Crypto is often talked about by young adults starting to invest and investors looking to make money quick. It’s hyped quite a bit as well as a fast growing investment opportunity which is unfortunate in my opinion … as I believe it is very mis-understood.

The reality is that crypto currency is weirdly classified as an asset. It’s meant to be a currency, but it’s not really included in the currency asset category. Instead, it is classified as an alternate investment.

What Is Crypto?

Let’s recap what crypto-currency is because there are many of them which isn’t simplifying understanding how crypto can fit in our society.

You can read the super detailed outline on Wikipedia, but the gist of crypto is that it’s meant to be used as a currency to transact between people or merchant. The big difference from the existing fiat currency we use daily, and digitally, is that it isn’t tied to a country, or government.

Furthermore, it’s also meant to track the history of all transactions through a ledger which technically prevents money laundering as a benefit, but I suspect it would only push those illegal transactions underground in a secondary economy.

The magic with crypto, if I am permited to say, is really what is known as blockchain. While the blockchain technology can be applied to other use like NFT, it has drawbacks compared with regular currencies.

A couple of critical drawbacks are:

- Power is necessary for crypto to be used. It means we need energy to power computers forever .. Considering gold is still seen as a safe haven, it’s hard to see crypto replace the fiat currency as nobody really transact with gold, and few transactions are made with Bitcoins.

- Due to power usage, and computing demand, crypto is not environmentally friendly. A rise in usage and transactions would have a negative environmental impact.

Crypto Investment Thesis

As an investor, when I invest in a company, I invest in the business and the ability for the company to make a profit.

Investing in currency, is usually about investing in macro-economics. Many companies have to deal with currency exchange and will work hard to ensure the currency conversion doesn’t eat into their profits but it is still hard to avoid. You often hear about currency impact during quarterly earnings.

So what’s the thesis for investing in crypto? In my opinion, it’s primarily a fad like a fashion that comes and goes. Except that it is still here …

- Some people love the idea of a global currency but I suspect prices one day would simply be adjusted to reflect purchasing power in various countries regardless of the one currency value.

- Some people love the idea of the technology but it’s hard to assess how it could replace cash when you see the world still fighting in various regions of the world. Power is often the first infrastructure targetted …

In fact, the first crypto was the Bitcoin and now there are more than 9,000 cryptocurrencies, and there are now ETFs tracking the major crypto to satisfy investors.

But what is the thesis? How do you forecast potential growth? Take a company like BCE, or Telus, while immigration is happening in Canada, those companies can expect new paying customers. There is a relationship that can be understood.

With crypto, how is the price moving? How do you make a profit? Currency exchange rates are often driven by the import/export of the nation, and the safety of the currency as it pertains to the government stability.

Government stability is gone with crypto, and it’s not tied to a county’s import/export. In fact, the only way for the currency to grow is to gain in popularity which is based on retailers adopting the currency to transact but there are few of them.

So we are left with “speculation” !!! Investors speculating that it will change the way we transact and wanting to get in early …

