Bad Investment Advice – Week in Review

Bad Investment Advice

I recently discussed with a family member about earning more money and paying more taxes. He was worried about higher taxes in the next bracket. This conversation got me thinking about bad investment and financial advice. Below are some typical bad investment and financial advice on social media that you should not listen to.

Don’t Earn More or You Will Pay More Taxes

First, let’s answer the question about earning more and paying more taxes in the next bracket. The problem with this advice is that taxes are incremental or marginal. So if you move up a tax bracket, you don’t pay the tax rate in the next higher tax bracket on your total earnings. Instead, you pay the higher tax rate only on the wages that fall in the bracket.

The marginal income tax rates for a single filer in 2022 are seen in the table below. In addition, you can look at the rates for other filers.

| Tax Rate | Income Bracket |

| 0% | $0 to $10,275 |

| 12% | $10,276 to $41,775 |

| 22% | $41,776 to $89,075 |

| 24% | $89,076 to $170,050 |

| 32% | $170,051 to $215,950 |

| 35% | $215,951 to $539,900 |

| 37% | $539,901+ |

The common misperception is if your income moves higher from $40,000 to $45,000, your tax rate jumps from 12% to 22% on your entire income. So, at a $40,000 income, your taxes are $4,800, and at a $45,000 income, your taxes are $9,900. That is not correct!

Assuming you now earn $45,000, the first $10,275 of your income is taxed at 0%, the next $31,500 is taxed at 12%, and then $3,225 is taxed at 22%. Your total income tax is $4,489.50 compared to $3,567 if you earned $40,000.

The point is if you earn more money, you will be taxed more, but it is incremental.

Interest Rates are Low, Invest Your Emergency Fund

Some social media influencers suggest people should invest their emergency fund since interest rates are so low. This point is bad investment advice number two. By their logic, your money is not keeping up after accounting for near-record inflation in 2022. However, emergency funds are for emergencies. When the market is down, you may need it, turning paper losses into actual losses when you sell investments. Keep your emergency fund in FDIC-insured high yield savings accounts or CDs. You can also consider I-Bonds. There are also other options for short-term investments.

Higher Risk Means Higher Returns, So, Invest in Riskier Investments

This statement is bad investment advice No. 3. In general, riskier investments generate higher returns, and lower-risk investments generate lower returns. Stocks are riskier than bonds and cash but have higher returns. The risk is in the form of volatility. On one end of the risky scale, startups, initial public offerings (IPOs), and cryptocurrencies are more volatile but can provide blockbuster returns. However, many often have little to no value after a time. Most investors should stay away from these types of investments.

Invest in a Taxable Account First Since You Can Access Your Money

This point is bad investment advice. A taxable account is good, but investors should first focus on their 401(k) and Individual Retirement Account (IRA). These types of retirement accounts are tax-advantaged. For instance, a traditional 401(k) is tax-deferred, meaning you pre-tax money and pay taxes on capital gains later. You use after-tax money in a Roth 401(k), and the gains are tax-free.

Furthermore, most 401(k) plans have a matching component for employers that is free money. For example, if you earn $50,000 and contribute 6% and your employer matches 3%, they give you $1,500 annually for your retirement account.

Final Thoughts on Bad Investment Advice

There are many more topics about bad investment or financial advice. For instance, buy as much house as possible since prices always go up. This statement was undoubtedly not valid during the sub-prime mortgage crisis. Another is to carry a balance on your credit card since it helps your credit score. Personally, I don’t like paying high-interest rates on credit card debt. Yet another piece of bad advice is to pay off your debt before you start investing. If you have student loans, it may be a while before you invest.

Affiliate

Dividend Power has partnered with Sure Dividend, one of the best newsletters for dividend stock investing. The newsletter comes out monthly and highlights their top 10 picks. A lot of effort goes into analyzing hundreds of stocks, doing much of the work for you. They have over 9,000 subscribers, and it grows every month.

Sign up for the Sure Dividend Newsletter*. You can also use the Sure Dividend coupon code DP41off. The regular price for Sure Dividend Newsletter* is $199 per year and the reduced price through this offer is $158 per year. There is a 7-day free trial and refund grace period as well. So, there is no risk.

If you are interested in higher-yielding stocks from the Sure Retirement Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Retirement Newsletter* is $199 and the reduced price through this offer is $158 per year.

If you are interested in buying and holding stocks with a rising income from the Sure Passive Income Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Passive Income Newsletter* is $199 and the reduced price through this offer is $158 per year.

The Stock of the Week

Today I highlight Colgate-Palmolive (CL). The stock price is down about (-15%) and in correction territory. The company is struggling with flat volume growth and missing expectations. However, the stock is a Dividend King with 59 years of dividend growth. The forward dividend yield is about 2.5%, more than the 5-year average and almost double the average for the S&P 500 Index. The stock is trading below its average price-to-earnings (P/E) ratio range in the past decade. In addition, the stock price has dropped below the 50-day and 200-day EMA. Investors should look at this market leader in oral care.

