Stock Market This Week

Stock Market This Week – 01/21/23

The stock market had an up-and-down week but finished strong on Friday. Inflation is showing signs of cooling but probably not enough for the Fed to ease up on rate hikes. However, investors are buying more growth-oriented names, with many of these stocks coming off their lows.

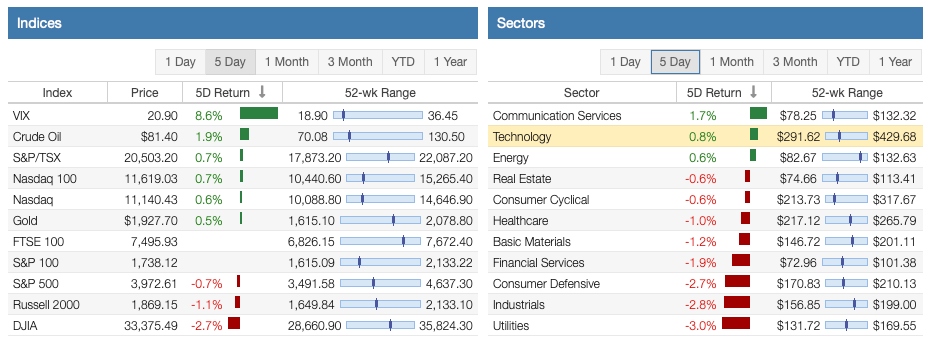

As shown by data from Stock Rover*, only the Nasdaq had positive returns for the week. The S&P 500 Index, Russell 2000, and Dow Jones Industrial Average (DJIA) had negative returns. The Dow 30 performed the worst, continuing a reversal of last year’s trends. Oil rebounded, and the VIX gained.

Three of the eleven sectors posted gains for the week. The Communications Sector led the way, followed by Technology and Energy. Conversely, the worst-performing indices were Consumer Defensive, Industrials, and Utilities.

The Nasdaq is performing the best for the year, followed by the Russell 2000. But all the major indices are up. In addition, all nine of the 11 sectors are up year-to-date. Only more defensive sectors, like Healthcare, Utilities, and Consumer Defensive, were down.

The dividend growth investing strategy has performed relatively well, with positive returns. The table below shows their performance by category. All categories are now in positive territory.

Affiliate

Sure Dividend analyzes 850+ income securities every quarter in the Sure Analysis Research Database using the same metrics that matter in order to find the best income securities for members.

This is real research, not a quick computer screen. And all of this analysis is what powers Sure Dividend’s Dividend Pro Plan. The Dividend Pro Plan includes:

- The Sure Dividend Newsletter focuses on investing in high-quality dividend growth stocks with a focus on expected total returns. It is Sure Dividend’s flagship newsletter. It always publishes on the first Sunday of the month.

- The Sure Retirement Newsletter focuses on investing in high yielding stocks, REITs, and MLPs. All recommendations must have a dividend yield of at least 4%. It always publishes on the second Sunday of the month.

- The Sure Passive Income Newsletter focuses on investing in high-quality dividend growth stocks with a buy and hold forever approach. It always publishes on the third Sunday of the month.

Dividend Power readers can use my Sure Dividend coupon code DP100 for $100 off the Dividend Pro Plan, reducing your price from $499/year to just $399/year.

Click here to start your 7-day free trial with the discount applied.

Dividend Increases and Reinstatements

Search for a stock in the list of dividend increases and reinstatements. This list is updated weekly. In addition, you can search for your stocks by company name, ticker, and date.

Dividend Cuts and Suspensions List

The dividend cuts and suspensions list was most recently updated at the end of November 2022. As a result, the number of companies on the list has risen to 602. Thus, well over 10% of companies that pay dividends have cut or suspended them since the start of the COVID-19 pandemic. The list is updated monthly.

Thirteen new additions indicate companies are starting to experience headwinds in December 2022.

Stock Market Valuation This Week

The S&P 500 Index is trading at a price-to-earnings ratio of 20.66X, and the Schiller P/E Ratio is about 29.05X. These multiples are based on trailing twelve months (TTM) earnings.

The long-term means of these two ratios are approximately 16X and 17X, respectively.

