First Republic Bank: Why I Am Sticking To My Investment

Anne Czichos

A couple of things have happened to First Republic Bank (NYSE:FRC) since I submitted a contrarian call to buy the community bank’s shares about two weeks ago. FRC stock has whiplashed ever since and the bank has seen significant deposit outflows in the days following the bank failure of Silicon Valley Bank. A series of 8K disclosures were meant to reassure investors that First Republic Bank has sufficient liquidity to manage a heightened level of deposit outflows, but investors have chosen to bet against the bank and they clearly expect the worst to happen. I continue to believe that First Republic Bank is not at risk of going out of business and that the common stock potentially offers very risk-tolerant investors triple-digit return potential!

Risk control and asymmetric upside potential

To account for extraordinarily high levels of volatility in the financial market, I have chosen to take a very small position in First Republic Bank: FRC accounts for just about 1.05% of my investment portfolio which chiefly consists of non-financial stocks. Given the asymmetric risk profile that I see with brutalized community banks, I believe investors could earn multiples of their investment here… if fears subside and confidence returns to the community banking sector. However, there is a chance that First Republic Bank might be shut down or be forced to do a highly dilutive capital raise which would likely seriously impair the remaining value of the equity. Therefore, investors must recognize that there is the potential to lose the entire investment if things turn south.

Liquidity update, estimated deposit outflows and 8K disclosures

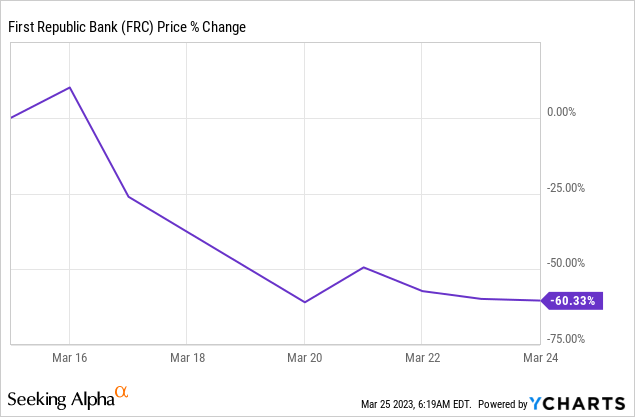

Since my last call to consider FRC in the midst of the banking bloodbath, shares of First Republic have revalued lower by about 60%. However, the bank has made a number of 8K disclosures throughout the banking crisis that were meant to inform investors about the strategic actions the community bank has been taking.

It all started with an 8K disclosure dated March 12, 2023 in which First Republic Bank announced that it secured additional liquidity from the Federal Reserve Bank and JPMorgan Chase & Co which brought its unused liquidity to a massive $70B. Undoubtedly, huge deposit outflows forced the company to bolster its cash position.

Just days later, on March 16, 2023, First Republic Bank announced that eleven lenders banded together and deposited a combined $30B into the bank (8K source) in order to signal confidence in First Republic Bank’s liquidity situation. This move also failed to calm investors and the lender’s shares have continued to sell off since.

Additionally, last week, First Republic Bank announced that a number of executives have agreed to reduce their annual bonuses to zero for 2023 while others have forfeited vesting all performance-based incentives (Source). The latest 8K, dated March 22, 2023, was meant to instill confidence in the bank yet again and align shareholder and executive interests. Since shares continued to fall last week, it is safe to say that the latest measures have not yet had a positive effect on investor sentiment.

