NIO Struggles To Adapt To Changing Market Realities

Andy Feng

Past coverage

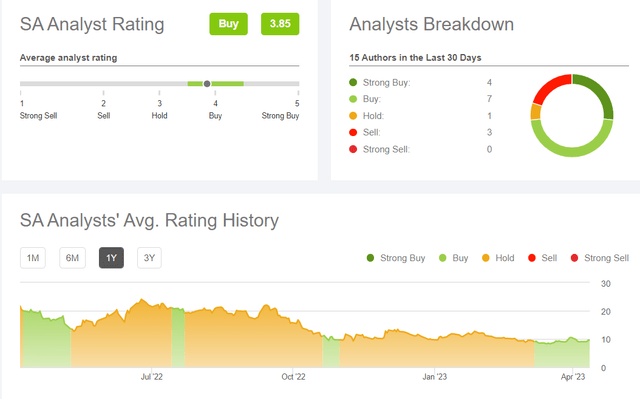

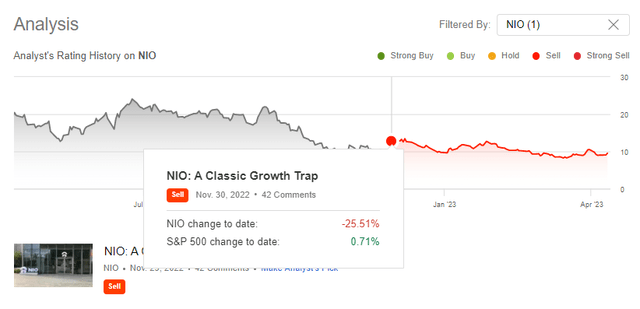

In my entire time as a Seeking Alpha author, I have written only once about NIO Inc. (NYSE:NIO) – that was on November 30, 2022, when the stock rose to $11.34 after a protracted decline and multiple contractions common to almost all growth companies at that time.

Seeking Alpha, my coverage of NIO stock

At that point, I looked at the trend of declining demand in the Chinese market and the inflated hopes for “the grand reopening.” Now I have decided to take another look at the company and the available data that may refute or confirm my old conclusions.

NIO And Its Place Among EV Makers

According to the company’s recent 6-k filing, NIO designs, develops, manufactures, and sells premium smart electric vehicles, focusing on innovations in autonomous driving, digital technologies, electric powertrains, and batteries.

In 2022, Mainland China was the largest market for electric vehicles [EVs], with 5.9 million units sold, representing 59% of all EVs sold worldwide. In 2021, EVs made up only 15% of light vehicle sales in the region. However, in 2022, their market share had risen significantly to 22%. This is an infinitely large market in which many investors have high hopes, which should undoubtedly explain the high valuation premium to some extent. And since NIO’s sales are mostly concentrated in China, it’s important to see its place in this fast-growing market:

![Jefferies, April 2023 [proprietary source]](https://stocksdividends.com/wp-content/uploads/2023/04/3hvFLB.png)

Jefferies, April 2023 [proprietary source]

Jefferies’ chart looks a bit outdated – by at least 2 calendar years. In the calendar year 2022, NIO delivered 122,486 vehicles, while the overall Chinese NEVs (New Energy Vehicles) market recorded sales of 6.89 units [+93.4% YoY]. That is, NIO in FY2022 accounted for about 1.78% of the total NEV market and about 0.46% of the total Chinese automotive market [26.86 million units]. So to date, NIO occupies about the same space you see in the Jefferies chart.

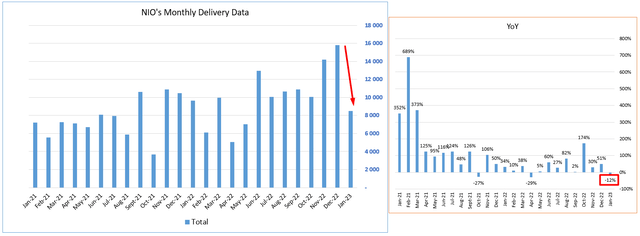

From an operational point of view, the recent past seems very good indeed. NIO had a successful Q4 2022, delivering a record-setting 40,052 vehicles, which is a 60% increase from the previous year. NIO’s December delivery count was 15,815, up 50.8% from the previous year, and its total vehicle deliveries in February 2023 amounted to 12,157, an increase of 98% from a year ago. In the fourth quarter, vehicle sales reached RMB 14.8 billion, marking a YoY increase of 16.2% and a QoQ increase of 23.7%.

