Michael Vi

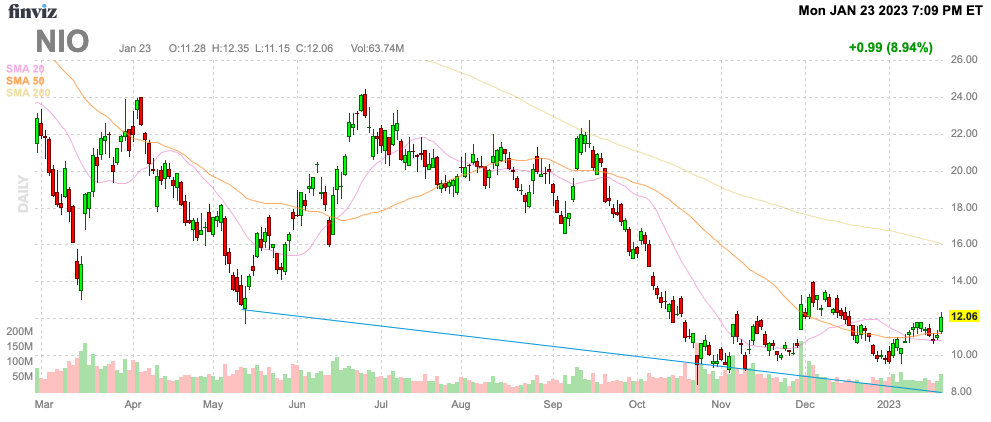

The China reopening should’ve been a huge boon to electric vehicle (“EV”) auto manufacturers in the communist country. NIO Inc. (NYSE:NIO) has hardly rallied in the last 3 months despite a huge rally in other Chinese stocks due primarily to Tesla, Inc. (TSLA) announcing price cuts on EVs in the country. My investment thesis is Bullish on NIO due to likely temporary price cuts by the EV giant hitting the stock for now.

FinViz

Tesla Price Cuts

Back on January 6, Tesla announced price cuts for the Tesla 3 and Model Y produced at the Shanghai Gigafactory. The EV giant again cut prices of the vehicles in China, leading to a 13% to 24% total reduction in prices from September levels, according to Reuters.

For January, Tesla slashed the Model 3 and Model Y prices from 6.0% to 13.5%, in part due to rising interest rates and the end of a subsidy program in China. The moves were expected to make the EVs more affordable to consumers.

The issue is that Tesla had horrible deliveries for December, with only 55,796 EVs delivered in China. Other Chinese EV manufacturers saw a huge rebound in December deliveries, while Tesla saw a 44% drop from November in a major question regarding demand as competition rebounded to the end of the year.

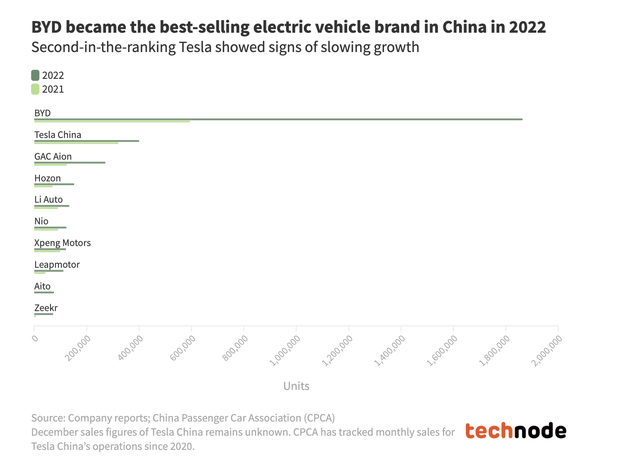

Tesla faces a scenario where Chinese automakers from NIO to Li Auto (LI) are pressuring the company for vehicle sales. Total EV sales for 2022 show Tesla’s market share dipping in the Chinese market, with nearly 6.5 million EV sales.

TechNode

According to Dan Niles, an informal survey conducted by Wedbush Securities of over 500 prospective EV buyers in China showed they were now more likely to consider a Tesla. In total, the survey suggested 76% of participants find a Tesla EV more compelling versus BYD (OTCPK:BYDDF) or even NIO. The survey is very limited and conducted by a historical Tesla bull.

