Alibaba: Mark The 16th On Your Calendars

Lintao Zhang

October 16 is a big day for China. On that date, China’s ruling party will hold its 20th Communist Party Congress, in which leader Xi Jinping is expected to cement his rule for another term.

The national congress is significant for a number of reasons. First, if Xi Jinping gets a third term as expected, it will be a major break from tradition – until 2018, China had term limits. Second, the congress will feature a number of speeches, including a State of the Union-like keynote from Xi Jinping that will name big priorities for China’s next five years. Third, the congress may feature commentary on China’s Zero-COVID policy, which has been a sticking point for Chinese stocks over the last 12 months.

Indications about the future of Zero COVID are perhaps the most important thing that could come from China’s party congress, at least from the perspective of a Western investor. China’s economy has been growing much slower than its historical norm this year, and Zero-COVID is the likely culprit. Much like when the West was doing lockdowns, China tends to see less business activity when quarantines are in place. Usually, China’s lockdowns are very local and short-lived, but a few (like the one in Shanghai in March to May of this year) have been prolonged.

Alibaba Group Holding Limited (NYSE:BABA, OTCPK:BABAF) has a lot riding on this national congress. If the news from the CPC is good, then BABA could find itself operating in a much friendlier environment next year. Last year, Alibaba took a big hit from China’s regulatory crackdown, at one point being fined $2.8 billion over antitrust infractions. This year, things initially looked good, but then China did a massive lockdown in Shanghai, resulting in 0% revenue growth for BABA. It was a tough time.

Which brings us to today. China has been without a long lockdown for about five months, but smaller and more targeted ones have been occurring. Most recently, there was a lockdown in Chengdu that lasted several weeks. Many Chinese investors are hopeful that Xi Jinping will announce an end to Zero-COVID at this year’s party congress. So far, those hopes have been dashed, with official pronouncements stating that China will stick with “Dynamic Zero-COVID” for now.

If the news from China’s party congress is good, then it could serve as a bullish catalyst. Most investors are aware that BABA stock is cheap going by conventional valuation metrics (e.g. P/E, price/sales, price/book, etc.). However, many aren’t convinced that the stock is worth the risk. In this sense, the difference between bulls and bears regarding Alibaba is one of risk tolerance (or perception of the level of risk). In this article, I will argue that the 20th party congress could be the news the markets need to bring Alibaba stock back into favor.

Why the Party Congress Matters

For politicians and pundits, China’s party congress has a number of important ramifications. Items ranging from Taiwan to chips to trade measures could come up, so there’s a lot for the politically minded to digest.

For investors, the party congress is important for two main reasons:

- Possible indications about where things are going with Zero-COVID.

-

Signs of possible economic stimulus.

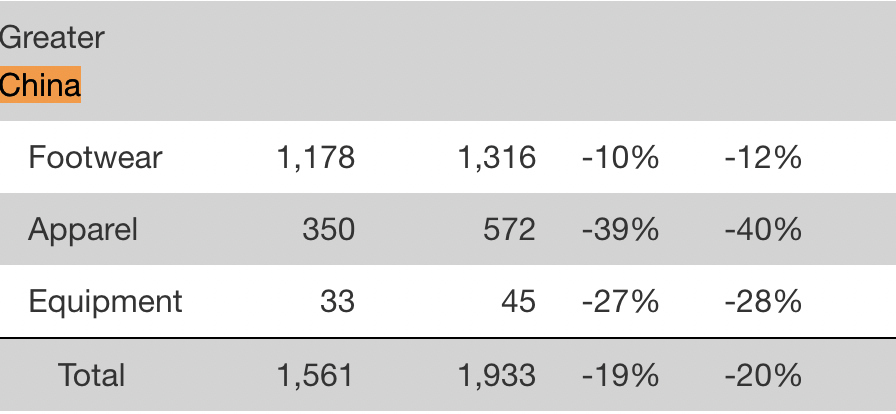

Zero-COVID is the biggest thorn in Chinese companies’ side right now. The policy has different effects on different sectors: manufacturing can be hit pretty hard when factories are forced to close, online retailers like Alibaba do not collapse but lockdowns can reduce their growth to 0%. Alibaba itself is known for selling a lot of clothing, a category that does take a hit when lockdowns emerge. In its most recent quarter, Nike (NKE) experienced negative sales growth in China. It’s not clear exactly what percentage of Alibaba’s business is clothing, but many sources say it’s a significant percentage. So, we’d expect some impact to Alibaba’s business as a result of Zero-COVID. Notably, the company delivered its first ever 0% growth quarter during China’s massive second quarter lockdown, so there’s a connection here that’s hard to deny.