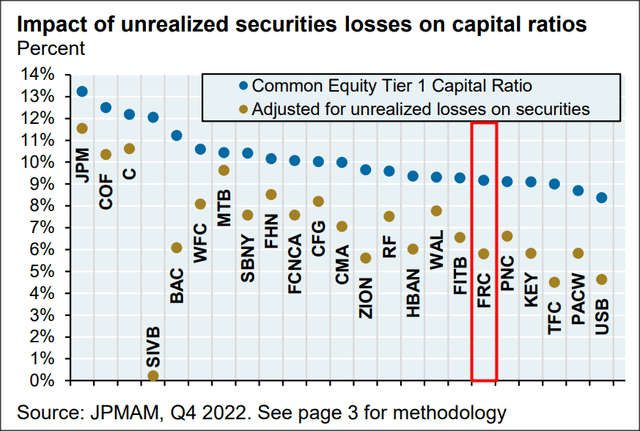

FRC’s business banking business and recent news about deposit outflows

What was First Republic Bank’s strength before the crisis, its banking business, has become its major weakness. The bank’s focus on venture banking — taking in deposits from venture capital-backed companies and making loans to them — has revealed an unforeseen vulnerability after Silicon Valley Bank shut its doors. The key problem with SVB was not deteriorating credit quality, but rather that the bank was forced to liquidate its bond portfolio at a significant loss in order to fund deposit outflows. Most banks now have unrealized investment losses, according to JP Morgan, including First Republic Bank… which is not a big issue of these assets don’t have to be sold. Additionally, FRC’s capital position is not necessarily much worse than those of other community banks.

Source: JP Morgan

A potential solution to the crisis

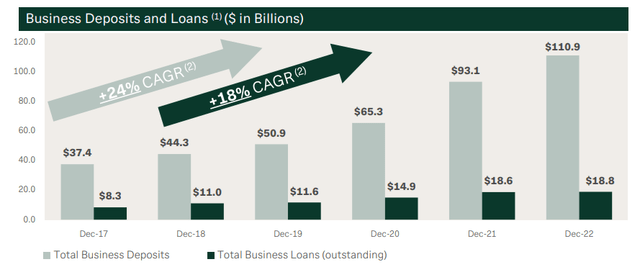

Since First Republic Bank has a considerable focus on business clients — 63% of its deposits came from its venture banking business which are at a higher risk of leaving the bank due to the FDIC’s $250,000 insurance limit — the bank has seen considerable deposit outflows. The bank said in its 8K disclosure for March 16, 2023 that “daily deposit outflows have slowed considerably” which is also what U.S. officials have remarked on lately. About 79% of First Republic Bank’s deposits were uninsured as of the end of FY 2022. Before the crisis, First Republic Bank’s business deposits were growing steadily and according to the bank’s Q4’22 update, the bank had exceptionally good credit quality, too.

Source: First Republic Bank

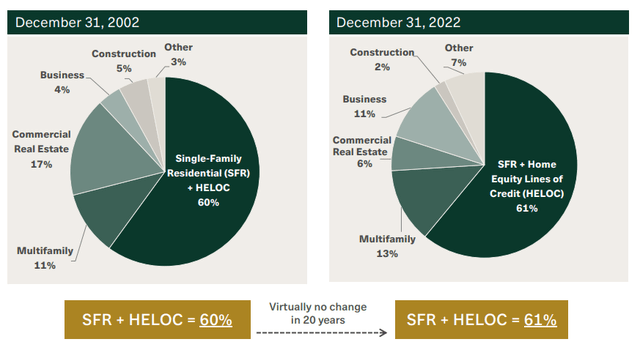

However, my guess is that the bank will sell a portion of its loan book in order to raise cash which would the best solution for First Republic Bank, and certainly preferable over an equity raise. The bank owned $166.9B in loans at the end of the December-quarter which mostly were collateralized by real estate. I can see FRC selling a portion of its loans at a fair price to larger banks in a big to shore up its balance sheet.

