4 Contrarian Ideas To Wrap Up 2022

welcomeinside/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to have a general macro-discussion around some opportunities in the market where I see potential for a contrarian rebound. The backdrop here was to find some investment ideas, themes, or sectors that are generally considered out of favor and have the potential for a future bounce as price action reverts to a more normalized level. When I see a general consensus that is either overwhelmingly positive or negative, it leads me to believe that a reversal is imminent, which is the basic premise for contrarian investing.

In this review I will discuss four areas that I see as broadly having a negative consensus. I must manage expectations up front, however. These may not be suitable investments for everyone. Often, investments are unloved for valid reasons, so while contrarian investing sets up retail investors for above-average gains, or “alpha,” it can also make for sharp short-term losses. Therefore, readers need to evaluate each idea carefully, and ensure that if one does take the plunge in to some of these contrarian ideas, they set realistic expectations and be willing to withstand forthcoming volatility.

Contrarian Idea #1: Crypto

The first contrarian idea illustrates my concept of managing risk more profoundly than any of the others. This is crypto – which is more than just Bitcoin (BTC-USD) – although that is what I will primarily focus on for purposes of this review. The reason I put this disclaimer in is that crypto is one of the riskier asset classes out there, and is not backed by earnings like beaten-down stocks, nor backed by an income stream the way bonds and loans are. You are investing purely in a speculative asset when you enter this realm, so approach carefully and selectively. Of note, this idea probably is not right for most.

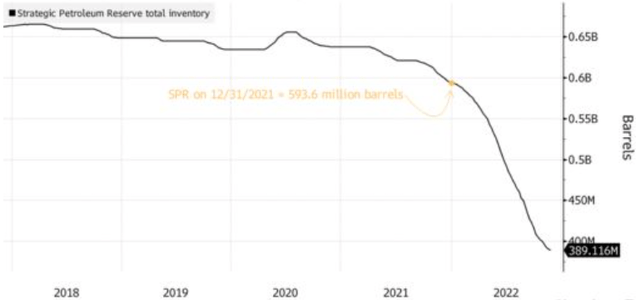

But if crypto does strike your fancy, it certainly is looking like a contrarian play here. After the FTX bankruptcy sent shock waves through the sector, investors keep on fleeing the space. But we should remember that the major crypto coins were hurting badly in 2022 long before this took effect. To illustrate, consider that three of the more popular ways to play this space are all down spectacularly in 2022. These include Bitcoin, Ether (ETH-USD), and Ripple/XRP (XRP-USD):

YTD Performance (Google Finance)

As you can see, these names all took a big hit after the news of FTX’s bankruptcy was announced in November, but the trend has been one of decline for most of the calendar year. Simply put, these assets are as out of favor as one can get, and easily surpass the losses of the S&P 500 and the NASDAQ, which are also down for the year.

I see this as about as contrarian as one can get for a few reasons. One, crypto was all the rage last year, driving prices to astronomical levels. I am certainly not a buyer of “hype”, but I am a buyer of “hate”. The sector has fallen completely out of fashion and that is the time to consider it, not the other way around. Unfortunately, too many investors buy in to hype and sell in to panic, the exact opposite of what investors should do. Hence, this details why contrarian plays often pay out. Further, I see the FTX collapse, as well as other financial pressures on other exchanges, as a real catalyst for regulation in the space. I welcome this, as a safer, more regulated environment will bring in investment, not discourage it. Personally, I expect regulation to take a while to go in to effect, and volatility will ensue as the government debates what actions to take and the market absorbs it. So “regulation” in and of itself will not drive prices higher in a straight line. But I do see a regulated environment as one that is more favorable to retail investors, and truly see recent headlines as the drivers that will finally cause regulators to act.

In this vein, I see two big drives for gains. The first is the beaten-down aspect, and the second is the regulatory tailwind. These are the two key positive attributes in my opinion. But I will caution investors from buying in on this backdrop alone. A word of caution: know your reasons for owning crypto.

