Rubis Fundamentals Unfazed By Geopolitical Tensions

André Muller/iStock Editorial via Getty Images

Rubis (RBSFY) is one of our largest holdings, and we discuss it mostly on our service, the Value Lab. With all that’s happening in Ukraine, we’ve reviewed our portfolio, which is by the way outperforming benchmarks by 15% YTD thanks to an overwhelming exposure to defense with Dassault Aviation (OTCPK:DUAVF) and Palladium, including Rubis. While the trading operations, which have been a major source of profitability during this commodity centric period, are at risk from sanctions, it represents a small part of the business, and everything else has unit margins. We don’t foresee negative volume effects as travel continues to recover to offset reduced retail activity due to higher prices.

Segment Overview

To get an idea of the business, we’ll run through the segments and some of the most interesting points with each.

Retail and Marketing

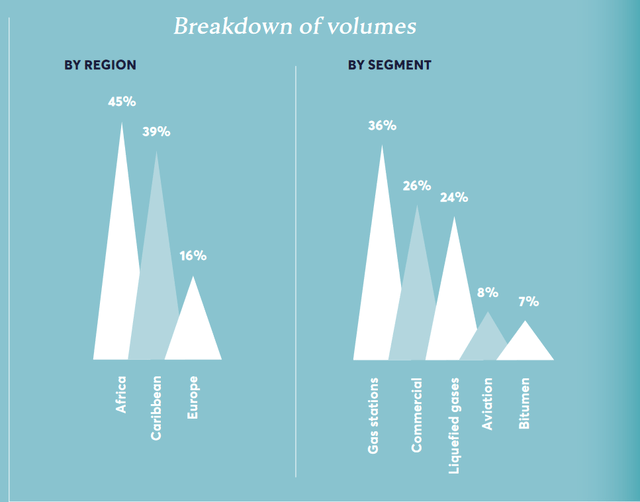

This segment includes gas stations and other downstream channels by which Rubis provides its various products, bitumen, LPG, petrol etc. to commercial and retail clients. A lot of this exposure is gas stations, and a lot of gas stations are in Africa. Some of this exposure is also aviation which has been hit hard.

Revenue Split (Annual Report 2020)

It’s good news that a lot of this dirty business is located in Africa where electrification initiatives are going to be substantially delayed, keeping the retail and provision of these products relevant. Some of their exposure is also in more troubled Caribbean nations like Haiti, where unfortunately the developing market status does more harm than good. Other Caribbean exposure is highly developed such as French departments like Martinique.

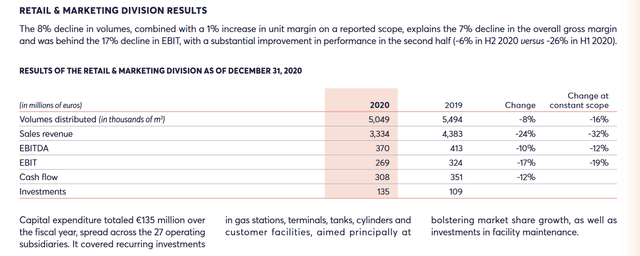

This sector uses markups, especially in gas stations, in such a way that is usually government regulated although sometimes company policy, whereby the absolute margin remains very constant. By charging an absolute markup on many of these activities, Rubis was able to have a more resilient bottom line than it’s topline, since its bottom line has a guaranteed unit margin where volumes are the main driver of change.

Rubis Retail (Annual Report 2020 Rubis)

The drivers of performance here over our investment period will be a recovery in tourism and a continued recovery in commercial activity and industry, with industrial closures likely forever behind us (look at the inflation that resulted). This should increase volumes and grow the EBITDA.

Logistics/Refinery

This is a bit of a catch-all segment that connects the downstream further upstream. There’s the trading and shipping business. Shipping is of course in very high demand right now with all the logistical bottlenecks. The trading business is also attractive in times of volatility, but investors should be aware that this segment could be the one that gets targeted among all energy companies in order for the west to not appear impotent and sanctions something in the Russian energy sector. If such sanctions were to happen, there will have to be a bit of a reshuffle, but it shouldn’t be a big problem for Rubis given the whole segment is just 13% of revenues.

And then there’s the port and pipe business which is focused on Africa specifically Madagascar. Tourism is the driver of this segment in Madagascar as well as other industry like mining.

The rest of this business is focused on the French departments in the Caribbean and South America, so developed markets, accounting for about 33% of the cash flow of this segment. Here they have a majority ownership in the Antilles refinery which produces product for these French departments with a price and margin. Thanks to this, the refinery business did not get demolished by this year’s terrible crack spreads, it actually grew. This segment is known as SARA.

Logistics, Trading and Supply (Rubis Annual Report 2020)

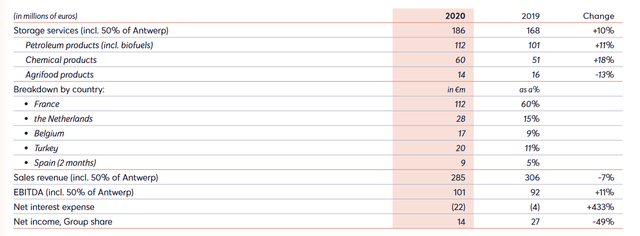

Terminals

This business is a JV and it contains the terminal assets including the recently acquired Tepsa in Spain which increased the JV’s capacity by 30%. Despite the acquisition, which increased the net debt of the J.V and thus the interest income, the sale of the Rubis stake in the J.V to their partner is the reason why the overall group net debt declined dramatically.

