Centene Has Overdelivered – It Is Time For A ‘Hold’

shapecharge/E+ via Getty Images

Centene (NYSE:CNC) is the sort of company I like writing about, as well as investing in. This company is stone-solid, with the sort of foundation to its business that you want to be looking at and looking for. In my initial Centene article, I posited a “BUY” thesis with the following results.

Centene Article (Seeking Alpha Centene)

Let’s revisit Centene and see what the company gets us if we invest in it today.

Revisiting Centene

So, Centene is a healthcare company that was originally founded as a nonprofit Medicaid plan almost 37 years ago. It went public on the market in 2021, and as such has around 20 years’ worth of history on the public markets.

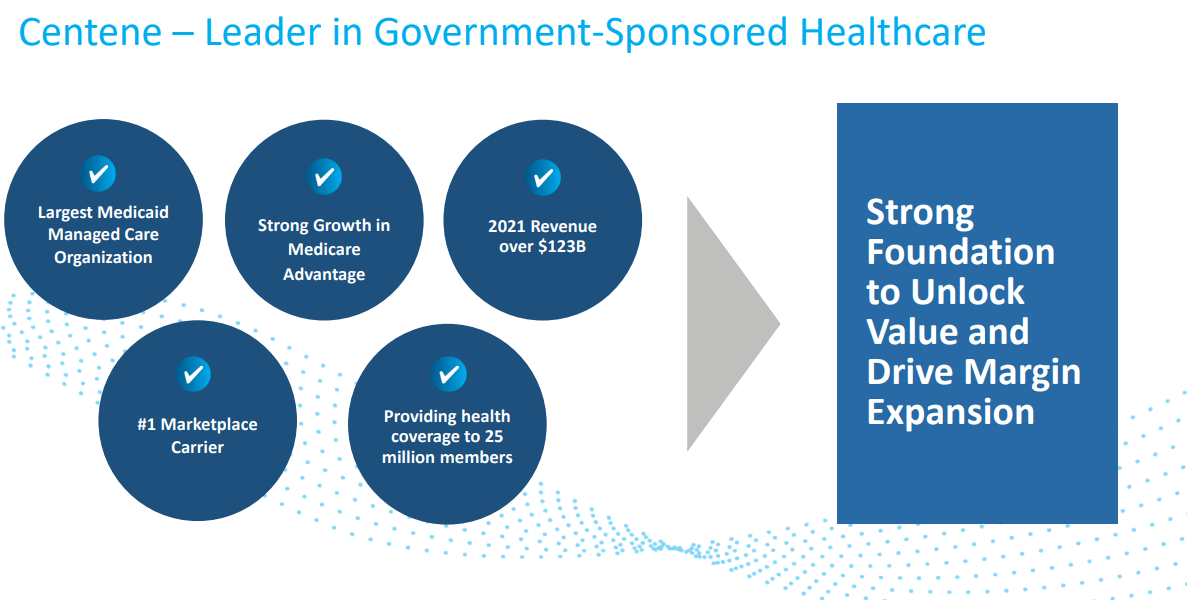

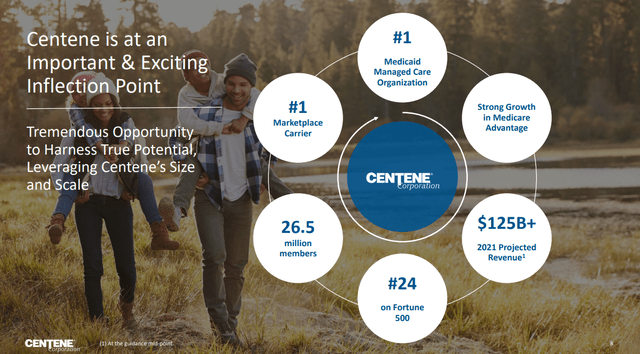

Centene offers healthcare plans/coverage. The company has 25 million members, and is the market leader in Medicaid, with continued growth in Medicare. The way healthcare is structured in the USA means that there can sometimes be difficulties for some gaining access to adequate care in times of need, because they may not have the money to pay for this. This is evidenced by the simple fact that prior to the introduction of the Affordable Care Act, tens of millions of citizens were without basic health insurance.

Due to Medicaid expansion, companies like Centene were able to enter the space. Its mission is essentially to offer high-quality cost-effective healthcare plans, with a specific focus on government-sponsored plans. Their focus is the specific demographic of underinsured or uninsured individuals and also provides important outreach services. The company, as such, goes a step further to provide its members with solid services at a cost-effective price.

Centene Foundation (Centene IR)

Its two segments are managed care and specialty services – covering health plan coverage and companies/organizations providing healthcare services to the former segment, respectively.

