Equitrans And Enbridge: The Least And Most Expensive C-Corp Midstreams

onuma Inthapong/iStock via Getty Images

Equitrans Midstream Corporation (NYSE:ETRN) is a natural gas midstream business that owns a moat-worthy footprint in the Appalachian basin. On top of that, it offers investors a very attractive 7.93% dividend yield that is expected to be covered by nearly 3.7x by distributable cash flow this year.

However, its biggest upside catalyst is also its biggest risk: its MVP project has been constantly plagued with cost overruns and regulatory hurdles. Management remains committed to the project and still believes it will get completed. If successful, ETRN is extremely cheap and should deliver massive upside to shareholders. However, if it fails to be successful, the company will suffer a major setback and long-suffering shareholders could suffer further downside. Given the uncertainty here, it is unsurprising that ETRN is arguably the cheapest C-Corp midstream opportunity there is.

Similarly, Enbridge (NYSE:ENB) also owns an impressive array of midstream assets that give it significant scale and diversification across oil and natural gas, ultimately rendering it an indispensable part of the North American energy industry.

Unlike ETRN, however, ENB has a much lower upside and downside profile, as its cash flow profile is much more stable, and its growth projects are less significant relative to its existing assets than ETRN’s are. Given its industry strong position and elite dividend growth stock status with 27 consecutive years of growing its dividend payout, it is unsurprising that it is the most expensive C-Corp midstream opportunity right now.

In this article, we will look further at both of these midstream companies and share why we view ENB as a Hold and ETRN as a speculative Strong Buy right now.

Asset Portfolios

ETRN has high quality gathering, transmission, and water infrastructure in the region and is in fact one of the largest natural gas gatherers in the United States. Additionally, it benefits from a symbiotic relationship with EQT Corporation (EQT) that gives it significant capital and operational efficiencies, including economies of scale in the Appalachian Basin for its gathering and processing assets.

Over half of its current revenue is derived from fixed fee take or pay contracts with average durations of 14 years on its gathering assets and 13 years on its transmission and storage assets. As a result, its current cash flow profile is pretty solid. If/when the MVP is completed and placed into service, its revenue from fixed fee take or pay contracts should soar to over 70%.

ENB meanwhile boasts an even more impressive asset profile. It owns North America’s largest crude oil pipeline network through which it moves 25% of crude oil consumed by the continent. The company also has an increasingly meaningful renewable power generation portfolio and plans to expand this for years to come as part of its energy transition efforts.

In addition to its oil and renewable power portfolios, ENB is a major natural gas player. It owns the second longest natural gas transmission pipeline network in the United States through which it moves 20% of the U.S.’s natural gas. It also has the distinction of being the largest natural gas distributor on the continent.

The result of all this is that ENB not only has enormous economies of scale and well-positioned and diversified infrastructure, but it also generates extremely stable cash flows. 98% of its cash flows are backed by either take-or-pay, fee-based, or hedged contracts and 95% of its customers are investment grade or equivalent.

While ETRN has a solid midstream portfolio, ENB clearly has a superior collective asset portfolio.

