AT&T Vs. Verizon: Which One Is The Best Investment Choice For 2025?

Prapat Aowsakorn

AT&T Inc. (NYSE:T) and Verizon Communications Inc. (NYSE:VZ) are two of the most iconic and successful communications companies in the world. Both companies were offshoots of the original Ma Bell when it was broken up in 1984.

Now they are two of the largest telecommunications companies in the world, with combined revenue of over $290 million per year. Both offer roughly the same telecommunication services to 100s of millions of people.

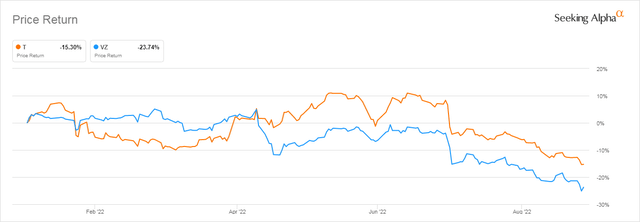

Year to date, both stocks have dropped significantly in price, VZ by 24% and AT&T by about 15%.

Seeking Alpha

In this article, I will compare the current status of both companies and come up with an investment recommendation for both.

Financial metrics

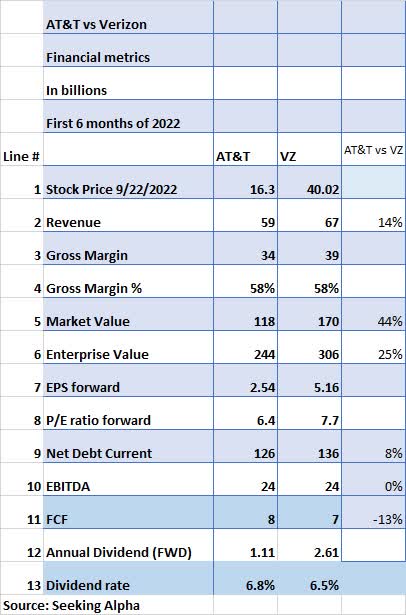

First of all, remember some of the data in the chart below is based on 6 months’ results. That is because AT&T’s huge spinoff of Warner Brothers in November 2021 would distort any 12-month number comparisons, for example, revenue.

One interesting note is the Gross margin (line 4) where both companies clock in at exactly the same 58%. That means both companies have the same percentage of revenue to work with after cost of goods sold, meaning the end results will be based on how well management uses that margin. Various uses include R&D, employee expenses (usually directly related to headcount), marketing, and CAPEX (Capital Expenditures).

Another interesting comparison is Revenue (Line 2) to Market Value (line 5). Note that although VZ has 14% more revenue its MV is 44% higher implying that T may be undervalued compared to VZ. The same holds true in the Revenue to Enterprise Value (line 6).

Comparables that are reasonably close in value are PE ratio (line 8), Price to Free Cash Flow (Line 11), Dividend rate (line 13), and EBITDA (line 10).

The one item that stands out to me is Net Debt (line 9) where VZ’s is higher than T’s even though a high debt load is one of the constant criticisms of AT&T analysts.

Seeking Alpha and author

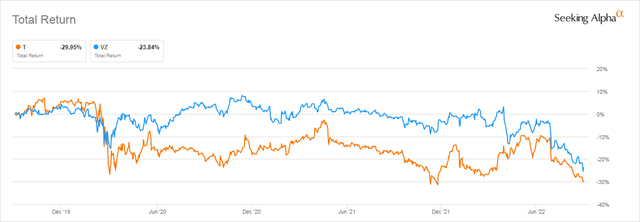

Looking over a longer term of the last 3 years, we can see that both companies have failed their investors miserably with AT&T down 30% and VZ down 24% and Total Return includes dividends.

Seeking Alpha

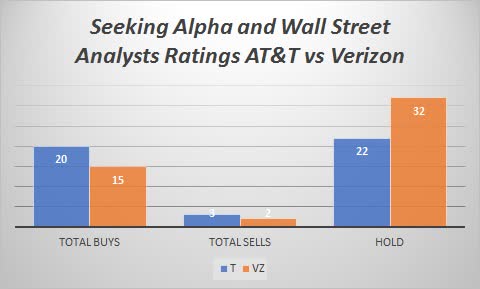

Analysts’ ratings are higher for AT&T than for Verizon

If we look at Seeking Alpha plus Wall Street analysts combined, we can see that T is more highly recommended than VZ with 20 Buys and 3 Sells versus VZ’s almost equal 15 Buys and 2 Sells.

In addition, VZ’s 32 Holds show some indecision on the part of analysts compared to T’s 22 holds.

Seeking Alpha and author

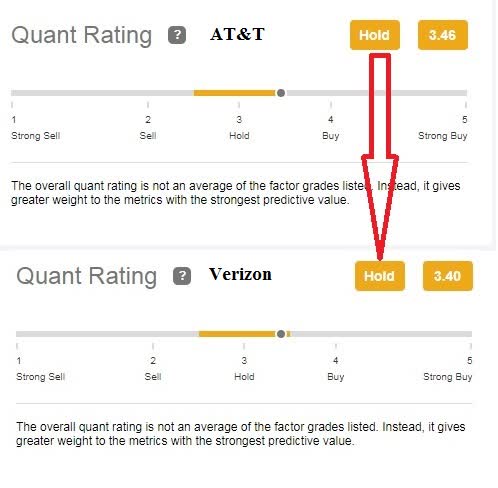

The quants don’t appear to think either one is a Buy at this point, with AT&T rated as a slightly higher Hold than VZ. No enthusiasm for either company from Quants either.

