Star Bulk: China’s Build-First, Sell-Later Policy May Boost Iron Ore Demand

guvendemir/iStock via Getty Images

We have previously covered Star Bulk Carriers Corp. (NASDAQ:SBLK) here as a post-FQ3’22-earnings article in November 2022. We posited that the company’s FQ4’22 results may be negatively impacted due to the lower-than-expected TCE rates. The increased expenses for dry docking in Q3, leading to a quarterly dividend cut then, were not well received by investors as well. Combined with the normalization of the Baltic Dry Index [BDI], SBLK may face more temporary headwinds indeed.

For this article, we will be focusing on SBLK’s intermediate-term prospects, as China reopens with a GDP target of up to 5.5% in 2023. Notably, Hebei is more aggressive with a target of up to 6%, potentially ramping up its steel manufacturing output after three years of the Zero Covid Policy. The government’s immense stimulus and extension of bank credits may support the recovery of the country’s property market as well, boosting consumer confidence ahead.

The Dry Bulk Investment Thesis Is Still Robust

5Y BDI Rates

Trading Economics

Dry bulk shipping spot rates have been hammered indeed, attributed to the overly drastic normalization from hyper-pandemic levels and easing port congestions. The BDI has shown drastic declines, reaching $801 by January 19, 2023, plunging by -85.5% from the peak levels of $5.54K in October 2021 and by -39.3% from the average of $1.32K in 2019.

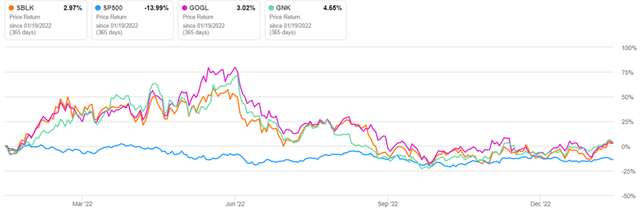

SBLK 1Y Stock Price

Seeking Alpha

Therefore, it is no wonder that many dry bulker stocks, including SBLK, Golden Ocean Group Limited (NASDAQ:GOGL), and Genco Shipping & Trading Limited (NYSE:GNK), have been notably trading sideways for the past few months.

However, we are naturally more bullish, attributed to the 30Y low dry bulk order book and the IMO 2023. The Panamax is expected to only expand by a minimal 1.6% in 2023, with Capesize similarly growing by 0.3% and Handysize by 2.1% at the same time. This is significantly aided by the record low order book at 960 vessels through 2024, accounting for a minimal 7.3% of the global vessel count of 13.1K.

Market analysts also expect a pick-up in the demolition of older tonnage in 2023 due to the introduction of IMO 2023, which requires fleets to achieve improved energy efficiency and reduced carbon output. With over 75% of the global dry bulk fleet not complying with the new regulation, we may also see slower steaming ahead, triggering a potential reduction in fleet supply by another -3%.

Why does this matter? SBLK has notably recorded elevated off-hire days of 1.26K over the past nine months (484 days in Q3, 491 days in Q2, and 291 days in Q1), resulting in dry-docking expenses of $29M, growing by 20.9% YoY. This is primarily attributed to its ballast water installation program and upgrading efforts to comply with the new IMO 2023 regulations.

With 98% of its fleets already fitted with water treatment systems, we naturally expect the company to benefit from the upgraded fleet and optimized sailing speed ahead. Therefore, we are especially encouraged by the management’s guidance of a minimal 520 off-hire days and $19M in dry-docking expenses for 2023, suggesting its improved fleet coverage ahead.

SBLK also guided that the dry bulk demand may increase by 1.4% ton-miles, attributed to the shift of coal, grain, and minor bulk trade patterns through longer haul routes. This will further build upon the growth in coal shipments by 3.7% YoY and minor bulk by 3.2% YoY in Q3’22.

Notably, the EU and India increased their coal imports in 2022, due to the Ukraine war and higher electricity demand, respectively. These headwinds are unlikely to lift in the short term as well, due to the higher oil/gas prices by 33% compared to pre-pandemic levels. These may trigger tailwinds for SBLK’s execution in the intermediate term.

China’s Property Market May Boost Iron-Ore Demand From H2’23 Onwards

Chinese New Year festivities and surging COVID-19 infections may temporarily delay the prompt recovery of the Chinese property market. However, we expect these headwinds to rapidly lift by H2’23, with policymakers in China aiming for GDP growth of up to 5.5% in 2023 to keep unemployment at bay. These numbers are impressive indeed, since the country recorded 2022 numbers of 2.8% and 2019’s 6%.