Source: First Republic Bank

First Republic: Deposit losses and impact on valuation

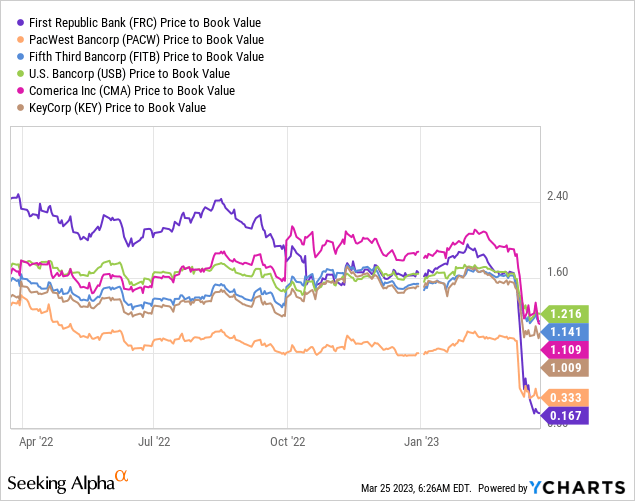

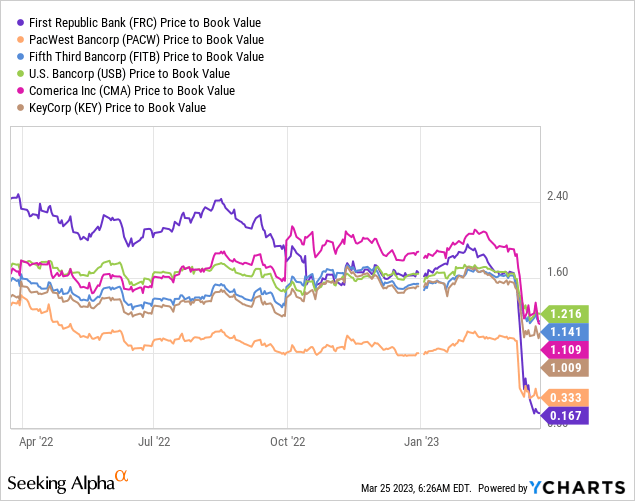

First Republic Bank is by far the worst performing community bank, largely due to its high percentage (79%) of uninsured deposits and the need to raise $30B in additional deposits from other companies.

It is impossible to know precisely at this point how many deposits First Republic Bank has lost, but the Wall Street Journal, citing insiders, said the bank has lost about half of its deposit base, which would calculate to about $70B.

This means that FRC is also going to report at a significant decline in its book value in Q1’23. First Republic Bank reported a book value of $75.38 at the end of FY 2022. Assuming a 50% decline in book value, chiefly due to deposit outflows and a shrinking balance sheet resulting from the crisis in the financial sector, FRC may report a BV around $37-38 per-share at the end of the first-quarter. Of course, more aggressive assumptions about deposit losses would translate into even higher book value declines. A, say, 60% decrease in cash/deposits implies, roughly speaking, a 60% decline in book value… which could put the Q1’23 BV closer to $30 per-share. Since First Republic Bank’s shares are trading at $12.36, the valuation implies an 84% discount to BV. If deposits indeed declined by 60%, then the valuation may more accurately reflect a 59% discount to book value.

FRC offers by far the biggest book value discount and therefore also has the highest perceived risk. However, fear clearly is present here and investors may overestimate the decline of FRC’s deposit base.

Risks with First Republic Bank

If deposit outflows continue, the big banks might decide that it is a better idea to convert the $30B in deposits into equity, which of course would heavily dilute shareholders. First Republic Bank has enough liquidity, in my opinion, through the Bank Term Funding Program, the FED’s discount window and other banks, so I don’t believe the bank couldn’t fund incremental deposit withdrawals. What would change my mind about FRC is if the company would have to liquidate (a portion of) its bond holding portfolio and realize losses, or if the bank would do a dilutive equity offering.

Final thoughts

First Republic Bank remains a high-risk, high-potential rebound stock in the community banking market, despite the stock being down dramatically since I took my initially position more than a week ago. The reason why I am sticking to my guns here is that I consider it highly unlikely that the FED will allow fear and panic to spread in the financial market as it has learned the lessons from 2008 financial crisis. This lesson is that failing to provide a liquidity backstop will eventually lead to a crisis much bigger, much harder to control and much more expensive than the initial, forceful intervention. First Republic Bank likely has suffered very considerable deposit outflows since I last covered the stock, but recent liquidity measures have proven to support the bank while deposit outflows appear to have stabilized lately. With the stock now trading at an 84% discount to book value, I believe investors continue to face a very attractive trading opportunity!

Published at Sat, 25 Mar 2023 20:28:04 -0700