Stanley Black & Decker: A Dividend King in Focus

Stanley Black & Decker, Inc. (SWK) engages in the tools and storage, industrial, and security businesses worldwide.

The company raised its quarterly dividend by 12.90% to 79 cents/share in July 2021. This marked the 54th consecutive annual dividend increase for this dividend king.

Stanley Black & Decker’s CEO, James M. Loree, commented, “I am pleased to continue our trend of consecutive annual dividend increases, which reflects the continued confidence we have in the cash generation potential of the company. A strong and growing dividend is a key element of our shareholder value proposition, and is consistent with our capital deployment philosophy to deliver approximately half of our excess capital to shareholders over the long term.” (source)

Over the past decade, Stanley Black & Decker managed to grow dividends at an annualized rate of 6.20%.

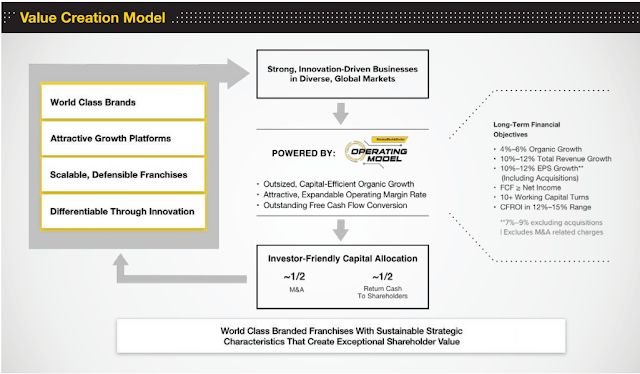

The company has managed to grow through acquisitions, notably the merger between Stanley Works and Black & Decker in 2010. In 2017 it acquired the Craftsman brand from Sears. It actively manages its portfolio of products. Growing the businesses through M&A is central to the company’s strategy

The company is looking to increase efficiencies in the supply chain to reduce cost, and increase sales in emerging markets. About 59% of sales comes from the US, 4% in Canada, 24% Europe, 8% Asia.

Stanley Black & Decker is also focused on growing its e-commerce sales, which account for $2 billion out of its $14 billion in sales.

The company is organized in three segments.

Tools & Storage accounts for 71% of sales and 80% of operating profits. The company is a leader in tools and storage. It has a portfolio of brands that tradespeople and DIY folks rely on. We are speaking about hand tools, power tools like DeWalt, Craftsman, Black & Decker etc.

Industrial accounts for 16% of revenues and 12% of operating profits. It builds solutions like preferred engineered fastening solutions in automotive and industrial channels to inflastructure solutions like hydraulic tools and attachments.

Security accounts for 13% of revenues and 8% of operating profits. The company delivers peace of mind with advanced electronic safety, security and monitoring solutions, automatic doors, and sophisticated patient safety, asset tracking and productivity solutions.

I believe that a picture is worth 1,000 words. Which is why I am including this slide from their annual report, which summarizes their value creation model.

Source: Company’s Annual Report

The company managed to reduce the number of shares outstanding between 2011 and 2016 from 170 million to 148 million. Shares outstanding are up since then due to acquisitions.

The payout ratio has largely remained between 30% and 45%, with the exception of two spikes in 2013 and 2018. Those were triggered by one-time accounting items affecting earnings per share in each of those two years.

Published at Wed, 01 Jun 2022 18:17:57 -0700