Balance Sheets

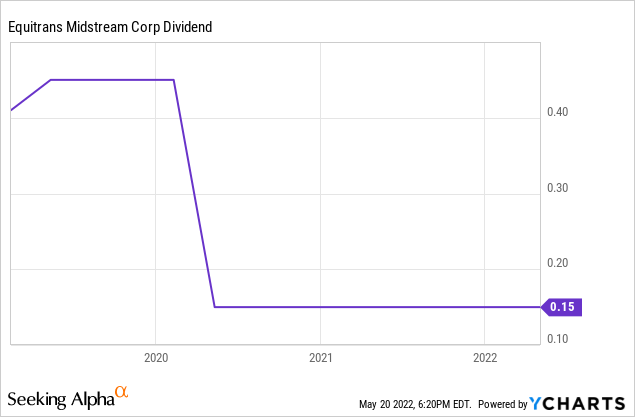

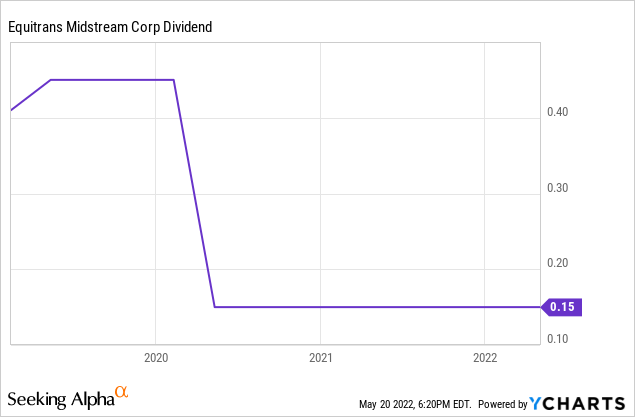

While the MVP cost overruns have certainly strained the balance sheet and forced the company to slash its dividend, the company is currently generating free cash flow above dividends which it is using to pay down debt and also has over $2 billion of available liquidity on its revolver line. Therefore, it should be in solid financial shape for the foreseeable future.

Once again, however, ENB is in much better shape with an industry-leading BBB+ credit rating, remains on track to achieve a net debt to adjusted EBITDA of under 4.7x, and has plenty of liquidity.

Dividend Profiles

ETRN’s dividend yield of 7.93% is 199 basis points greater than ENB’s dividend yield of 5.92%. ETRN’s dividend coverage of 3.7x is also significantly better than ENB’s, though ENB’s dividend coverage is still quite conservative at 1.56x.

ENB’s dividend safety profile is further strengthened when taking into account its very stable cash flow profile and much stronger balance sheet relative to ETRN. On top of that, ENB recently achieved 27 consecutive years of dividend growth, whereas ETRN has no dividend growth streak and in fact slashed its dividend and had to slash its dividend significantly back in 2020:

As a result, we actually consider ENB’s dividend to be safer than ETRN’s. As far as dividend growth goes, ENB is likely to achieve better dividend growth in the near term, but if ETRN is able to successfully complete its MVP project, it could see large upside to its dividend payout.

Growth Profiles

Similar to the outlook for their respective dividend growth profiles, ETRN’s overall cash flow growth profile largely hinges on the outcome of the MVP. If successful it should boost EBITDA by 30% ($315 million of annual incremental adjusted EBITDA), which would make it a terrific midstream growth investment. However, if this project falls short, growth will likely dry up as the company will have to pour its retained cash flow into paying down debt to right size the balance sheet.

ENB, meanwhile, has a very promising growth outlook with plenty of capital and opportunities to invest in growth as well as accretive M&A. Management has guided for a 5-7% DCF per share CAGR through 2024, which we view as very achievable.

Risks

ETRN is clearly a much riskier bet right now given its heavy dependence on the outcome of the MVP project.

Beyond that major risk, both companies face the usual operational risks that come with running pipelines and other midstream infrastructure. Given that ENB is a much bigger player and is involved in both Canada and the United States, its risk of running into regulatory or political trouble is likely greater than ETRN’s is (other than the MVP project).

A final consideration when comparing the risk factors is the impact of the exchange rate between Canadian and U.S. Dollars. ENB – as a Canadian company – declares its dividends in Canadian Dollars whereas ETRN declares its dividends in U.S. Dollars.

However, given that ENB’s cash flows come from a much more diverse array of sources, its balance sheet is stronger, and its contract terms and counterparties are stronger than ETRN’s, ENB is definitely lower risk.

Valuations

Valuation is the only point where ETRN really stands out relative to ENB. In addition to its 199 basis points higher dividend yield, ETRN trades at a 2.78 turn lower EV/EBITDA multiple and also boasts a price to DCF multiple of just 3.44x compared to ENB’s which is significantly higher at 8.29x.

Investor Takeaway

Comparing these two stocks is difficult to do because ETRN is extremely cheap and has a much higher yield than ENB does, but also has considerable risk between its less solid balance sheet and uncertain outlook for its massive MVP project. ENB meanwhile, generates utility like cash flows and has a very stable growth outlook alongside a decent yield. That said, its valuation multiples make it appear a bit stretched at the moment.

For investors who are looking to hit a home run in the midstream space and are optimistic / believe management’s narrative about ETRN’s chances of getting the MVP completed and in-service relatively close to the current schedule and cost estimate, ETRN is a strong buy here. However, we would caution investors that it remains a speculative investment and failure to place MVP in service at a reasonable cost and timeline could result in an additional dividend cut.

ENB, meanwhile, looks like a safe place to hide during the current macroeconomic and geopolitical storm, but the valuation is not very appealing. As a result, we rate it a hold, but a worthwhile portfolio holding for conservative dividend growth investors.

Published at Mon, 23 May 2022 05:30:00 -0700