SGS: A Sustainable 4% Dividend From A Leader In The TIC Industry

Manuel Milan/iStock Editorial via Getty Images

Introduction

SGS (OTCPK:SGSOY) (OTCPK:SGSOF) is a Swiss company and one of the global leaders in the TIC industry (Testing, Inspection and Certification). The company operates all over the world using SGS as its brand name as it has worldwide recognition and is regarded as a well-known and reliable label. The company operates out of almost 3,000 offices and laboratories all over the world. About 20% of its revenue is generated in the Americas while Europe (in combination with Africa and the Middle East) accounts for 44% of the revenue. Interestingly, the APAC (Asia-Pacific) region accounts for 35% of the revenue which means this region is almost twice as important for SGS compared to the Americas.

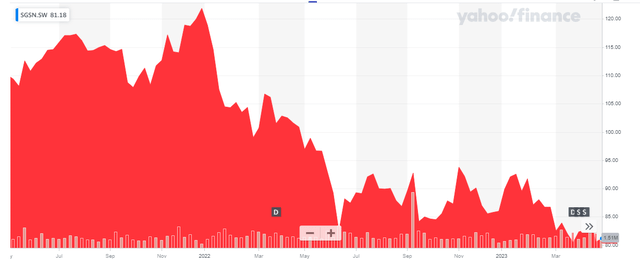

Yahoo Finance

SGS is a Swiss company and it shouldn’t come as a surprise its Swiss listing is more liquid than any of its secondary listings. The company is trading in Switzerland with SGSN as its ticker symbol and the average daily volume is approximately 435,000 shares. As there are currently approximately 184M shares in circulation (the share count as of the end of last year and adjusted for the recent 1:25 stock split where 1 share was split in 25 new shares), the market capitalization is approximately 14.8B CHF based on the current share price of around 80 CHF per share.

Being a leader in the TIC industry results in robust cash flows

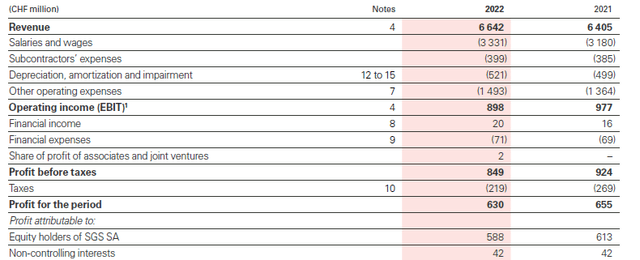

While results can always fluctuate, SGS is a pretty consistent and steady performer. The company reported a total revenue of 6.64B CHF in 2022 resulting in an EBIT of 898M CHF. This means that although the revenue increased by almost 4%, the EBIT decreased by almost 9M.

SGS Investor Relations

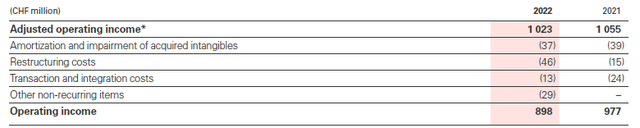

That being said, there were some non-recurring items which weighed on the reported EBIT. And granted, FY 2021 also contained some non-recurring items but to a lesser extent. The image below shows the adjusted operating income was 1.02B CHF in 2022, compared to 1.06B CHF in 2021, a decrease of approximately 3%. Still not great but definitely not as bad as the reported EBIT decrease.

SGS Investor Relations

SGS also reported slightly lower net finance expenses and a lower average tax rate which resulted in a total net income of 630M CHF of which approximately 588M CHF was attributable to the shareholders of SGS. This represented an EPS of 78.86 CHF based on the weighted average share count in FY 2022 but to make it easier to interpret, using the current share count results in an EPS of approximately 3.2 CHF per share.

As most readers know by now, I focus on the cash flow performance of a company. And as SGS is a pretty capex-light company, it usually does generate a healthy amount of operating cash flow and free cash flow.

