My Top 3 Picks For 2022 Revisited: 2 Huge Winners, But Google Falters

JHVEPhoto

In my last article of 2021, I gave my top long-term picks heading into 2022. Now that we are more than halfway through a turbulent year, an update is in order.

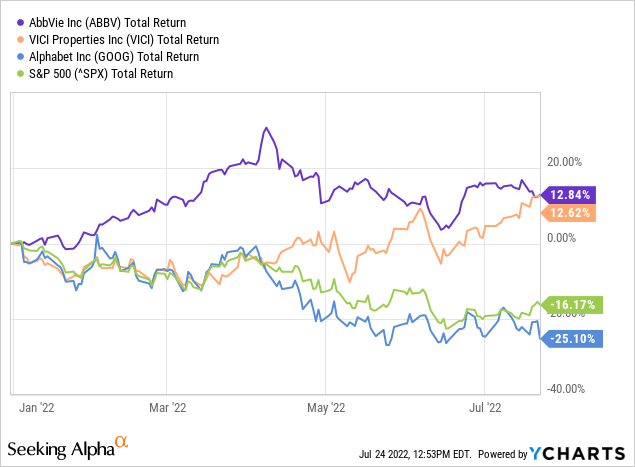

AbbVie (ABBV), VICI Properties (VICI), and Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) were the picks. The first two were geared toward income, as much of the economic writing was on the wall. I chose Alphabet as a growth pick as its valuation was reasonable and margins impressive.

AbbVie and VICI have been absolute standouts returning more than 12% year-to-date (YTD) and beating the S&P 500 by 29%. Alphabet has lagged and now sits off 25% YTD and 9% off the market’s pace. All eyes are on Tuesday’s earnings release.

It’s hard to believe that when that article was published: the Federal Reserve had yet to raise rates; Putin had not invaded Ukraine; a gallon of regular averaged $3.32; heck, even Will Smith’s palm hadn’t been formally introduced to Chris Rock’s face.

May you live in interesting times.

The broader market has tumbled on recession fears, rate hikes, and plummeting consumer sentiment. But there are bright spots. Unemployment remains low, and many companies are posting impressive results.

Let’s look at each stock and see if staying the course or altering strategy is the best move.

Is Alphabet stock still a good long-term pick?

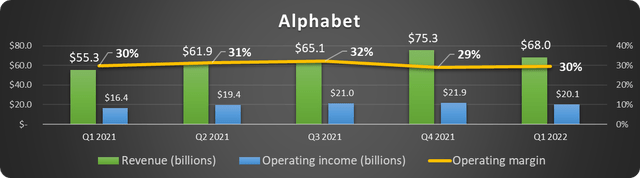

Q1 2022 results showed consistent performance.

Alphabet posted a strong Q1 2022 and has dropped on fears of an advertising slowdown. There has been some misconstruing of its Q1 earnings. One article I read (definitely not published by Seeking Alpha) explained that expenses were up in Q1 2022, so the company’s net income dropped to $16.4 billion from $17.9 billion in Q1 2021. That is not what happened.

Alphabet’s revenues rose 23% in Q1 2022 year-over-year (YoY), and it posted an impressive operating income of $20.1 billion, a 22% increase YoY. The operating margin remained steady at 30%. In other words, expenses rose at a similar rate to revenue.

The chart below summarizes Alphabet’s operating results over the past five quarters.

Alphabet selected results. (Data source: Alphabet. Chart by author.)

The decline in net income, from $17.9 billion to $16.4 billion, was overwhelmingly due to the difference in unrealized gains and losses on equity and debt securities (Note 6 to the financial statements for anyone interested). This is because the market rose substantially in Q1 2021 and fell in Q1 2022.