Notably, the Hebei province aimed to achieve an even more ambitious GDP of 6% in 2023, with Liaoning expecting 5%. These two provinces matter, since Tangshan, the country’s largest steel-producing city, is located in the Hebei. The city accounted for 58% of China’s total steel output in 2022. The raised GDP target suggests a potential ramp-up in its manufacturing output indeed, after three years of Covid disruptions.

Liaoning has also been dubbed as the ‘cradle of China’s steel industry,’ since it is home to the country’s five largest iron ore mines, producing up to 58M metric tonnes of iron ore annually.

In addition, the Chinese government has poured immense stimulus packages, worth 300B Yuan ($43B) for infrastructure investments and 1T Yuan ($140B) for the semiconductor industry. These may further contribute to the recovery cadence for iron ore prices and major dry-bulk rates ahead. Edward Al Hussainy, analyst at Columbia Threadneedle, said:

The reopening story is looking quite good and … there is a lot of credit and fiscal stimulus that China is putting into the system. That stimulus is finding its way into global asset prices. (Reuters)

These numbers matter to SBLK indeed, since 89 of its 128 fleets namely, Newcastlemax, Capesize, Post Panamax, and Kamsarmax, are configured to carry major bulks such as iron ore and coal. It is noteworthy that 83.1% of its 14.1M deadweight tonnage is also attributed to major bulks (fleets between 80K dwt and 210K dwt), with up to 77% of the global Capesize fleets commonly used for iron ore transports. While the company does not publish how much of its business is attributed to China or counterparties, it has disclosed this information in its quarterly financial statements:

Economic slowdown in the Asia Pacific region, particularly in China, may have a materially adverse effect on us, as we anticipate a significant number of the port calls made by our vessels will continue to involve the loading or discharging of dry bulk commodities in ports in the Asia Pacific region. We conduct a substantial portion of our business in China or with Chinese counterparties. (Seeking Alpha)

The iron ore prospects seem bright in the intermediate term as well, with multiple Chinese banks extending over $378B of credit lines to real-estate developers over the past few months, propping up the ailing industry with increased insolvency risk.

Market analysts speculated that the government is keen on ending the decades-old practice of selling properties first and building later, especially after the catastrophic mortgage loans boycott worth $43B in Q3’22. The move from pre-sale purchases to after-construction sales may boost the flagging consumer confidence in the currently distressed real estate industry indeed. Andrew Polk, co-founder of consulting firm Trivium, said:

We think this will lay the groundwork to exit the presales model of housing. Sales aren’t going to lead construction. Construction will lead sales. (Bloomberg)

As China accounts for over a third of the annual dry bulk imports and 43.07% of global iron-ore demand at 1.12B tonnes, it is no wonder that market analysts are optimistic about a reversal of TCE rates by H2’23, attributed to the start of new constructions then. The country’s iron ore inventory is also notably much lower YoY by -14.8% to 133.6M metric tonnes at the time of writing, suggesting a strong market demand.

In the first sign of optimism, Wanda Properties Global Company recently issued a two-year US dollar bond with a yield of 12.375%, receiving up to $1.4B in orders from global investors, such as Blackrock, Fidelity, Pictet AM, Invesco, and PAG. It marked a tremendous reversal from the country’s property default crisis in 2021, which had led to the panic selling of Chinese dollar bonds then.

Terence Chia, head of debt capital markets syndicate for Asia-Pacific at Credit Suisse, said:

It was almost impossible to do any China property high-yield deal last year [after China’s property crisis]. But we started to see the market turn as a result of the Chinese government’s relaxation and supportive measures for the real estate sector, as well as the lifting of its Zero-Covid policy. (South China Morning Post)

Lastly, Chinese households grew their savings tremendously in 2022, due to the Zero Covid Policy impacting their discretionary spending. The sum grew to an eye-popping sum of $1.9T in bank deposits just within the first nine months of 2022, a number which is notably greater than Canada’s 2022 GDP of $1.64T.

There are already some early signs of a turnaround in China’s property market, with new-home sales rising at an average of 20% YoY over the first three days of the 2023 calendar year. This is especially true in big cities such as Beijing at 80%, Shanghai at 74%, and Guangzhou at 131.5%. Analysts are attributing this phenomenon to the pent-up demand after three years of lockdowns, significantly aided by developer discounts and government policies.

