Visa – Is Visa A Good Stock To Buy?

Is Visa a Good Stock to Buy? Some investors limit their knowledge of a company to its stock price behaviour. This, however, is a fundamentally flawed manner by which to invest because:

‘In the short run, the market is a voting machine. In the long run, it is a weighing machine.’ – Benjamin Graham

A superior investing method is to:

- identify high-quality companies;

- invest in them when they are attractively/fairly valued; and

- hold for the very long-term.

This strategy is far less stressful and time-consuming. Furthermore, very actively managed investment strategies can lead to higher tax obligations. This is why I have been a Visa (V) investor almost from its March 18, 2008 initial public offering (IPO).

During this timeframe, the value of V has experienced an average annual total return above 22% when dividends are automatically reinvested. In essence, a $100,000 investment has grown to ~$1,547,000 without any effort on the investor’s part.

V’s historical investment return, however, is of little relevance to someone who has never invested in the company. What is of greater importance is its future total investment return potential.

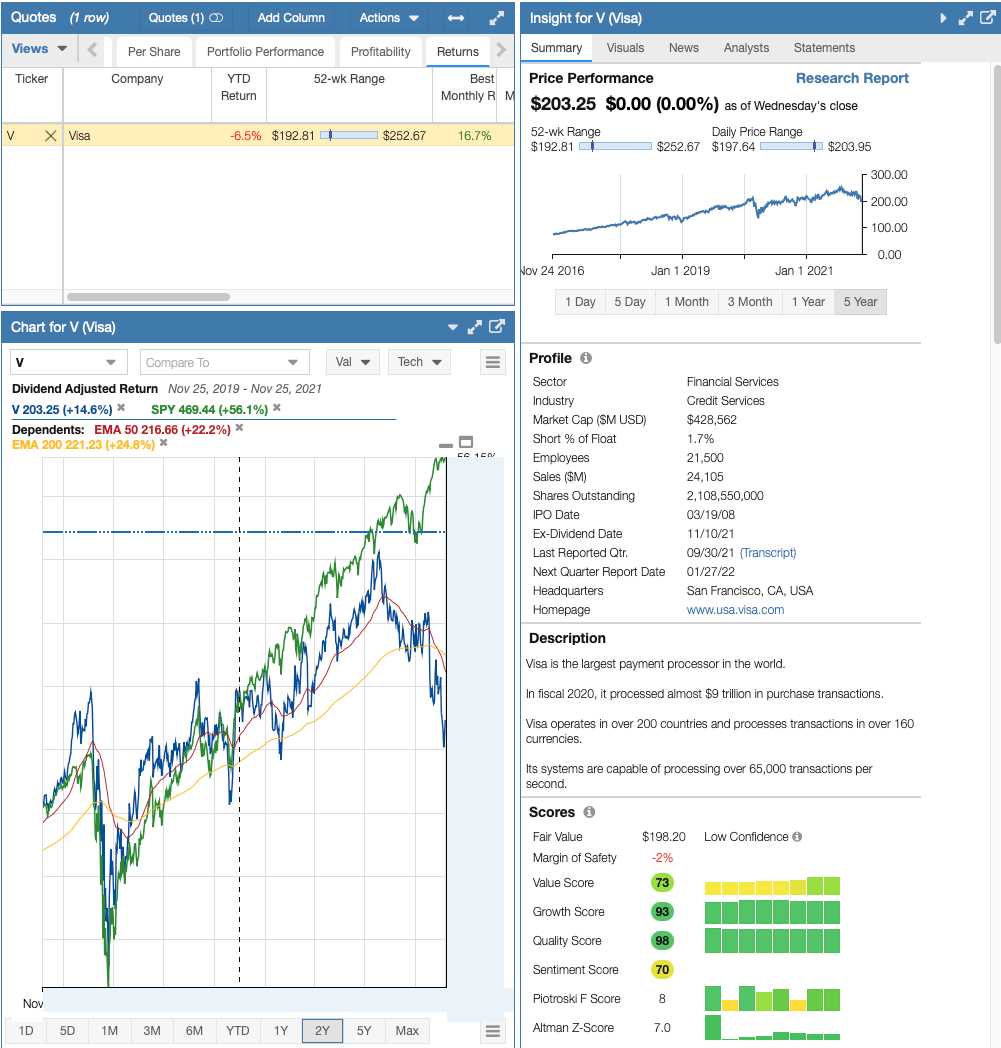

With some of the headwinds V is facing, this has led to a recent pullback in its share price. The stock chart from Stock Rover* shows that the stock price is below the 50-day and 200-day moving averages. The share price, however, is only one aspect of the investment equation. In this post, I explain why I have acquired additional shares given its recent share price weakness.