The screenshot below is from Stock Rover*.

Dividend Increases and Reinstatements

Search for a stock in the list of dividend increases and reinstatements. This list is updated weekly. In addition, you can search for your stocks by company name, ticker, and date.

Dividend Cuts and Suspensions List

The dividend cuts and suspensions list was most recently updated at the end of January 2022. As a result, the number of companies on the list has risen to 543. Thus, well over 10% of companies that pay dividends have cut or suspended them since the start of the COVID-19 pandemic. The list is updated monthly.

One new addition indicated that companies are experiencing solid profits and cash flow in January.

The new addition was Compass Diversified (CODI).

Market Indices

03/19/22

Dow Jones Industrial Averages (DJIA): 34,748 (+5.48%)

NASDAQ: 13,894 (+8.18%%)

S&P 500: 4,463 (+6.15%)

Market Valuation

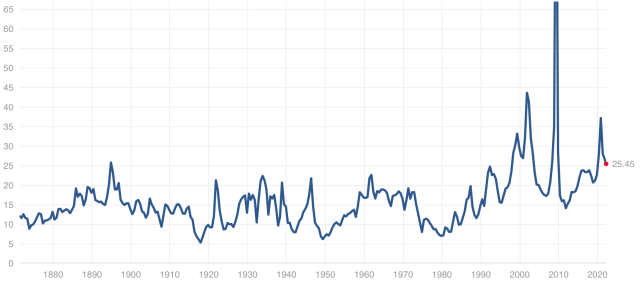

The S&P 500 is trading at a price-to-earnings ratio of 25.45X, and the Schiller P/E Ratio is about 36.16X. Note that the long-term means of these two ratios are 16.0X and 16.9X, respectively.

The market is still overvalued despite the recent market correction and rebound. Earnings multiples more than 30X are overvalued based on historical data.

S&P 500 PE Ratio History

Shiller PE Ratio History

Stock Market Volatility – CBOE VIX

This past week, the CBOE VIX measuring volatility was down about seven points to 23.87. The long-term average is approximately 19 to 20. The CBOE VIX measures the stock market’s expectation of volatility based on S&P 500 index options. It is commonly referred to as the fear index.

Yield Curve

The two yield curves shown here are the 10-year US Treasury Bond minus the 3-month US Treasury Bill from the NY York Fed and the 10-year US Treasury Bond minus the 2-year US Treasury Bond from the St. Louis Fed.

Inversion of the yield curve has been increasingly viewed as a leading indicator of recessions about two to six quarters ahead, according to the NY Fed. The higher the spread between the two interest rates, the higher the probability of a recession.

Economic News

The Labor Department reported that the producer price index for final demand increased by a seasonally adjusted 0.8% in February after climbing 1.2 % in January and 0.4% in December. As a result, the PPI is up 10.0% for the 12 months ending in February on an unadjusted basis. A primary contributor to the rise in the final demand index was a 2.4% increase for final demand goods, the most significant advance since the series started in December 2009. In addition, an 8.2% increase in the index for final demand energy accounted for two-thirds of the rise in the last demand goods index.

The Commerce Department reported advance US retail and food services sales increased 0.3% to $658.1B in February; this follows an upwardly revised 4.9% increase for January. Retail sales are running 17.6% higher than a year ago. Total sales for December 2021 through February 2022 were up 16.0% year over year. Contributing factors included increases from gas stations (+5.3%), bars and restaurants (+2.5%), and miscellaneous stores (+1.9%); which were offset by decreases from non-store retailers (-3.7%), health and personal care (-1.8%), and furniture (-1.0%).

The US Census Bureau reported new residential building permits were down 1.9% in February to a seasonally adjusted 1.859M, 7.7% above the February 2021 rate of 1.726M. Single-family permits were down 0.5% to 1.207M, from a revised January figure of 1.213M. New residential building permits increased in the Northeast leading (+22.7%) and the West (+2.1%), while the Midwest (-8.4%) and South (-5.5%) saw declines. Single-family homebuilding increased in the Northeast (+28.7%), Midwest (+15.3%), and South (+11.4%) but fell in the West (-11.4%).

Thanks for reading Bad Investment Advice – Week in Review!

Here are my recommendations:

If you are unsure how to invest in dividend stocks or are just getting started with dividend investing. Please look at my Review of the Simply Investing Report. I also provide a review of the Simply Investing Course. Note that I am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors. I suggest reading my Review of The Sure Dividend Newsletter. Note that I am an affiliate of Sure Dividend.

If you want a leading investment research and portfolio management platform with all the fundamental metrics, screens, and analysis tools you need. Read my Review of Stock Rover. Note that I am an affiliate of Stock Rover.

If you would like notifications about when my new articles are published, please sign up for my free weekly e-mail. You will receive a free spreadsheet of the Dividend Kings! You will also join thousands of other readers each month!

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Published at Sun, 20 Mar 2022 04:00:00 -0700