Centene’s fundamental upside, and one thing you need to understand and agree with if you’re bullish on the company, is its extensive expertise in government-sponsored healthcare. The company has been in this business since before I was born and has built up knowledge in the field like no one else.

Centene is an effective capital allocator with historically proven results. Its priorities are clear. First, Organic growth. Second, Capital management and M&As through debt reduction, M&As, and finally, share repurchase to increase returns.

As I wrote in my initial article, you won’t get rich with dividends in Centene – because the company doesn’t have any, nor is it likely to ever pay a dividend. It’s, to date, the only company I have bought knowing I won’t be receiving a dividend, and so far it’s paid off in spades. The company’s credit rating also isn’t that fantastic, and it would not be unfair to characterize Centene as a “volatile” investment overall.

The key here is buying it cheap – which I did. Looking at the company’s results, it’s easy to see why the market has treated the company positively with its valuation.

Centene Goals (Centene IR)

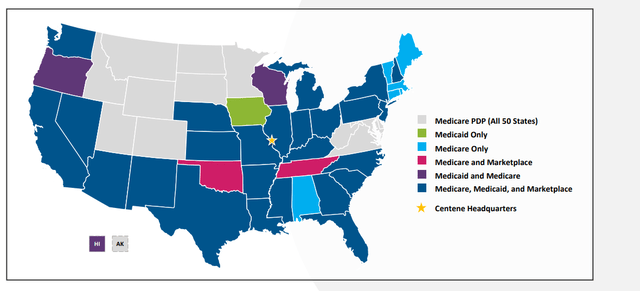

The company has given us 2022 guidance. Thanks to Medicaid Growth, PDP growth, Magellan, and some redetermination and Carve-out headwinds, the company expects almost $10B in increased revenue for 2022 fiscal, with a high-end target of almost $138B and a diluted EPS of $4.23. The company has expanded its geographical coverage even further thanks to its recent actions, and the company’s footprint for the coming year and going forward now looks like this.

Centene Footprint (Centene IR)

The company continues its tradition of winning procurements. Centene won its reprocurements in Ohio, Nevada, and Arizona, going live during various dates during 2022. Its Ambetter coverage has improved to 49% of all US counties, with 27 states (5 new in 2021).

The company continues, simply put, to deliver in accordance with its strategy and goals. Membership grew 4% to 26.6M driven by strong Medicaid growth as well as Medicare, and superb performance in the company’s marketplace business.

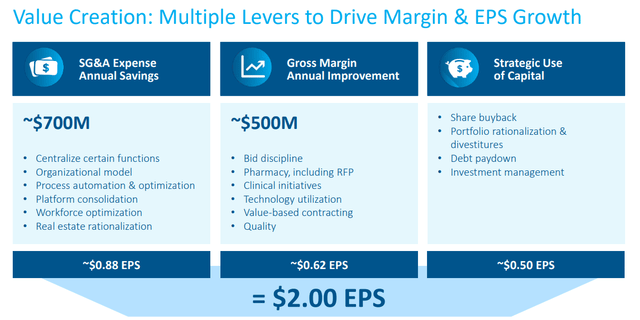

The company’s fundamental drivers and demands are massive. Specifically, the need for mental health care since the pandemic has exploded, and the company’s expansion into Magellan will allow Centene to start expanding its coverage into behavioral health. Share repurchases continue to be the major reward shareholders are receiving here. The company is exploring multiple avenues for higher EPS and for the use of capital – but as before, Dividends are not on the menu.

Centene Capital use (Centene IR)

The company targets a 2024E EPS target of $7.75 on the high end, almost coming on a 40-50% increase from the current EPS, based on ongoing value creation, organic growth and underlying demand drivers. There is also the opportunity in the pharmacy space. Centene is planning to consolidate all of its current business into a single PBM platform for all health plans, which of course will allow for massive savings, due to scale, automation, leaner and more efficient organizing, and staff reductions.

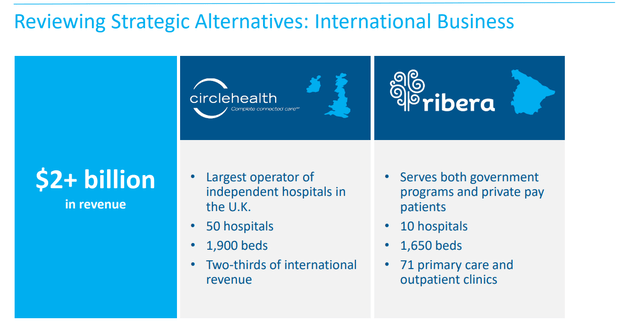

The company also continues to be active in the international business for the time being.

