Covered Call ETF Added – Corp Account

The second transaction for the company income account is complete. The intention with this account is to share the process used to find the holdings.

Corp Account Guidelines

A reminder on the account guidelines:

- Preserve capital by not taking unnecessary risks while not expecting growth per say.

- Earn income from the investment with a yield above 5% from dividends or distributions.

- Keeping up with inflation is not necessary as it’s not a retirement account.

- No re-investment of income. It will either be used to pay taxes, or withdrawn from the corporation as dividends to myself.

- Focus on Canadian currency.

High Yield Candidates

One learning I can share over the past few years is that companies on the stock market generally pay upward to 5% yield for a high income. Anything above that is a risk indicator.

If you want more than 5%, then you need to approach your investing with different income strategies such as executing Covered Calls on your holdings, income/covered call ETFs or specialty funds such as Canoe Income Fund.

Between high yield stocks and advanced income investments, you have REITs. As you know, I am not a big fan of REITs in the accumulation years. What about for income?

As I wrote in my Canadian REIT Buying Guide, to get yield above 5% from REITs, you need to buy smaller REITs which are then riskier by nature of market capitalization grouping (business maturity & risks factors are implied). Since I want to limit downside risks, I will look elesewhere for the yield I want.

I also still want stable blue-chip stocks in my portfolio with a high yield and the best way to achieve that is through a covered call ETFs or Canoe Income Fund.

When it comes to covered calls, you really want boring which means I want to focus on the following industries (not sector as it is way too broad of a coverage); banks, insurance, utilities, telecommunication, medical devices, or drug manufacturer.

The above outlined industries are usually filled with many companies that form an oligopoly which provides more stability in the underlying stocks.

ETF Screening Method

Looking for an ETF is the same as looking for a stock, you need a screener. Since Dividend Snapshot doesn’t have a screener on ETFs (yet), I used Stock Rover as it’s a very cheap service to access a massive amount of securities and their data in North America.

As an alternative, you can manually go through each ETF provider and search for covered calls if you want, but with Stock Rover, I got the full list trading on the TSX, sorted by yield and looked for “Covered Call” in the name and pulled the ones matching the industries I wanted. I stopped once the yield was under 6%.

I pulled out each ticker for those that matched the industries I outlined. Tech covered call ETFs have a higher yield by the way but I don’t want the risk of technology.

The short list I compiled is the following with the yield from the prospectus of the companies as it varies based on the price. Trailing twelve months (TTM) yield is often used as opposed to forward yield since forecasting yield on inconsistent distribution is difficult.

| Ticker | Name | Yield |

| ZWB | BMO Covered Call Canadian Banks ETF | 6.24% |

| ZWU | BMO Covered Call Utilities ETF | 6.98% |

| FHI | CI Health Care Giants Covered Call ETF | 7.03% |

| EIT.UN | Canoe Income Fund | 8.41% |

Reviewing Fund Holdings

Since they are all funds, I did an inspection of the underlying funds to ensure those are companies I would hold individually.

- ZEB simply hold the 6 major Canadian Banks. I own a few in my portfolio.

- ZWU holds pipeline, utilities, and telecoms and they are the usual leaders in the space.

- FHI holds 15 of the big pharma and medical devices companies mostly from the US.

- EIT.UN is more specialized. It’s an actively managed fund and holds North American stocks.

Picking The ETF

I find that Canoe Income Fund is currently expensive in price since the yield is below the 5-year average (using Dividend Snapshot Screener data). I will be patient and watch it. I would prefer to buy it around $12 which is a yield closer to 10%. Zoom out and look at the 5 year chart when you pull it up you can see the price pattern.

I also find FHI and ZWB to have appreciated more than ZWU in recent months thus pushing the yield down. BMO’s ZWB and ZWU have a decent trade volume to get in and out which is a good thing. The MERs for the ETFs are similar as well.

The next step is to inspect the distribution for tax efficiency.

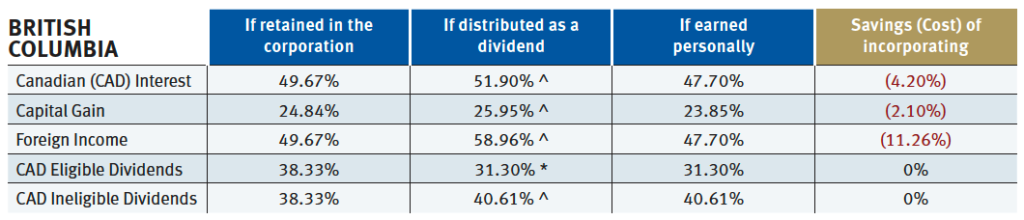

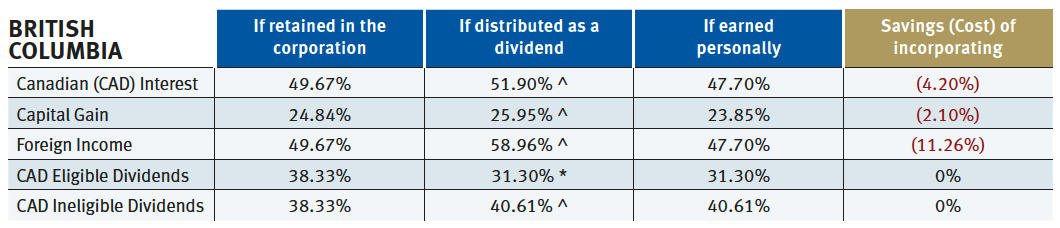

I am ruling out FHI as it’s mostly foreign income with return of capital. While they all have return of capital, the foreign tax rate is impacting the yield after tax. I do like it for a RRSP or a TFSA (even if there is a bit of withholding tax on the foreign income).

Since ZWU has foreign income and the yield is close to ZWB, I need to assess if the tax implication favor ZWB or ZWU. It’s spreadsheet time.

I downloaded the 11 year historical distribution data for both ZWB and ZWU and applied the corporate tax for BC.

Both ETF distribute an average of 45% in return of capital. While ZWU has foreign income, it averages to 7% annually and the tax impact on the 7% still brings ZWU ahead on the yield.

The tax results is an average of 77.56% efficiency with ZWU vs 76.37% with ZWB for the corporation tax rates. Both have similar efficiency but ZWU has a higher yield overall.

The final selection is BMO’s ZWU ETF.

I much prefer a covered call ETF over a small REIT for income.

Published at Mon, 25 Apr 2022 07:55:12 -0700