Therefore, TCE rates may indeed recover moderately by mid-2023, if the optimistic sentiment persists.

So, Is SBLK Stock A Buy, Sell, or Hold?

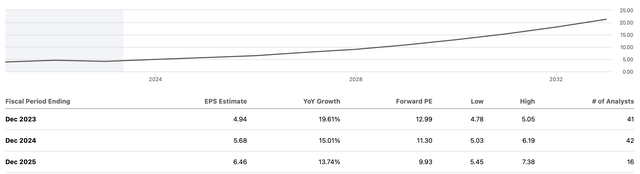

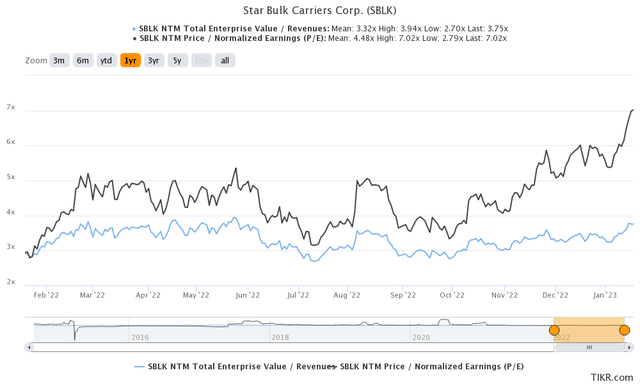

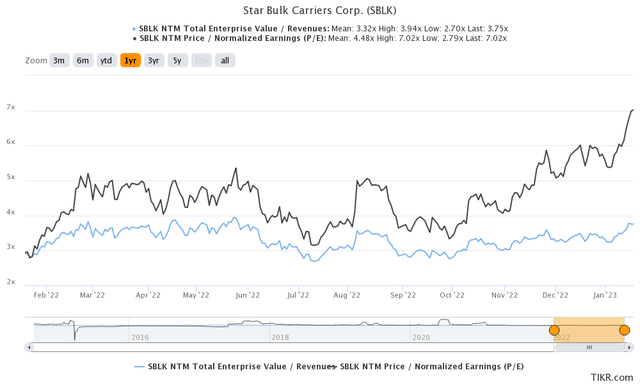

SBLK 1Y EV/Revenue and P/E Valuations

S&P Capital IQ

SBLK is currently trading at a NTM P/E of 7.02x, lower than its 3Y mean of 9.29x, though higher than its 1Y mean of 4.48x. Based on its projected FY2024 EPS of $4.77 and current P/E valuations, we are looking at a moderate price target of $33.48. These mirror the consensus estimates target of $28.33 as well, suggesting an excellent 29.7% upside potential from current levels.

Despite the highly promising China reopening and 30Y low order book, it is apparent that Mr. Market is uncertain about dry-bulker’s short-term prospects. This is likely due to the 70% chance of a recession in 2023, with the Feds’ recent meeting minutes suggesting a raised terminal rate to over 5% by mid-2023 and a pivot only from 2024 onwards.

In addition, market analysts are growingly concerned about China’s unexpected reopening as it may throw a wrench in the Fed’s battle with the rising inflation ahead. As the world’s leading importer of crude oil and iron ores, the latter two commodities have seen spot prices rallying by 14.9% and 52.7% over the past two months, respectively. These naturally trigger more uncertainties in the short term, delaying the recovery of global macroeconomics. It also remains to be seen if the pent-up demand from China is able to counterbalance the deceleration in global demand over the next few quarters.

Therefore, there is a good chance that SBLK may continue trading sideways in the short-term, before speculatively recovering by H2’23. Investors must also understand the inherently cyclical shipping and commodity industry, pointing to the stock’s speculative nature. Then again, opportunistic investors may be tempted by the projected FY2024 dividends of $4.43, suggesting a stellar forward yield of 20.2% against its 4Y average of 6.84% and sector median of 1.69%.

As a result, we rate the SBLK stock as a Buy, due to the improved margin of safety. Naturally, portfolios must also be sized appropriately in the event of volatility, since the excellent dividends may not be sufficient to cover the potentially drastic gap down from this possible volatility.

Published at Sat, 21 Jan 2023 11:00:00 -0800