I was a serious Quicken user back in 2008 and had been for years. I started using Quicken back in 1997. You read that right – even before the automatic updates from the web were possible!

As you can probably imagine, I have a good grasp on my accounting but even after all those years, there was one view of my portfolio I could not get with all the software out there.

I wanted to view my investment from a capital invested perspective rather than the adjusted cost base (ACB). Unfortunately, all software I found are setup for accounting and all DRIP shares are considered capital invested.

I could see different fields in Quicken but I have not been able to see the ROI on my capital invested the way I want. The way all software calculate the dividend re-investment is simple since they need to handle all transactions for capital gains tax purposes.

When you look at one investment, the calculation on your ROI is simple but it treats DRIP shares as additional contributions.

ROI % = (Total Market Value / Adjusted Cost Base) -1

Total Market Value = Share Market Price * Number of Shares

ACB = Initial Investment + Additional Contributions + Reinvested Distributions – Previous Redemptions

However, when you start selling and buying and selling and buying and so forth … the ROI calculation starts to get blurry. The initial investment changes when you buy a new investment.

The initial investment is the amount you invested which may well include profits (or loss) from other investments. As you can see, the number of transactions starts to blurry the ROI calculations of an account.

As such, I started to track my own performance in a spreadsheet so I get the view on my performance just the way I want it.

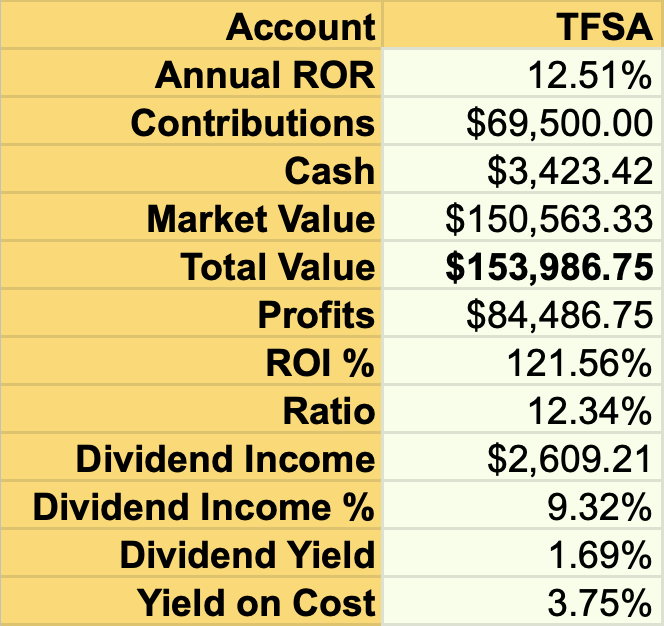

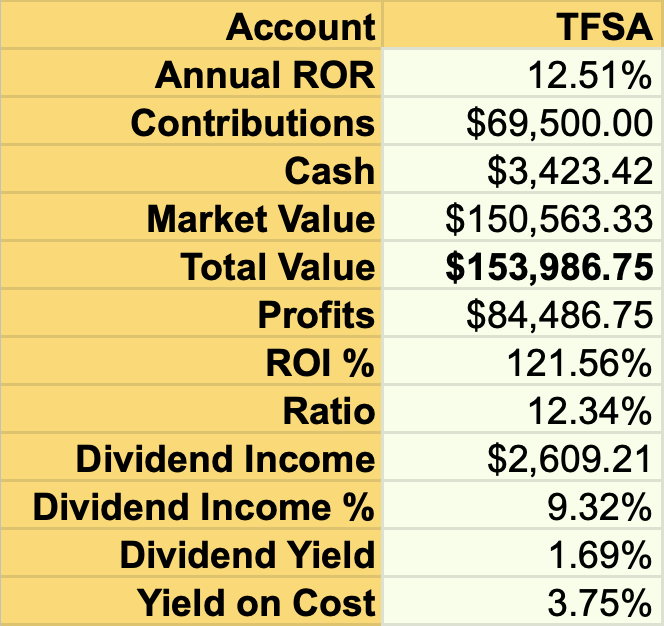

Not convinced yet? The TFSA was introduced in 2009 in Canada and everyone can invest the same. If you maximize your contributions, what you put in up until 2020 is $69,500, anything above that is profits and you use that to calculate your ROI.

