DGRO: There Are Better Dividend Growth Alternatives

Galeanu Mihai

Like many, I regularly read Rida Morwa here on Seeking Alpha. His High Dividend Opportunities is a great asset to the high yield hunting investors.

Recently he posted When Dividend Growth Goes Off The Rails which very eloquently presented a scenario where an investor could have invested in a company they believed was “safe” from a dividend growth perspective such as Intel (INTC), Hanesbrands (HBI), or Boeing (BA), only for the company to either cut or suspend the dividend.

This is certainly a risk when it comes to dividend growth investing. Part of the allure of dividend growth is you passively invest and watch the dividends grow over a long period of time. However, using the examples of Intel, Boeing and Hanesbrands – an investor would have needed to actively manage the investment as the stress on each company financials became apparent.

Clearly, actively managing a dividend growth portfolio is not for everyone, but luckily for investors there are dividend growth focused ETFs that try to mimic a dividend growth portfolio.

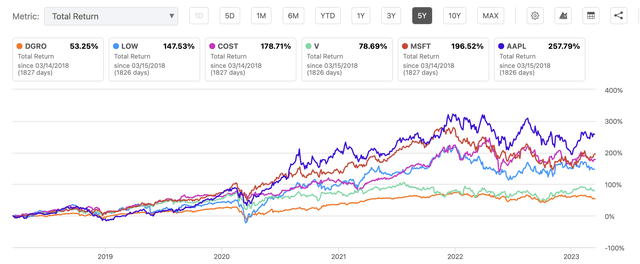

iShares Core Dividend Growth (NYSEARCA:DGRO) tends to be towards the top of the list. From an expense ratio coming in at 0.08%, it’s not as low as Schwab’s U.S. Dividend Equity (SCHD) 0.06%. Additionally, the total return of DGRO over the past 5 years has lagged SCHD.

Seeking Alpha

Not only is SCHD’s overall yield of 3.58% higher than DVGO’s 2.4% – the total return over the past 5 years speaks for itself. Not to mention the expense ratio is lower.

That’s not to say that DVGO’s not worth owning as the portfolio of assets is quite different.

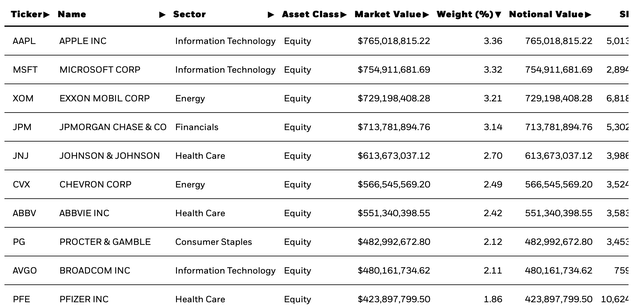

iShares

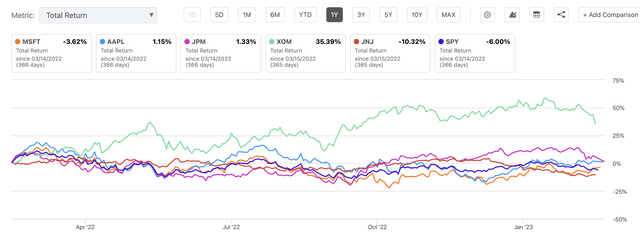

The holdings aren’t overly concentrated into one name, however the top 5 holdings have struggled from a stock performance perspective over the past year. Just Exxon Mobil (XOM) has significantly outperformed and the rest are either flat or down.

