SCHG: Overvalued In A Rising Rate Environment

aluxum/E+ via Getty Images

Investment Thesis

Large-cap growth stocks have been for a long time the favorite pick for both professional and retail investors. Given the abysmal performance of growth stocks year-to-date, many investors are now wondering if it’s a good time to hunt for bargains. In the context of high rates and persistent inflation, I believe growth stocks haven’t yet reached a bottom yet, as valuations remain stretched across the board. Moreover, I expect this category of stocks to underperform the market over the next couple of months unless we have a reversal in monetary policy. As a result, I believe it’s still early to invest in growth stocks, and better entry points will probably surface over the next 12 months.

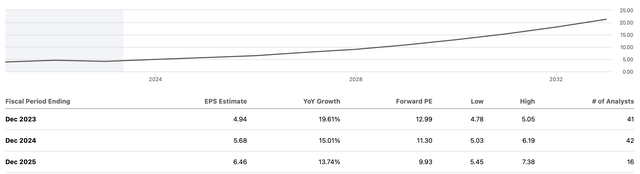

Refinitiv Eikon

Strategy Details

The Schwab U.S. Large-Cap Growth ETF (NYSEARCA:SCHG) tracks the investment results of the Dow Jones U.S. Large-Cap Growth Total Stock Market Index. The index is composed of large-cap US equities that exhibit growth style characteristics.

If you want to learn more about the strategy, please click here.

Portfolio Composition

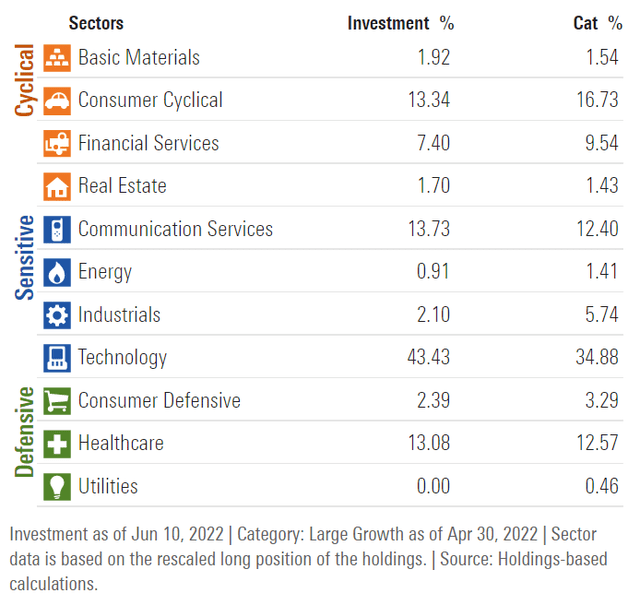

The index invests ~43.4% of total assets in Technology stocks, followed by the Communication Services sector (13.7%) and Consumer Cyclical stocks (~13.3%). The largest three categories have a combined allocation of approximately 70.4%. In terms of geographical distribution, SCHG invests exclusively in the US.

Morningstar

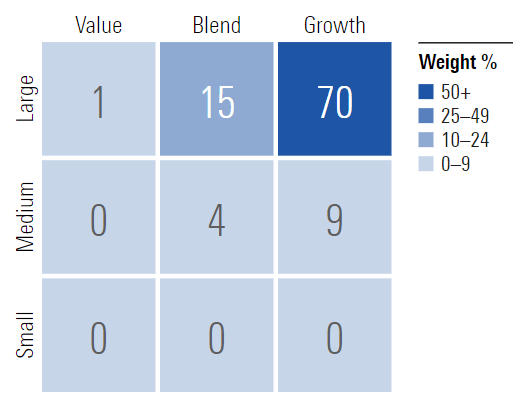

~70% of the portfolio is invested in large-cap growth stocks, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap “blend” stocks, which account for 15% of the portfolio.

Morningstar

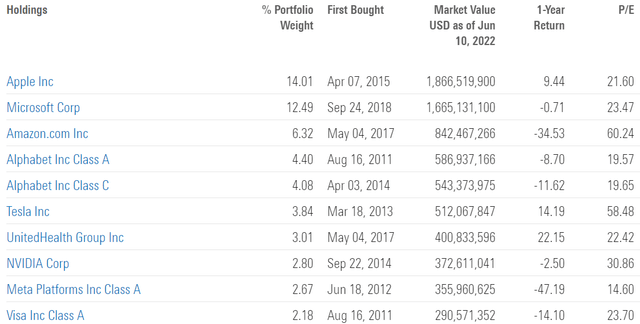

SCHG is currently invested in 226 different stocks. The top 10 holding account for ~56% of the portfolio, with no single stock weighting more than 14%. In my opinion, the fund runs a concentrated portfolio where a few stocks are likely to drive future returns. I think investors need to feel comfortable owning such a portfolio before investing in it, as concentration can remove some of the benefits of ETF investing.