NOTE: Much of what I mention in this post also applies to Mastercard (MA). Both are high-quality companies and have a bright future. Rather than try to determine in which company I should invest, I decided several years ago to invest in both. However, you can read about the differences between Visa and MasterCard.

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter*. It is a good value and one of the best dividend newsletters available. There is a 7-day free trial and grace period so it is risk-free. The service provides top 10 stock picks with a discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my stock research. If you want to educate yourself more about dividend investing, then I suggest taking a course. The Simply Investing Course* is a good value and fairly comprehensive.

Visa – Overview

V is one of the world’s leaders in digital payments. It facilitates global commerce and money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions, businesses, strategic partners and government entities through innovative technologies.

A great source of information from which to learn about the company is Item 1 in its FY2021 10-K. Item 1A addresses the key risks.

Visa – Recent Events

US Justice Department Probe

The U.S. Justice Department is probing V’s relationships with large fintech companies as part of its antitrust investigation of the card giant. Antitrust investigators are looking into the financial incentives that V gave Square Inc., Stripe Inc., and Paypal Holdings Inc.

V has declined to comment on this matter. In March 2021, however, it indicated the US Justice Department was looking at its debit practices to determine whether it uses anti-competitive practices in the debit-card market.

The US Justice Department previously investigated the credit card payments industry. In 2010, V and MA settled with the US Justice Department when they agreed to allow merchants to offer consumers incentives to use a low-cost credit card.

Legal Matters

V is engaged in multiple legal matters. Details are provided in NOTE 20 in the FY2021 10-K (pages 99 -105).

Amazon (AMZN) vs Visa

Recently, AMZN indicated it will stop accepting V credit cards issued in the UK starting January 19, 2022; AMZN accounts for less than 1% of V’s UK credit card volume.

AMZN states the reason for this move is due to high credit card transaction fees; V debit cards will still be accepted.

Although AMZN may yet back down on the UK front, the dispute is a bad sign for the card industry. Some analysts said it could presage a fight in the much bigger U.S. market.

AMZN has stated it is considering dropping V as a partner for its Amazon Prime Rewards credit card; it is considering operating its Prime credit card with American Express (AXP) or MA instead.

While V is disappointed with AMZN’s decisions, V’s fee structure has undoubtedly been a topic of discussion for quite some time. V has likely held fast on its position with the knowledge that if AMZN decided to take public its dispute with V, its share price would take a hit.

Recently, V’s CEO indicated:

‘Clearly, we’re in a challenging negotiation. What’s different here is that Amazon, unfortunately, decided to take the negotiation challenges that we’re having public and oddly has chosen to threaten to punish consumers.’

Despite the current challenges with AMZN, V’s CEO and CFO expect both parties to resolve their US and UK disputes.

On November 19, V’s CFO stated:

‘We’ve resolved these things in the past and I believe we’ll resolve them in the future.’

Some analysts have suggested AMZN is using negotiating tactics similar to those other retailers have successfully used.

Buy Now, Pay Later (BNPL)

In 2020, credit cards dominated a third of North American e-commerce spending. However, mobile payment options like Venmo and ‘buy now, pay later’ (BNPL) financing plans are chipping away at market share. According to Worldpay, which was acquired and merged into Fidelity National Information Services (FIS), the credit cards’ share of North American e-commerce spending declined ~7% in 2020. BNPL’s share, however, increased ~78% thus making it the fastest-growing form of payment.

Although alternative payments have been growing for years, the COVID-19 pandemic has accelerated a downward trend in credit card applications; BNPL financing popularity has grown especially among younger consumers.

To counter the erosion in e-commerce spending, V announced on October 27, 2021, a growing list of issuers, acquirers and fintechs that are leveraging its technology to bring BNPL options to their customers.

