iShares MSCI Spain Capped ETF: Headwinds Outweigh Tailwinds

Antonio Carlos Soria Hernandez/iStock via Getty Images

ETF Snapshot

The iShares MSCI Spain Capped ETF (NYSEARCA:EWP) is one of the oldest global ETFs around with a listing history dating back to 1996! EWP is also quite a small and focused portfolio; compared to most of the other European iShares ETF alternatives, which typically cover over 40 plus stocks from a specific region, EWP only offers coverage to 21 Spanish stocks.

Macros

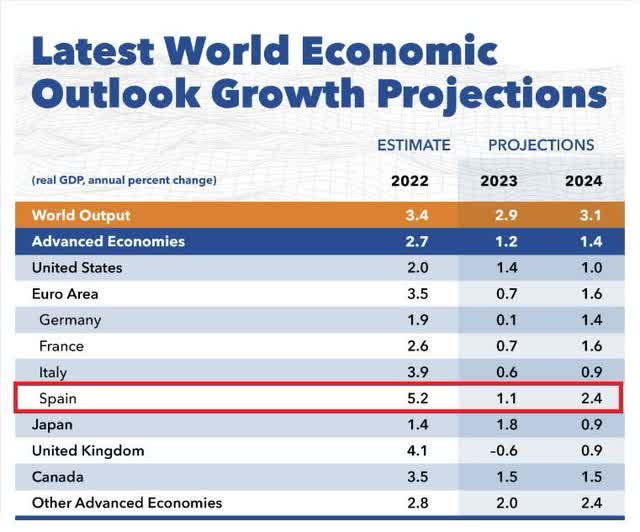

The Euro region will likely be subject to a subdued growth environment this year (0.7% real GDP growth), but in 2024 things should be a lot better with real GDP growth poised to hit 1.6% even as the US continues to slow for yet another year. Within the major European economies, Spain appears to offer the most promising growth forecasts (1.1% and 2.4% real GDP growth in 2023 and 2024), and much of the momentum there will likely be driven by the services sector.

IMF

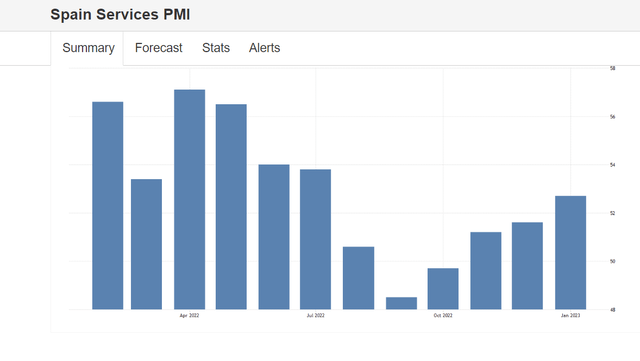

The latest forward-looking services PMI report pointed to a number of encouraging developments. After bottoming in September last year, the Spanish services PMI has been trending up every month, and the most recent reading of 52.7 for Jan (Dec: 51.6) represented the largest increase since July. A metric capturing new business improved solidly, even as another metric measuring business optimism hit an eight-month high.

Trading Economics

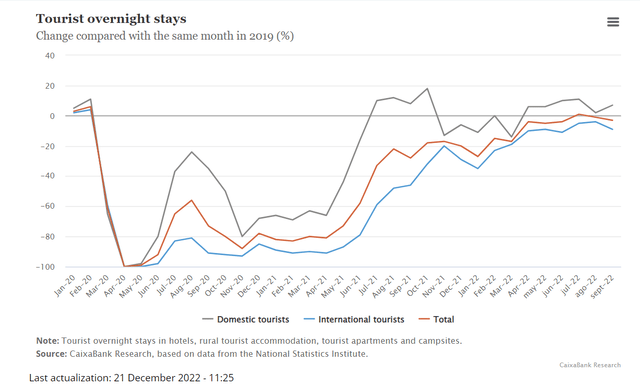

Within the services sector, dynamics within the tourism sector (14% of Spanish GDP according to ING Think) are worth highlighting as this terrain has suffered for a few years, and has plenty of ground to make up. Much of this could be driven by international demand (particularly non-European international arrivals) as this still remains below the pre-pandemic levels.

