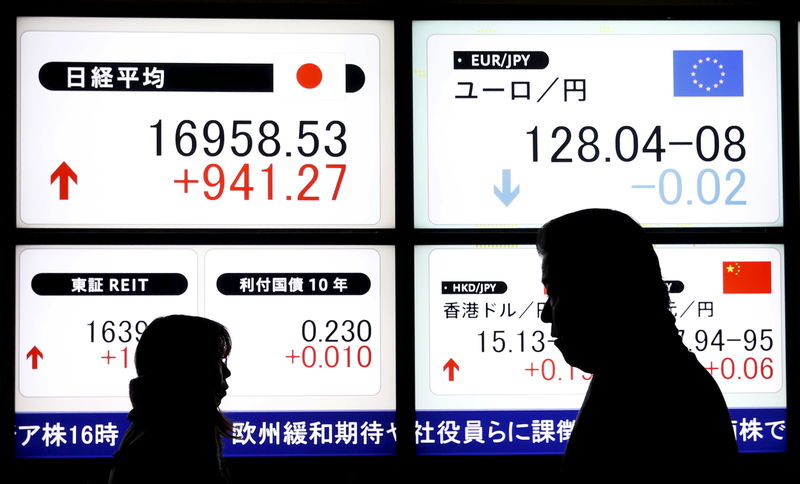

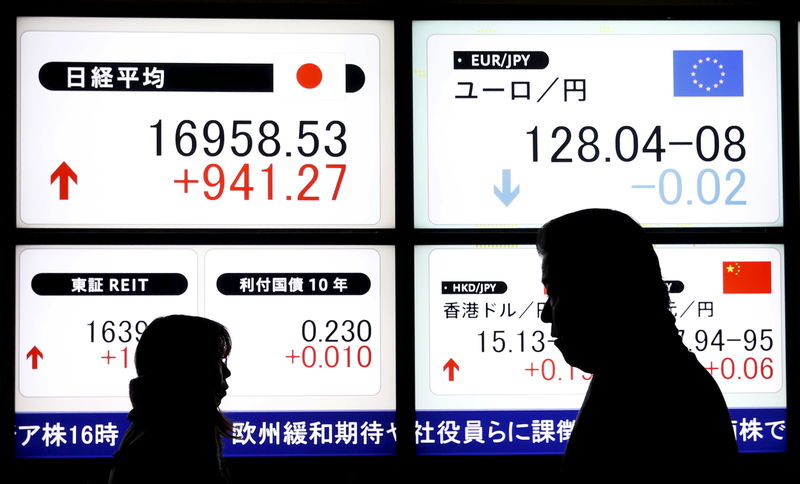

Asian stocks surge as bank fears ease before Fed meeting

© Reuters.

By Ambar Warrick

Investing.com — Asian stock markets rallied on Wednesday as easing concerns over a banking crisis saw investors pile into discounted financial stocks, with focus now turning squarely to a Federal Reserve interest rate decision later in the day.

Japan’s was among the best performers for the day, rising over 2% in catch-up trade as major financial stocks surged. Focus this week is also on Japanese consumer inflation data due on Friday, which is expected to factor into the Bank of Japan’s stance on monetary policy.

Other bank-heavy indexes also advanced, with Australia’s up 0.9%, while India’s and indexes added 0.2% each.

Technology-heavy indexes surged, with Hong Kong’s index up 2.1%, while South Korea’s and the index rose 0.9% and 1.3%, respectively.

Regional stocks largely tracked , as U.S. indexes surged on hopes that the worst of a potential bank crisis was over. Government intervention in the sector, including emergency liquidity measures and mergers, helped increase confidence in the banking sector. U.S. financial stocks also rallied in overnight trade, while European shares gained in the prior session.

Optimism over stability in the banking system helped markets gain ahead of a later in the day, with markets pricing in an that the central bank will hike rates by 25 basis points.

Still, traders remain uncertain over the bank’s outlook on monetary policy, amid some bets that concerns over more pressure on the banking system will limit the Fed’s hawkish stance.

But given that inflation is still trending well above the Fed’s annual target, the bank may yet retain its hawkish outlook. Rising interest rates battered Asian markets through 2022, with the trend having continued so far in 2023 as the Fed gave little indication it will pause its hike cycle.

Chinese stocks lagged their peers on Wednesday, with the and indexes only adding about 0.1% each. Markets were seeking more cues on an economic recovery in the country, following middling signals on a rebound.

A meeting between President Xi Jinping and his Russian counterpart Vladimir Putin also kept the market on edge.

Published at Wed, 22 Mar 2023 05:29:05 -0700