A recent V study found that ~42% of all global consumers expressed interest in installment financing that is offered on their existing credit card or one for which they could apply. To help partners meet this demand, Visa Installments Solution is being deployed globally to make issuer-offered BNPL options available in-store and across e-commerce channels. With the network-based solution, financial institutions can add BNPL as a customized feature for credit card holders, on their already approved credit lines. Acquirers on the network can also activate the ability to enable installments for any of their retailers that accept V.

On the Q4 earnings call, V indicated that while installments are fast-growing, they are just a fraction of the total industry’s payment volume.

By bringing scale to disrupters through a two-pronged strategy, V will provide a network solution as well as solutions for its BNPL fintech partners; the network solution offers issuers the ability to extend installments to their existing credit clients and for merchants to offer a seamless installment option to their customers with flexible terms.

By partnering with fintechs, V generates revenue as customers pay their installments through virtual V cards for B2B or consumer payments and through value-added services.

The majority of the installment payoffs are on cards today. For example, over the last year in Canada, the number of V cards used to repay installments has grown more than 300%.

Tink Acquisition

On June 24, 2021, V announced it had signed a definitive agreement to acquire Swedish fintech Tink months after it ditched a planned acquisition of Tink’s U.S. rival Plaid; V terminated a planned $5.3B deal with U.S. data-sharing platform Plaid in January 2021 following a U.S. government lawsuit aimed at blocking the deal on antitrust grounds.

Tink is a European open banking platform that enables financial institutions, fintechs and merchants to build tailored financial management tools, products and services for European consumers and businesses based on their financial data.

Terms are 1.8B euro (~$2.2B) inclusive of cash and retention incentives.

The transaction is subject to regulatory approvals and other customary closing conditions.

V will fund the transaction from cash on hand. This transaction will have no impact on V’s previously announced stock buyback program or dividend policy.

Currencycloud Acquisition

On July 22, 2021, V announced its intent to acquire British cross-border payments provider Currencycloud at a valuation of 700 million pounds (~$0.962B).

Launched in 2012, Currencycloud facilitates cross-border payments for nearly 500 banking and technology companies, including well-known European fintechs Klarna, Monzo, Starling and Revolut. Since its launch, it has moved more than $75B in payments to over 180 countries.

V has been a Currencycloud shareholder since 2020; the financial consideration will be reduced by the equity that V already owns in the startup.

The transaction is subject to regulatory approvals and other customary closing conditions.

V will fund the transaction from cash on hand. This transaction will have no impact on V’s previously announced stock buyback program or dividend policy.

Cybersource

CyberSource Payments, a V solution, processes debit, credit and closed-loop gift cards across the globe and multiple channels with unparalleled scalability and security. It supports an extensive list of payment cards and recurring billing options across a wide choice of gateways and acquiring banks, all through one connection.

Using CyberSource solutions, merchants can accept payments (cards, digital payment services, alternative payments) in over 190 countries, fund in more than 20 currencies, and protect customers from fraud loss.

Payment security and tokenization solutions enable payment acceptance via the web, mobile and call center/IVR.

In FY2021, CyberSource added 28 new acquirer partners and 45,000 merchants resulting in growing payments volume twice as fast as V’s broader client base. In addition, V’s risk solution on CyberSource, called Decision Manager, grew over 30%.

V has doubled the number of tokens over the past year to 2.6B and enhanced the capabilities to manage them through Visa Cloud tokens. Across more than 8,600 issuers and 800,000 merchants, tokens have led to a 2.5% increase in approval rate and a 28% reduction in fraud rates.

Visa Advanced Authorization and Visa Risk Manager use artificial intelligence and machine learning capabilities. Screening 30% more transactions in 2021 than in 2020 helped reduce fraud by $26B.

V’s efforts in authentication, risk, identity, and authorization optimization have led to cross-border card-not-present approval rates increasing by nearly 2% in the past year. Value-added services (VAS) revenue grew 25% in Q4 and also drove additional volume. Since the beginning of the COVID pandemic, V’s VAS revenue has averaged a quarterly growth rate in the high teens and was ~$5B in FY2021.

