KonaTel Is Trying To Scale But Lacks Visibility

Urupong

KonaTel (OTCQB:KTEL) is an MVNO (Mobile Virtual Network Operator) provider using subsidized government programs to ramp subscribers for mobile broadband, not unlike SurgePays (SURG).

While they are able to rapidly ramp subscriber growth, this has come at the cost of margins and cash flow, and the company has plunged into the red.

Since we know little about crucial variables like CAC (customer acquisition cost), attrition rate, and margins on their MVNO service, it’s hard to figure out the chances of this turning around, but on the basis of some reasonable assumptions things don’t look too promising.

So we’ll stick to SurgePays as our preferred stock in this sector.

KonaTel has two subsidiaries:

- IM Telecom, a wireless reseller that distributes Lifeline and EBB services under its Infiniti Mobile brand

- Apeiron Systems: CPaaS (communication platform as a service)

These produce two revenue sources, that is two segments in which it reports.

- Hosted Services, the CPaaS business of Apeiron

- Mobile Services basically, the Lifeline and ACP business of IM Telecom

Growth

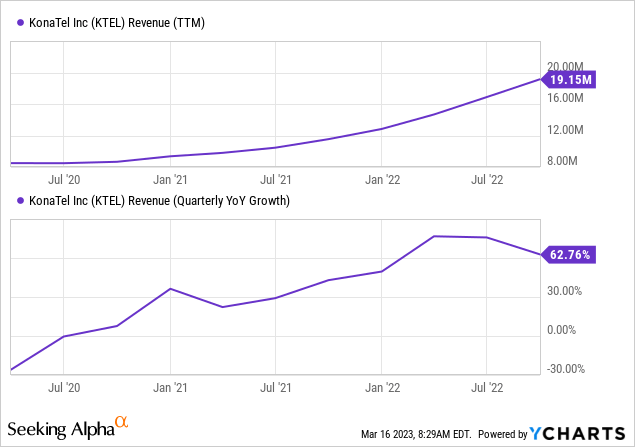

The company is certainly growing revenue, as it has embarked on an extensive customer acquisition program, which is paying off:

Q3 revenue grew 62.8% y/y and 15% sequentially to $5.9M, a $24M run rate.

IM Telecom

Most of the growth is coming from the mobile segment in the form of new subsidized subscribers for the ACP and Life Line programs. The EBB program has now progressed into the ACP (Affordable Connectivity Plan), a Federal program to close the digital gap for low-income Americans by subsidizing broadband subscriptions.

The ACP program subsidizes qualified households to the tune of $30 per month for broadband (including mobile broadband) subscriptions (and also up to $100 in one-time subsidy for devices like tablets or mobile phones).

There are up to 50M US households that could qualify for ACP subsidies with 16.7M signed up by March 17, 2023, which is 33% of these have signed up to date.

We are familiar with ACP through virtue of SurgePays which has used the program to boost its mobile broadband subscribers from 30K at the start of 2022 to 220K by the end of the year so we know fast subscriber growth is possible here.

We are not familiar with the details of the company’s MVNO agreements with the carriers, but if it’s anything like the agreement that SurgePays has we can assume that they pay their carriers in the order of $15/M per subscriber for a gross profit of $15 per subscriber for the company.

Of course, we also know that these gross profits aren’t materializing instantly as the company incurs upfront CAC (customer acquisition costs) and it will take some time before it can book the revenue.

Then there is the issue of attrition, which at SurgePays is around 8% per month. SurgePays is reducing these attrition costs in two ways:

- It is reducing CAC by signing up new subscribers online and through an 8K (now at least 11K) partner shop network.

- It makes a one-time profit by giving away tablets, for which it receives a one-time $100 ACP subsidy but which cost the company only $75 (previously this was $90, but they now order directly from the manufacturer in large quantities).

These free tablets are also a great marketing tool but we assume KonaTel isn’t providing any devices. We would like to know what their CAC is, management didn’t say anything more than this (earnings PR):

Mobile customer acquisition costs are not amortized over the average life of the customer, but are generally recognized at the start of service and typically recovered within 120 days after activation. Mobile customer acquisition costs for the third quarter 2022 were $2.9 million compared to $283,000 for the third quarter of 2021.

But we don’t know the number of subscribers (or the increase during the quarter), the gross margin on their MVNO contracts or their attrition rate all things we have to know before we can make any more precise determination of the unit economics.

In fact, we don’t even know which program (the ACP or the Lifeline program) is responsible for the bulk of new subscribers or whether (and if yes to what extent) their unit economics differ.

While we can roughly assume the gross profit on subscribers is in the order of $15/M (similar to SurgePays), two variables are crucial to make the economics work, which is CAC and attrition, as they together determine attrition cost.

If, as management argues, it takes 120 days to earn a return on new subscribers that suggests 3 or 4 months (depending on whether they receive the ACP subsidy in month one), this suggests a CAC of $45-$60.