Bright spots in Q1 and opportunities ahead

The two most significant drivers of sales growth in the first quarter were Google Search and Google Cloud, which grew 24% and 44%, respectively. Google Search is a cash cow and will likely remain so unless stiff, effective, and targeted antitrust laws are passed. Possible, but not likely. Google has tremendous pricing power in the industry as advertisers can’t afford not to be on page 1 of Google Search. This should help Alphabet maintain margins during inflation.

Google Cloud is the most significant opportunity to increase operating income substantially over time. The segment is not profitable despite its growth. In Q1, it produced an operating loss of $931 million. For comparison, Amazon’s (AMZN) AWS posted an operating margin of 35% in Q1, and Microsoft’s (MSFT) Intelligent Cloud posts operating margins routinely above 40%.

Google Cloud is in its infancy when compared to AWS and Microsoft Azure. As it scales, it should begin turning profits. This would significantly boost Alphabet’s bottom line, earnings-per-share (EPS), and stock price.

As streaming looks to erode cable’s hold on viewers, YouTube should continue to grow. YouTube’s viewership share rose from 6.7% to 6.9% in June.

YouTube TV topped 5 million subscribers surpassing Disney’s (DIS) Hulu as the subscriber leader in live TV streaming. YouTube Shorts, Alphabet’s answer to TikTok, reached 1.5 billion monthly users. Streaming and social platforms are in a high-stakes battle for eyeballs, and the winners will see massive profits. Alphabet is making headway.

Hints of rocky results

On the other hand, many expect a significant slowdown in advertising this year which would hurt Alphabet’s sales and profits. Snap (SNAP) stock’s disastrous reaction to its underwhelming Q2 results has investors on edge.

There have also been reports that Alphabet is slowing hiring for the remainder of 2022. This move is aimed at reining in expenses which is wise in this economy; however, it is also a sign that growth could be slowing and inflation damaging margins.

The verdict

As a long-term investor, I continue to hold Alphabet and believe it will outperform the market over time. There will probably be a sizable reaction to Q2 earnings. A solid earnings beat should spark a relief rally, while even a tiny miss will likely lead to short-term pain.

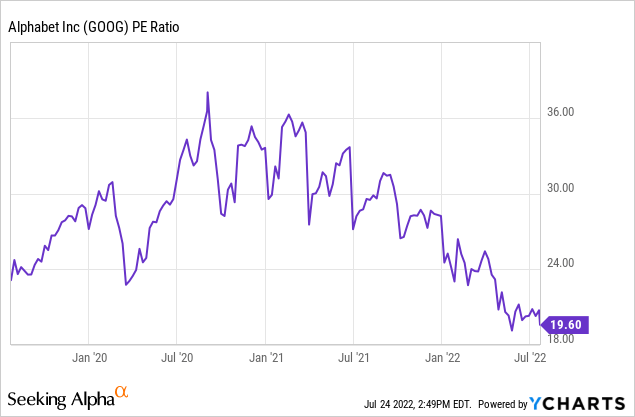

The price-to-earnings (P/E) ratio indicates the stock is undervalued, as shown below. But it also shows that Wall Street is predicting earnings to continue falling.

AbbVie’s spectacular performance

On the opposite end of the spectrum, AbbVie continues chugging along and providing income investors with a steady paycheck. Q1 saw more of the same, with revenues up 4% YoY and adjusted diluted EPS up 9%.

AbbVie made the top pick list because of its high yield, strong management, and resilience to an economic downturn. As predicted, investors have flocked to its stock as a haven this year.

The oncology portfolio was disappointing in Q1 with tepid overall growth, while neuroscience and aesthetics rose impressively.

The company continues to rely less and less on Humira as it prepares for biosimilars coming to the U.S. in 2023. Humira accounted for 35% of net revenue in Q1 2022, a significant drop from 55% in Q1 2020. AbbVie confirmed guidance of $15 billion in sales for Rinvoq and Skyrizi by 2025. This is crucial to fill the revenue gap from lost Humira sales.