Caixa Bank

Inflation in Spain still remains elevated (it came in at 5.9% in Jan following a reading of 5.7% in Dec), but more worryingly, it is the persistence of core inflation that actually rose to a fresh high of 7.5% from 7% previously which should be a cause for concern. This shows that even though energy and gas prices may have cooled off, the second-order passed-through effects on other items continue to leave a mark across the economy.

Nonetheless, it looks like the ECB will continue to press the pedal on further rate hikes through the summer and the swap markets suggest this may hit an all-time high of 3.7%.

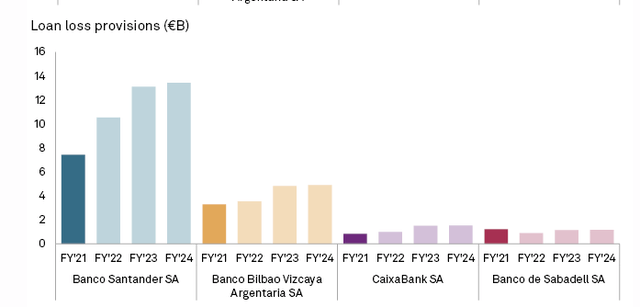

Prima facie this should be very encouraging for the net interest margins of Spanish banks (which account for the largest share of EWP’s portfolio at 34%), as they have a very high component of variable rate loans as a function of the average loan book relative to other European banks. But then again, one also needs to consider the debt servicing ability of the Spanish populace in the face of higher rates, particularly those who’ve taken mortgage loans. Imagine what this could do for bank credit costs and provisioning. Just for some context, in Spain, variable-rate mortgages account for 75% of all mortgages! In effect loan loss provisions for the major Spanish banks look set to increase over the next two years. This will no doubt weigh on profit margins.

S&P Global

Besides banks, EWP’s portfolio is also dominated by Utility stocks (31% of the holdings). Unfortunately, the profitability of both these sectors will be hampered by the windfall$6bn tax that the Spanish government plans to levy, in order to ameliorate pressures linked to soaring prices. Already EWP’s largest holding which is a utility- Iberdrola has warned that these taxes will reduce profit growth for FY23 to just mid-single digit growth vs previous levels of 8-10%.

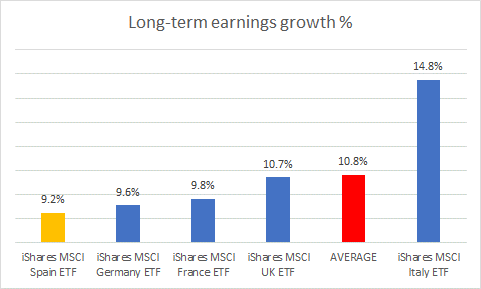

All in all, according to YCharts forecasts, it’s also worth noting that EWP’s constituents offer the lowest long-term earnings growth potential versus other alternatives from Europe.

YCharts

Closing Thoughts

As a rotational candidate within the Eurozone terrain, EWP does look relatively promising. As you can see from the image below, even though there’s been a recovery since 2022, a ratio comparing Spanish stocks to its Eurozone counterparts (represented by the iShares MSCI Eurozone ETF) is still ~23% away from the mid-point of its long-term range.

Stockcharts

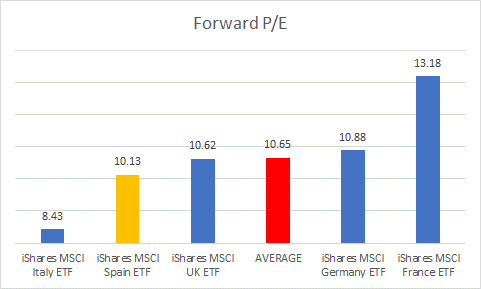

EWP’s forward P/E valuations too are cheap enough, trading at a ~5% discount to the average of other comparable European ETF options (only the Italian option- EWI trades at a larger discount of ~20%). But then again, as noted in the previous section, there’s a reason why EWP is cheap; you’re unlikely to get solid enough earnings growth compared to the rest of the pack.

