Best Canadian Renewable Stocks: 3 Companies To Watch

Renewable energy is good for the planet and can be good for your portfolio as well. Since it’s also in the early stages of development, there is a potential to earn more money by investing early.

In fact, the time is now to focus on renewable energy as we have reached peak oil according to Bloomberg. With the new US administration friendly towards renewable energy, there will be many more projects.

On a separate note, they expect the cost of eletric cars to match the ICE cars in a couple of years as battery technology is improving.

Now, while there are pure play renewable stocks, you should know that all the big players in the utility sector are actively pursuing renewable energy.

They are much bigger and could probably buy the pure play renewable energy stocks. You should not ignore them and understand what their strategy is when it comes to clean energy.

What Is a Renewable Energy Company

Before we look into investing in clean energy, let’s identify what consists of renewable energy. Renewable energy comes from natural resources that cannot be depleted such as water, solar rays or wind to name a few.

The most common renewable energy resources are hydropower, solar, wind and geothermal. In Canada, hydropower already consists of 59% of the electricity generation.

As you can guess, all Canadian utility stocks have some clean energy but are not exclusively focused on clean energy but are putting plans together to reduce non-clean energy to reduce green gas emissions.

Other sources of renewable energy consist of:

- Biodiesel

- Ethanol

- Solar

- Tidal

- Wind

Considerations for Choosing Renewable Energy Stocks

Unlike a regular utility stock, renewable stocks need to be looked at from a potential perspective. They don’t feed the massive population just yet.

They don’t reach homes the way Emera, Fortis, or Hydro One do. Algonquin Power & Utilitties Corp, the largest clean energy stock by market capitalization, servers 750,000 customers across 12 US states. In comparison, Fortis servers 3.3 millions customers across all subsidiaries..

Generally speaking, when investing in stocks, you have a 3 part analysis:

But in the case of renewable energy stocks, you need to increase your insight and that’s a tough one. Since they need to use clean energy to serve their customers, it’s not all acquisitions that fit the bill and it’s not easy to setup clean energy infrastructure where it’s needed.

There are a couple of ways I can think of a renewable energy company can grow and it’s through acquisition or clean energy development. One is much easier than the other and much faster. I expect to see consolidation but a proper investment in clean energy infrastructure is important for their business and it takes time to develop and see the fruit of labor.

The flip side of the investment thesis, can a regular utility catch up and change their fossil fuel energy production to a clean solution? Can they do it faster than the pure play clean energy stocks?

All Utility Stocks

As mentioned earlier, have a look at all the utility stocks before you just focus on the pure play clean energy stocks. Here is the list of Canadian utility stocks sorted by market capitalization.

Most of them are involved in the transformation but still profit from other sources.

Best 3 Renewable Energy Stocks

Going by the Dividend Snapshot Opportunity Score – a pure quantitative approach – the following are the top Canadian bank stocks. When the score is within a 5 to 10 point range, that’s when you really need to review the qualitative aspect of the company.

Before we identify the top 3 stocks, here is the complete list of dividend renewable energy stocks.

1. Algonquin Power & Utilitties Corp

Algonquin Power & Utilities is a diversified utility company in North America with $10 billion in total assets. The company engages in the generation, transmission, and distribution of water, gas, and electricity to communities across the U.S.

As a growing renewable energy company, Algonquin Power owns a strong portfolio of long term contracted wind, solar and hydroelectric assets with 1.5 GW of total installed capacity.

The company has more than 50 power generation facilities and 20 utilities across North America. Algonquin’s utility business serves nearly 770,000 customers in twelve states across the U.S., through 1,200 miles of electrical transmission lines and 100 miles of natural gas transmission pipelines.

Key Investment Data

- Ticker: TSE:AQN

- Sector: Utilities

- Industry: Utilities – Renewable

- Market Cap: 12.07B

- Market Cap Group: Large Cap

- P/E: 27.20

- Dividend Yield: 5.22%

2. Northland Power

Northland Power is a power producer that develops, builds, owns, and operates clean and green power infrastructure assets in Canada, Europe, and other global markets.

As one of Canada’s first independent power producers, Northland Power has global operating facilities generating over 2.6 GW of electricity, with an additional 130 MW of generating capacity under construction and 1,100+ MW in the project pipeline.

Northland has in-house development, plant design, financing, and operations capabilities. The company has a long track record of more than three decades in the business of producing electricity from natural gas and renewable energy sources.

