Stock Market or Real Estate: Where Should You Invest & Why?

What you invest in today, gives you results tomorrow. The importance of investing money for increasing assets is undeniable.

We know that for increasing the value of money we need to invest it the best way we can to get the highest return. Plenty of options are available to invest money, but before choosing an option you should learn the benefits of various investments.

Two investment methods are prominent with investors today; the stock market and real estate. While crypto-currency is gaining popularity, it’s not used to build a retirement nest egg. It’s used to bet big similar to how penny stocks are used.

Either of these investment options are good and you should provide investors with a decent return on investment (a.k.a. ROI). The two approaches are quite different though, know the difference and learn what works for you. In some cases, it’s both but you may start with one and then diversify into the other one.

What Is Stock Market Investing

Investing in the stock market has become a common investment practice through mutual funds, ETFs, or stocks. It’s usually easy to get going and requires little funds.

The stock market allows for investors to invest for short, or long, period of time and buy stocks at different price ranges. However, there are many risk factors associated with buying and selling stock. On the surface, the concept seem easy but you can also lose money quickly if you don’t know what you are doing.

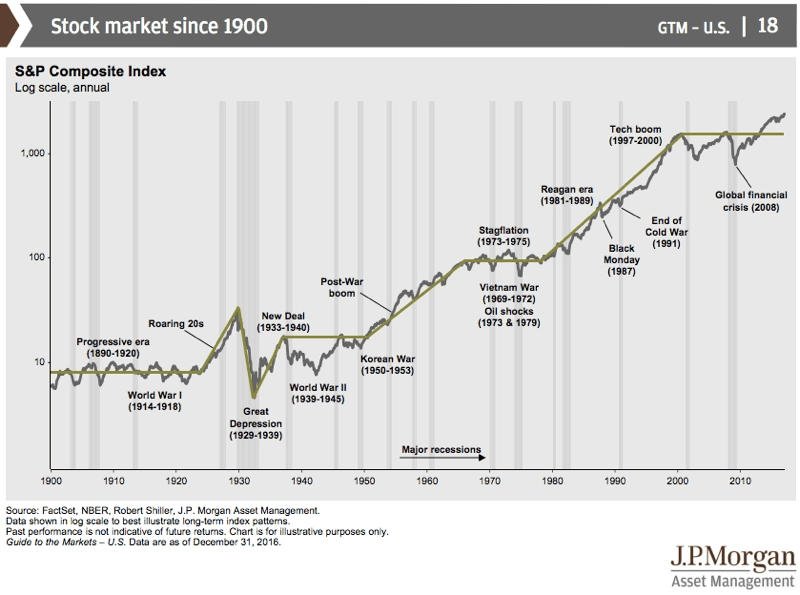

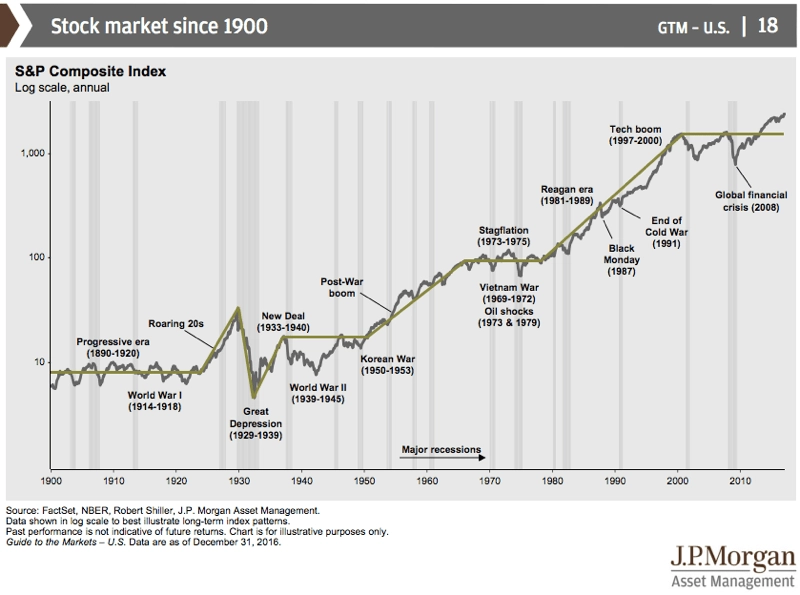

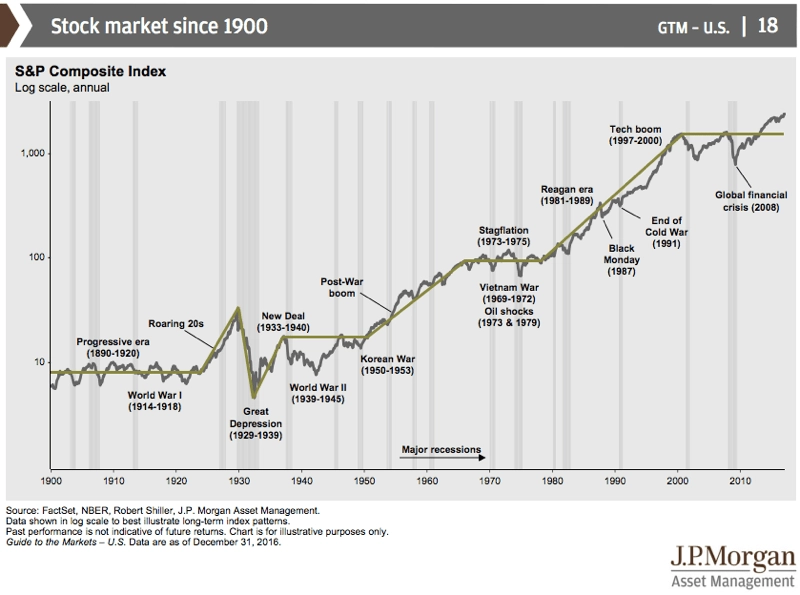

The principle is to buy low and sell high but it’s easier said than done. If you look at the US stock market chart, you can see that buying at the wrong time can take much longer to make your money grow. It can be the difference between a 3% annual rate of return vs a 10% annual ROR.

There are many investment strategies such as dividend growth investing or dividend income for retirement that are easier to execute than option trading or even value investing.

The professional mentors at Online Trading Campus can provide you with the best guidelines to invest in the stock markets.

| Pros | Cons |

|---|---|

| Easy to start | You can lose money quickly |

| Index investing is simple | It can get very emotional |

| More liquid asset for cash |

What Is Real Estate Investing

Investing in real estate means buying a property that you can sell for a profit, or rent it out to get a financial return from your invested capital.