Visa – Financial Overview

V’s Q4 and FY2021 results are accessible here.

Despite the backdrop of economic uncertainty and the lingering impacts of the COVID-19 pandemic, V’s solid results demonstrate the resiliency of the business. It further validates the company’s growth strategy as it continues to rapidly grow digital payments and enables innovative means by which to move money globally.

The company’s September 30th fiscal year-end means that FY2021 results include two very different halves. In the first half, net revenues declined 4% and non-GAAP EPS was down 2%. This is because FY2020 results included 2 pre-COVID quarters. In the second half, the recovery was well underway and FY2021 results were being compared to 2 quarters in FY2020 in which COVID-19 had the largest negative impact. As a result, net revenue grew 28% and non-GAAP EPS was up 43% in the second half.

Q4 results were better than expected with net revenues up 29%. This was driven by strong US domestic trends, robust value-added services growth, and higher cross-border volumes from a faster than anticipated recovery in travel.

Free Cash Flow (FCF)

V’s FY2011 – FY2021 annual FCF (in billions) is $3.52, $4.63, $2.55, $6.65, $6.17, $5.05, $8.61, $12.22, $12.03, $9.70, and $8.71.

V’s consistent ability to generate strong FCF is likely to continue going forward despite the headwinds it faces.

Visa – Financial Guidance

Through the first 3 weeks of October, US payments volume was up 32% above 2019 with debit up 44% and credit up 22% from 2019. Processed transactions were 26% above 2019. Cross-border volume excluding transactions within Europe on a constant dollar basis was 94% of 2019 and up 8 points from Q4 and 2 points from September 2021.

Travel-related spending versus 2019 improved 4 points compared to September and is 65% of 2019 levels. Card-not-present non-travel was 49% above 2019 and up 6 points from Q4 and down 2 points from September.

On the Q4 earnings call, management states business has been recovering for the past 3 to 4 quarters. However, business is not yet back to normal on a global basis.

Debit and e-commerce have outperformed and stayed resilient.

While cross-border travel is recovering, this area of business is still well below pre-COVID levels; the pace of recovery depends on border openings.

Assuming current trends are sustained through December, V expects Q1 2022 net revenue growth in the high teens. Client incentives as a percent of gross revenue are likely to be 26% to 27% which is in line with Q4 2021.

V is finding it to be a challenge to have reasonably accurate visibility 4 quarters out. Gross revenue growth is heavily dependent on the pace of the cross-border travel recovery. Forecasting is, therefore, a function of various variables and the following assumptions V has made for internal planning purposes:

- Domestic volumes and transactions – no disruptions from COVID-related lockdowns. The recovery trajectory underway in payments volumes and processed transactions stays intact for FY2022.

- Cross-border travel – the recovery underway continues steadily through FY2022 to reach 2019 levels in the summer of 2023.

- E-commerce – the strong growth in cross-border e-commerce continues.

- New flows and value-added services growth in the high teens.

- Client incentives as a percent of gross revenues between 26% – 27% which is consistent with Q4 2021. Pre-COVID, this percentage increased by 50 – 100 basis points each year due to the impact of new deals and renewals.

- Benefit from revenue mix improvement as cross-border travel continues to recover. This is partially offset by the lapping of incentive reductions in FY2021 due to the pandemic’s impact.

These assumptions result in the high end of mid-teens net revenue growth for FY2022 with Q1 growth in the high teens moderating through the year.

Operating expenses are expected to grow in the low teens in FY2022. V has already increased marketing investment and heavy investment is being made in the technology platforms to continue to enhance functionality, flexibility, security, and reliability.

Expense growth will be higher in the first half of FY2022 and will moderate in the second half.

Non-operating expenses are expected to be ~$0.12B – $0.13B.

NOTE: The new COVID-19 strains will likely exacerbate the challenges many are facing. V will not be immune to these challenges. I strongly suspect its earnings will come under pressure if domestic and international travel restrictions are reinstated.

Visa – Credit Ratings

V’s current unsecured domestic long-term debt credit ratings and outlook are:

- Moody’s – Aa3 (stable)

- S&P Global – AA- (stable)

These ratings are the lowest tier of the high-grade investment-grade category and define V as having a VERY STRONG capacity to meet its financial commitments. The ratings differ from the highest-rated obligors only to a small degree.