Morningstar

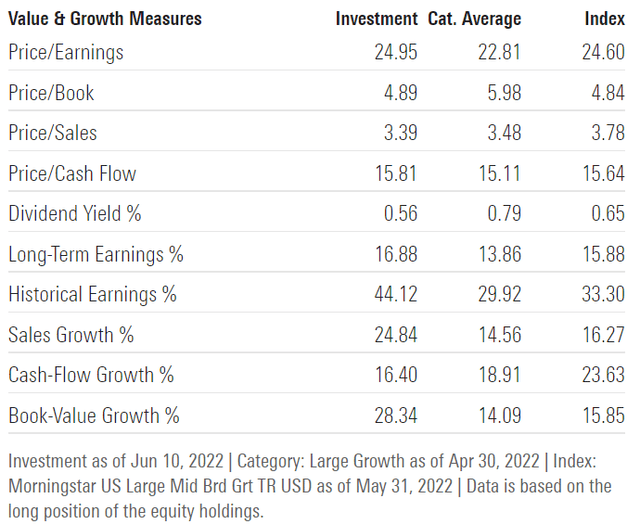

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, SCHG trades at a price-to-book ratio of ~5 and has a price-to-earnings ratio of ~25. In a high-interest-rate environment, I believe owning stocks at these lofty levels will eventually turn out to be detrimental to investors because rates act like gravity on valuations. In other words, as rates rise, the multiples paid for a business/asset generally tend to decrease.

Morningstar

Is This ETF Right for Me?

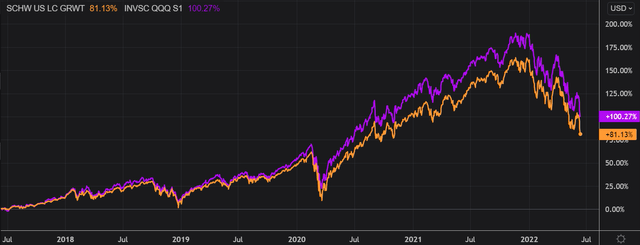

I have compared below SCHG’s price performance against the Invesco QQQ ETF (QQQ) over the last 5 years to assess which one was a better investment. Over that period, QQQ outperformed SCHG by ~19 percentage points. To put SCHG’s returns into perspective, a $100 investment in SCHG 5 years ago would now be worth $181.13. This represents a compound annual growth rate of ~12.6%, which is a good absolute return.

Refinitiv Eikon

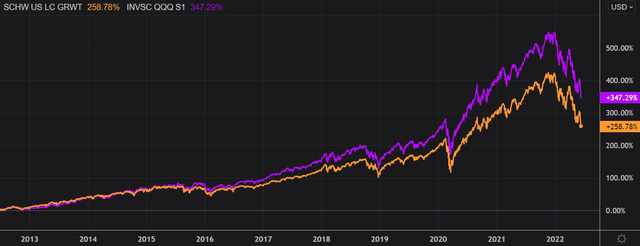

If we take a step back and look at the 10-year price returns, the results don’t change much. QQQ came on top once again, outperforming SCHG since Q2 2015. In my opinion, I see little benefit in owning SCHG when you can own QQQ, which trades at a lower valuation and has a track record of outperforming.

Refinitiv Eikon

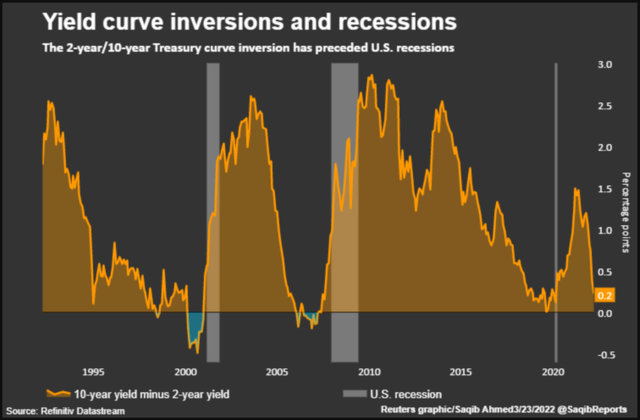

I think investors need to be very careful when buying stocks in general over the next couple of months. The recent yield curve inversions are a fairly good accurate indicator of an incoming recession. It also signals a steepening of the front end of the yield curve, which means the Fed will be aggressive over the short term and the equity markets are now in the process of adjusting to this new reality. As a result, I expect volatility to be the main theme of this year and to probably continue in the first half of next year.

Refinitiv Eikon

Since the CPI is skyrocketing and unemployment is at a record low, there is nothing that could lead to a reversal from a hawkish monetary policy to a dovish one over the next couple of months in my opinion. Stocks which trade at lofty valuations are particularly vulnerable in this environment. Therefore, I believe investors are likely to get a better deal on SCHG by simply being patient and purchasing this ETF at a lower valuation once the correction offers an attractive entry point.

Refinitiv Eikon

Key Takeaways

SCHG provides exposure to large-cap US equities that exhibit growth style characteristics. This ETF runs a concentrated portfolio where the top 10 holdings are likely to drive future returns. Growth has been the winning investing style over the last decade thanks to an expansionary monetary policy. However, I think there is a paradigm shift in which higher rates pose a fundamental threat to this investing style. It is hard to anticipate a Fed reversal since inflation is proving very resilient, which means it is very difficult to pick a bottom in growth stocks. For the time being, I think that investors who are paying over 25x earnings for growth stocks are in a tough spot and are likely facing more downside risks in the months ahead.

Published at Wed, 15 Jun 2022 23:51:46 -0700