Key Investment Data

- Ticker: TSE:NPI

- Sector: Utilities

- Industry: Utilities – Renewable

- Market Cap: 8.92B

- Market Cap Group: Mid Cap

- P/E: 27.83

- Dividend Yield: 3.11%

3. TransAlta Renewables

TransAlta Renewables is a renewable energy company and one of the largest generators of wind power in Canada. It is a sponsored vehicle of TransAlta Corporation. With more than a century’s experience under its belt, TransAlta Renewables has developed a rich experience of owning, operating, and maintaining a large fleet of power generation assets.

TransAlta Renewables owns and operates 21 wind farms, 13 hydroelectric facilities, seven natural gas plant, one solar facility and one natural gas pipeline in the US, Canada, and Australia. Highly contracted renewable and natural gas power generation assets, and long-term contracts with strong counterparties ensure stable cash flows for the company.

TransAlta Renewables owns renewable energy facilities across different regions and multiple technologies. The company owns directly or through economic interests more than 2,400 MW of net generating capacity and are strategically located to supply growing industrial regions.

Key Investment Data

- Ticker: TSE:RNW

- Sector: Utilities

- Industry: Utilities – Renewable

- Market Cap: 4.49B

- Market Cap Group: Mid Cap

- P/E: 34.81

- Dividend Yield: 5.59%

Opportunity Score Formula

The top 5 stocks identified above are based on a score calculated using a number of financial data points from the companies. In the end, the score is generated from following five key indicators:

- 52-Week Range: Trend over the past 52 weeks. Is the stock pulling back from a 52 week high?

- P/E Ratio: Is the stock price running away from its earnings?

- Revenue Growth: Is the revenue growing? Growing revenue is important. We don’t want to be fooled by share buybacks and cost management only.

- Dividend Yield: Is the yield attractive? Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high.

- Dividend Growth: Uses dividend growth and the Chowder Rule. Is the company capable of growing the dividend consistently?

- Dividend Payout Ratio: Uses historical averages to put today’s ratio in perspective. Is the company able to grow the dividend at the same rate it increases its earnings?

The generated score is meant to assess an entry point opportunity based on historical and today’s numbers. It completely ignores the business quality, the quality of the company is for every investor to assess. My stock selection process breaks down the quantitative and qualitative assessments investors should establish to pull the trigger before buying.

If you are interested in more details, the Dividend Snapshot Screener provides many more data points to help make your investment decision.

Dividend growth investing works and you can generate a healthy retirement income but you have to buy individual stocks. If you are not comfortable with holding individual stocks, you can always buy dividend ETFs or consider different passive income ideas to generate a retirement income.

Renewable Energy Stock FAQs

What is the largest renewable energy stock?