These ratings are acceptable for my conservative nature.

In comparison, these are the current unsecured domestic long-term debt credit ratings and outlook for MA, AXP, and Paypal (PYPL).

MA

- Moody’s – A1 (stable)

- S&P Global – A+ (stable)

AXP

- Moody’s – A3 (stable) – 3 tiers below V

- S&P Global – BBB+ (stable) – 4 tiers below V

- Fitch – A (stable)

PYPL

- Moody’s – A3 (stable) – 3 tiers below V

- S&P Global – A- (stable) – 3 tiers below V

- Fitch – A- (stable)

All ratings are investment grade. V’s ratings, however, are the highest of the group with those assigned to MA being the second-highest.

Unlike V and MA, AXP and PYPL assume credit risk. V and MA merely flow payments through their respective networks. The financial institutions which issue V and MA branded cards assume the credit risk.

Visa – Dividends and Share Repurchases

Dividends and Dividend Yield

V’s dividend history is accessible here.

On October 22, V’s Board of Directors authorized a 17% recent increase in the $0.32/share quarterly dividend to $0.375/share. With shares trading at ~$203.75 as of November 24, 2021, when this article is being composed, the dividend yield is ~0.7% as seen in the chart from Portfolio Insight*. Visa has raised the dividend for 13 consecutive years making the stock a Dividend Contender. The stock has a double-digit dividend growth rate of ~25% in the past decade, ~20% in the trailing 5-years, and ~21% in the past 3 years.

Share Repurchases

In January 2020, V’s board of directors authorized a $9.5B share repurchase program. In January 2021, it authorized an additional $8.0B share repurchase program. These authorizations have no expiration date.

V had $4.7B of remaining authorization for share repurchase as of September 30, 2021.

The weighted average number of diluted outstanding shares has been reduced from 2.828B in FY2011 to 2.17B in Q4 and 2.19B for FY2021.

In Q4, V bought 13.2 million shares of Class A common stock at an average price of $231.33 for $3.053B. In FY2021, V repurchased 39.7 million shares of Class A common stock at an average price of $219.34.

Hopefully, V is repurchasing a significant number of shares during the recent swoon in the share price.

Visa – Current Valuation

In early September I wrote a V post at Financial Freedom is a Journey at which time V’s share price was ~$226. FY2021 – FY2023 guidance from the brokers which cover V was:

- FY2021 – 32 brokers – mean of $5.82 and low/high of $5.69 – $5.93. Using the mean estimate, the forward adjusted diluted PE is ~38.8 and ~38.3 if I use $5.90.

- FY2022 – 35 brokers – mean of $7.26 and low/high of $6.85 – $7.83. Using the mean estimate, the forward adjusted diluted PE is ~31 and ~29.3 if I use $7.70.

- FY2023 – 24 brokers – mean of $8.60 and low/high of $8.01 – $9.60. Using the mean estimate, the forward adjusted diluted PE is ~26.3 and ~24.3 if I use $9.30.

Following the release of Q4 and FY2021 results, I wrote another post on October 30 at which time V was trading at ~$212. V had just reported FY2021 GAAP EPS of $5.63 for the publicly traded Class A common stock thus resulting in a diluted PE of ~37.7.

By way of comparison, V’s FY2011 – FY2020 diluted PE levels are 28.44, 42.11, 29.34, 30.42, 30.06, 31.46, 40.72, 29.85, 35.32, and 44.73.

In addition, FY2021 adjusted diluted EPS was $5.91 thus giving us an adjusted diluted PE of ~36.

At the time of my October 30 post, the brokers which cover V were likely still in the process of adjusting their adjusted diluted earnings estimates. These, however, were the estimates at the time of my post.

- FY2022 – 34 brokers – mean of $7.09 and low/high of $6.83 – $7.45. Using the current ~$212 share price and the mean estimate, the forward adjusted diluted PE is ~30 and ~29 if I use $7.45.

- FY2023 – 30 brokers – mean of $8.45 and low/high of $7.96 – $9.60. Using the current ~$212 share price and the mean estimate, the forward adjusted diluted PE is ~25 and ~22 if I use $7.45.