Seeking Alpha

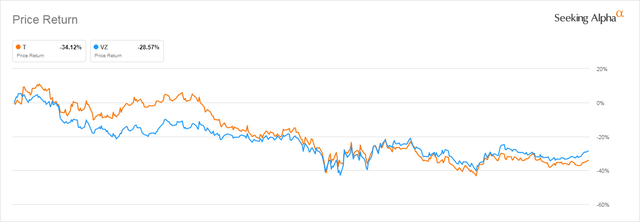

Neither AT&T nor VZ did well in the last recession

If you are concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

From December 2007 through June 2009 was the last recognized recession period and both companies did poorly, with VZ down almost 29% while T was down 34%. However, please note that both bottomed about midway through the 2007 – 2009 recessionary period, meaning depending on where we are now they may have some more downside to their prices.

Seeking Alpha

However, we do have a recession-like period during COVID-19 that we can use as a comparison, running from 01/01/2020 to 12/31/2021. In that particular case, we can see once again that both companies’ prices dropped, but T dropped much more at 36% compared to VZ’s 14%.

Seeking Alpha

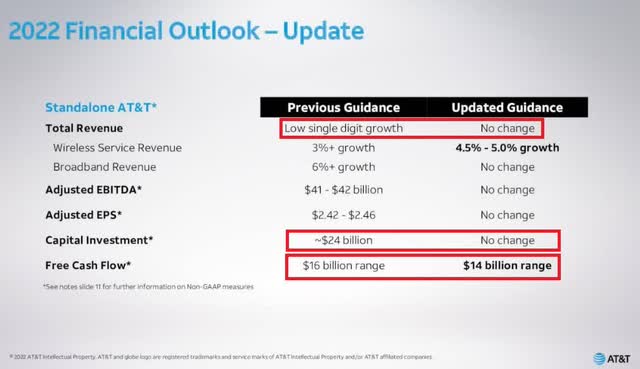

Managements’ outlook for the rest of the year is not inspiring

Both companies’ presentations for Q2 2022 were less than inspiring.

In AT&T’s case, note that revenue is projected to grow slowly through the rest of the year but Free Cash Flow is projected to drop by $2 billion. That’s especially concerning considering that CAPEX spending is a staggering $24 billion.

AT&T

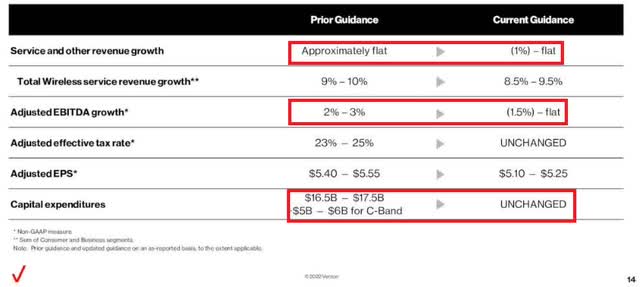

But Verizon’s projections look even worse, with both revenue and EBITDA growth possibly going negative. The good news, at least relative to AT&T is that VZ’s CAPEX is going to be about $7 billion less than T’s. That’s especially good news for VZ because of their larger Net Debt numbers as seen in the above section on Financial Metrics.

Verizon

Conclusion

Based upon all of the above discussion, I think it is correct to say that neither company’s management team inspires much confidence. If there is one word to describe their 2022 prospects, it is lackluster.

Long-term though may be a different story because telecommunications is going to be growing forever with 5G and the ever-increasing data load on all networks all over the world.

I think an investor should look at T and VZ through the eyes of Vince Lombardi, not Warren Buffett.

“Football is two things. It’s blocking and tackling. I don’t care about formations or new offenses or tricks on defense. You block and tackle better than the team you’re playing, you win.” Source: ESPN

Their business has never been high-tech or exciting. It has been about digging holes in the ground and laying more cable, acquiring more customers, and transmitting more bits every single day. That’s the definition of business excelling at blocking and tackling.

The obvious investment question is whether now is the time to buy either of these two companies.

I find Verizon uninspiring at this particular time. They seem lethargic and perhaps in need of new management. You know, the blocking and tackling type.

AT&T on the other hand is at its lowest price in almost 20 years and has a solid and safe 6% plus dividend.

Here’s T’s price return chart going back to March 31, 2003.

Seeking Alpha

As someone who emphasizes turnaround potential, that’s what I call a “wow” chart. I mean 19 and a half years and counting since AT&T has been this cheap. And future cash flows are going to be huge and growing. And the dividend should be growing too, although it might be 2024 before we see the next increase.

AT&T is a Strong Buy for those who are long-term dividend investors and are willing to hold the stock through at least 2025.

Verizon is at best a Hold at least until they learn to do blocking and tackling better.

Published at Mon, 26 Sep 2022 09:03:53 -0700