more important and more valuable every month, as many markets around the globe seek to replace Russian energy exports, instead moving to suppliers such as the US.

The Dividend Restoration Is On Track

On Tuesday, Energy Transfer announced that its upcoming dividend payment will be $0.265 per share (for a quarter), which makes for a 15% increase relative to the previous level of $0.23.

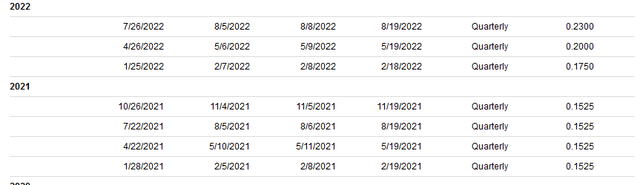

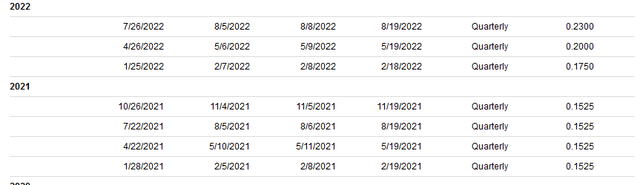

This aligns with the last couple of quarters, during which Energy Transfer has increased the dividend regularly and at a meaningful pace as well:

Seeking Alpha

From the pandemic low of $0.1525 per share, ET has now increased the dividend by 74% in a single year. Another 15.1% dividend increase is needed, and ET’s dividend will be back at the pre-crisis level of $0.305 per share per quarter. I do believe that there is a high likelihood that this will be done a quarter from now, as ET has increased its dividend hikes, in absolute terms, over the last couple of quarters. The first hike was for 2.25c, with the next ones being 2.5c and 3.0c. The most recent dividend increase, the one that was just announced, was for 3.5c. If ET raises the dividend by 4c in the next announcement, then the dividend would be in line with where it was before the pandemic. That would be a slightly bigger hike, in absolute terms, than during the most recent announcement. But that was slightly bigger than the one before, etc., so it would be in line with what ET has done.

We can also look at the relative quarter-to-quarter growth rate, which has been in the 15% range for all four of these dividend increases. Since a 15.1% dividend increase would be needed for ET to get the dividend back to the old level, it seems reasonable to me to assume that this is what Energy Transfer will be doing a quarter from now.

At that point, ET’s dividend yield would be 10.2%, calculating with a share price of $12. That would be highly attractive. The dividend yield, based on the most recent dividend announcement, is 8.8%, which is quite strong as well. Even better, the dividend looks very sustainable at those levels, and could be grown beyond the $0.305 per quarter level eventually.

Energy Transfer has forecasted that its EBITDA will total around $12.7 billion this year. Not all of that will turn into distributable cash flow, of course. When we adjust for interest expenses, maintenance capital expenditures, forecasted growth spending, EBITDA that belongs to minority shareholders, and preferred stock dividends, then $12.7 billion in EBITDA should translate into roughly $6 billion to $6.5 billion in free cash — with all capital expenditures being accounted for already. Going with the lower bound of that estimate, ET would be able to return $6 billion per year to its investors, even while continuing to invest for maintenance and some growth. At the $0.305 per quarter/$1.22 per year level that I believe will be hit soon, ET’s dividend will cost $3.8 billion per year, based on a share count of 3.09 billion. In other words, ET would pay out a little less than two-thirds of its free cash flow in that scenario. Growth spending is forecasted to decline in 2023 and beyond, thus free cash flows should be higher in the future.

It is far from guaranteed that ET will pursue future dividend growth beyond the restoration of the pre-crisis dividend. And it’s not necessarily the best strategy, I believe. In fact, I think that going for buybacks once the dividend has been restored could make a lot of sense, as shares can be bought back at a very low valuation, which will not only make the dividend safer over time, but which will also result in significant cash flow per share growth over the years. It’s thus very much possible that ET’s shareholders will not get any dividend increases for some time once the old dividend has been fully reinstated, but if ET’s management uses the $2+ billion of surplus free cash for debt reduction or buybacks, that will be creating shareholder value as well. Nevertheless, the above calculation shows that ET has significant potential when it comes to increasing the dividend further — if the company wanted to pay out $1.50 per share per year, that would cost the company around $4.6 billion per year, for example, which would still be easily covered by our (arguably conservative) free cash flow estimate of $6 billion. A hypothetical $1.50 per share dividend would result in a dividend yield of 12.5% for someone buying at $12.

Takeaway

Energy Transfer is unloved, but that provides opportunities for investors. ET has risen over the last year, but remains quite inexpensive, trading for around 6x this year’s free cash flow right now — with all growth spending already being accounted for.

With a dividend yield of 9% that will very likely rise to around 10% a quarter from now, ET is a strong income pick. And its dividend is very sustainable at those levels, which makes it somewhat of an outlier relative to many other high-yield stocks. Whether we investors will get further dividend increases once the dividend has been fully restored, or whether ET opts for further debt reduction or buybacks, it looks like the company has ample ways to create significant shareholder value in the long run. I continue to be happy with my investment in ET.

Published at Wed, 26 Oct 2022 10:01:31 -0700