What I mean is this – why are you buying the space? Is it as a generational investment opportunity? Is it to use the digital asset for online purchases? It is a buy-the-dip move? Or perhaps you are like me, and bought it as an equity hedge.

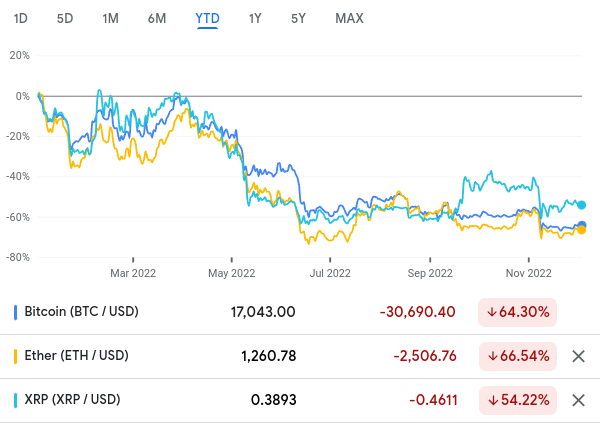

That last point is the critical one for me personally, and it may be for others. I initially bought a position in BTC because the equity market was soaring (in 2021) and I wanted ways to diversity from my Tech-heavy/S&P 500 positioning. This include non-U.S. stocks, bonds, Utilities, and, with a small amount, Bitcoin. The problem now, and the reason I had shed my investment at a net zero return, is that Bitcoin is not acting like much of a hedge anymore. It has fallen victim to the same forces as the rest of the market: rising interest rates, a difficult consumer environment, lack of real earnings, and uncertainty. The net result has been that BTC has been trading in-line with the S&P 500 (SP500) and the NASDAQ for quite a while:

Asset Correlations (Charles Schwab)

This is the big worry spot for me, in addition to the obvious breakdown in prices. Bitcoin, and other cryptos, are just beginning to trade like the broader market indices. This negates one of my primary reasons for buying the asset class, and suggests to me that I should wait for this correlation to ease a bit before making any sizable position. But the contrarian in me is interested due to the large drop in prices and all the negative sentiment. So I will be monitoring it closely, and believe readers should take a close look.

**I am likely to re-enter a Bitcoin position directly through Coinbase Global, Inc. (COIN), but the position will be very small ( < 1% ) as a position in my portfolio.

Contrarian Idea #2: China

My second topic is Chinese equities, specifically large-cap companies. This is an area I follow closely, and has also been in the headlines quite a bit recently. The challenges here are different than what are facing most other nations and asset classes. Rather than the traditional market pressures, such as inflation and rising interest rates, Chinese stocks have been hammered because of political uncertainty, with President Xi Jinping gaining another term and a strict lock-down approach to Covid that most of the world has turned away from.

These factors led me to fade my outlook on Chinese stocks, which I had been bullish on earlier in the year. When I invest in the country I use a large-cap fund, which I wrote about in mid-July. This is the iShares China Large-Cap ETF (FXI), which has indeed performed poorly since publication:

Fund Performance (Seeking Alpha)

I view this weakness as a buying opportunity simply because I see these headwinds as temporary. As President Jinping solidifies his power, the uncertainty of what that means will be removed. Investors will get a chance to evaluate what his new leadership will consist of and, after that is cemented, it is unlikely to change much. That suggests to me that the volatility will be short-lived.

In addition, I think the rising Covid cases and corresponding lockdowns make for a time to invest because they are also temporary. While these have been going on for longer than anticipated, the government’s approach to Covid has got to change eventually. To me, the timing is good now because share prices are low. As we see cases eventually tick down and the country reopen, stocks are going to get a boost. Retail investors do not want to wait for that to actually happen to invest, you need to front-run this eventuality.

