Lump Sum or Dollar Cost Averaging

The dilemma of doing dollar cost averaging or lump sum investing is a situation all investors face at a point in time during an investing journey. It could be when you start, when you are young or even later in you approach retirement.

Generally speaking, we all do dollar cost averaging as we invest every year.

Take your TFSA account, as you invest your $6,000 per year, you do an annual dollar cost averaging. If you invest, $500 per month, you do monthly dollar cost averaging.

What Is Dollar Cost Averaging?

Dollar cost averaging is a term used when you add to an investment over time at various prices and your cost becomes the average of all transactions.

As mentioned above, we are all technically doing it if you add to existing holdings over time or if you simply participate in DRIP programs where your dividends are re-invested.

One benefit of dollar cost averaging is that you don’t try to time the market. It just happens over a long period of time. You end up buying during the ups and the downs of the market but more importantly, you take the emotions out of the equation.

What Is Lump Sum Investing?

Lump sum investing is when you invest a large amount at once that is considered outside the norms of your recurring investment approach.

Say you normally invest $100 of your pay every two weeks and then one day you have an extra $2,000 and invest it, that’s a lump sum investing for you.

Other common examples are money you receive from a bonus, an inheritance, and an RRSP refund.

Which Is Better? Lump Sum Investing or Dollar Cost Averaging

There is a saying that the best time to invest was yesterday and the next best time is today. It refers to being invested as soon as you can as you never know when the opportunity is.

When you are faced to deciding to invest a $50,000 inheritance, your thinking is about what happens the following day when you bought instead of thinking about what it means 10 years from now.

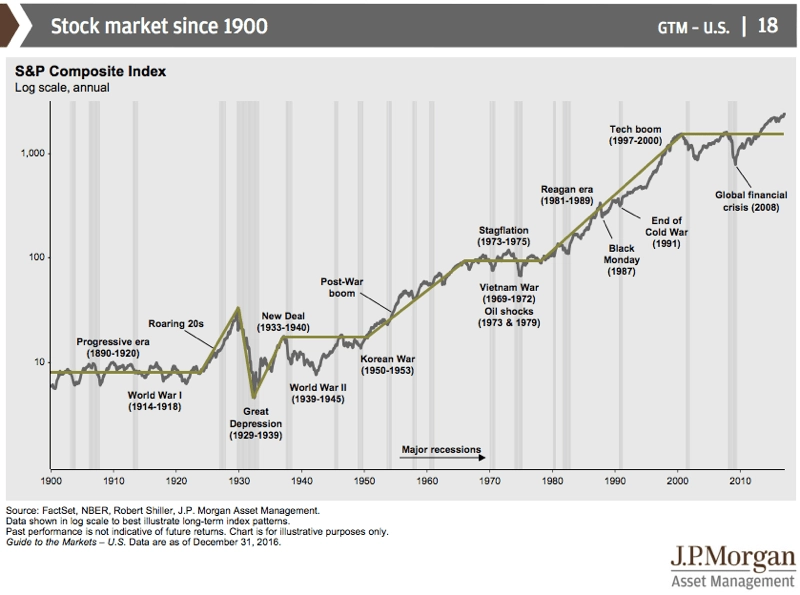

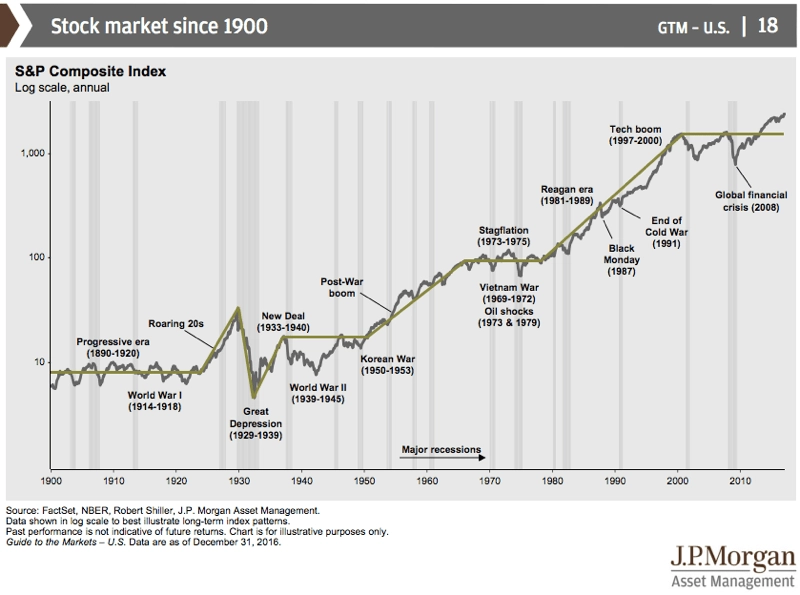

It’s perfectly normal. It’s an emotional response that investors need to overcome. You need to take a step back and look at how the stock market behaves over time.

Generally speaking, you want to invest as soon as you can to take advantage of the markets over time. It is especially true when markets pull back.

Often times, the trick is to find the right stock at the right time. It’s not that you should wait based on the markets, it’s more that you need to find the right investment.

However, emotions around seeing your new investment down a few days later are not easy to swallow. As such, it can be easier to break down the $50,000 into 3 or 5 transactions over a small period of time.

It’s a form of dollar cost averaging but not an automated one.

Putting theory, or back testing, aside, the best option is the one that makes you sleep well as the real goal is to be invested and putting your money at work. The next best action you can take is to know your annual rate of return so you can decide where you add more over time.

The Best Way To Do Dollar Cost Averaging

Aside from your employer’s plan where you would do a pretty standard dollar cost averaging contribution, the next best is to make your own.

One word of caution first. Mutual fund companies have made it easy to invest by deferring the cost and having hidden cost. Don’t go down that path even if it’s easier. If you did, it’s not too late and ditch your mutual funds.

To get started, you want a discount broker with free ETFs, or free trades. The following discount brokers fit the category.

Unless you have free trades, it makes it hard to justify the trading fees on stocks with a bi-weekly contribution. For example, say you put $230 per pay in your TFSA, it’s expensive to buy stocks and pay a $5 trading fee on every transactions.

The Best Way To Do Lump Sum Investing

Let’s be clear that we refer to a large amount of money to invest here. Something unusual for your personal situation.

Assuming a lump sum of $50,000, do you invest it all at once in 1 stock for example?

That’s a tough one to answer without context on the markets or your portfolio. Assuming you have portfolio rules, like I do, then you don’t want to break them either.

If the market is really beaten down, you can think of investing it all at one but only if you have conviction in your decision. One way I look at my decision for an ultimate conviction is to be clear that the business of the company is solid (oligopolies are nice), that the PE is low compared to historical and that the yield is higher than historical.

Otherwise, if your conviction isn’t 100%. Break your lump sum into 3 transactions and execute them over a few weeks. If you are ready to invest during the earnings season, don’t do all your transactions before the earnings, keep some money for after the news but don’t sulk if the stock goes up. Move on and pick another.

Published at Sun, 29 May 2022 22:18:53 -0700