YCharts

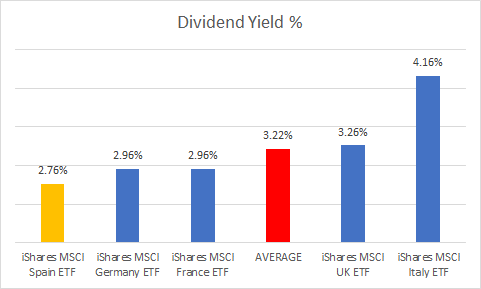

For investors who also appreciate the income facet, it’s fair to say that EWP isn’t the most compelling choice in Europe. Compared to the average dividend yield of the ETFs of the other major European peers, EWP’s yield comes across as sub-par as it is the lowest in the group and almost 50bps lower than the peer set average.

Seeking Alpha

Besides, if one shifts focus to EWP’s own long-term price imprints, it doesn’t feel like the most opportune time to take a position. If one looks at the structure of EWP over the last 14-15 years, we can see that the price has trended in the shape of a wedge pattern. I also feel that the strong move since October warrants some sort of pause or a pullback, particularly as the price has coincided with the upper boundary of the wedge, a boundary that has served as a point of resistance on 4 separate occasions since 2009.

Investing

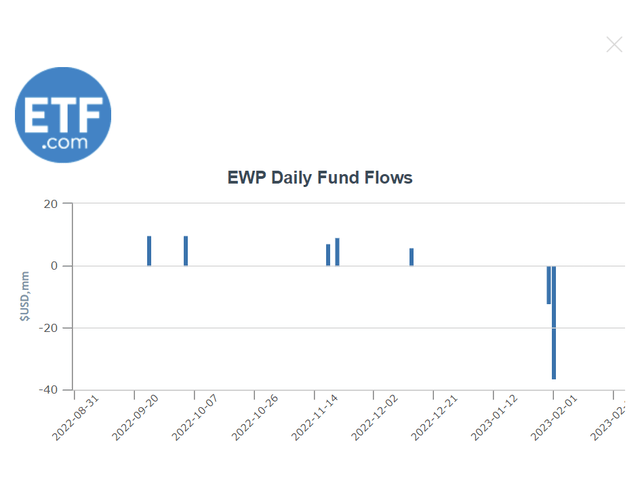

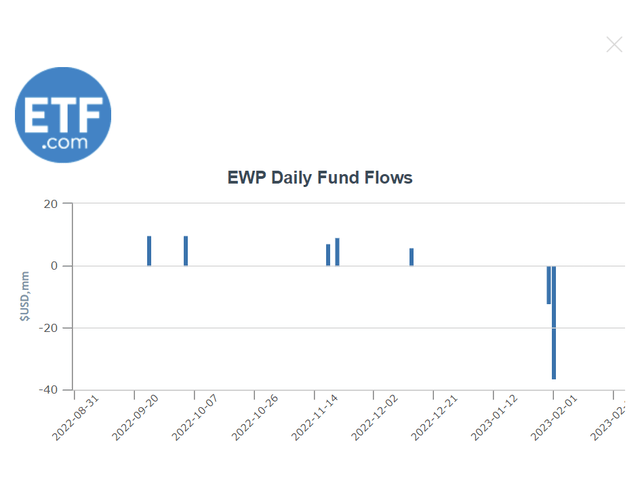

Investors should also note that over the last 6 months, after witnessing intermittent fund inflows, EWP was recently subject to some heavy bout of outflows (over $48m), equating to roughly 10% of the fund’s AUM.

ETF.com

Nonetheless, staging a long position at this point doesn’t appear to offer the best risk-reward, more so, as it looks all but likely that Feb’s monthly candle will close in the shape of a bearish shooting star pattern indicating some buying fatigue. I’d like to think that investors would be better served waiting for a better entry point.

Published at Sun, 26 Feb 2023 21:32:03 -0800