Now, V is trading at ~$203.75 and these are the current earnings estimates:

- FY2022 – 33 brokers – mean of $7.06 and low/high of $6.83 – $7.36. Using the current share price and the mean estimate, the forward adjusted diluted PE is ~28.9 and ~27.7 if I use $7.36.

- FY2023 – 31 brokers – mean of $8.43 and low/high of $7.96 – $9.60. Using the current hare price and the mean estimate, the forward adjusted diluted PE is ~24 and ~21 if I use $9.60.

Only 8 brokers have provided estimates for FY2024. Since so much can occur in a 2-year timeframe I place very little credence on these estimates.

Visa – Return on Invested Capital (ROIC %)

The ROIC % metric measures how well a company generates cash flow relative to the capital it has invested in its business.

According to conventional wisdom, an annual ROIC of ~7% or greater is considered good for an equity investment. This is also about the average annual return of the S&P 500 when accounting for inflation.

While I like to compare a company’s ROIC % relative to its competitors and other investment opportunities, I appreciate that it has its limitations because it does not account for risk or time horizon and it requires an exact measure of all costs. As a result, investment decisions must be evaluated based on multiple metrics and not just ROIC%.

V’s annualized ROIC % for the quarter that ended in September 2021 was 22.49%.

As of November 25, 2021, V’s weighted average cost of capital is 6.89% and its ROIC % is 19.34% using trailing 12-month income statement data; V generates higher returns on investment than it costs to raise the capital needed for that investment.

Visa – Final Thought on Is Visa a Good Stock to Buy

I last analyzed my percentage ownership of every holding within the FFJ Portfolio, and in accounts for which I do not disclose details, in my April 12, 2021 post. Although there have been changes since then, V and MA are still my two largest holdings; I have recently been adding to both positions on weakness within a taxable account.

At the beginning of this post, I indicated my preference is to invest in attractively/fairly valued high-quality companies and to hold shares for the very long term. In my opinion, V and MA check all the right boxes.

I would not be the least bit surprised if the broad equity markets were to experience a significant pullback. In my opinion, investors would be wise to adopt a ‘risk off’ position.

As noted earlier, I think the new COVID-19 strains will lead to domestic and international travel restrictions. This will likely lead to pressure on V’s and MA’s share price for the foreseeable future. Investors might want to view this weakness as an opportunity to acquire shares.

Despite the headwinds V faces, it has ample growth opportunities. Its fee structure is such that it benefits as the prices for goods and services purchased with V increase. Secondly, it is actively taking measures to compete in the BNPL space. Thirdly, investors can participate in the growth of cryptocurrencies without investing directly in cryptocurrency. Fourthly, invest in both companies. This way you stand to benefit if V loses business to MA and vice versa.

I wish you much success on your journey to financial freedom.

Thanks for reading Visa – Is Visa A Good Stock To Buy?

Disclosure: I am long V and MA.

Another article by Charles Fournier is Microsoft – (MSFT) ‘AAA’ Dividend Safety.

Author Bio: I am a self-taught investor and run the Financial Freedom is a Journey blog. I have invested in the North American equities markets for over 34 years. I retired from a career in banking and continue to invest as this is something about which I am passionate.

Author Disclosure: I disclose holdings held in the FFJ Portfolio and the dividend income generated from these holdings. I do not disclose details of holdings held in various tax-advantaged accounts for confidentiality reasons.

Author Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

Here are my recommendations:

Look at my Review of the Simply Investing Report if you are unsure how to invest in dividend stocks or are just getting started with dividend investing. I provide a review of the Simply Investing Course and am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors, I suggest reading my Review of The Sure Dividend Newsletter and I am an affiliate of Sure Dividend.

Read my Review of Stock Rover if you want leading investment research and a portfolio management platform with all the fundamental metrics, screens, and analysis tools you need. I am an affiliate of Stock Rover.

Please sign up for my free weekly e-mail if you would like notifications of when my new articles are published. You will receive a free Dividend Kings spreadsheet and will join thousands of other readers each month!

*This post contains affiliate links meaning I earn a commission for any purchases you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Published at Thu, 02 Dec 2021 04:00:00 -0800