Real estate investing requires a much greater capital to get started and your home cannot be considered an investment. The return on investment for a property depends on many factors including the market condition, facilities of the property, and the location value.

Generally, the property value increases with time but many factors can influence the time it takes to see it appreciate in value. The big question is if you are buying to make a profit from appreciation, or to get paid rent.

The main challenge with owning properties, aside from the large capital needed to make the purchase, is dealing with the tenants. While you can contract it out, it will eat into your profit.

| Pros | Cons |

|---|---|

| Easy to understand | Large capital needed to get started |

| Easier to project cost and income | Nightmare tenants |

| Growth from rent limited | |

| Not easy to access cash |

Which Is Suitable For You?

When it comes to investing your hard-earned money, you should be cautious about the chances of getting a proper return on investment.

Be it stock investing or real estate investing, there are some risk factors and benefits of investing in either as seen above.

Real Estate VS Stock Market Returns

If you keep your money in the bank and say you get 2% interest from a high-savings account, you will not grow your money fast and you don’t keep up with inflation.

The stock market will provide an average of 6% to 8% depending on the country and securities you invest in. The broad US stock market has an average of 8% for example.

If you use the rule of 72, you double your money every 9 years.

Real estate returns will depend on your initial outlay. When the real estate market is hot, many real estate investors invest for appreciation while being cashflow neutral. That approach is a lot riskier since your approach is similar to buying stocks where you want the value to go up.

Will real estate always go up? Over a long period of time it should so the above approach can make you a profit but can you get an annual rate of return of 8% in the end?

That’s the biggest question investors should try to answer.

If you can be cashflow positive then you make a profit every month and you get capital appreciation in the long term. This is where the magic of real estate investing come into play.

What It Comes Down To

You should take time and consider all the pros and cons of making an investment in the stock market or real estate. See if which one can give you the rate of return you want and assess if you can handle the emotion when your investment is down or when you have a tenant from hell …

Published at Sat, 28 May 2022 18:22:26 -0700