Toro: Sales And Margin Growth Is Encouraging But Shares Are Still Expensive

Onfokus/E+ via Getty Images

Great Start To The Year

The Toro Company (NYSE:TTC) reported fiscal 1Q 2023 results on 3/9/2023. The company showed strong sales growth compared to 1Q 2022. Gross margin and operating margin both improved as well. Sales were up an impressive 23.2%. Most of this growth again came in the Professional segment, where sales were up 30.9%. In the Residential segment, sales were up only 3.6%. Both segments were successful at putting through price increases to more than offset cost inflation. Additionally, Professional got some growth from last year’s acquisition on Intimidator Group. Residential was negatively impacted by a light snow season. The cluster of early season snowstorms that I mentioned last quarter did not continue through the season.

The company also delivered margin improvements. In addition to the price increases more than offsetting material costs, Toro also delivered productivity improvements. Operating leverage also helped as fixed costs were spread out over the higher sales totals. Finally, the “other income” category improved strongly over last year. This mostly comes from the Red Iron JV which provides financing to retailers to carry inventory. The more normal (higher) inventory levels compared to last year are a benefit, as are higher interest rates.

Toro 1Q 2023 Earnings Slides

Looking forward, demand remains strong in the Professional segment. Supply chain issues continue to return to normal. The high order backlog that the company had at the start of the year has not come down yet, suggesting strong future sales. Analysts asked about weak end markets on the earnings call, but Toro management said that demand was strong across the board from all the main customers – landscapers, specialty and underground equipment, and golf courses. Similar to what we have seen in the auto market, management commented on the call that the market for used golf course maintenance equipment is tight, supporting demand for new equipment.

Despite the strong results and outlook, the company left full year 2023 guidance unchanged at 7-10% sales growth and EPS of $4.70-$4.90. I was concerned last quarter that the full year goals were ambitious, however after the strong 1Q, the plan for the rest of the year looks more achievable. The stock is up about 4% since my last article and now trades at a P/E over 24. This looks fairly valued for a company with EPS growth in the mid-teens especially one that pays a modest dividend in a higher-for-longer interest rate environment. Toro remains a well-run company, but the stock is still a hold at these levels.

Earnings Model Updates

I updated the earnings model to show 1Q 2023 actuals and implied results for the rest of the year to meet full year guidance. My sales and operating profit estimates are unchanged from last quarter, but I did increase my estimate of Other income for the year in line with the much better performance of the financing JV. As a result, I now expect Toro to earn $4.81/share this year, up from the estimate of $4.71 last quarter.

Author Spreadsheet

Given the strong 1Q growth, the results for the rest of the year now do not have to be as strong to still hit full year guidance. Compared to the last 3 quarters of 2022, sales growth of only 5.3% and operating income growth of 8% are needed to hit the full year guidance.

Author Spreadsheet

Capital Management

Free cash flow is typically negative for Toro in the first quarter and this year was no exception. The company typically builds inventory for the spring selling season. Despite this, the company still expects Free Cash Flow Conversion (FCF/Net Income) to be around 100% for the full year. Capex will still exceed depreciation by about $30 million, but working capital draw down will provide about that level of cash, making FCF equal net income.

My expectation of FCF and net income is now $499 million for 2023. The $0.34 quarterly dividend delivers a yield of 1.2% and will consume about $140 million of cash. Assuming no large acquisitions this year, I still expect the company to pay off around $150 million of debt this year. That leaves $209 million available for buybacks. The company did not buy back any shares in 1Q.

Gross Debt to trailing EBITDA ratio is still comfortable 1.5 times, within the company’s target range of 1-2 times.

Valuation

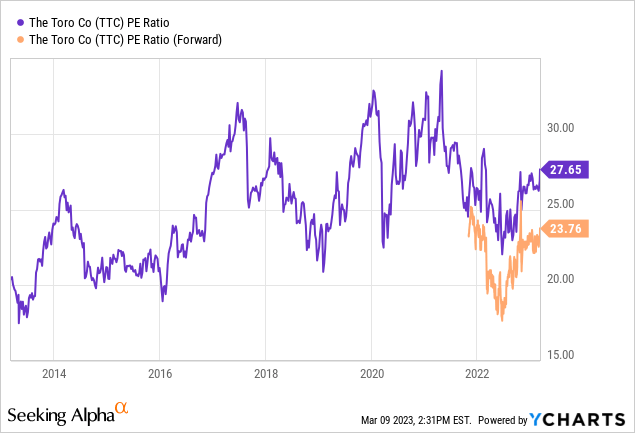

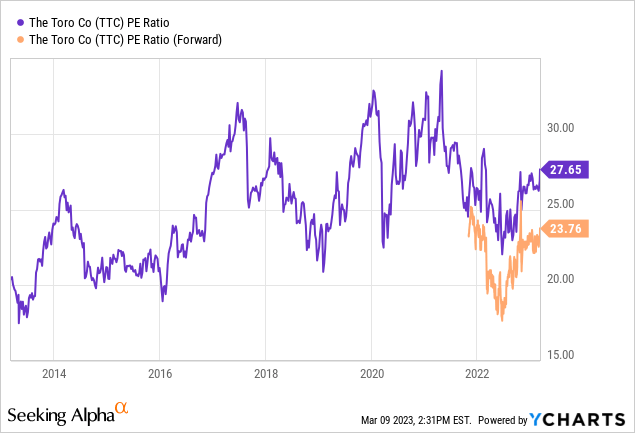

At $4.81 EPS, Toro has a forward P/E of 24.1. The trailing P/E is in line with the average since 2017. The forward P/E is now in the top of the range it has traded in over the past year.

With interest rates now expected to remain higher for longer, high P/E stocks without a high dividend yield face a valuation headwind. Although EPS growth in the mid-teens would help support the high valuation, the interest rate environment suggests caution.

Conclusion

Toro had an excellent start to Fiscal 2023 with strong sales growth and margin improvement in the first quarter. These results make it easier for the company to hit the full year guidance, which was unchanged from when it was rolled out last quarter.

Still, at 24.1 times earnings, the stock is even more expensive than it was last quarter, especially considering the expectation that interest rates will remain high. From current levels around $116, the end-2024 valuation of $130 I put out last quarter would provide returns of 7.9% including the modest dividend yield. The company remains well-run, and the stock is one of my longest-held positions, but I do not wish to add to my position at these levels.

Published at Thu, 09 Mar 2023 22:51:52 -0800