Canoe Income Fund (TSE:EIT.UN)

Canoe has expanded from its Calgary head office to across Canada, including a significant presence in Toronto and offices in Vancouver, Winnipeg, Ottawa and Montreal. Since launching its first mutual funds in February 2011, Canoe has grown its mutual fund assets to more than $2.8 billion, making it one of the fastest growing entities in the Canadian mutual fund industry.

One of Canada’s largest closed-end investment funds, designed to maximize monthly distributions and capital appreciation by investing in a broadly diversified portfolio of high quality securities.

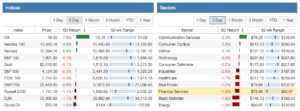

Stock Chart & Metrics

- Ticker: tse:eit.un

- Sector: Financial Services

- Industry: Asset Management

- Market Cap: 1.74B

- P/E: 2.68

- Dividend Yield: 9.34%

- Payout Ratio (TTM): 25.00%

Competitors

The competitive landscape is important as they compete for the same business. Below is the list of competitors in the same industry. While not displayed, a number of metrics you can also use to evaluate your picks are the Chowder Score, the Relative Strength Index (RSI), the Graham Number, and the Piotroski F-Score.

Top Picks By Bay St Experts

Expert stock analysts have shared their opinions, and sometimes prediction, on the company.

For more top picks from stock analysts on Bay Street, check the full list of top picks by expect stock analysts from investment and asset management firms.

Not all analysts are equal and they don’t cover the same type of stocks. The analysts performance and ownership is tracked for comparison.

Canoe EIT Income Fund – FAQ

What is the stock ticker for Canoe EIT Income Fund?

The stock ticker for Canoe EIT Income Fund is TSE:eit.un.

Is Canoe EIT Income Fund a good stock to buy?

You need to consider your investment strategy and how TSE:eit.un can fit in your portfolio.

The current dividend income score of 4/10 and dividend growth score of 2/10. Those 2 metrics together should help you decide the fit for your portfolio. Be it for income or for growth.

Is Canoe EIT Income Fund a Buy, Sell or Hold?

The Dividend Snapshot Opportunity Score of 30 out of 100.

The score reflects the strength of a buy signal but it does not show a sell signal if it’s low. The higher the better.

A sell signal is more difficult as it often relies on the reason you bought the stock in the first place.

Published at Sun, 24 Oct 2021 07:28:08 -0700