The market is still overvalued despite the recent correction and a bear market and rebound. Earnings multiples of more than 30X are overvalued based on historical data.

Stock Market Volatility This Week – CBOE VIX

This past week, the CBOE VIX measuring volatility ended at 19.85. The long-term average is approximately 19 to 20. The CBOE VIX measures the stock market’s expectation of volatility based on S&P 500 Index options. It is commonly referred to as the fear index.

Economic News This Week

Provided by Stock Rover*.

The Commerce Department reported advance U.S. retail and food services sales were down 1.1% to $677.1B in December. It was the second consecutive monthly decline and the fourth negative reading in the past six months. Retail sales, which are adjusted for seasonal shifts but not inflation, were up 6.0% year over year. Total sales for October 2022 through December 2022 were up 6.7% year over year. Sales declines were broad-based, with home furnishings (-2.5%), auto dealers (-1.2%), electronics and appliance stores (-1.1%), internet retailers (-1.1%), and clothing stores (-0.3%), all dropping in December. Department stores were especially hard-hit, plummeting (-6.6%), while gasoline stations fell (-4.6%). Restaurants, the only services category, declined (-0.9%) for the month and is up (+12.1%) year over year. Sales at garden centers rose (+0.3%), grocery (+0.1%), and sporting goods, hobby, musical instrument, and bookstores were up slightly (+0.1%). Core retail sales, which excludes spending on autos, gasoline, building materials, and food services, decreased by (-0.7%) in December.

The Labor Department reported that the Producer Price Index for final demand declined by an adjusted 0.5% in December. This follows increases of (+0.2%) in November and (+0.4%) in December. The PPI index was up 6.2% for 2022 after climbing 7.3% for the 12 months ending in November. The monthly decline was driven by a (-1.6%) drop in prices for final-demand goods, with energy and food leading the way. Nearly half of the decrease in the index for final demand goods is attributable to a (-13.4%) decline in gasoline prices, as the index for final demand energy dropped (-7.9%). The indexes for diesel fuel (-27.0%) and jet fuel (-17.7%) also fell significantly. Food prices dropped (-1.2%), led by declines in fresh and dry vegetables (-9.4%), and fresh fruits (-7.8%), while prices for chicken eggs (+24.5%) skyrocketed. The index for final demand services edged up (+0.1%), the smallest increase since April. The services increase can be traced to margins for final demand trade services (+0.3%). The final demand transportation and warehousing services index declined (-0.2%), while prices for final demand services less trade, transportation, and warehousing were unchanged. Excluding food, energy, and trade services, the so-called core PPI increased (+0.1%) in December, up 4.6% from a year ago. The core PPI increased (+0.3%) in November.

The U.S. Census Bureau reported housing starts dropped 1.4% to a seasonally adjusted annual rate of 1.382M units in December. Single-family housing starts, which account for the largest share of homebuilding, slid (-1.4%) to a rate of 1.382M units, down (-21.8%) from a year ago. Starts of five units or more slumped (-18.9%) to a rate of 463K units, down (-16.3%) from a year ago. New residential building permits, a proxy for future construction, fell (-1.6%) to a seasonally adjusted rate of 1.330M units. New residential building permits are running (-29.9%) below their December 2021 level. Single-family permits were down (-6.5%) from November’s revised 781K, while multifamily permits increased (+7.1%) to 555K. Leading the decline in building permits was the Midwest (-15.6%), followed by the Northeast (-2.5%) and the South (-1.7%). Only the Midwest saw an increase (+9.3%). Single-family housing completions at 1.005M were (-8.0%) below November’s revised reading, while multifamily completions were up (+12.1%) to 385K. The number of houses approved for construction but has yet to start dropped (-3.7%) to 285K units, with the backlog for single-family housing dropping (-4.9%) to 137K.

Curated Weekend Reading From Around The Web

Portfolio Management and Investing

Retirement

Financial Independence

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Sure Dividend Pro Plan is an excellent resource for DIY dividend growth investors and retirees. Try it free for 7 days.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free spreadsheet of the Dividend Kings! Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Published at Sat, 21 Jan 2023 11:25:09 -0800