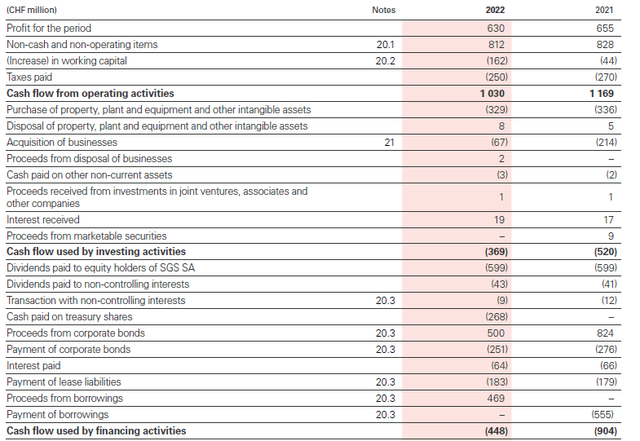

The reported operating cash flow was 1.03B CHF, but this includes about 162M CHF in working capital investments which means the underlying operating cash flow was 1.2B CHF before making lease payments and interest payments (which totalled 247M CHF). The adjusted operating cash flow was 950M CHF and approximately 980M CHF if you also use the total amount of taxes owed versus the total amount of cash taxes that was paid during 2022.

SGS Investor Relations

The total amount of capital expenditures incurred during FY 2022 was 329M CHF and in combination with the 183M CHF in lease payments, CHF spent just over 500M on capex and lease liabilities. That is pretty much in line with the incurred depreciation amortization expenses which totalled 521M CHF (including an 184M CHF depreciation and impairment charge related to the right of use assets).

Deducting the 329M CHF in capital expenditures from the 980M CHF in adjusted operating cash flow (the 980M CHF already includes the lease payments), the underlying net free cash flow result was approximately 650M CHF. Approximately 43M CHF was paid to the non-controlling interests which means the underlying net free cash flow attributable to the shareholders of SGS was approximately 607M CHF and this works out to be 3.3 CHF per share.

The company proposed and paid a dividend of 80 CHF per share on a pre-split basis, which works out to approximately 3.2 CHF per share for a dividend yield of approximately 4%. That sounds great, but the 35% dividend withholding tax rate in Switzerland is a little bit a deterrent and every investor should check if a double tax treaty applies to his/her personal situation.

SGS Investor Relations

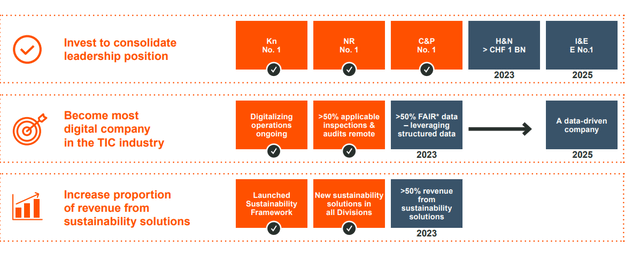

Investment thesis

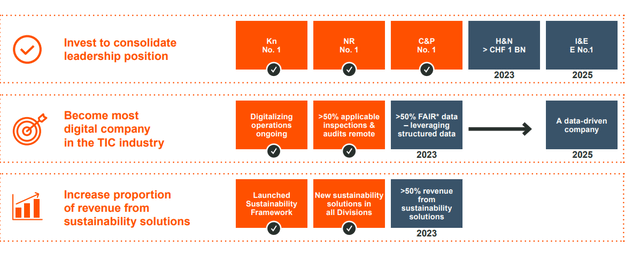

This means SGS is currently trading at a free cash flow result of just over 4% which is not cheap at all. While I understand quality has its price, I’m not particularly keen on investing in stocks with a free cash flow yield that’s barely higher than investing in bonds. That being said, SGS has a strong position in the TIC market, and I expect the market to grow while SGS will likely be able to at least maintain its market share so I’m definitely not dismissing an investment in SGS.

The company is also guiding for a mid-single digit organic growth rate this year and higher margins. This means the 3.3 CHF in adjusted free cash flow will likely increase by a high single digit percentage and it is now very likely the FCFPS will exceed 3.5 Swiss Francs. And as SGS likes to buy back shares, its share count will likely decrease again by a few percent which will prove to be more valuable in the future as well. And let’s also not forget SGS is in an excellent position to pursue M&A and bolt-on acquisitions could be very helpful to create economies of scale and synergy benefits.

While the 4% dividend yield is pretty attractive for investors looking to invest in CHF, it is important to take the high dividend withholding tax into consideration.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Published at Sat, 06 May 2023 08:45:00 -0700