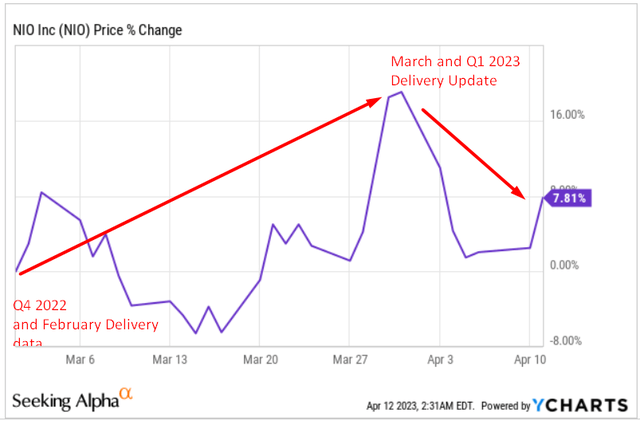

The company’s shares began to recover slightly – 3 weeks after the release of February delivery data, the CEO gave an interview to Bloomberg in which he expressed confidence in achieving the company’s target of selling 250,000 electric vehicles this year. Mr. Feng cited the introduction of new models, the expansion of charging and battery-swapping swap networks, and the development of autonomous driving technologies as ways to achieve the goal.

The high expectations sparked a new round of hope, sending NIO shares up >20% in a matter of days. However, when the March delivery data were released, some believers started to flee:

YCharts, author’s notes

What happened?

Despite all the hopes of China opening up and a sharp increase in demand for premium vehicles, NIO delivered only 10,378 vehicles in March 2023, the first year-on-year decline in deliveries in many months:

Author’s work, cnevpost.com data

This is a pretty bad sign for NIO in my opinion, especially if we remember Tesla’s (TSLA) and BYD’s (OTCPK:BYDDF) price cuts – most likely some of the Chinese buyers have migrated to cheaper segments or more affordable premium NEV manufacturers. I drew your attention to NIO’s position in its market for a reason – with less than 2% of the NEV market share, the company has absolutely no pricing power. Given the current downward trend in prices, NIO’s management decision to maintain prices may negatively impact the company’s potential for future business expansion, in my view.

No price cuts planned: NIO has no plans to cut prices for, or release affordable versions of, its flagship models to counter recent price cuts by competitors, Pu Yang, assistant vice president of sales operations, told Chinese reporters on Tuesday. A NIO spokesperson confirmed the report.

Source: technode, emphasis added by the author

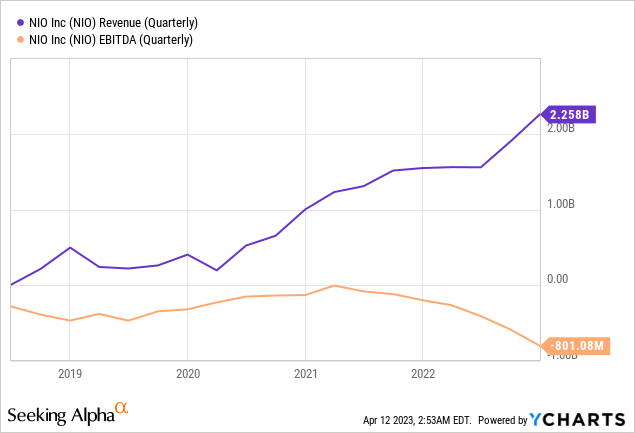

When we look at the company’s quarterly financial metrics – which include data for the most recent Q4 2022 – it shows that EBITDA breakeven is moving further and further away from the revenue figures. These 2 metrics are actually negatively correlated, when in fact it should be the opposite – the company continues to burn money in huge amounts, asking investors to look further into the future to see their potential benefits.