Centene International (Centene IR)

So, at its heart, Centene is exactly the company I wrote about months ago – only far better. The company has improved its operations, and the future for Centene seems bright.

We’ll now look at valuation to see what you, as the investor, can expect to get from a company that won’t pay you a dividend.

Centene’s valuation

You all know that dividends are really part of my core thesis. I want them. If I don’t get them, that growth better damn well be fantastic. With Centene, it has been. I’ve been making money hand over fist thanks to well-placed options and a good amount of common shares that have appreciated nicely.

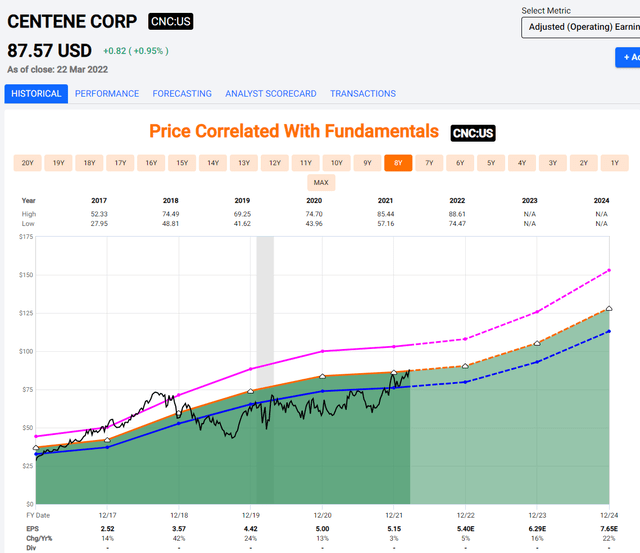

If the company had even a slight dividend, I’d be willing to accept a somewhat bullish thesis for Centene here. But the fact is we’re talking about a company that typically trades below 15X P/E, currently trading at almost 17X. We’re talking about a company that carries a BBB- in credit rating. These two facts don’t make for an appealing combo in my book. While Centene’s earnings aren’t exactly terrible in terms of stability – they’re damn stable – the share price hasn’t been. The only case of overvaluation like this in the past 10 years has brought about ROR of less than 5.3% based on today’s valuation, severely underperforming the market.

Centene just doesn’t have the valuation history of a premium you’d want in order to chance it and buy it at a “not-cheap” valuation.

My options expired worthless and my position is up massively. I’m selling Centene here and taking profits.

Centene Share Price (F.A.S.T graphs)

This isn’t because Centene is somehow a bad business, or that I don’t believe in the company’s future. I believe it very well could be positive. The problem is that even in the case of that positive 2024E, you’re getting 9% annualized RoR from a zero-yield, BBB- rated company with a volatile share price history. That’s the 15X P/E upside on a 2024E basis. around 9.5% annualized.

That’s not good enough for me.

And it shouldn’t be good enough for you either. There are alternatives on the market that will pay you not only dividends and potentially give you some solid-type returns, but that will do so while happily giving you better foundations in the form of credit rating, share price stability, and good forecastability. While Centene may not be “bad” in any of these areas, it’s still not as good as the companies we’re seeing here.

That’s some of the backgrounds regarding my stance here – and here’s more. As I’m writing, the company is in the negative 5%. I sold my shares a few days back when it went up over $85/share, which was close to my previous higher-end PT. S&P global has 19 analysts following Centene, giving it a range of $82-$109, with around half of the analysts currently at a “BUY” rating.

I understand their stances. I know the numbers. I even agree that they’re a possibility. I just consider the cost of risk to be higher in this business at this valuation than I would like, and I see plenty of better alternatives on the market right at this second – even in the same space.

In the end, that’s why I can’t get behind Centene as a positive investment at this time. I like the company, love the future here, but I don’t think the fundamentals are good enough to justify this multiple, and the lack of a yield and BBB- doesn’t help.

I’m at a “HOLD” rating now, and my PT is $83/share, going to the lower-end target that S&P global has here. I can see how you might consider Centene with a higher target, but I don’t agree with the risk calculation when you compare what’s available on the market.

Analysts have an unfortunate tendency to allow for a premium here, with S&P global averaging at about 10-15%. That’s exactly the sort of premium in its targets that would have prevented investors from selling and making money here.

Thesis

At this price, I don’t like the options. I don’t like the common.

I’m looking forward to the company dropping down, but for now, I’m out.

I’m a “HOLD” at Centene, with a price target of around $83/share.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

Published at Wed, 23 Mar 2022 19:39:25 -0700