However, there is a BIG difference between the profit percentage (ROI) and the annual rate or return (ROR). The annual ROR takes into account time whereas ROI does not.

| wdt_ID | Year | Yearly Limit | Cumulative | 5% Growth | 10% Growth | Dividend Earner | Spousal |

|---|---|---|---|---|---|---|---|

| 1 | 2009 | 5,000 | 5,000 | 5,250 | 5,500 | Not Tracked | Not Started |

| 2 | 2010 | 5,000 | 10,000 | 10,762 | 11,550 | Not Tracked | Not Started |

| 3 | 2011 | 5,000 | 15,000 | 16,550 | 18,205 | Not Tracked | Not Started |

| 4 | 2012 | 5,000 | 20,000 | 22,628 | 25,525 | Not Tracked | Not Started |

| 5 | 2013 | 5,500 | 25,500 | 29,534 | 34,128 | $41,742 | Not Started |

| 6 | 2014 | 5,500 | 31,000 | 36,786 | 43,590 | $52,820 | Not Started |

| 7 | 2015 | 10,000 | 41,000 | 49,125 | 58,949 | $56,307 | Not Started |

| 8 | 2016 | 5,500 | 46,500 | 57,356 | 70,984 | $70,200 | Not Started |

| 9 | 2017 | 5,500 | 52,000 | 65,999 | 84,034 | $78,900 | $13,308 |

| 10 | 2018 | 5,500 | 57,500 | 75,074 | 98,487 | $96,937 | $58,818 |

| 11 | 2019 | 6,000 | 63,500 | 85,128 | 114,986 | $129,467 | $82,596 |

| 12 | 2020 | 6,000 | 69,500 | 95,684 | 133,030 | $153,993 | $95,906 |

| 13 | 2021 | 6,000 | 75,500 | 106,769 | 152,933 | $181,601 | $113,194 |

| 14 | 2022 | 6,000 | 81,500 | 118,407 | 174,827 | $169,702 YTD | $128,018 YTD |

| 15 | 2023 | 6,500 | 88,000 | 131,152 | 199,459 | ||

| 16 | 2024 | 6,500 | 94,500 | 144,536 | 226,555 | ||

| 17 | 2025 | 6,500 | 101,000 | 158,587 | 256,361 | ||

| 18 | 2026 | 6,500 | 107,500 | 173,342 | 289,147 | ||

| 19 | 2027 | 7,000 | 114,500 | 189,359 | 325,762 | ||

| 20 | 2028 | 7,000 | 121,500 | 206,177 | 366,038 | ||

| 21 | 2029 | 7,000 | 128,500 | 223,836 | 410,342 | ||

| 22 | 2030 | 7,500 | 136,000 | 242,902 | 459,626 | ||

| 23 | 2031 | 7,500 | 143,500 | 262,923 | 513,838 | ||

| 24 | 2032 | 7,500 | 151,000 | 283,944 | 573,472 | ||

| 25 | 2033 | 7,500 | 158,500 | 306,016 | 639,069 | ||

| 26 | 2034 | 7,500 | 166,000 | 329,192 | 711,226 | ||

| 27 | 2035 | 7,500 | 173,500 | 353,526 | 790,599 | ||

| 28 | 2036 | 7,500 | 181,000 | 379,078 | 877,909 | ||

| 29 | 2037 | 7,500 | 188,500 | 405,906 | 973,950 | ||

| 30 | 2038 | 7,500 | 196,000 | 434,077 | 1,079,595 |

The Details To Track

It’s all in the details. I basically track the initial number of shares I purchase and then I track the total number of shares I have which gives me the number of shares from my DRIP using simple math. Over time, I have updated my approach to track all transactions such as BUY, SELL, DIV and DRIP.

I basically don’t include my DRIP shares in my capital ACB. I separate capital ACB from taxable ACB.

My reason is simple, the DRIP shares are part of my profit and I want to track my profit. It’s comparable with capital gains only investment where you don’t earn dividends, I compare my invested capitals with the overall value of the investment.

Surprisingly, you can’t track this in Quicken or Google Finance. I am astonished that a proper profit calculation is not included. I was never sure how dividend was calculated in the performance either so I was always questioning the numbers and doing them myself.

That’s why I track my dividend income (see How To Track Dividend Income) and my dividend performance separately. I just need to look at it in a different view and it’s easy to do with a dividend tracker.