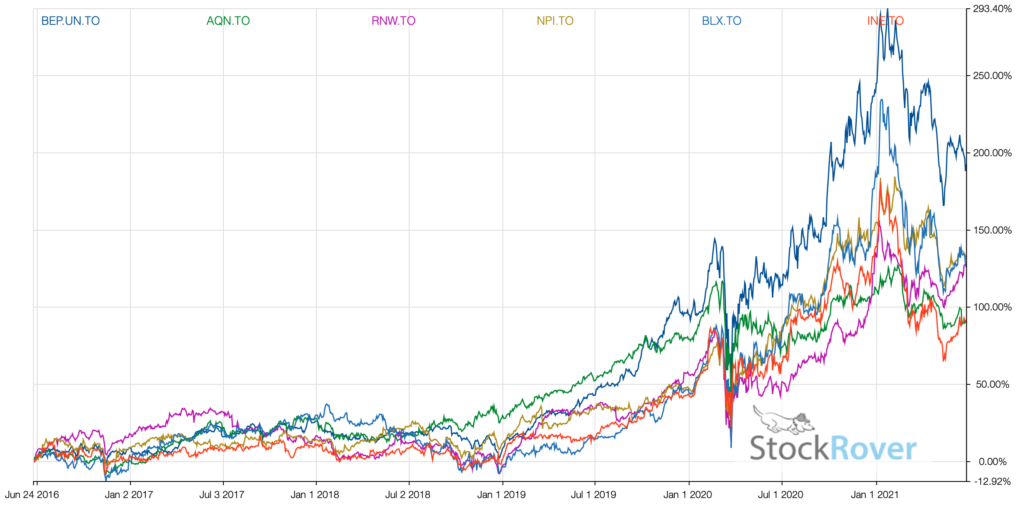

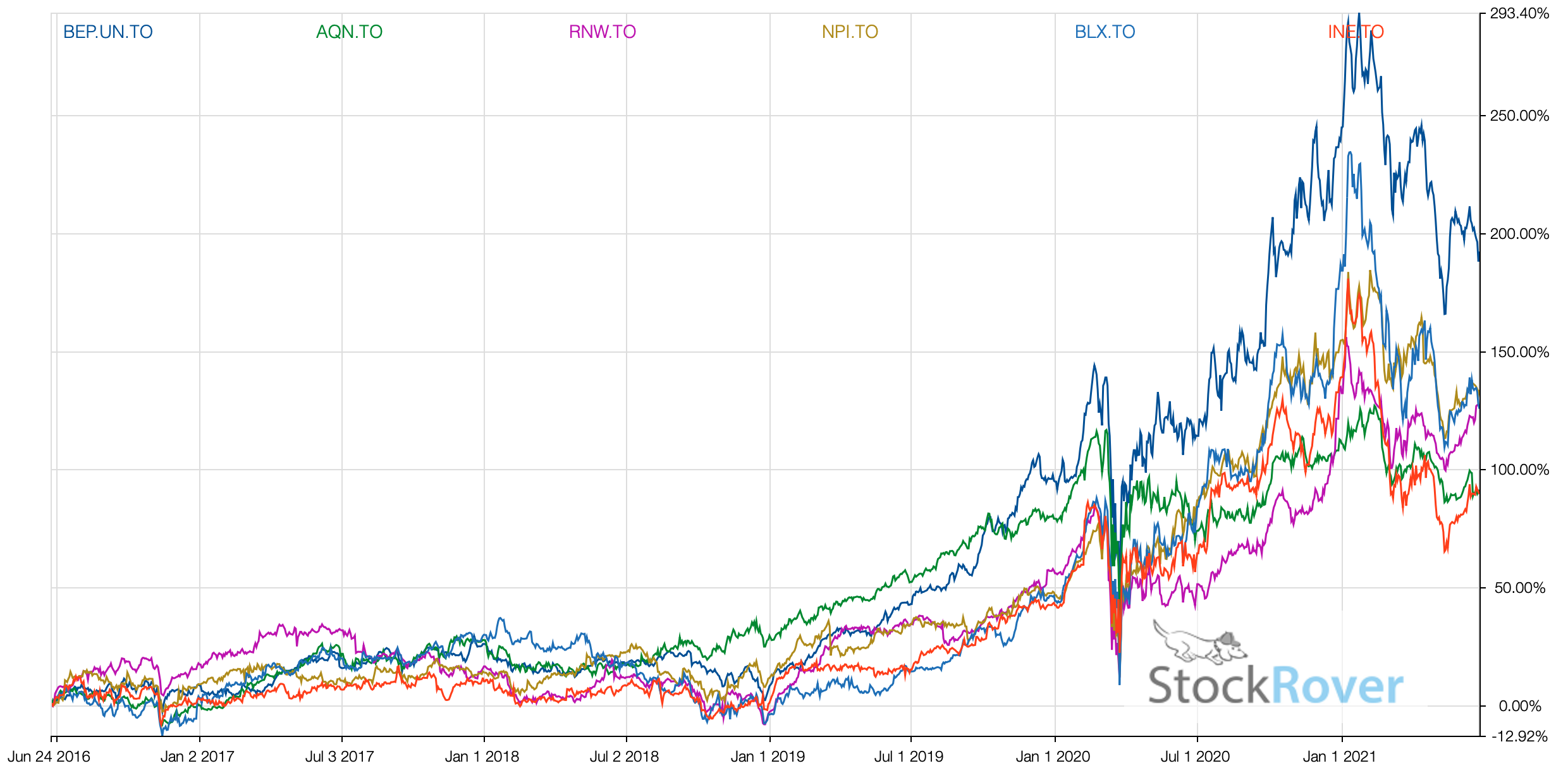

To date, the largest company is Brookfield Renewable Partners. Brookfield in general is very active in the merger & acquisition space.

What is the best renewable stock to invest in?

Based on historical performance (total returns), the best renewable stock is Brookfield Renewable Partners with Boralex a close second.

Today’s best might not be tomorrow’s best so be careful.

What is the best renewable energy source in Canada?

The best renewable energy source in Canada by far is hydro with wind turbine picking.

Boralex is going to benefit from projects in Quebec and the democrats in the coming years.

Published at Sun, 26 Jun 2022 07:15:00 -0700