The reality today is that the middle class in China is less and less willing to spend money on new cars. That’s the conclusion I come to when I look at the recent Credit Suisse study, in which analysts at the bank’s Chinese branch present interesting statistics from a recent survey:

![Credit Suisse, China Quantitative Insight, [April 4, 2023 - proprietary source]](https://stocksdividends.com/wp-content/uploads/2023/04/mhVIgz.png)

Credit Suisse, China Quantitative Insight, [April 4, 2023 – proprietary source]

The desire to buy a car in the next 6 months is still very low – people prefer to put money on deposits, most likely due to economic uncertainty in the region. What can we say about premium cars – especially from a manufacturer that has no intention of giving you a concession [i.e. price cut]?

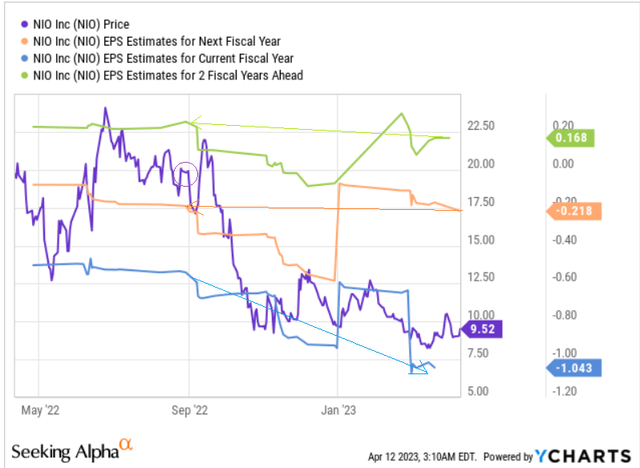

One of NIO’s main concerns – besides the price elasticity of demand for its products in an economic downturn – is its current market valuation and high expectations. The CEO is not reaching into his pocket for a word and promising mountains of gold – at least it seems that way to me. This leads the Street to keep reassessing its growth prospects by raising its EPS and price target. But NIO’s reports again disappoint the market, and its shares slide lower despite all the buy recommendations.

![TrendSpider Software, Seeking Alpha's data [author's compilation]](https://stocksdividends.com/wp-content/uploads/2023/04/KMrF0a.png)

TrendSpider Software, Seeking Alpha’s data [author’s compilation]

I think it will be the same this time. If you look at the EPS revisions in the dynamics of last year, where NIO fell ~52%, you’ll see that the current estimate of future EPS numbers [FY24 and FY25] is back to about where it was in mid-2022 when NIO stock was trading at ~$19-20:

YCharts, author’s notes

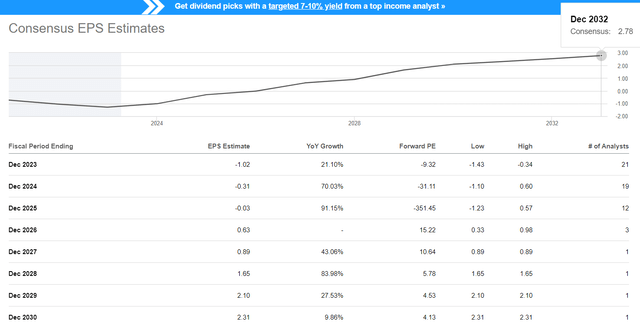

The main hit to the company’s EPS comes on the FY2023 numbers – analysts expect the company to come away with a slight scare this year but catch up very quickly next few years:

Seeking Alpha, NIO’s Earnings Estimates

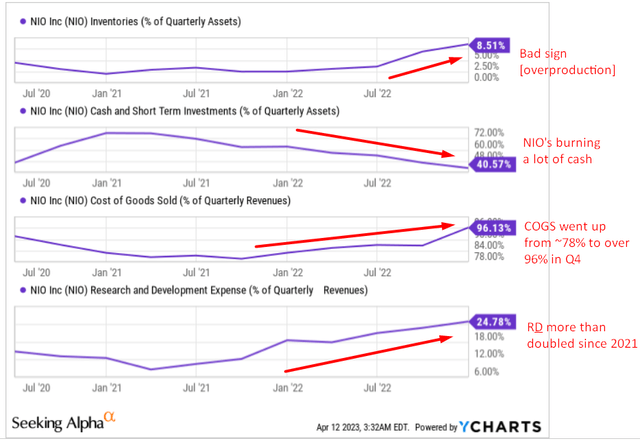

And at the same time, when I look at the company’s key production metrics, I realize why NIO did not want to cut selling prices – it already spends more than 96% of its revenues on costs[COGS], is quickly burning through any remaining cash, and is increasing inventory in the warehouse.