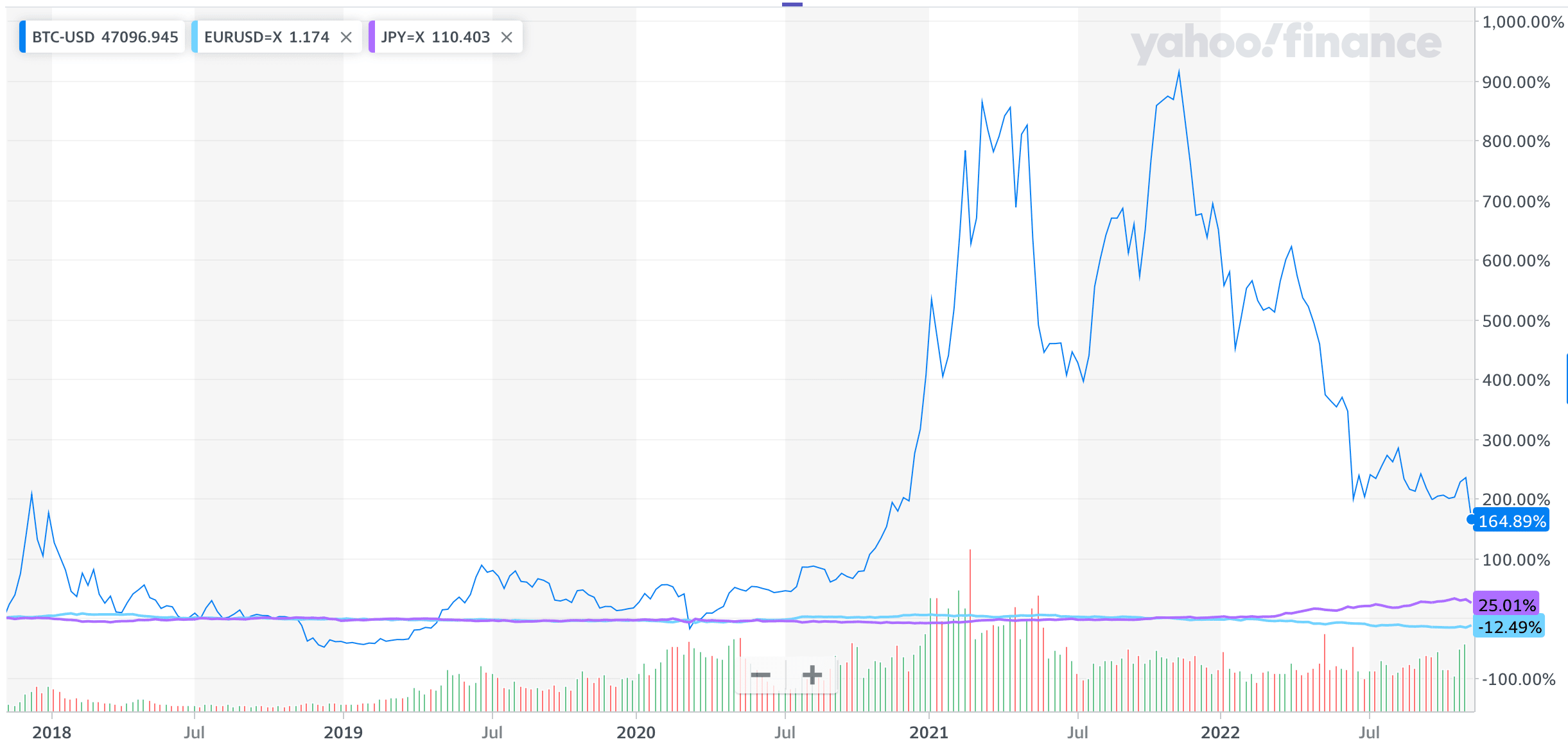

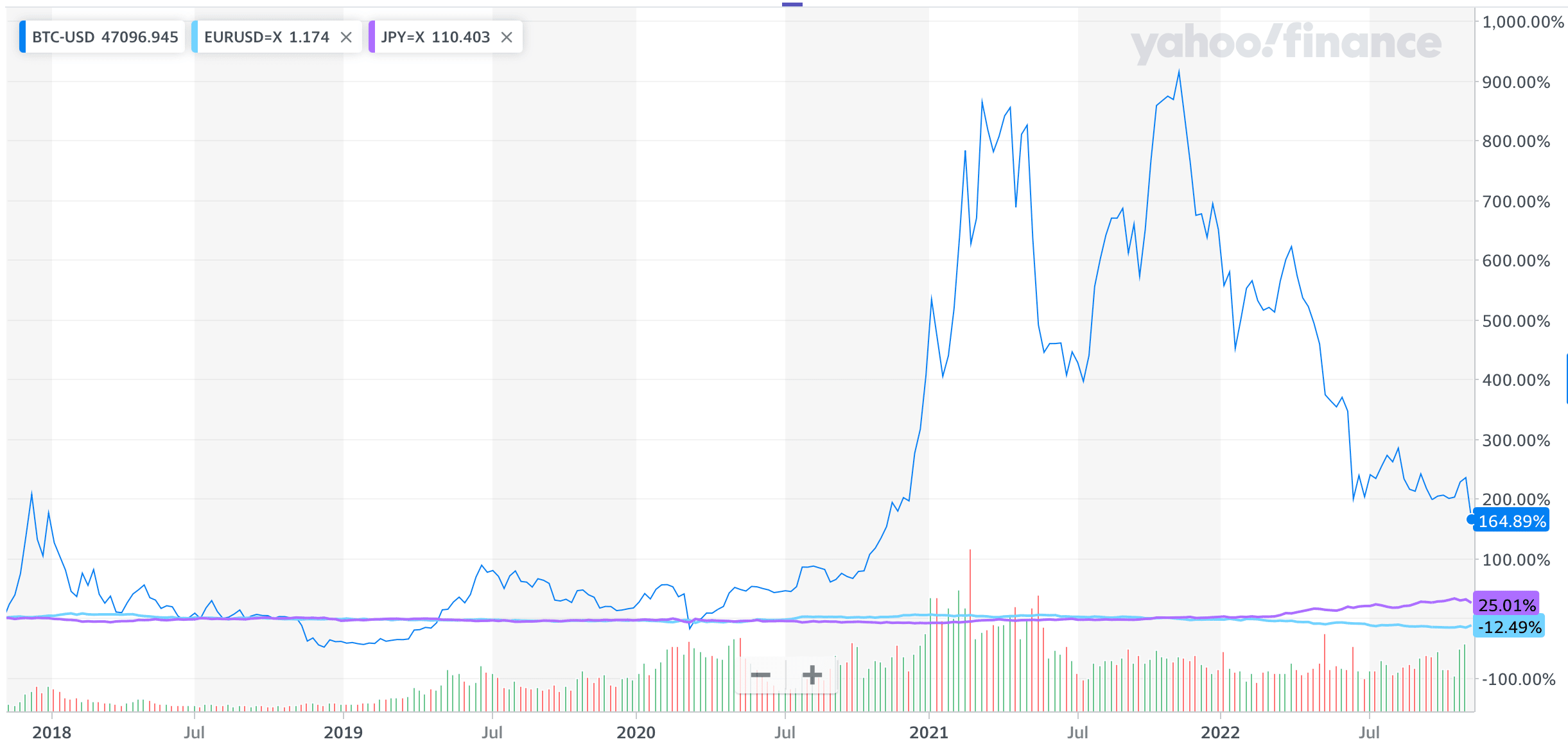

When you compare Bitcoins against the USD vs the Euro and the Japanese Yen, the swings are not warranted with Bitcoin and speaks to speculation rather than rational understanding of the currency movement.

Why Crypto Has No Place In My Portfolio

As you can see, in my opinion it’s purely speculation with no ability to understand potential trends and patterns. It makes it a very risky investment.

I am not going to argue against the fact that some people made money with the speculation but some also lost money because when it turns sour, it’s tough to anchor your investment on anything … That’s what speculation is.

I only invest in what I understand and while I understand crypto and blockchain, I do not understand the relationship of the value against a currency. As such, I am staying away.

It is mesmerizing how investors want to make a quick buck. These days, even solid investors decided to put 5% towards crypto in the hope to get a massive edge.

Moreover, I am well aware that blockchain technology is not environmentally friendly and I want to do my part to help our planet. As such, there is no need to add one more negative impact to our planet.

