PayPal: Now Beyond Dirt Cheap (Rating Upgrade)

Justin Sullivan

I recently increased my stake in PayPal Holdings, Inc. (NASDAQ:PYPL), doubling down on the stock in my All-Weather Portfolio, bringing my average price per share paid to approximately $70. Can you believe that PayPal’s stock peaked at more than $300 in 2021 and has dropped by a whopping 80% since then?

Yes, PayPal was overbought and overvalued around its highs. However, the drop in PayPal’s stock has brought its share price down to an absurd level. PayPal’s fundamentals remain robust even as the company battles through the overall slowdown process. Furthermore, PayPal’s recent earnings beat estimates, and the company provided solid guidance, given the challenging economic atmosphere.

Nevertheless, instead of rallying, PayPal’s stock dropped like a rock to a new multi-year low after its earnings results, primarily due to a downgrade from the experts at Credit Suisse Bank. Despite the company’s temporary challenges, PayPal remains a high-growth candidate, and its stock price is now at a meager 11 times the consensus forward EPS estimate. PayPal has a strong probability of continuing to increase revenues at double-digits, providing significant EPS growth and enabling its stock price to rise substantially in the coming years. PayPal’s stock is beyond cheap now. It’s ridiculous, and I am using this remarkable buying opportunity to accumulate shares for the long haul.

From A Technical Standpoint – PayPal Is A Buy

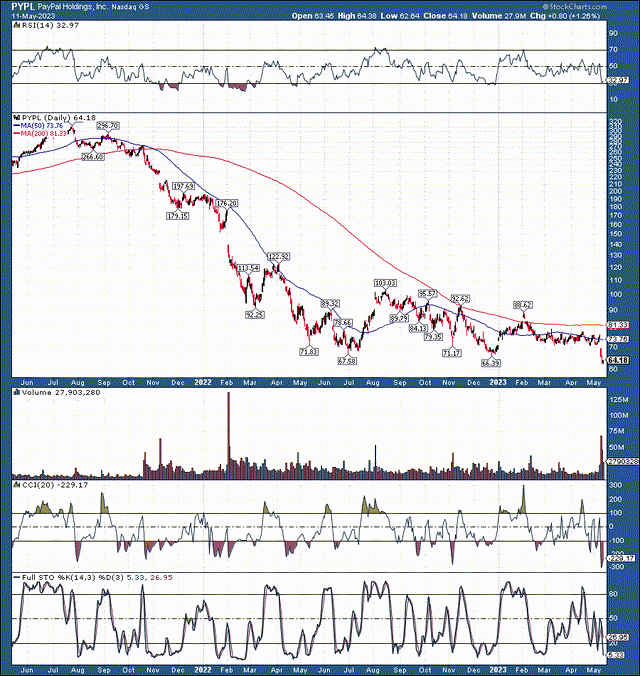

PYPL (stockcharts.com)

We see that much of the meltdown occurred during a year-long bear market from July 2021 to July 2022. PayPal’s stock has been trading sideways and slightly lower over the last year. Most recently, PayPal dropped to a new multi-year low at about $62-63. The RSI, CCI, full stochastic, and other technical indicators illustrate that PayPal’s stock is extensively oversold, likely has minimal downside, and has a high probability of recovering and moving much higher in the intermediate and long term. The latest wave of selling appears like irrational panic selling, reminiscent of capitulation in PayPal’s stock. This phenomenon implies that investors and traders are dumping the stock, despite a possible bottom being near.

Strong Earnings – Even in Tough Times

Like most companies today, PayPal is going through a temporary slowdown and decreased profitability phase due to external economic challenges. Nevertheless, the company’s recent earnings came in better than expected. PayPal delivered non-GAAP EPS of $1.17 vs. the $1.10 consensus estimate. Also, the company beat revenue estimates, growing sales by 8.3% YoY to $7.04B. The company’s better-than-expected results materialized due to robust growth in the e-commerce industry and effective cost-cutting measures. Furthermore, PayPal raised its full-year 2023 EPS growth guidance from 18% to 20%, bringing the anticipated full-year EPS number to $4.95 vs. prior guidance of $4.87.

The Takeaway – The market became too bearish on PayPal Holdings, Inc., and sales and earnings revisions decreased too much. Now PayPal is beating estimates, and this dynamic could continue as we advance. As the slowdown moderates and the macroeconomic condition improves, PayPal should return to low double-digit revenue growth, and the company’s EPS should continue increasing substantially in the coming years. At 13 times this year’s EPS estimates and 11 times 2024 EPS projections, PayPal’s stock is remarkably cheap, and its multiple should increase with the company’s stock price in future years and quarters.

So, Why is the Stock Tanking Instead of Surging, You Say?