The Tepsa acquisition was technically dilutive, but due to the increase in non-oil terminal exposure that it offered, it makes sense that the multiple would be higher than Rubis’.

Terminals Financials FY 2020 (FY 2020 Report)

Again much of the activities are focused in developing markets here, and this is great since at the same time, more of the products stored are harder to oust non-oil based products. With the EU especially moving towards electrification, this is a valuable hedge away from oil while benefiting from stability effects offered by developed market economies. The biofuel exposure is also attractive due to the ridiculously low incremental costs for European refiners to make it, and the attractive markets of biofuel in harder to electrify modes of transport like freight. The EBITDA above excludes the Tepsa acquisition, and the proforma EBITDA were Tepsa to have been included is 127 million EUR.

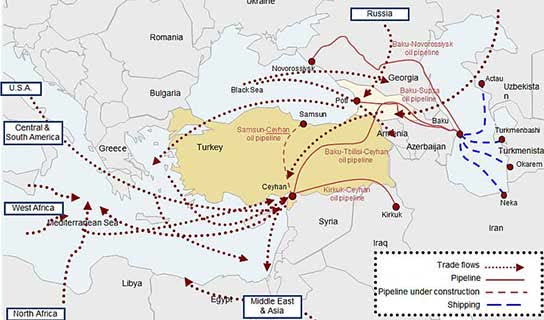

The only exposure here that was a bit testy was the terminals in Turkey.

Turkish Terminals (Rubis Terminals Website)

The terminals in Turkey were more exposed than the other Rubis terminals, all located in Europe, to Russian trade flows. While it doesn’t appear that hard sanctions are going to hit the oil sector, reduced trade flow through these routes, where it would then be more likely to go east where there is real industrial demand, wouldn’t be great for that asset. In any case, these terminals in Turkey have been sold just now in January, and no longer constitute a risk at all.

The Solar Panel acquisition is not yet closed, and therefore not yet consolidated.

Valuation

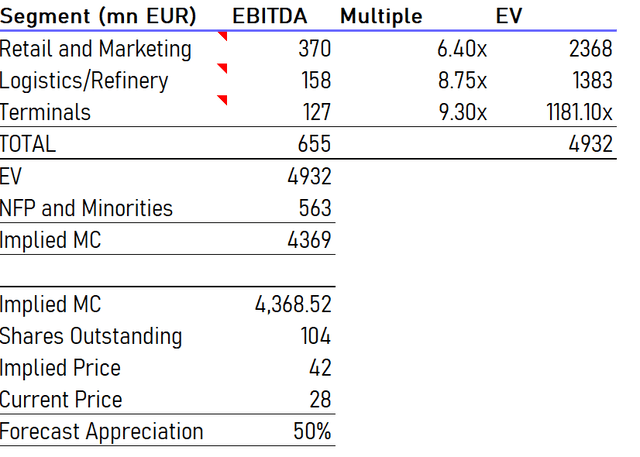

Taking the Macquarie Infrastructure Corporation sale of the IMTT business last year at a multiple of over 9x, you have a multiple for the terminal business. SARA could be valued using refinery multiples, which trade around 10x these days in the Gulf Coast. We’ll blend that down to what shipping companies were trading at in years past (around 7.5x). While it’s hard to find a gas station pureplay, it’s not hard to imagine that it might sell at least the current blended Rubis multiple of 6.6x, meaning the valuation gets heavily averaged up by the other segments which account for 50% of the EBITDA.

Valuation

Conclusions

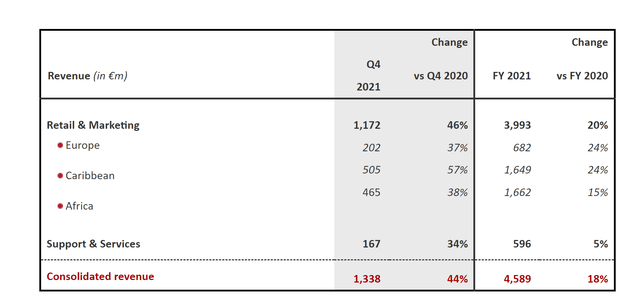

The most recent quarter has been reported, and while there’s no annual report yet, we get the typical taste of Rubis’ resilience. Everything is stable, and ultimately depends on the volumes passing through the Rubis infrastructure and gas stations.

Revenue Evolution (Q4 PR Rubis)

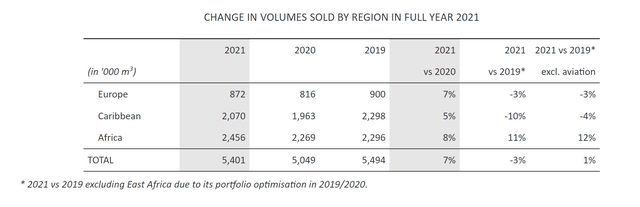

Oil prices have of course risen substantially these days in connection to the fears around Russia, and the higher price could become an issue for the volumes of gas sold. However, the overall picture is changing, with much of the recovery to pre-COVID levels in terms of volumes occurring as a consequence of the recovery in travel, which was particularly problematic for the quite relevant Caribbean region.

Volume Evolution (Q4 PR Rubis)

Logistics constraints and unusual unit margin economics on the French Antilles refinery mean that trading, shipping and logistics segment continues to deliver superb growth.

Overall, the moving parts in Rubis’ picture point to continued benefits from the commodity environment in the SARA business, and offsets in terms of the volumes coming through their retail operation. The dividend remains attractive at above 6%, and we remain comfortably long, waiting for an infrastructure fund to buy the whole thing for a nice premium.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Published at Sun, 27 Feb 2022 17:39:59 -0800