Avoid Hyped Products

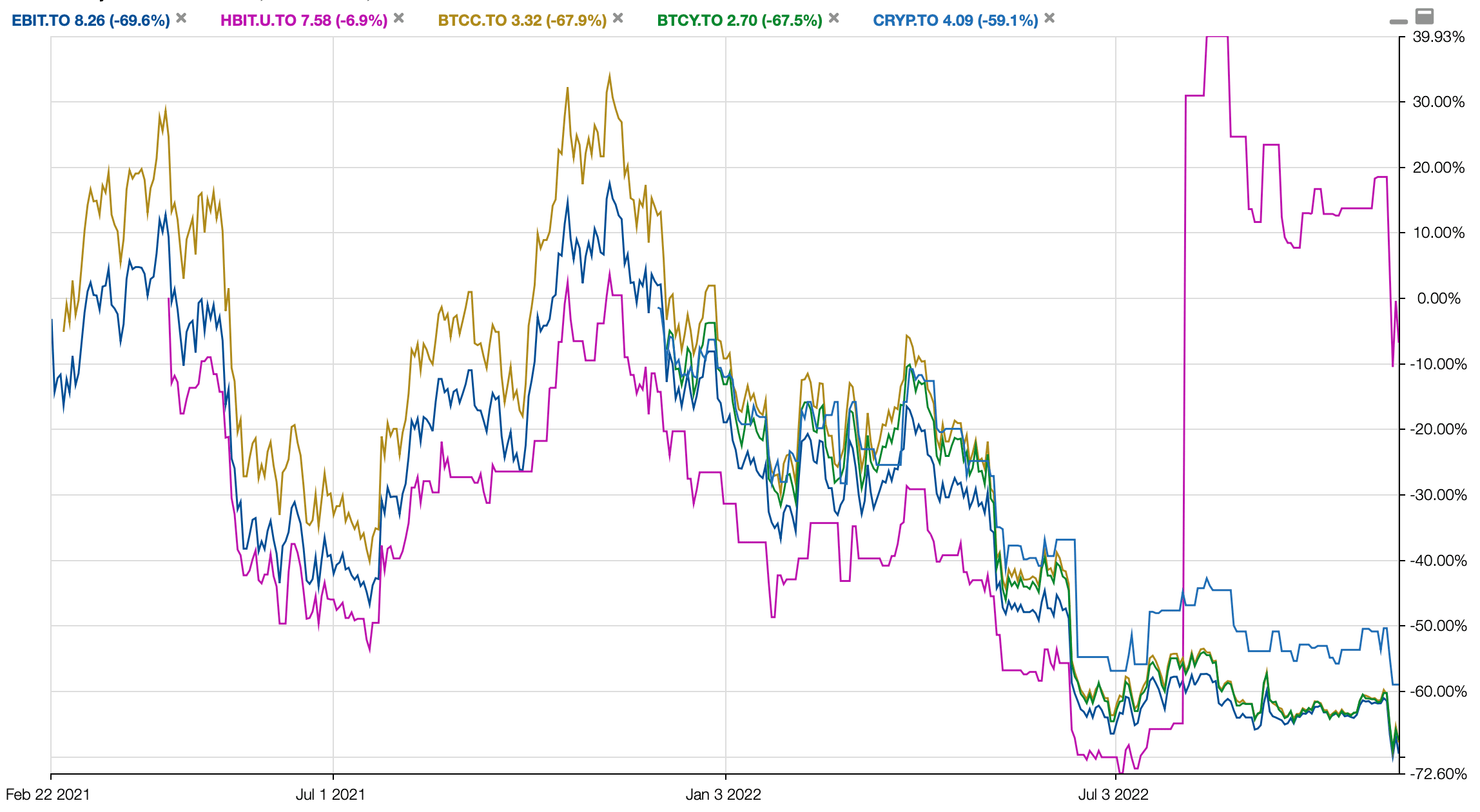

Ask yourself why we have Bitcoin and Crypto ETFs but no fiat money currency ETF aside from hedging? Why did the investment firms create those products? Is it to serve investors, or to pocket a fee from investors?

It’s usually the latter. Products are created based on demand, not based on the benefit to the investors. The companies creating the products are in the business of making money.

Here is how some crypto ETFs have performed since they have been introduced. Currencies don’t fluctuate like that. It should further confirm that it is pure speculation!

Published at Sat, 12 Nov 2022 03:28:10 -0800