Let’s ask Credit Suisse Group AG (CS) analyst Timothy Chiodo, who downgraded the stock to a hold, lowering his price target to $85 (still a 33% upside from here). Mr. Chiodo cites margin pressure and other variables affecting profitability in the near term. However, Chiodo could become more constructive on the shares if he sees the “potential for a resumption of more meaningful total company gross profit growth in 2024 and beyond.”

Am I the only one who sees a problem here? First, who downgrades a stock when it’s around a 52-week low? Second, the stock price is close to $60, and the analyst’s “downgraded” price target is $85, roughly 33% above PayPal’s current price. Also, where was Mr. Chiodo when the stock dropped 80%? In my view, downgrading PayPal’s stock from a buy to hold down here is pointless and misleading. Fortunately, this nonsensical dynamic provides a substantial buying opportunity here.

What The Other Wall St. Guys Think

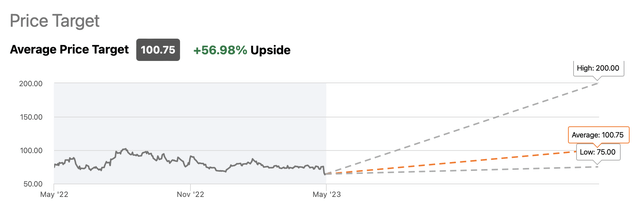

Of the 47 Wall St. analysts covering PayPal, 23 have it rated as a strong buy, 11 as a buy, and 13 as a hold here. There are no sell or strong sell ratings on the stock.

PayPal price targets (seekingalpha.com)

While we have a relatively broad price range for PayPal, the average one-year price target is approximately $101 on the stock. As the stock is around $64 now, the average estimate provides around 58% of potential upside over the next twelve months.

Valuation – Now Beyond Cheap, and It’s Ridiculous

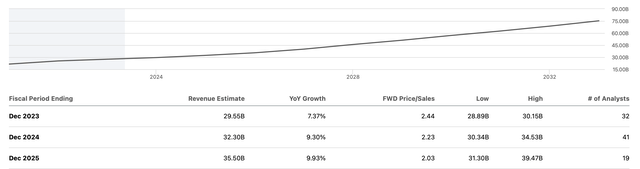

Revenue Estimates – Likely Lowballed

Revenue estimates (seekingalpha.com )

Consensus revenue estimates have come down during the slowdown phase, but we’re seeing PayPal surpass the recent projections. Therefore, we could see PayPal continuing to outperform the overly depressed sales estimates, returning to 10-12% revenue growth in the coming years.

EPS Estimates – Likely Moving Much Higher

EPS estimates (seekingalpha.com)

We have the average EPS estimate at $4.94 this year, but let’s presume that PayPal can earn $5. Also, with a 20% YoY EPS growth rate, PayPal can provide about $6 next year. At around $64, a potential double-digit revenue growth rate, and earnings increases ahead, PayPal is beyond dirt cheap here. We’re looking at a stock with a long growth runway and significant profit potential trading at 10-12 forward EPS estimates. Furthermore, utilizing consensus estimate figures, we now arrive at a meager PEG ratio of just 0.65 for PayPal. As the economic slowdown moderates and more liquidity returns to the market, PayPal’s valuation will likely increase to a forward P/E ratio of 20 or higher. This dynamic should enable PayPal’s stock to rise sharply due to a combination of EPS growth and multiple expansion in the coming year, making PayPal one of my top buy-and-hold stocks for the next 3-5 years.

Where PayPal’s stock price could be in the coming years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $30 | $34 | $38 | $42.7 | $47 | $52.5 | $58 |

| Revenue growth | 8% | 13% | 12% | 12% | 11% | 11% | 10% |

| EPS | $5 | $6 | $7.14 | $8.50 | $10 | $11.80 | 13.85 |

| EPS growth | 20% | 20% | 19% | 19% | 18% | 18% | 17% |

| Forward P/E | 10.5 | 15 | 18 | 20 | 19 | 19 | 18 |

| Stock price | $64 | $111 | $153 | $200 | $225 | $263 | $300 |

Source: The Financial Prophet.

I am using standard (higher-end) estimates to achieve my projections. However, the company could reach higher than anticipated revenue growth, upwards of 15%, in a bullish scenario in the coming years. Also, the company could become more efficient, leading to higher EPS growth. Moreover, PayPal’s multiple can expand sooner and move above twenty, enabling the stock price to appreciate quicker than anticipated. Therefore, PayPal’s stock price is highly likely to appreciate significantly, making it one of the top stocks to buy and hold in the coming years.

Yes – There are Risks

Of course, as with almost any investment, there are risks involved. PayPal Holdings, Inc. may face more significant margin compression. This dynamic will make achieving the projected EPS and revenue growth figures more difficult. Moreover, macroeconomic factors, completion, and other elements may weigh on the stock price for some time. Additionally, PayPal Holdings, Inc.’s multiple may not expand as envisioned, and its stock price could stay depressed or appreciate less than anticipated as we advance.

Published at Fri, 12 May 2023 08:56:31 -0700