Earn Up To $50K Tax-Free in Canada

Not only is dividend investing a way to live from your income but you can earn the first $50K in dividend tax-free! It’s not easy to achieve though.

Once your reach your retirement number, retirement income is as much about tax management as it is portfolio income. In fact, it’s all about how you manage the withdrawal per account.

Which Account Is Important?

Remember that you are incentivize to put money in your RRSP for the tax deduction, but what do you do with the tax deduction? Invest it back in your RRSP or TFSA? If not, you pretty much negatively impacted the purpose of your RRSP unless you can guarantee you will earn less once you withdraw from your RRSP.

Why go over the RRSP and TFSA when the goal is to earn $50K in dividend tax-free? Simple, to earn $50K in dividend tax-free, you need to generate $50K in dividend from your non-registered account.

With a 5% yield, to be generous, you need $1,000,000 in your non-registered account to earn $50,000 in dividends. Since most people will find it hard to reach that number across all accounts, let alone in a non-registered account, it’s a pretty high bar to achieve but possible.

So, should you just focus on your non-registered account? Well, no is the short answer. You want to make sure you contribute to your TFSA no matter what!

Between the TFSA and the RRSP, the TFSA wins in my opinion.

TFSA To The Rescue

It’s not all gloom. Investing in your non-registered account or TFSA is all done with after-tax dollars.

Instead of having $1,000,000 in only one account, let’s have $200,000 in your TFSA and $800,000 in your non-registered account with the yield at 5%. You can get $10,000 from your TFSA and $40,000 from your non-registered account.

In 20 years, you should easily get your TFSA to $200,000. I almost got mine there in 12 years. The bigger you can get it, the smaller your non-registered account has to be for tax efficient income.

Why $50K Tax Free?

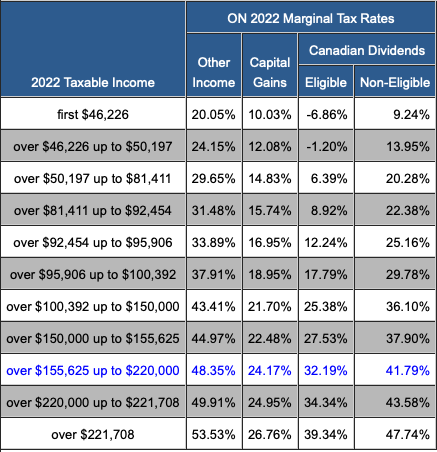

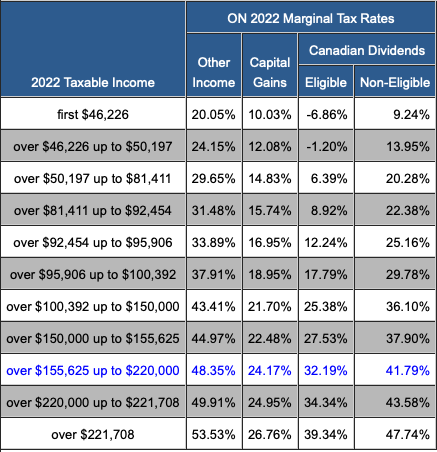

It’s pretty simple really. Dividend income identified as eligible dividend has a preferential tax treatment. It’s more efficient than capital gains until you reach a certain income and then it swaps.

Unlike employement income, capital gains and eligible dividends are more favorable for your taxes. Here is how it plays out for Ontario and British Columbia on the tax front.

As you can see, no taxes is paid up to $50,000 on eligible dividends when earned in a non-registered account but it’s not an easy task to get there. If you want to see a table for your province, you can access here on Tax Tips.

The trick now that the TFSA exists is to have a balance between the TFSA and the non-registered account.

Published at Sun, 01 May 2022 16:29:35 -0700