NIO recently launched the ET5 electric sedan to compete directly with the Model 3 from Tesla, with an original starting price of $46,100. Ironically, the company planned to sell 10,000 monthly units of the ET5 right before Tesla started making price cuts. NIO only sold a total of 8,973 premium smart electric sedans, including 1,379 ET7s and 7,594 ET5s, during December.

NIO

The company has innovative battery swap technology, with 1,315 Power Swap stations in the county allowing for a quick 3-minute swap of the battery versus a lengthy charge. In addition, the new smart SUV has a battery capable of holding a charge far beyond the 358 miles listed by the Model 3.

The Gift

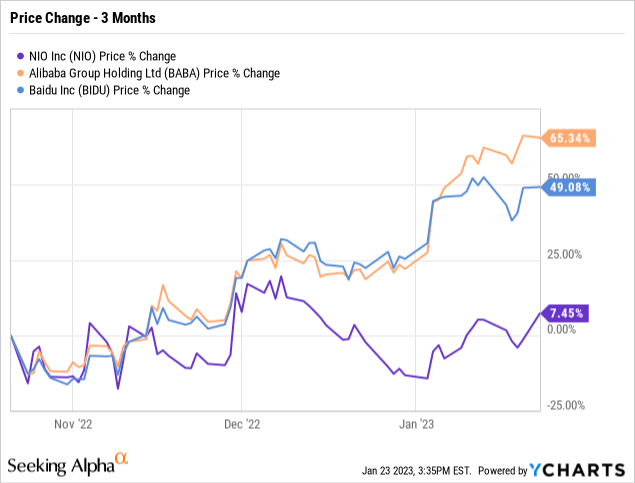

The multiple EV price cuts by Tesla in China have held NIO back from rallying in the last 3 months on signs of a Chinese reopen from covid lockdowns. Over the course of this period, Chinese tech stocks like Alibaba Group (BABA) and Baidu (BIDU) are up 50%. During this period, NIO is only up a meager 7% due to concerns about a price war, with other Chinese EV manufacturers cutting EV prices as well.

NIO did jump 9% on Monday to erase a loss entering the week for this 3-month period. A similar rally to the tech giants would have the stock trading in the $16 to $17 range.

Investors can now buy NIO knowing the stock hasn’t fully factored in the covid reopen that has already occurred. The biggest risk is that Tesla presses margins to a point where NIO needs to use growth in 2023 to generate a big improvement to the large ongoing losses.

Consensus analyst estimates have NIO producing losses for the next 2 years before – only 3 analysts are listed with estimates for a 2025 profit. In essence, most analysts aren’t even providing Wall St. with positive EPS estimates for the stock.

Seeking Alpha

NIO reported record revenues of $1.8 billion in Q3’22, and sales reached a record of 15,815 deliveries in December setting up a big quarter ahead. After several weak monthly delivery totals, the Chinese EV manufacturer ended the year with November and December combining for nearly 30K deliveries to almost match the 31,607 vehicle number from all of Q3’22.

The company is forecast to produce massive sales growth in 2023 following some very weak monthly sales during the 2022 covid lockdowns. NIO was still forecast to produce a large $0.71 loss this year and a pricing war, even temporarily, isn’t going to help the profit view.

Even the much improved sales on the Q3 earnings report included a larger adjusted operating loss of $458 million due to a lower margin from sales not matching production goals. The forecasts for vastly smaller losses by Q1 change the equation of NIO burning out of control amounts.

A scenario where these price cuts lead to ongoing $400+ million quarterly losses with no end in sight could stall any delayed reopening rally in the stock. NIO has a $7.2 billion cash balance to fund investments for growth, but investors don’t want to see the company burn all of this cash on ongoing losses.

Takeaway

The key investor takeaway is that NIO Inc. remains a trading stock and not necessarily a long-term investment, considering the competitive EV market in China. The lack of a rally due to the EV price cuts in China by Tesla gives investors a chance to buy a beaten-down Chinese stock with the covid reopening now de-risked.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Published at Tue, 24 Jan 2023 14:32:56 -0800