Nike China sales (Nike)

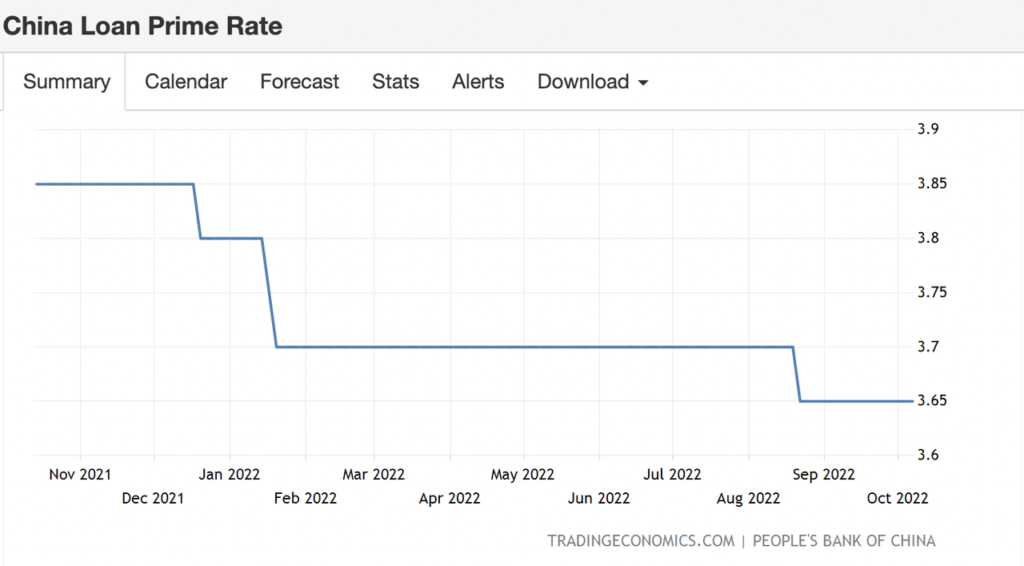

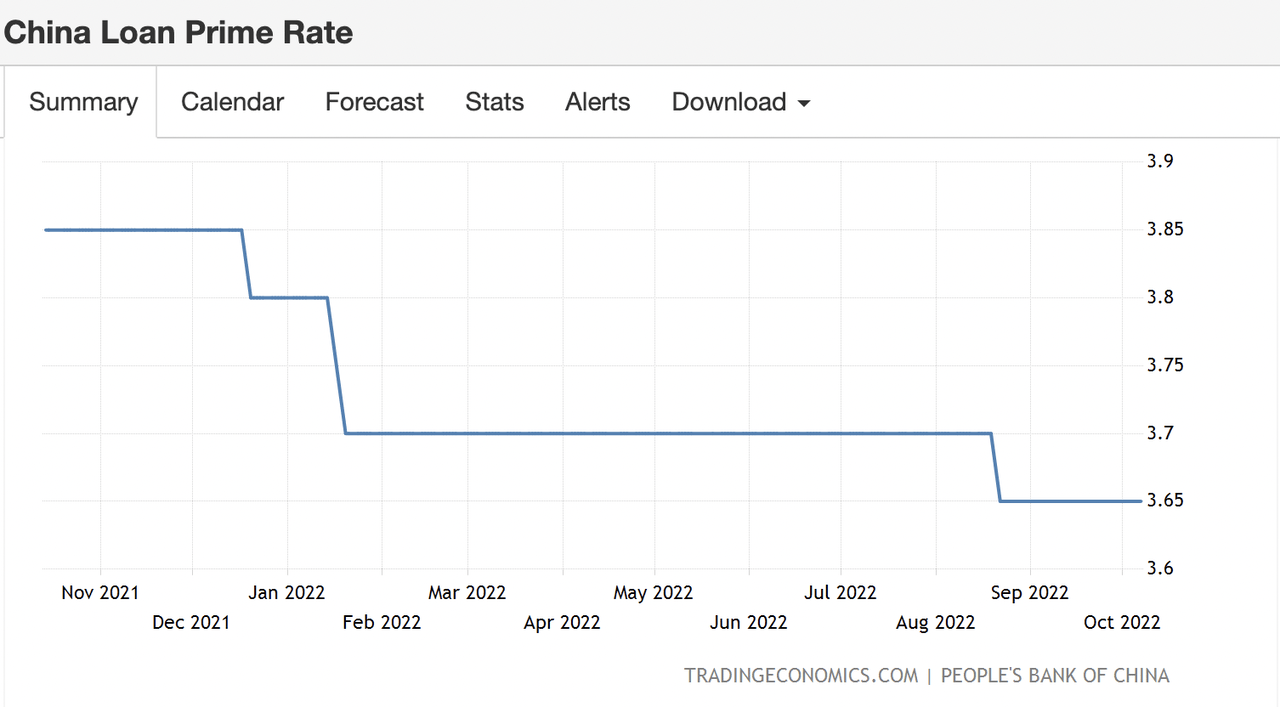

A second item of interest to investors that could come up at the party congress is stimulus. China has made numerous statements this year saying that it wants to “support markets” and “stimulate the economy.” It has taken some measures, like cutting interest rates and telling banks to buy up stock, but it hasn’t done anything just yet. Notably, China’s prime rates post-cut are still about as high as the U.S.’s after considerable rate hiking. So, investors might want to be on the lookout for more meaningful stimulus. It could be a major catalyst for Alibaba stock.

China interest rate (TradingEconomics)

Alibaba Valuation

Having looked at Alibaba’s potential catalyst in the form of the CPC party congress, we can now turn to its valuation.

Alibaba boasts a unique combination of a cheap valuation and high historical growth. At today’s prices, it trades at:

-

10.32 times adjusted earnings.

-

1.72 times sales.

-

1.49 times book value.

-

9.1. times free cash flow (calculated by the author using GuruFocus’ FCF per share estimate).

This stock is super-cheap going by multiples. Furthermore, if you take the last 12 months’ FCF (free cash flow) per share and discount it at 6%, you get a $136 terminal value estimate. The discount rate used here is less than the current treasury yield and the Chinese 10-year bond yield, so it’s well ahead of the risk free opportunity cost for the two major pools of investors.

The million dollar question is when can Alibaba return to positive growth and achieve a fair value much higher than the one I estimated using a 0 growth assumption. In its most recent quarter, Alibaba had near-zero revenue growth and negative growth in earnings. Management directly attributed the poor growth to effects of the COVID-19 pandemic. Certainly, the pent-up demand in China is there, and the economy is still growing, but as long as Zero-COVID is a part of the picture, there is potential for poor corporate earnings growth. So investors choosing to take a position in Alibaba will want to be realistic about how long they can wait. This stock faces major challenges stemming from current Chinese government policy.

Risks and Challenges

I’ve already covered what’s probably the biggest risk facing Alibaba stock right now, namely the continuation of China’s Zero-COVID policy. That risk took a bite out of revenue last quarter, it could do the same in this quarter. There are other risks and challenges worth mentioning, too. In no particular order:

-

Delisting. Alibaba just recently had the first round of its U.S. audit review. SEC officials flew to Hong Kong to review BABA’s audit documents, conduct on-site inspections, and interview key people, pledging to report their findings by the end of the year. The fact that this happened at all is encouraging, because it signals a possible end to the delisting drama. However, if the review goes badly, it could be the end of BABA listing on the NYSE. If BABA is delisted then it will only trade in Hong Kong, which may cause U.S. retail investors to lose interest, as they may not want to stay up late to follow the stock. Delisting could even deter institutional investors, as Hong Kong is much less liquid than the U.S. markets they’re familiar with.

-

An invasion of Taiwan. If China chooses to invade Taiwan, then that could cause a variety of problems for U.S. based investors in Chinese stocks. The perception of increased risk could trigger selling. The SEC could suspend trading in Chinese stocks. ADRs could be pulled off the exchanges. After Russia invaded the Ukraine, trading in several Russian stocks was halted. Something similar would probably happen if China invaded Taiwan.

-

Lack of chips. Alibaba is currently working on a proprietary chip set for its cloud business. The cloud was the fastest growing of all of Alibaba’s segments in the most recent quarter, and the only profitable non-core segment. A high quality server chipset would be a game changer in the cloud segment, but unfortunately the U.S. recently moved to ban exports of a variety of chips to China. This includes not only CPUs but also components like DRAM and NAND flash-the latter are needed to build a modern system on a chip. Alibaba will probably be able to source these components from foreign suppliers, but it may face delays in its efforts.

All in all, a considerable number of risks. For me personally, Alibaba is a buy, as I think the rewards outweigh the risks, but I definitely wouldn’t recommend this stock to everybody. It is suitable only to investors with very long time horizons who are willing to wait for a reward. Definitely don’t buy this stock expecting a quick payoff, it’s a thesis that will take quite some time to play out. Given BABA’s cheap valuation, high profitability and strong competitive position, we’d expect investors to be rewarded sooner or later. As for when that “sooner or later” will be, I can’t say.

Published at Fri, 14 Oct 2022 09:43:58 -0700