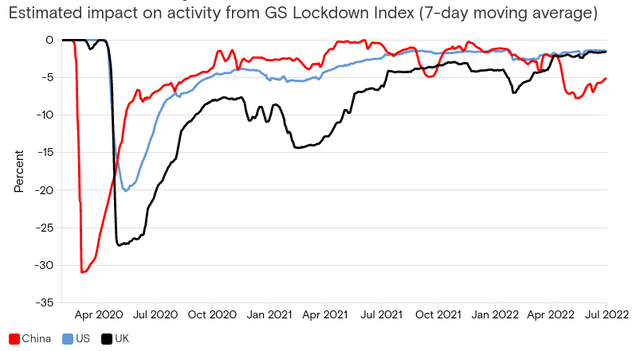

To put this in perspective, note that “lockdowns” have been a relative drag on China compared to developed markets. This, and the recent social unrest, have no doubt played a role in why Chinese equities have under-performed:

Lockdown’s Impact (Goldman Sachs)

While this may not instill a whole lot of confidence at the moment, what I see is a potential rebound. The rub is that the rebound could be far out. If the lockdowns persist and unrest continues, Chinese stocks will suffer. I’m anticipating a rebound and looking to build a position with the premise this sector will out-perform on that news. There is legitimate merit to this idea, since the U.S. and Europe are likely to be in recessions next year. With the expectation that China will be emerging from lockdowns, that recessionary environment may not hit China at the same time. It seems like a win-win scenario in my view.

**I will be initiating a long position in FXI.

Contrarian Idea #3: Muni CEFs

My third idea is one I have been harping on for a while, and also recently wrote about in-depth a few weeks ago. Due to that, I will keep the discussion here brief. Suffice to say I like municipal bonds at these levels, as the sector offers a reliable, high, tax-free (mostly) income stream that I think deserves a lot of attention at current levels. This is an area that has been (in my opinion) unjustifiably beaten down in 2022. Yes, duration risk was high so rising interest rates pressured the sector. I have no beef with that premise – but the declines have simply been too far, too fast. Buying in to this type of market mismatch should serve investors well in the long-run.

I personally see a strong buy case for muni closed-end funds (“CEFs”) in particular. These are leveraged products, so investors are taking on more risk. If the trade goes south, leverage amplifies the downside. Further, rising interest rates has pressured short-term borrowing costs while an inverted yield curve has limited the opportunity for fund managers to earn a positive yield pickup on the longer end of the curve. These factors could continue to push muni CEFs down in the coming months, so readers need to evaluate this risk.

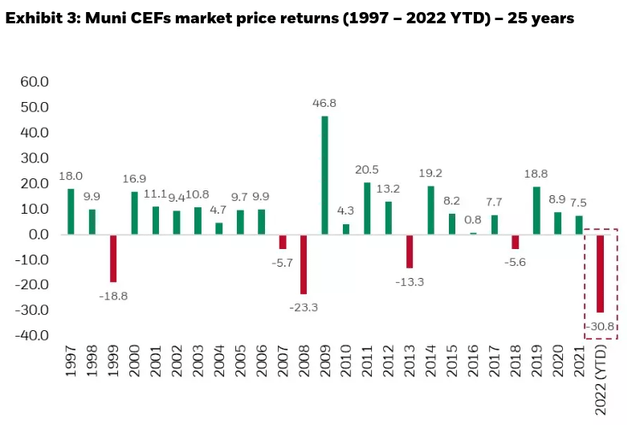

But the fact is that muni CEFs rarely perform as poorly as they have in 2022. And, in the years when losses have been comparable, the calendar years that follow have been very strong for the sector as a whole:

Calendar Year Returns For Muni CEFs (Average) (BlackRock)

The takeaway for me is this space has been hit disproportionately making it a smart contrarian play. Investors have been fleeing, but history suggests the years that follow will be quite strong. To top it off, many muni CEFs trade at steep discounts to their underlying value, so there is inherent value in them as well. This is one of my highest conviction areas for 2023.