YCharts, author’s notes

So the problem of overproduction, raised by UBS analyst Patrick Hummel just recently, seems particularly acute at NIO:

OEMs argue with pent-up demand, but that expectation is not supported by latest macro trends. Given the bullish production schedules, we see high risk of overproduction and growing pricing pressure as a result,” the team told clients. “The price war has already started unfolding in the EV space, and we expect it to spread into the combustion engine segment in H2.”

Source: Seeking Alpha [April 5, 2023]

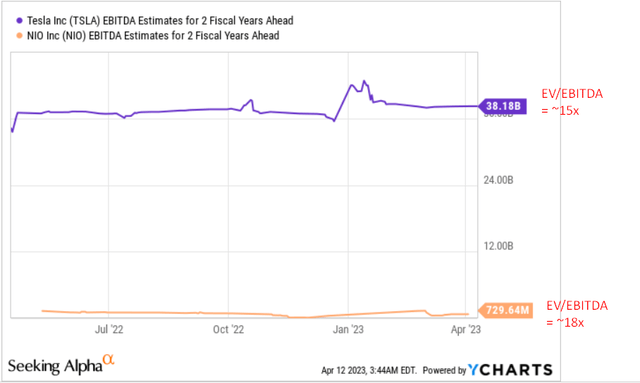

Yes, if you compare NIO’s 1-year forward price-to-sales ratio of 0.893x, it seems much lower than Tesla’s 4.4x – however, all NIO bulls are not advised to move down on the P&L to avoid getting upset. If we look at the estimated EBITDA numbers 2 years ahead and derive the valuation of these two companies from the current enterprise value, NIO is overvalued by 20%:

YCharts, author’s calculations

Concluding Thoughts

Of course – NIO carries a premium in its valuation for above-average growth rates going forward, so my conclusions about comparative overvaluation may be untenable. But what’s the point of doubling revenue if you give more than 90% of it to COGS%? Of course, I am exaggerating – most likely the decline in gross profit margin is just a temporary phenomenon that will pass once NIO fully completes its entry into European markets and Chinese consumers want to spend money on luxury cars again. Tesla, to which NIO is constantly compared, once had complex and relatively similar operational problems. At the time, however, Elon Musk’s company was a pioneer in the industry as a whole. Today, NIO is just a niche player, one of many in the market, with a negligible share and no moat, in my opinion.

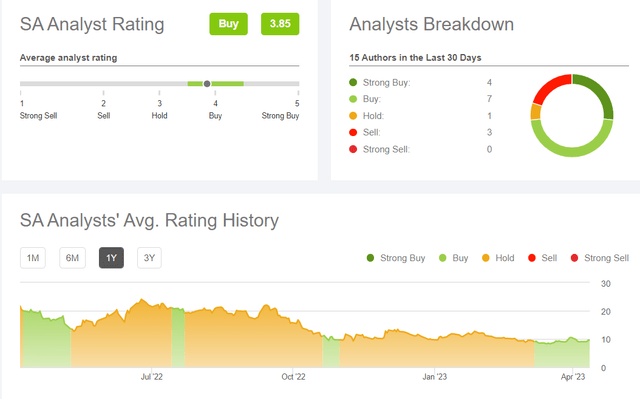

NIO stock has sold off and capitulated in recent months – as you may have seen in one of the charts above, the stock is now near its local bottom. As a result, many bulls have been speaking out recently, predicting strong recovery growth for the stock shortly.

SA Analyst Ratings, NIO stock

This is not the first time I take a contrarian position. I reaffirm my earlier Sell rating as I expect demand to continue to weaken and NIO to struggle to capture the NEV market in China and globally. I do not rule out the possibility that NIO stock could rise quickly as a result of a short position closing or a new round of optimism in the market – there could be many reasons, but it’s unlikely that they are fundamental. I expect new lows – at the very least, NIO should retest its $8 low, which would represent a 16% decline to the current share price.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Published at Wed, 12 Apr 2023 08:03:39 -0700