That’s considerably higher than those of SurgePays and it doesn’t look like the company has one-off benefits selling tablets to compensate for the high CAC.

So while it could very well be true that the company recovers the CAC in 120 days as they claim, attrition can be a serious problem here.

For instance, suppose all of their $11M of Mobile revenue in Q3 comes from ACP, which would be $3.7M per month or 120K subscribers. Gross profit on these would be in the order of $1.85M per month.

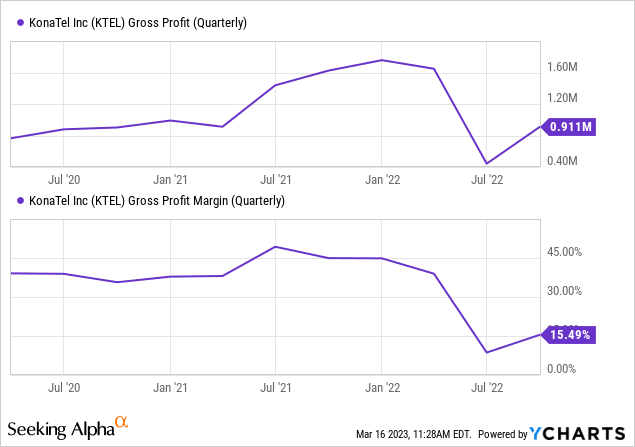

With Q3 CAC at $2.9M or nearly $1M per month, which should leave $2.55M in gross profit for Q3, the reported gross profit was only $911K, which might give us an indication of the cost of attrition ($1.6M for the quarter).

Or another way, at an attrition rate of 8% per month and an attrition cost of $45 (CAC minus the gross margin on the subscription rate), that’s $432K per month or $1.3M for the quarter which is close enough to our previous calculation to have some confidence in these figures.

As argued above, SurgePays is reducing these attrition costs by reducing CAC itself (through signing new customers up through their partner shops) as well as offsetting them by one-time profits on the tablets, but does KonaTel have ways to deal with attrition costs? We don’t know.

Hosted Services

While Mobile Services is responsible for all revenue growth, their Hosted Services (the company’s CPaaS business) got a shot in the arm from the US Prison System (Q3 earnings PR):

We recently executed a new three-year extension with one of our largest cloud services customers that doubles their monthly minimum revenue commitment. Under the terms of the new contract, which has a minimum value of $7.2 million over the term, we will continue to provide our national cloud communications platform to support their network, which provides inmate communications services to prisons across the United States.

Financials

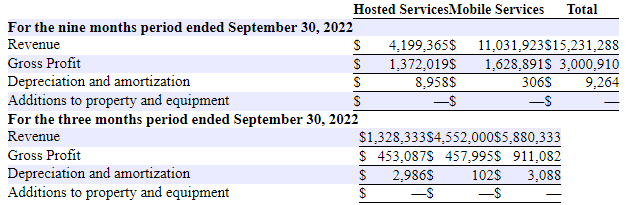

There is a split out in segment revenue from the 10-Q:

KTEL 10-Q

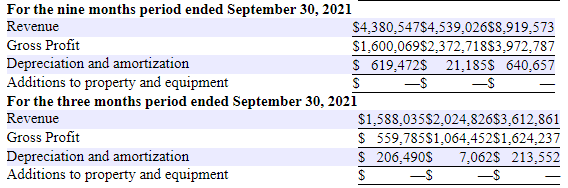

And for comparison, the same figures from 2021:

KTEL 10-Q

Mobile service revenue increased by 143.0% in Q3 while Hosted Services revenue declined by 4.1%, so some things become instantly clear:

- All revenue growth comes from the Mobile Services segment

- This growth comes at the cost of gross profits.

There has been a notable collapse in gross profit and gross profit margins:

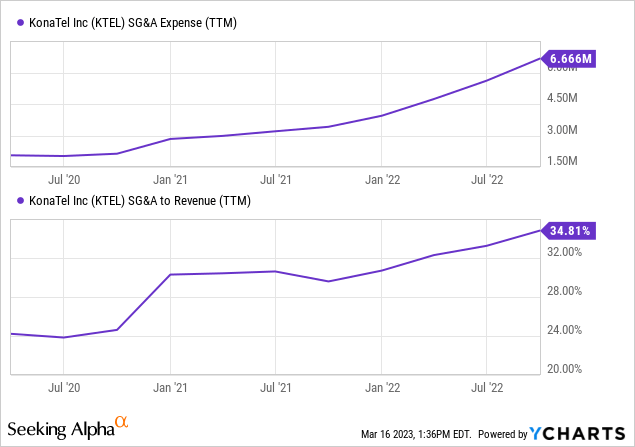

And it’s not only COGS that are increasing, taking a toll on gross profit and margins, CG&A is increasing as well in order to sign up the new customers and support them:

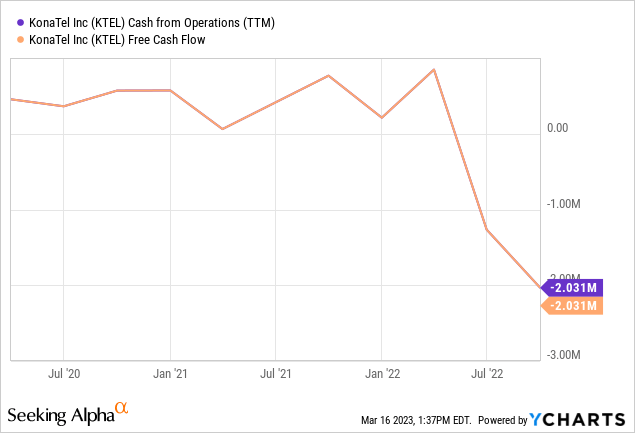

No surprise this is taking a toll on the company’s cash flow:

Accelerating new subscriber growth has turned mildly positive cash flow into significant negative cash flow and since we know little about their CAC, attrition rate, and attrition cost, we can’t be sure this will turn around.

It can turn around when they stop the intensive new subscriber drive, but then attrition will slowly reverse their subscriber growth.

Balance sheet

The company had $2.24M in cash and $3M in debt (10-Q):

On June 14, 2022, the Company and its wholly owned subsidiary companies entered into a Note Purchase Agreement and related Guarantee and Security Agreement with CCUR Holdings, Inc. (as collateral agent), and Symbolic Logic, Inc., whereby the Company pledged its assets to secure $3,150,000 in debt financing. The term is for a period of twelve (12) months, at an interest rate of 15%, with two successive six-month optional extensions. As a condition of securing the loan, the Company paid a 3% origination fee, and other legal and closing expenses, in the amount of $153,284, resulting in a net loan balance of $2,984,181. The loan costs of $153,284 and the net loan balance of $2,984,181 are to be amortized over a 12-month period.

So their balance sheet situation isn’t too comfortable, the debt is all current, pays a high (15%) interest rate and they are bleeding quite a bit of operational cash as well.

Valuation

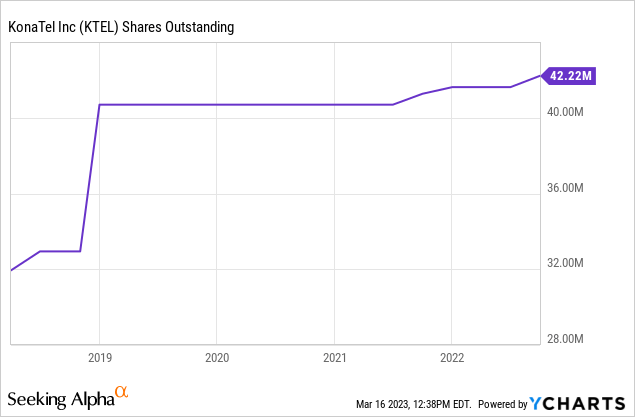

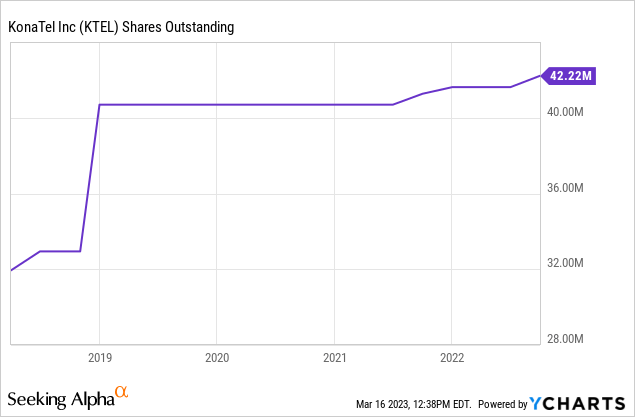

The company has 4.43M options outstanding, 1.93M of which are vested and exercisable so a fully diluted share count of 44.2M. At $0.7 a share that’s a $31M market cap and provided FY22 sales are in the order of $23M, the shares sell at roughly 1.35x FY22 EV/S.

Conclusion

The company is successfully ramping up subscriber growth, which takes a considerable investment hence the steep fall in gross margin and the rise in SG&A.

Management argues that this investment has a return of just 4 months, and while that points to a relatively high CAC, we assume that’s correct, it’s not the whole story.

We would like to know their subscriber numbers, attrition rate and CAC, although making some assumptions based on another company (SurgePays) the attrition rate will be in the order of 8% per month and the attrition cost will be substantial and rising with the number of subscribers.

We would like to know whether they have tricks up their sleeve like SurgePays, which has lowered CAC and by buying tablets in bulk and making a substantial profit on these, offsetting much of the CAC (and hence attrition cost).

If KonaTel can do something similar, they could have a viable business model, but if they’re stuck with a high CAC, and high attrition without means to lower or offset these, the economics are much more difficult.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Published at Sun, 19 Mar 2023 00:29:36 -0700