**I have positions in the Nuveen AMT-Free Quality Municipal Income Fund (NEA), the BlackRock Taxable Municipal Bond Trust (BBN), and the Invesco California Value Municipal Income Trust (VCV).

Contrarian Idea #4: Oil

My last contrarian move may seem odd. This is crude oil, which had been one of the top performing asset classes initially in 2022. This begs the question – how can it be a contrarian play?

The reason being that oil’s metaphoric rise in the first half of the year has mostly evaporated. After rising over $120/barrel twice this year, the trend since mid-June has been mostly negative, as shown below:

WTI Crude’s Price (2022) (CNBC)

The trend lower has been multi-fold. There has been quite a bit of volatility (although the end result is the price keeps pushing lower), which has been driven by EU sanctions on Russia crude exports, uncertainty on China lockdown measures (which have hurt the demand outlook), and the rising probability of a recession in the U.S. and other developed nations.

In fairness, these are all legitimate reasons for oil to trend lower so this contrarian idea is not a result of “panic” selling. But the move seems to be all in one direction, so that piques my interest anyway. Further, I believe that oil’s price could be supported at levels higher than this for a few key reasons.

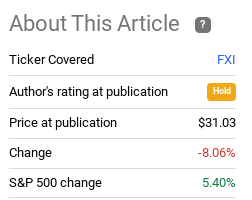

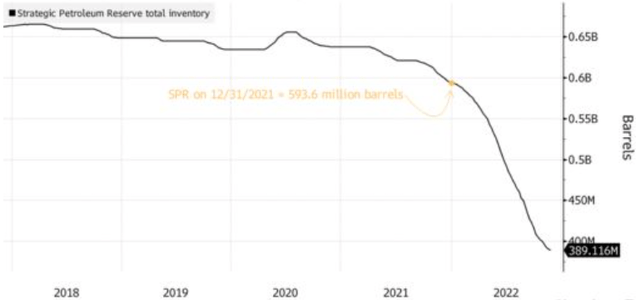

One, OPEC+ has started to cut back on production, with a 2 million/barrel per day cut announced last month. This is already removing supply from the market and, perhaps more importantly, signals that OPEC+ is willing to make adjustments based on prevailing market conditions. That means further cuts could be on the way, helping to balance supply even if the globe enters a recessionary economic period. Two, as mentioned in idea #2, I see an economic rebound in 2023 out of China. This means that nation will likely see an increase in demand for crude, also helping to counteract a potential drop from the U.S. and EU. Three, the U.S. Department of Energy is looking to halve the release of further Strategic Petroleum Reserve (SPR) distributions and to begin refilling the inventory. I view this decision positively, because the SPR inventory level is extremely low and needs refilling for strategic reasons:

SPR Inventory Level (Department of Energy)

The conclusion I draw here is that this removes what could have been more supply hitting the market, suggests the U.S. government may add to demand pressure, and signals a change in tone out of Washington. In my view, oil remains a smart way to hedge equities, and its price action in the second half of the year indicates this is a beaten down asset. This tells me to stay long in my crude and energy positions.

**I own the Vanguard Energy ETF (VDE) and ProShares Ultra Bloomberg Crude Oil (UCO) (this is a leveraged futures ETF and should be used primarily for shorter term positions to manage risk).

Bottom line

Markets have started to recover a bit, with November being a generally strong month. That is the good news, but we have to remember 2022 has still been rough overall. The four assets/ideas I mentioned in this review look especially beaten down and have piqued my interest ahead of the new year. While I will again emphasize these are for the more risk tolerant investor and should be approached carefully and selectively, the time to buy is often when an asset is unloved. All of those discussed here fit that narrative, and I will be looking to add or initiate positions in all of them in the weeks to come.

Published at Wed, 07 Dec 2022 09:31:59 -0800