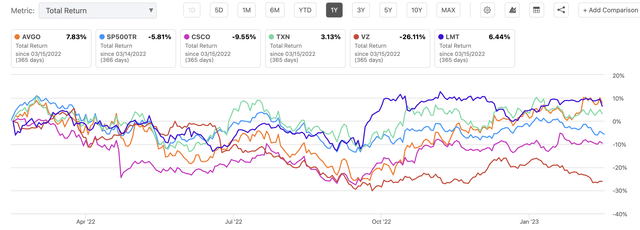

Seeking Alpha

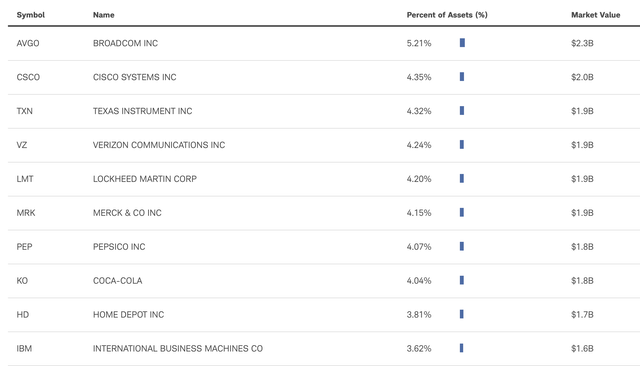

In comparison, SCHD’s top 5 holdings have performed slightly better with the top holding Broadcom (AVGO) up nearly 8% over the past year.

Schwab

Seeking Alpha

Shifting back to DGRO, I understand the strategy of dividend growth can play out over a long period of time. But in general you’re hoping for a total return well in excess of either a broad market diversified ETF or simply getting exposure to single stocks.

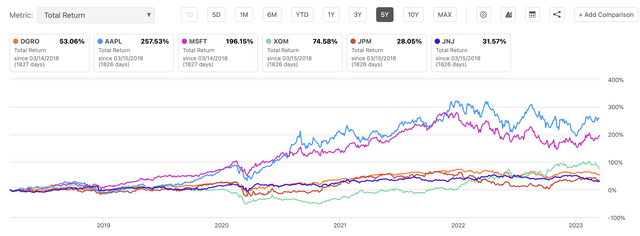

While Rida Morwa brought up some examples of dividend growth gone wrong, it can easily turn out great. Using just DGRO’s top 5 holdings 3/5 would have dramatically outperformed DGRO over the past 5 years with Apple (AAPL) returning 257% and Microsoft (MSFT) producing 196% total return.

Seeking Alpha

Sure, past performance isn’t indicative of future results but DGRO has lagged popular dividend ETFs such as SCHD which has a higher overall yield and better total returns over the past 5 years. In fact, DGRO’s total return is essentially identical (53%) to the S&P 500 over the past 5 years. In that case, an investor could find a lower expense ratio ETF and have a more broadly diversified set of holdings and achieve similar performance.

Finally, if an investor wanted to pick dividend growth stocks on its own, simply concentrating into Apple or Microsoft would have yielded tremendous results. Yes, there’s risk Apple or Microsoft turns into Intel, Boeing or Hanesbrands – but is the downside risk that much lower than what DGRO would experience if these names underperform?

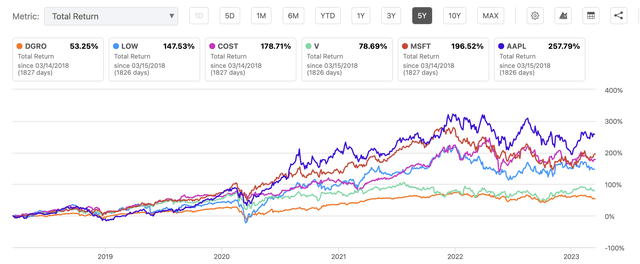

Total return doesn’t lie. DGRO is good but not great. Broader market S&P500 funds or dividend focused ETFs such as SCHD are better. From an individual stock perspective, I posted a video with my top 5 last week. The list is as follows:

The average 5 year total return of this basket comes in at 171% compared to DGRO’s 53%.

Seeking Alpha

Investors can do better than DGRO if they want dividend payouts and growth. I would reallocate assets into a lower cost ETF with a higher yield like SCHD if dividend yield was my main focus. If dividend growth was your primary focus, concentrating into the top 5 names I have listed – or simply using the holdings list of DGRO as a guide likely presents similar performance with the chance of multi-bagger type upside.

Published at Thu, 16 Mar 2023 00:11:31 -0700