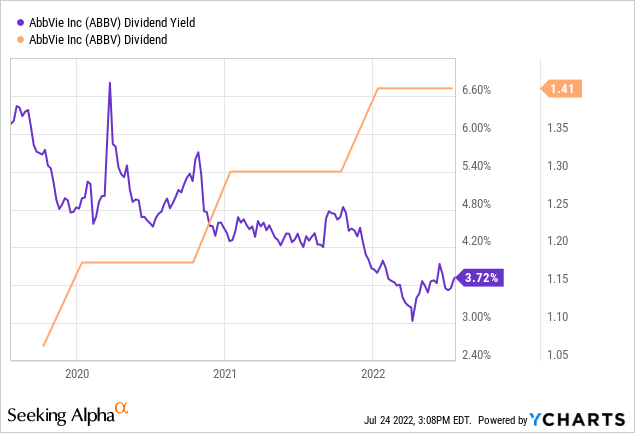

The dividend yield has fallen below 4% because of the stock’s rise, as shown below.

I won’t add to an AbbVie position for a yield under 4%. The regulatory and Humira risks demand a higher yield.

AbbVie is still a terrific buy-and-hold income play but be careful accumulating at this level.

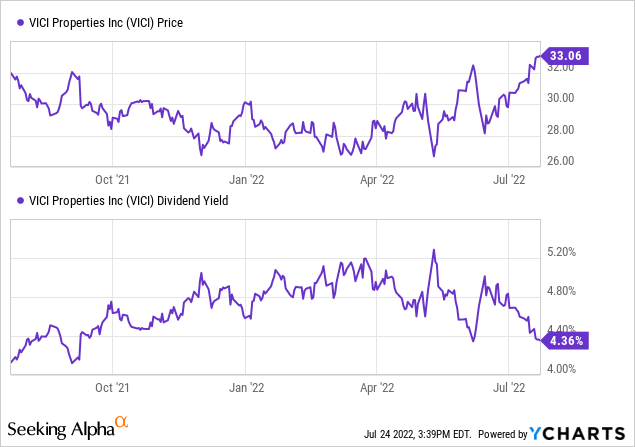

Will VICI continue to shine?

VICI Properties is an income stock, and the recent stock price appreciation is a welcome bonus.

A gaming Real Estate Investment Trust (REIT) like VICI may not be the first stock that comes to mind when looking for safety, but its track record proves it.

VICI maintained its revenue and raised its dividend even when Las Vegas was effectively shut down in 2020 due to the pandemic. In fact, rent collection in 2020 was 100%.

VICI has several positives. A significant portion of its portfolio is at least partially inflation-protected; it completed the accretive acquisition of MGM Growth Properties last quarter; its properties are unique, and average lease terms are over 40 years.

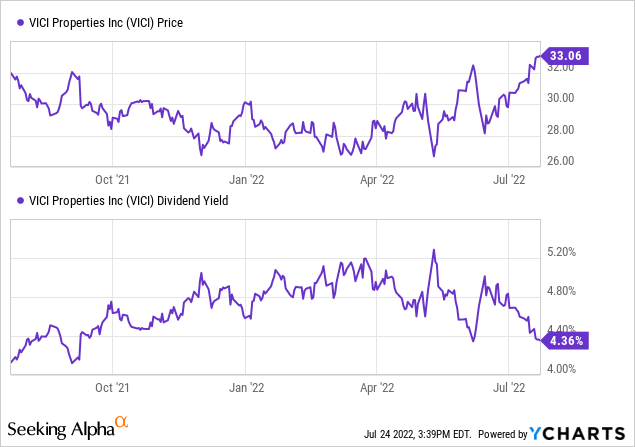

The company typically raises the dividend in Q3, so its following dividend announcement should provide investors with another raise. Judging by the recent share price rise, investors expect a significant increase.

The stock’s price may have gotten ahead of itself recently, so look for a return to Earth shortly. VICI remains a sturdy source of income for long-term investors.

Published at Mon, 25 Jul 2022 00:11:21 -0700